Creating Appendix 8A Data

This topic provides an overview of the Appendix 8A Creation process and discusses how to create Appendix 8A data.

The Appendix 8A calculation process captures and stores values for section 4 on the Appendix 8A Forms component (representing 4a to 4k on the tax form). The program uses the information that you set up on the IRAS Tax Forms SGP page and should be run after creating the Appendix 8A pages. You have to manually create the Appendix 8A Details page before entering any benefit-in-kind details. You can also create the Appendix 8A details by selecting the Create Records check box in the run control. This process uses the Tax Form Table to determine which earnings and benefit or deduction balances are to be included with the Appendix 8A amount fields.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPSG_RC_APP_8A |

Enter the run control data for the Appendix 8A calculation process, which captures and stores values on the Appendix 8A Forms component (representing 4a to 4k on the tax form). |

The Application Engine process GPSG_ APP8A_CR creates or updates the Appendix 8A data records as follows:

The system creates a list (in a temporary table) of employees to be processed in this run.

If you use the Select Employees run control option, only employees with an existing Appendix 8A record for the specified tax year and tax reference number are selected. Otherwise, the employees are those who have a corresponding IR8A record for the specified tax year and tax reference number. If you specify a list of employees, only those employees are included.

For each of the employees that do not already have an Appendix 8A record for the tax year and tax reference number, a record is created, containing all default values.

For those that do already have Appendix 8A, the fields that are calculated are reset to their defaults (zeros and blanks).

Each of the fields on Appendix 8A page for the employees are then updated as follows:

The amount fields are extracted from the GP_RSLT_ACUM table, using the Seg Stat key fields for the latest pay segment, as identified in the IR8A Creation process.

The accumulator values to be included are those with PIN_NUMS nominated on the GPSG_TAXFORM_CAT records for the appropriate category.

The value that is assigned is the sum of the CALC_RSLT_VAL and USER_ADJ_VAL amounts for the accumulators, multiplied by the GPSG_CAT_MULT value from the GPSG_TAXFORM_CAT record.

The fields to be updated and the corresponding tax form categories are:

Category

Tax Form Code

Interest paid.

4B

Life insurance.

4C

Holiday passages.

4D

Educational expenses.

4E

Non-monetary long service award.

4F

Subscription to social clubs.

4G

Asset gains.

4H

Motor vehicle cost.

4I

Car benefit.

4J

Other benefit.

4K

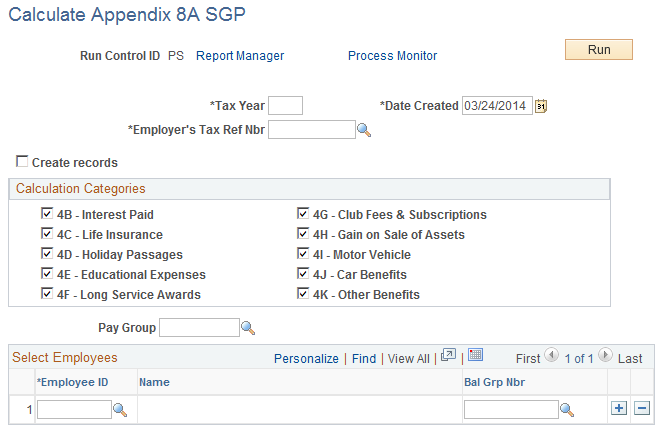

Use the Calculate Appendix 8A SGP page (GPSG_RC_APP_8A) to enter the run control data for the Appendix 8A calculation process, which captures and stores values on the Appendix 8A Forms component (representing 4a to 4k on the tax form).

Navigation:

This example illustrates the fields and controls on the Calculate Appendix 8A SGP page.

Field or Control |

Description |

|---|---|

Create records |

Select for the system to create new Appendix 8A forms for employees that have values for some benefits, but don't have an existing Appendix 8A. (Otherwise the Appendix 8A must be created manually first.) You can therefore create new Appendix 8A forms, without manually creating the data first. |

Calculation categories

The category and category name of the tax form categories that you assign to the tax form appear. For IRAS reporting, all accumulators are categorized. You define and allocate the categories to the tax form on the IRAS Tax Forms SGP page. Each category comprises a set of accumulators that you use to calculate the values on the IR8A or Appendix 8A forms. Select the Calculate check box next to its corresponding category to enable recalculation. Every time that you run the process, the system checks the accumulator balances and updates them in the Appendix 8A forms.