Defining Contribution Rates for Social Security

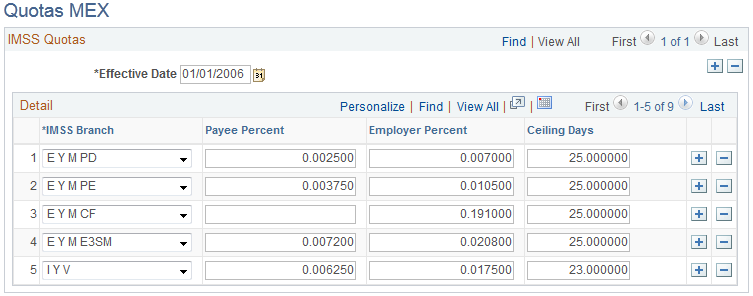

To define social security contributions, use the Quotas MEX (GPMX_IMS_QUOTA) component.

Note: In Mexico, "social security quota" is used to refer to social security contributions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPMX_IMS_QUOTA |

Define payee and employer contribution rates to social security for each IMSS branch. |

Global Payroll for Mexico initially delivers the rates and ceiling days that the system uses to calculate employee and employer contributions to each branch of social security. You must maintain this data when the government issues changes.

To calculate contributions to a branch of social security, the system:

Compares the employee's integrated daily salary (SDI) amount to the (Minimum Wage * Ceiling Days).

Multiplies the minimum amount by the contribution rate.

Note: Global Payroll for Mexico calculates the SDI factor automatically based on parameters you enter on the Xmas, Vac, Premium, SDI Factor page. Once the system has calculated the SDI factor, it uses the SDI factor to calculate IMSS quotas. The Xmas, Vac, Premium, SDI Factor page is discussed in another topic.

Example: Calculating the Employer Contribution to RETIRO

Suppose an employee's integrated daily salary (SDI) amount is 100 MXN, the minimum wage is 45.24, the employer contribution is 0.02, and the day ceiling is 25. The system calculates the employer RETIRO contribution as follows:

Compares SDI (100) to the Minimum Wage * Ceiling Days (45.24 * 25 = 1131.00) and determines that 100 is the smaller amount.

100 * .02 = 2.00 MXN

Now, if the employee's SDI amount is 1200 MXN, then the Minimum Wage * Ceiling Days (45.24 * 25 = 1131.00) is lower. The RETIRO contribution is 1131.00 * .02 = 22.62 MXN

Use the Quotas MEX page (GPMX_IMS_QUOTA) to define payee and employer contribution rates to social security for each IMSS branch.

Navigation:

This example illustrates the fields and controls on the Quotas MEX page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

IMSS Branch |

Select the IMSS branch for which you want to define contribution rates. |

Payee Percent |

Specify the percentage of SDI that the payee contributes. |

Employer Percent |

Specify the percentage of the employee's SDI that the employer contributes. |

Ceiling Days |

Enter the number of days that the system should use to calculate the SDI ceiling for the branch. |