Defining Year End Reports

This section discusses different Form data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPIN_ECR_RC |

Create Electronic Chellan Cum Return (ECR) text file. This file is a consolidated return for all the monthly and yearly returns. |

|

|

GPIN_YE_F3A |

Define the report for the annual statement of individual payees detailing provident fund contributions and other information during the currency period. |

|

|

GPIN_YE_F5 |

Define the report containing details of contributions and remittances to the profession tax authorities for the financial year. |

|

|

GPIN_YE_F6 |

Define the report for consolidated detailing of contributions and other information for the currency period to the employee state insurance authorities. |

|

|

GPIN_YE_F12BA |

Define the report submitted to the statutory authorities containing details of perquisites that are provided by the employer to the employees and their valuation and tax status. |

|

|

GPIN_YE_F24_F16 |

Define the report for:

|

|

|

GPIN_QT_F24Q_DTL |

Define tax receipt data for Form 24Q quarterly return and statement. |

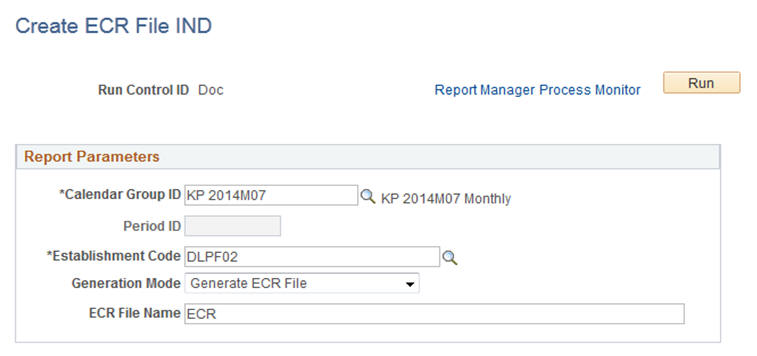

Use the Create ECR File IND Page (GPIN_YE_F3A) to create Electronic Chellan Cum Return (ECR) text file.

Navigation:

This example illustrates the controls and definitions of Create ECR File IND page.

Field or Control |

Description |

|---|---|

Calender Group |

Select the calendar group ID that is associated with the pay run for which the ECR file needs to be created. |

Establishment Code |

Select the Establishment code for which you need to create the ECR file. |

Generation Mode |

Required flag for running the process in lead ECR data mode in generate ECR file mode. |

ECR File Name |

Mandatory field to generate ECR file mode. |

Note: The employees, who are covered under The Employee’s Provident Funds and Miscellaneous Provisions Act, 1952, are required to register their establishment on EPFO (Employee Provident Fund Organization) website for filing Electronic Chellan Cum Return (ECR). This return is a consolidated return for all the monthly and yearly returns (Form 5/10/12A, 3A and 6A) which the employees used to file earlier separately.

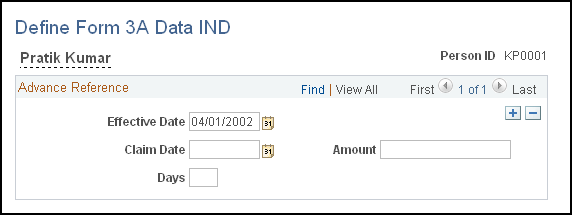

Use the Define Form 3A Data IND page (GPIN_YE_F3A) to define the report for the annual statement of individual payees detailing provident fund contributions and other information during the currency period.

Navigation:

This example illustrates the fields and controls on the Define Form 3A Data IND page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Claim Date |

Enter the date of the availing advance. |

Amount |

Enter the amount of the advance amount taken. |

Days |

Enter the number of days of noncontribution service. |

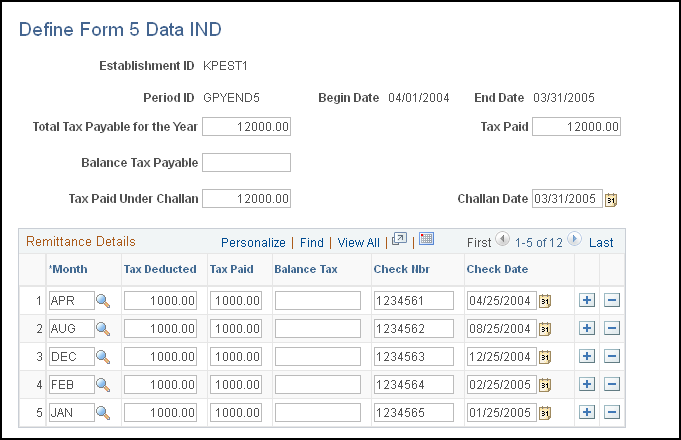

Use the Define Form 5 Data IND page (GPIN_YE_F5) to define the report containing details of contributions and remittances to the profession tax authorities for the financial year.

