Entering Payee Loan Information

This topic discusses how to enter payee loan information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPGB_EE_LOAN_DT |

Set up and adjust loan data for payees. Use this page to specify the loan type, loan amount, the interest rate and amount. |

|

|

Employee Loans - Comments Page |

GPGB_COM_SEC |

Enter comments related to the loan, if required. |

|

GPGB_EE_LOAN_BN |

Enter the names of the beneficiaries of a loan. |

|

|

GPGB_EE_LOAN_IN |

Record the interest paid by the payee for each tax year during the repayment period. The information entered on this page is used for P11D reporting. |

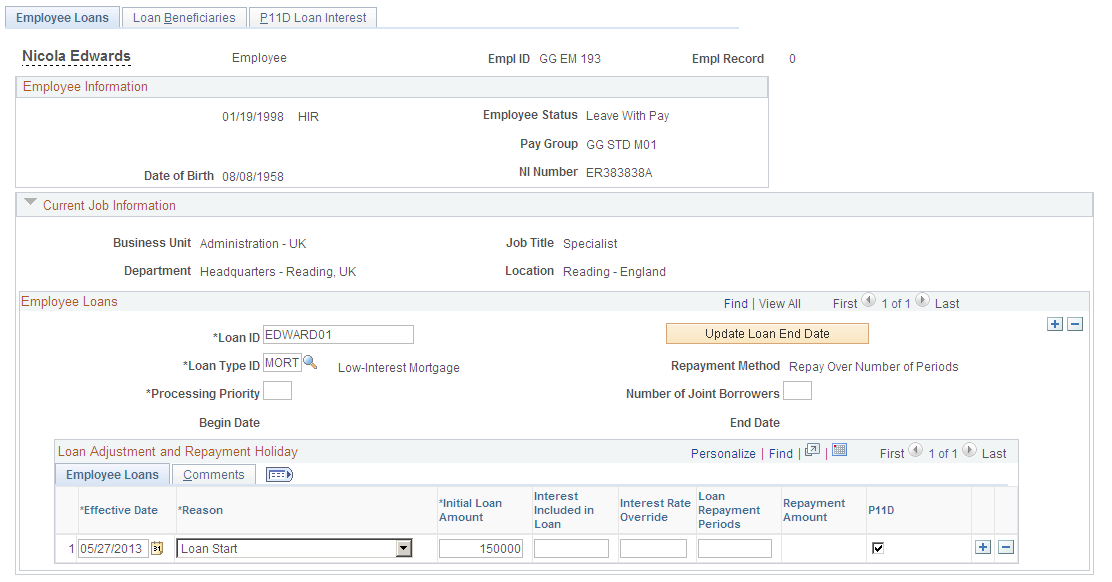

Use the Employee Loans page (GPGB_EE_LOAN_DT) to set up and adjust loan data for payees.

Use this page to specify the loan type, loan amount, the interest rate and amount.

Navigation:

This example illustrates the fields and controls on the Employee Loans page.

Field or Control |

Description |

|---|---|

Loan ID |

Enter a unique identifier for each employee loan. This can be any identifier you require. The loan ID is used as user key1 for the loan accumulators. |

Loan Type ID |

Select the loan type. You define loan types on the Loan Type Definition GBR page. The Loan Type ID is used as user key2 for the loan accumulators and is used as an identifier to set up deduction recipients. |

Repayment Method |

Displays the repayment method: Repay Fixed Amount Per Period: Payee pays a fixed amount each pay period. Repay Over Number of Periods: Payee pays the loan over a fixed number of pay periods. The repayment method is defined when you set up loan types on the Loan Type Definition GBR page. |

Processing Priority |

If an employee has multiple employee loans, assign each loan a priority. Priority determines the order in which the loans are processed. The lower the number, the higher the priority. |

Number of Joint Borrowers |

Enter the number of borrowers for joint loans. This information is required for P11D reporting. |

Begin Date |

Displays the start date for the loan. This is the date you entered for the Loan Start row in the Loan Adjustment and Repayment Holiday group box. This date is used in P11D reporting. |

End Date |

Displays the date on which the loan was repaid or loan processing was terminated. The system populates this field when:

The Update Loan End Date button updates the End Date field if loan processing results exist. This date is used in P11D reporting. |

Update Loan End Date |

Click this button to update the End Date field. The system checks loan processing results and populates the End Date field if the payroll has been finalized and the loan has been repaid, or the employee was terminated. A warning message appears if the system does not find a value to populate the end date (because the loan balance is greater than zero or the payroll results are not finalized). |

Loan Adjustment and Repayment Holiday - Employee Loans

Use this group box to:

Define the loan start date and loan repayment information when you add a loan initially.

Make adjustments to existing loans.

Access the Employee Loans tab.

Field or Control |

Description |

|---|---|

Effective Date |

Enter the loan start date, loan end date, or date of the changes to the loan data, according to the reason you select. For the loan start date, enter the date when the first repayment is made. The first loan repayment is taken out of the employee's earnings in the pay period within which the start date falls. |

Reason |

Select a reason for the change to the loan information. Options are: Loan Start: Use this to define the loan data initially. You cannot save this page without a row for the loan start information. Stop Loan: Indicates when the loan was repaid or loan processing was terminated. The system inserts a Stop Loan row when the loan is repaid or when a payee is terminated. You can also add a row manually to force the system to stop processing a loan. See Understanding Loan Processing. Holiday Suspend Recovery: Stop loan processing temporarily. You can only suspend loan deductions if the loan type allows repayment holidays. See Setting Up Employee Loan Types. Holiday Resume Recovery: Restart loan processing after a repayment holiday. This reason must follow a Holiday Suspend Recovery row. Interest/Amount Change: Select to make an adjustment to the loan amount or the interest included in the loan. P11D Reporting: Select if there is a change in P11D reporting. Revised Repayment Plan: Select to change the repayment amount or the number of repayment periods. Depending on the repayment method for the loan, the system makes the Loan Repayment Periods or the Repayment Amount field available when you select this reason. |

