Creating IR8A or IR8S Data

This topic provides an overview of the IR8A/IR8S Creation process and discusses how to create IR8A/S Data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPSG_RC_IR8A_CR |

Enter run control options for the IR8A Creation process. |

The IR8A/IR8S creation process calculates and generates amounts for the different entities of the IR8A/IR8S and stores them in the IR8A/IR8S Form tables. After you run this process, you can use the IR8A/IR8S (CPSG_IR8S_FORM) component to review, maintain and add information. You can view IR8A/IR8S data and, where the data is not available from the payroll system, manually update it.

The IR8A/IR8S Creation Process

The application engine process GPSG_ IR8A_CR creates or updates the IR8A and IR8S data records as follows:

The system creates a list (in a temporary table) of employees to be processed in this run.

The employees are selected from those that have an active job record during the specified tax year for a pay group that has the specified tax reference number. This applies regardless of the other run control parameters that you enter.

If you specify a pay group on the run control, only job records in that pay group are included.

If you specify a list of employees on the run control, only those employees are included. If you do not select the Recreate check box, only employees that do not already have an IR8A record for the specified tax year and tax reference number are included. If you select theRecreate check box, only employees that do not already have an IR8A record with a status of issued for the specified tax year and tax reference number are included. If it is part of the IR21 process, only terminated employees are included.

For each of the employees that do not already have an IR8A record for the tax year and tax reference number, a record is created, containing personal data fields (such as name, birth date and address).

Other fields all appear by default.

When recreating data, all amount fields on the existing IR8A data are reset to zeros.

Each of the fields on the IR8A form records for the employees are then updated.

The system determines which of the employees requires IR8S records. IR8S is required for:

Employees with voluntary CPF contributions.

Employees with a value set for the variable IRS VR IR8S REQD on the Payee Supporting Elements record (GP_PAYEE_SOVR).

For each one that needs an IR8S form:

A row is created on the GPSG_IR8S_MONTH table for each month of the year (1 to 12). This table stores the CPF details for each month for employees requiring an IR8S form.

For each month, the CPF contribution amounts are retrieved from the GPSG_CPF_RPTG table.

This table includes GPSG_CPF_EMPLR_REF (employer's CPF reference number) as a key.

To determine which numbers to include, the system selects all the CPF numbers (from the GPSG_IRAS_CPY_CPF table) that are for the current tax reference number.

Another IR8S record is created with the month set to 99, containing the total amounts for all of the months.

The GPSG_ IR8A_FORM table stores a list of employees to be processed in the IR8A creation process.

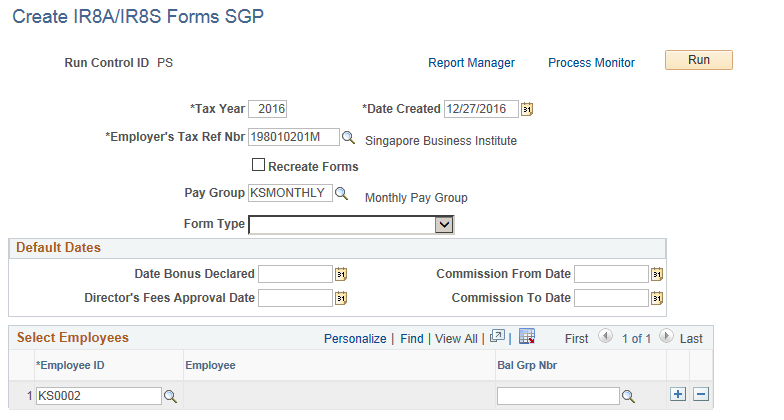

Use the Create IR8A/IR8S Forms SGP page (GPSG_RC_IR8A_CR) to enter run control options for the IR8A Creation process.

Navigation:

This example illustrates the fields and controls on the Create IR8A/IR8S Forms SGP page.

Field or Control |

Description |

|---|---|

Tax Year |

While creating an amendment record, note that the amendment can be made only for two previous tax years. If the year you enter is more than two previous tax years, system shows an error message. |

Recreate Forms |

Select this check box if you want to recreate the date (previously created) for any forms. The system checks the status before attempting to recreate. If the status is awaiting issue (to the employee), the system saves any manual entries contributing to the existing form and creates another form. If the status is issued, the system ignores the recreate instruction. The manually entered fields are not affected by recreating, and the records with a status of issued are not updated by a recreate run. When recreating data, all amount fields on the existing IR8A data are reset to zeros. |

Form Type |

Select from the following:

Note: If you are creating an amendment record, select the form type as ‘Amendment’. |

Default Dates

Field or Control |

Description |

|---|---|

Date Bonus Declared |

Enter the date on which the non-contractual payment is declared payable. Non-contractual bonuses are due and payable at the discretion of the employer and are regarded as the employee's income on the date that the employer decides that the bonuses are payable. For example, you should declare in 2006 to pay a non-contractual bonus in 2007, for the year ending December 31, 2006. Note: If the bonus or directors fees dates are not entered on the run control, the payment date is used. However, this is not the case for commissions. If commission dates aren't entered, they are left blank. |

Director's Fees Approval Date |

Enter the date that the payment of director's fees is approved. Director's fees are regarded as paid to the director on the date on which the fees are voted for and approved at a company's annual general meeting of that calendar year. (Director's fees do not require a CPF contribution). |

Commission From Date and Commission To Date |

Enter the period on which the commission is paid in the tax year. |