Setting Up Additional Recipient Information

Use the Deduction Recipients SGP (GPSG_RECIPIENT) component to set up additional recipient information.

You can link an electronic file format to a provider, enter pay entity and commission payment details and your group ID with a provider. You can also link payee membership numbers to providers using the provider's recipient ID.

This topic discusses how to set up additional recipient information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPSG_RECIPIENT_EXT |

Link an electronic file format to a provider and enter pay entity and commission payment details and your group ID with the provider. |

|

|

GPSG_RCPPYE_EXT |

Link payee membership numbers to providers using the provider's recipient ID. From this page, you can access the Deduction List page, where you enter the deductions to which a particular membership number belongs. |

|

|

Deduction List Page |

GPSG_RCPPYE_SEC |

Enter the element names of the deductions to which a particular membership number belongs. |

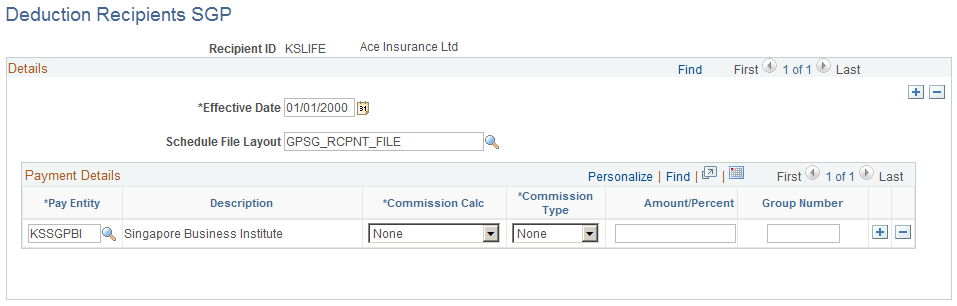

Use the Deduction Recipients SGP page (GPSG_RECIPIENT_EXT) to link an electronic file format to a provider and enter pay entity and commission payment details and your group ID with the provider.

Navigation:

This example illustrates the fields and controls on the Deduction Recipients SGP page.

Field or Control |

Description |

|---|---|

Schedule File Layout |

Select the appropriate file layout from those you have created in Application Designer for the electronic files you submit to your recipients |

Pay Entity |

Enter the pay entity that is going to receive any commission payable by the recipient. If the commission is to be deducted from the payment due to the recipient, the debit to this pay entities source bank will be reduced by the commission amount. |

Commission Calc (commission calculation) |

Select from Deduct Commission (payment) to have the amount deducted from the payment to be made to the recipient,None, or Report Only to report the amount of commission for later payment from the recipient back to the pay entity. |

Commission Type andAmount/Percent |

Select from Flat Amt (amount), None, or Percentage and enter the amount or percentage in theAmount/Percent field. |

Group Number |

Enter the ID the recipient has allocated to your pay entity, your "customer number" with them. |

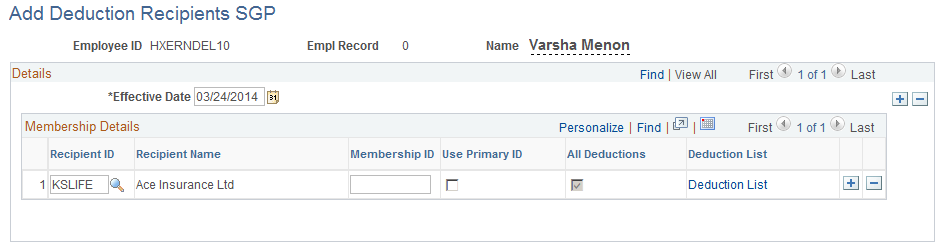

Use the Add Deduction Recipients SGP page (GPSG_RCPPYE_EXT) to link payee membership numbers to providers using the provider's recipient ID.

From this page, you can access the Deduction List page, where you enter the deductions to which a particular membership number belongs.

Navigation:

This example illustrates the fields and controls on the Add Deduction Recipients SGP page.

Field or Control |

Description |

|---|---|

Membership ID and Use Primary ID |

Enter the payee's membership number associated with particular recipients. If you select the Use Primary ID check box, the Membership ID field is unavailable for input. The Membership ID is retrieved from the employee's National ID Table (PERS_NID.NATIONAL_ID) during the EFT file creation process. If the payee's Membership ID is the same number as their Primary ID, you can indicate this by selecting the Use Primary ID check box and leaving theMembership ID blank. You have the option to specify if that recipient ID/membership number combination is for all deductions or to designate specific deductions for that combination. You can enter multiple Recipient ID/Membership ID combinations. |

Deduction List and All Deductions |

Click the Deductions List link to access the Deduction List page where you enter the deductions to which a particular membership number belongs. When you return from the Deduction List page, theAll Deductions check box is automatically updated and selected if you have entered specific deductions. |