Initial Loan Amount |

Enter the initial amount of the loan that was taken out by the employee. The value you enter must include interest. This field is available when you select Loan Start or Interest/Amount Change only in the Reason field. |

Interest Included in Loan |

Enter the total interest paid on the loan. |

Interest Rate Override |

Enter the interest rate for the payee's loan, if the default interest rate for the loan type does not apply. The default interest rate is defined on the Loan Type Definition GBR page. |

Loan Repayment Periods |

Enter the number of periods over which the loan is to be repaid. Periods are determined by the frequency of the pay period that you defined. This field is not available if the repayment method is Repay Fixed Amount Per Period. You can adjust the repayment period for existing loans if you select Revised Repayment Plan or Interest/Amount Change in the Reason field. |

Repayment Amount |

Enter the amount that is deducted from the payee's net pay each pay period. You can change the repayment amount if you select Holiday Resume Recovery, Revised Repayment Plan, or Interest/Amount Change in the Reason field. If the repayment method is Repay Over Number of Periods this field is not editable. Instead, the system calculates and displays the repayment amount (initial loan amount divided by the number of loan repayment periods). |

P11D |

Select this check box if the loan should be included in the payee's P11D report. The system displays the default for the loan type but you can override the default if required. This field is available if you select Loan Start or P11D Reporting in the Reason field. |

Loan Adjustment and Repayment Holiday - Comments

Access the Comments tab.

Field or Control |

Description |

|---|---|

Comments |

Click this link to access the Comments page where you can enter comments if required. |

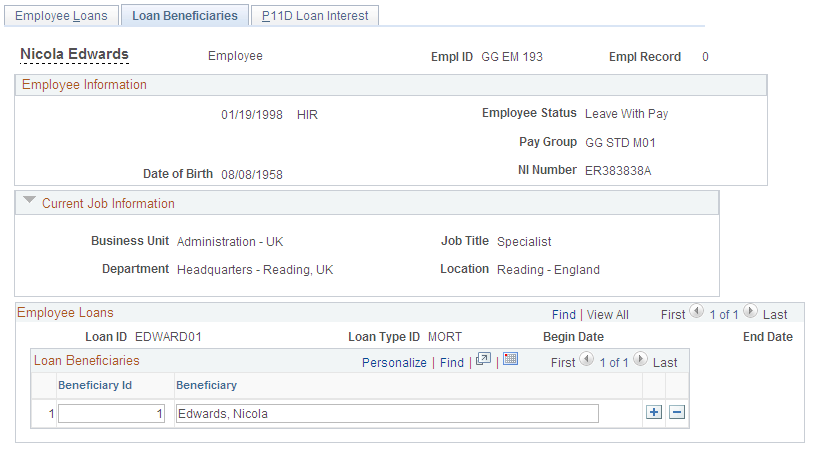

Use the Loan Beneficiaries page (GPGB_EE_LOAN_BN) to enter the names of the beneficiaries of a loan.

Navigation:

This example illustrates the fields and controls on the Loan Beneficiaries page.

The beneficiary information is not used in loan processing or P11D reporting. The data is for information only.

Field or Control |

Description |

|---|---|

Beneficiary Id |

Enter a number for each beneficiary. The system automatically increments this value, but you can override this value. |

Beneficiary |

Enter the name of the person or persons to whom the loan was paid. |

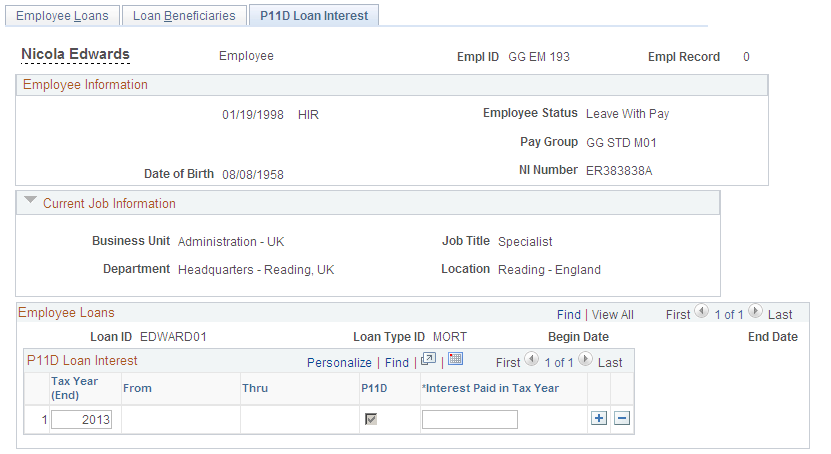

Use the P11D Loan Interest page (GPGB_EE_LOAN_IN) to record the interest paid by the payee for each tax year during the repayment period.

The information entered on this page is used for P11D reporting.

Navigation:

This example illustrates the fields and controls on the P11D Loan Interest page.

Field or Control |

Description |

|---|---|

Tax Year (End), From, and Thru |

Enter the year in which the loan is reported to HM Revenue and Customs (HMRC). The system displays the start and end dates for the tax year in the From and Thru fields. |

P11D |

Indicates if the report is included on the payee's P11D report for the reportable tax year. This is determined by the setting of the P11D check box on the Employee Loans page as at the end of the tax year you specified. |

Interest Paid in Tax Year |

Enter the interest paid during the tax year. This information is included in the P11D report. |