Navigation:

This example illustrates the fields and controls on the Define Form 5 Data IND page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Total Tax Payable for the Year |

Enter the total tax payable for the year. |

Tax Paid |

Enter the tax paid for the year. |

Balance Tax Payable |

Enter the tax balance that still needs to be paid for the year. |

Tax Paid Under Challan |

Enter tax paid under challan. |

Challan Date |

Enter the challan date. |

Month |

Select the month for which taxes are deducted and remitted. |

Tax Deducted |

Enter the amount of tax deducted. |

Tax Paid |

Enter the tax paid for the specific month. |

Balance Tax |

Enter the tax balance. |

Check No (check number) |

Enter the number of the check used to pay the tax. |

Check Date |

Enter the date of the check used to pay the tax. |

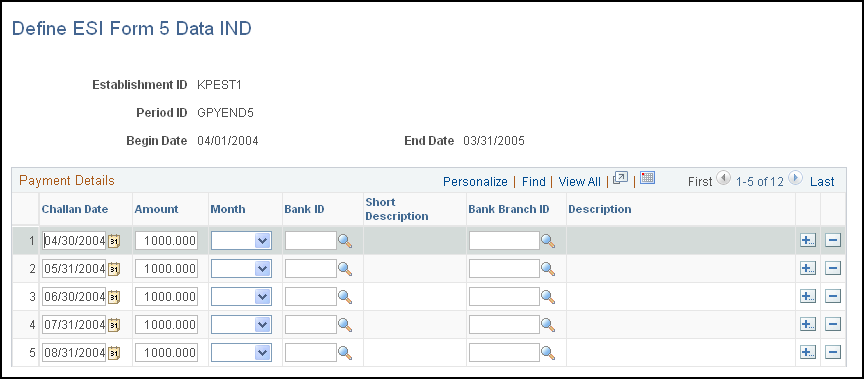

Use the Define ESI Form 5 Data page (GPIN_YE_F6) to define the report for consolidated detailing of contributions and other information for the currency period to the employee state insurance authorities.

Navigation:

This example illustrates the fields and controls on the Define ESI Form 5 Data page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Challan Date |

Enter the date on which the challan was submitted. |

Amount |

Enter the amount paid. |

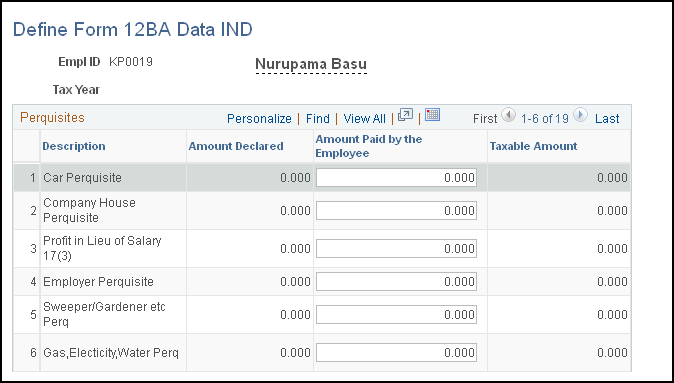

Use the Define Form 12BA Data IND page (GPIN_YE_F12BA) to define the report submitted to the statutory authorities containing details of perquisites that are provided by the employer to the employees and their valuation and tax status.

Navigation:

This example illustrates the fields and controls on the Define Form 12BA Data IND page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Period ID |

