Setting Up Country Data

To set up minimum wages, use the Minimum Wages MEX (GPMX_MIN_WAGE) component. To set up general parameters, use the Pay Groups MEX (GPMX_PARM_PYGRP) component. To set up element lists, use the Element Lists MEX (GPMX_PAYSLIP_FORMA) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPMX_MIN_WAGE |

Define minimum wages for each wage zone. You can update this page as minimum wage rates change. |

|

|

GPMX_TAX_PARM |

Define general parameters for federal taxes and IMSS quotas. |

|

|

Element List MEX page |

GPMX_PAYSLIP_FORMA |

Enter the earnings and deductions that are eligible to print on a payslip. Element lists are used in the payroll results register and in termination/layoff letters, as well as the payslip generation process. |

|

GPMX_UMA_VALUES |

Define Unit of Measure. |

|

|

GPMX_STATE_LGL |

Map PeopleSoft States with the Legal Codes Mexican states (tags) provided by the SAT. |

|

|

GPMX_UMA_SOVR |

Define element overrides. |

|

|

|

GPMX_CFDI_PARAM |

Define whether electronic files (CFDI) and payslips must only consider Finalized Calendars |

|

GPMX_MIN_WAGE_INF |

To view the daily, monthly and annual values exclusive to INFONAVIT for the system elements. |

This table lists some PeopleSoft-delivered variables that are populated into the core application as override variables. You can override these variables through positive input, as an earning/deduction assignment, or at the calendar or payee levels.

|

Field |

Entry Type |

Global Payroll for Mexico Element |

|---|---|---|

|

GPMX_ADJ_FACTOR |

Variable |

FD VR AJU FAC ISR |

|

GPMX_DAY_FACTOR |

Variable |

FD VR FAC MEN ISR |

|

GPMX_TAX_METHOD |

Variable |

FD VR SEL TIP ISR |

|

GPMX_TAX_CRED |

Variable |

FD VR APL CRE SAL |

|

GPMX_IMS_ER_PAID |

Variable |

GN VR CUO PAG X PA |

|

GPMX_BASE_DAYS |

Variable |

IM VR DIAS VARIAB |

|

GPMX_BAS_SAL_IMS |

Variable |

IM VR BASE SAL IMS |

|

GPMX_PYGRP_CALC |

Variable |

GN VR TIPO CALC |

|

GPMX_7TH_DAY_PAY |

Variable |

PE VR SEPTIMO DIA |

|

GPMX_CRE_SAL |

Variable |

FD VR NOM CRED EF |

|

GPMX_XMAS_AVG |

Variable |

AG VR PROMEDIO |

Note: All of these parameters are mapped to the corresponding variable. You can override the value to any of these variables at any level (pay group, pay calendar, payee) on the corresponding Supporting Element Overrides page. For example, the tax method for a pay group could be defined originally as Adjustment During the Month, but you can override this value at the payee level to be Without Adjustment.

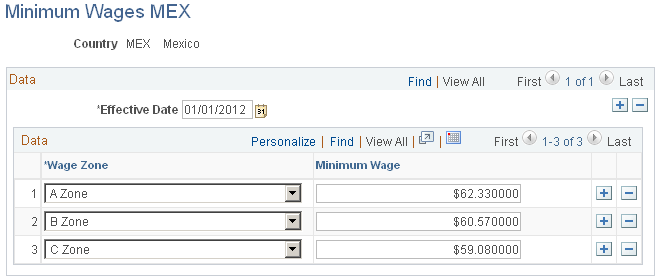

Use the Minimum Wages MEX page (GPMX_MIN_WAGE) to define minimum wages for each wage zone.

You can update this page as minimum wage rates change.

