Setting Up Tax Location Information

To set up tax location information, use the Tax Location USA (GPUS_TAX_LOCATION) and Department USA (GPUS_DEPT) components.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPUS_TAX_LOCATION |

Define tax locations. |

|

|

GPUS_DEPT |

Assign tax location codes to departments. |

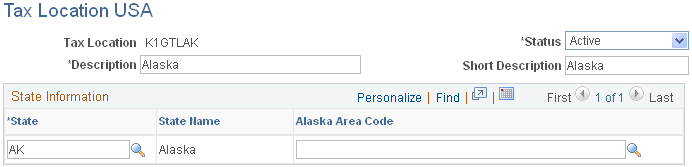

Use the Tax Location USA page (GPUS_TAX_LOCATION) to define tax locations.

Navigation:

This example illustrates the fields and controls on the Tax Location USA page.

Field or Control |

Description |

|---|---|

State |

Enter the work state for the location that you are defining. |

Alaska Area Code |

Select the appropriate area code if you are defining a tax location that includes the state of Alaska. This code appears on certain Alaska quarterly reports. |

County |

Select the county for the location that you are defining. This field is available only if you select MD in the State field. |

County Name |

Displays the name of the county you select. |

Rate |

Displays the tax rate for the county you select. |

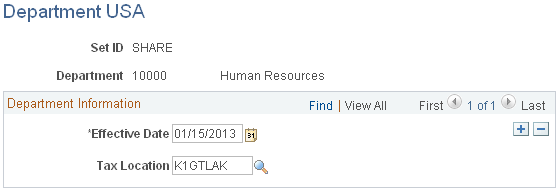

Use the Department USA page (GPUS_DEPT) to assign tax location codes to departments.

Navigation:

This example illustrates the fields and controls on the Department USA page.

Field or Control |

Description |

|---|---|

Tax Location |

Enter a tax location code for the department. Newly hired payees from this department automatically have this tax location associated with their tax profile if the Populate Payee Tax Data check box is selected on the Installation Table USA page. In addition, if you enter a new location for a department on this page, the system creates a new tax profile row for payees associated with the department. |

Note: For default tax location to be provided, Integration Broker must be set up, and Workforce_Sync and GPUS_JobSync must be active.