Enrolling Payees in a Provident Fund Program

This section provides an overview of provident fund program enrollment and discusses how to enroll payees in a provident fund program.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPIN_PF_ENROLL |

Enroll a payee in a provident fund program. |

To enroll a payee in a provident fund program:

Make sure the provident fund registration information for the establishment is entered on the Provident Fund Registration page.

Enroll the payee by using the PF Enrollment (provident fund enrollment) page.

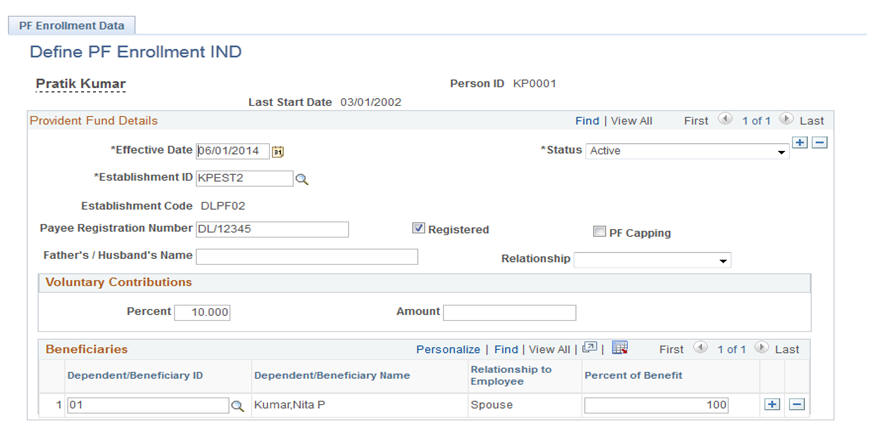

Use the Define PF Enrollment IND (define provident fund enrollment IND) page (GPIN_PF_ENROLL) to enroll a payee in a provident fund program.

Navigation:

This example illustrates the fields and controls on the Define PF Enrollment IND page. You can find definitions for the fields and controls later on this page.

Provident Fund Details

Field or Control |

Description |

|---|---|

Effective Date |

The effective date must be on or after the payee hire or rehire date. If the effective date is before the hire date for the payee, the system issues an error message. |

Payee Registration Number |

Enter the payee's provident fund registration number. This number will generally be available a month after the employee is hired. |

Registered |

Select if you have a provident fund registration number for the payee. |

Voluntary Contributions

Field or Control |

Description |

|---|---|

Percent |

If the payee elects to contribute an additional percentage beyond that legally mandated, enter the percentage. |

Amount |

If the payee elects to contribute an additional amount beyond that legally mandated, enter the amount. |

Note: The voluntary contribution for the payee can be either a percentage or an amount. You cannot enter both.

Beneficiaries

Field or Control |

Description |

|---|---|

Dependent/Beneficiary ID |

Select the dependent or beneficiary to whom the benefit should flow. Any number of payees can be entered, but the total of the Percent of Benefit must equal 100%. |

Percent of Benefit |

Enter the percentage of funds to be distributed to the dependent beneficiary should the payee die. The percentages that you enter must total 100. |

Note: To terminate a payee from a provident fund program, add a row and change the status to Inactive.

Note: Additional Provident Fund reports, which are required to be submitted to the statutory bodies, are provided for year end processing.