Navigation:

This example illustrates the fields and controls on the Minimum Wages MEX page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Wage Zone |

Enter the wage zone. Values are A Zone, B Zone, and C Zone. |

Minimum Wage |

Enter the minimum wage for the wage zone. The minimum wage in Mexico is determined as a daily amount, not an hourly amount. For example, in A Zone, the minimum wage for the year 2004 is 45.24 MXN (per day). Minimum wages are used in determining several earnings caps such as vacation premium caps and Sunday premiums. For example, the law states that the non-taxable base for a Sunday premium will be equal to one daily minimum wage rate. Note: Because minimum wage amounts usually change from year to year, you can update this table by adding a new effective-dated row. |

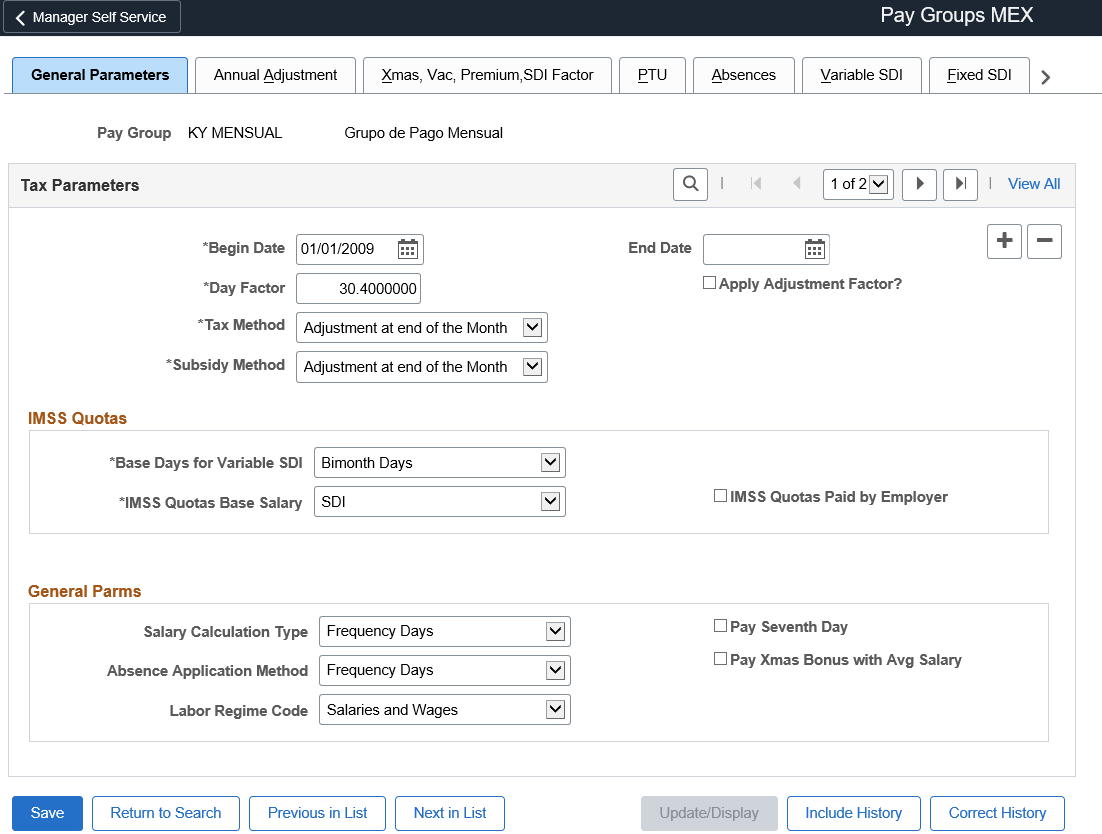

Use the General Parameters page (GPMX_TAX_PARM) to define general parameters for federal taxes and IMSS quotas.

Navigation:

This example illustrates the fields and controls on the General Parameters page. You can find definitions for the fields and controls later on this page.

Tax Parameters

These fields apply to federal tax processing.