Enter the period ID for the period on which you want to report. |

Amount Paid by the Employee |

Enter the amount to be paid by the employee. |

Taxable Amount |

Displays the amount of the perquisite that is taxable. |

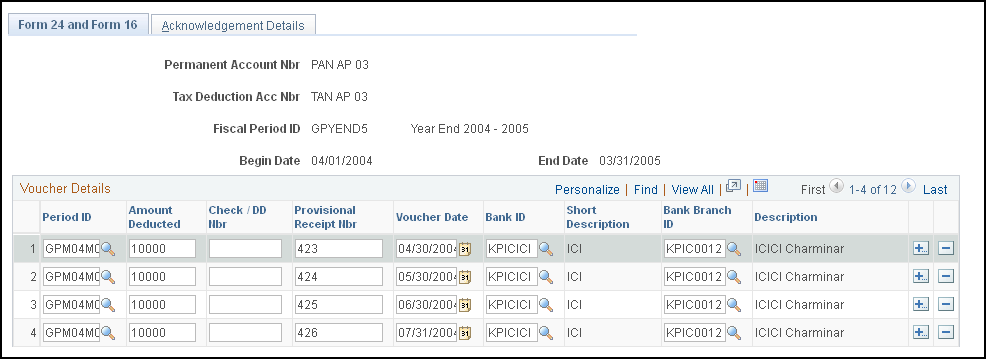

Use the Form 24 and Form 16 page (GPIN_YE_F24_F16) to define the data for end of year reporting and to process employee and employer data for Form 16, Form 12BA, Form 24. The annual statement contains details of the remuneration paid and tax deducted and remitted during the previous year by an employer.

Form 16 is the certificate issued under section 203 of the Income tax Act for tax deducted at source (TDS) from income under the head 'salary'. It is issued on deduction of tax by the employer from an employee's salary and deposit of the same with the government. The certificate provides a detailed summary of the amount paid or credited to the employee and the TDS on the same.

Form 24Q is used for preparing e-TDS returns for the TDS deducted on salary under Section 192 of the Income Tax Act, 1961. It has to be submitted on a quarterly basis by the deductor. It contains details like salaries paid and the TDS deducted of the employees by the employer.

Navigation:

This example illustrates the fields and controls on the Form 24 and Form 16 page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Period ID |

Enter the period ID for the period on which you want to report. |

Amount Deducted |

Enter the remittance amount. |

Voucher Number andVoucher Date |

Enter the remittance voucher number and date. |

Bank ID andBank Branch ID |

Select the bank ID and bank branch ID for the bank branch from which the monthly remittance was transferred to the central government account. The description appears after you select a bank ID and bank branch. |

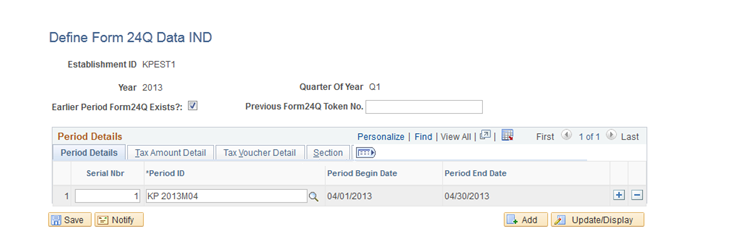

Use the Acknowledgement Details page (GPIN_QT_F24Q_DTL) to define tax receipt data for Form 24Q quarterly return and statement.

Navigation:

This example illustrates the fields and controls on the Define Form 24Q Data IND page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Serial Nbr (sequence number) |

Enter a sequence number for each line item in the report. |

Period ID |

Select the period ID. The begin date and end date appear as soon as you select the period ID. A period ID is created for each reporting period, such as monthly or annual. If the reporting is monthly, create a period ID for every month for reporting purposes. |

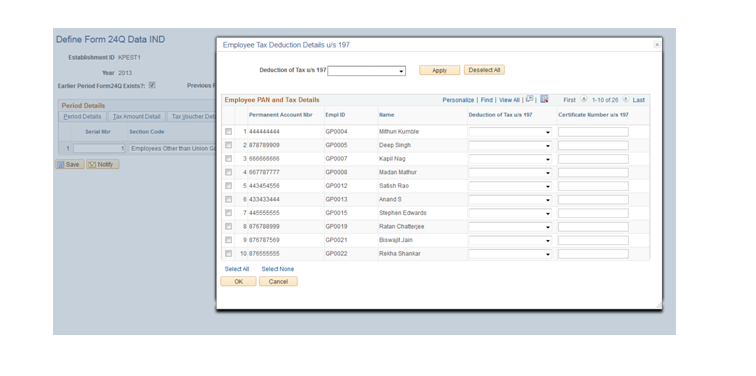

Select Tax Deduction u/s 197 Details in the Section tab.

The screenshot illustrates the Define Form 24Q Data IND Page that shows the employee tax deduction details under section 197.

The Employee Tax Deduction Details u/s 197 lists all the employees’ PAN details for the selected establishment. For employees not having PAN and the field for the PAN is not updated, the PAN field is pre-populated with value PANAPPLIED and tax deduction at higher Rate. The Admin user has to enter the tax deduction details of employees for each and every period defined in Define Form24Q Data IND page. The tax deduction details and Define Form24Q Data IND pages need to be saved for the changes to take effect in Form24Q - Annexure I file.