Field or Control |

Description |

|---|---|

Day Factor |

If you select the Apply Adjustment Factor check box, enter the day factor. Values are 30 or 30.4, in most cases. The value you select corresponds to the monthly taxable base. |

Apply Adjustment Factor? |

Select if your company adjusts the payroll for federal taxes. For example, federal taxes in Mexico are due monthly, but let's say that your company has a semimonthly payroll. So, you will divide the number of days so that it's adjusted for the monthly federal taxes. Note: Day Factor andApply Adjustment Factor are only used to calculate federal taxes. |

Salary Credit only in Adj Prd (adjustment period) |

Select if you're going to give a subsidy or salary credit to an employee only in an adjustment period (usually the last period of each month). Note: This field does not appear on the page when the value of the Begin Date field is01/01/2008 or later. |

Pay Cash Salary Credit |

Select to indicate that the Cash Salary Credit will be paid on a separate payslip (if a separate payroll is run). If you select this check box, the Cash Salary Credit will not appear in an employee's regular payslip. Note: This field does not appear on the page when the value of the Begin Date field is 01/01/2008 or later. |

Tax Method |

Select the method used for calculating the month to month tax deduction. The tax methods you can choose from are: Adjustment During the Month, Adjustment at end of the Month, Annual Projection Method, Semi-monthly Projected and Without Adjustment. |

Subsidy Method |

Enter the subsidy method. The subsidy methods you can choose from are: Adjustment During the Month, Adjustment at end of the Month, Payment in the Last Period, and Without Adjustment. |

IMSS Quotas

These fields apply to social security setup.

Field or Control |

Description |

|---|---|

Base Days for Variable SDI |

Select the method you'll use for calculating the variable portion of SDI. Values are 60 Days, Bimonth Days, Hourly Payee, and Paid Days. For example, when you select 60 Days, the system always uses 60 days (minus the number of days that the payee was not active) no matter what bimonthly period the system is calculating. If Bimonth Days is selected, then the number of days considered depends on the bimonthly period processed (61 days for the second bimontly period). Paid Days is for payees who do not work on a regular basis. Hourly Payee is for payees whose payment is based on hours worked instead of days worked. |

IMSS Quotas Base Salary |

Helps to determine if you should pay IMSS quotas for workers with minimum wages by comparing the Minimum Wage to the SDI or Daily Salary. Values are SDI and Salary. |

IMSS Quotas Paid by Employer |

Some companies pay employees' IMSS quotas. If you select this check box, it helps determine whether your company should subtract the IMSS quotas from the employee's earnings or not. Note: You'll select the IMSS Quotas Paid by Employer check box if the employee quotas will not be deducted from the net pay of the employee. You'll also define which salary type the system will compare to the minimum wage (either the Daily Salary or the SDI) in theIMSS Quotas Base Salary field. Although the law states that employers do not need to withhold IMSS quotas for employees with minimum wages, some companies compare the SDI versus the minimum wage instead of the Daily Rate versus the minimum wage to decide if they're going to withhold IMSS quotas for employees with the minimum wage. In Global Payroll for Mexico, you have the choice of how you want to define your IMSS quotas for employees earning minimum wages. |

General Parms (parameters)

Field or Control |

Description |

|---|---|

Salary Calculation Type |

Values are Calendar Days, Frequency Days, and Hourly. If you select Calendar Days, the salary base will be calculated based on the days of the calendar. If you select Frequency Days, the salary paid will be calculated according to the days being processed in the period. If you select Hourly, the pay will be calculated for the hours entered at the payee level. It is also possible to calculate salary units based on calendar days for employees with segmentation events in the period. For Calendar Days method for Segmentations, you need to set the value for variable PE VR SDO F MET 1 to “1”, in the Pay Group SOVR page. |

Absence Application Method |

Select how you want the system to determine the number of days to be considered for absence calculations in a given calendar period for monthly and semimonthly payrolls. If you select Calendar Days, then the system uses the number of calendar days (28, 29, 30, or 31) depending on the month that is being processed. If you select Frequency Days, then the system uses 30 as the upper limit for the number of days to be considered for a given month. |

Labor Regime Code |

Select the Labor Regime Code. Valid values are:

|

Pay Seventh Day |

Select if workers should be paid for the seventh day in a week. This field is commonly used for union purposes. If you select this check box, it will trigger an earning to separate regular earnings from the seventh day earnings. |

Pay Xmas Bonus with Avg. Salary |

In Mexico, it's common for employees to receive their Christmas bonus with the daily rate. However, some employees may receive commission or other additional pay. In these cases, the Christmas bonus can be paid by the sum of the daily salary, which results in the average salary. If this situation applies for a pay group, select this check box. |

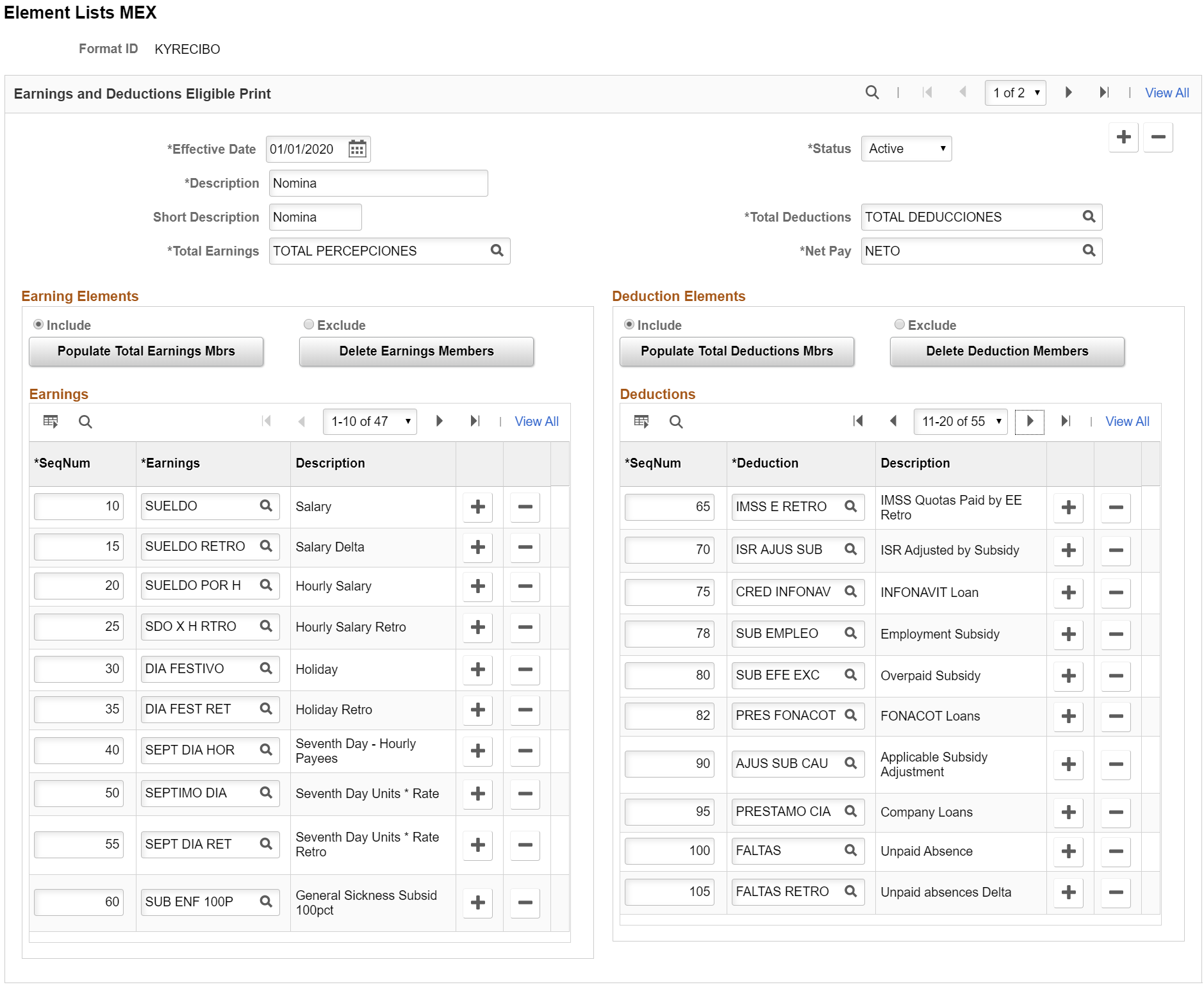

Use the Element Lists MEX page (GPMX_PAYSLIP_FORMA) to enter the earnings and deductions that are eligible to print on a payslip.

Element lists are used in the payroll results register and in termination/layoff letters, as well as the payslip generation process.

Navigation:

This example illustrates the fields and controls on the Element Lists MEX page. You can find definitions for the fields and controls later on this page.

Earnings and Deductions Eligible Print

Field or Control |

Description |

|---|---|

Effective Date |

Date from which the new element created is added to the corresponding element lists. Note: If this step is skipped then the new elements are not considered for processing. |

Total Deductions |

Select the element that corresponds to total deductions. |

Total Earnings |

Select the element that corresponds to total earnings. |

Net Pay |

Select the element that corresponds to net pay. |

Earning Elements

Field or Control |

Description |

|---|---|

Include/Exclude |

You can choose to enter the earnings you want included on the payslip or you can choose to enter the earnings you want excluded, depending on what is the easiest way for you to define your payslips. For example, if you have defined 20 types of earnings and you only want to include 5 of them, the easiest way is to include those 5 earnings, instead of excluding the other 15 earnings. On the other hand, if you want to exclude only 3 earnings from the payslip, you can select Exclude and then enter the 3 earnings that you want to exclude, instead of including the other 17 earnings. |

Populate Total Earnings Mbrs (members) andPopulate Total Deductions Mbrs (members) |

If you click this button, all the earnings and deductions that contribute to the selected accumulator will be populated. |

Deduction Elements

The fields on the Deductions Elements group box are similar to the fields on theEarnings Elements group box.

Earnings

Field or Control |

Description |

|---|---|

SeqNum (sequence number) |

Enter the sequence number for the earnings. |

Earnings |

Select the individual earnings elements that will be included (or excluded) in the payslip. |

Deductions

The fields on the Deductions group box are similar to the fields on theEarnings group box.

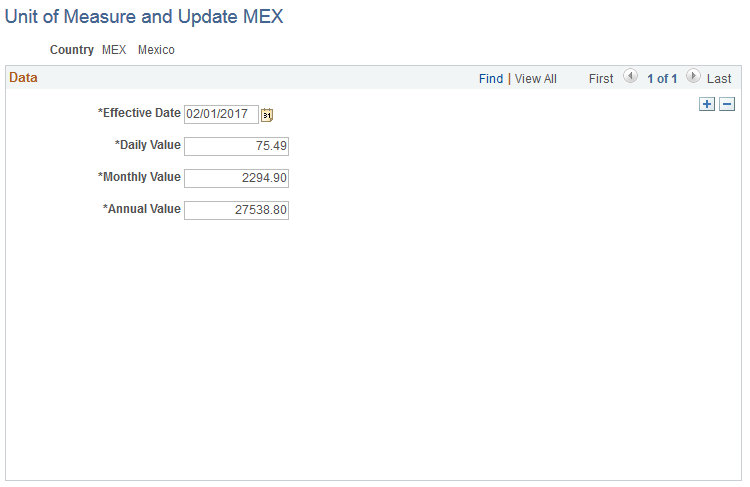

Use the Unit of Measure and Update MEX page (GPMX_UMA_VALUES) to define Unit of Measure.

Note: UMA is the economic reference in Mexican Pesos to determine the amount of the payment the obligations and assumptions provided for the federal laws. This amount will be updated every year by the Government Institution (INEGI).

Navigation:

This example illustrates the Unit of Measure and Update MEX page.

The monthly value of the UMA is calculated by multiplying its daily value by 30.4 times and its annual value is calculated by multiplying its monthly value by 12.

Use the State Code MEX page (GPMX_STATE_LGL) to map People Soft States with the Legal Codes Mexican states (tags) provided by the SAT.

Navigation:

This example illustrates the State Code MEX page.

Field or Control |

Description |

|---|---|

State |

Select a state code. Sates code are stored in the STATE_TBL table in PeopleSoft |

State Legal Code |

Enter 3 characters SAT legal codes to map to the select State code. |

Note: The State Legal code is printed in the tag ClaveEntFed in the CFDI file.

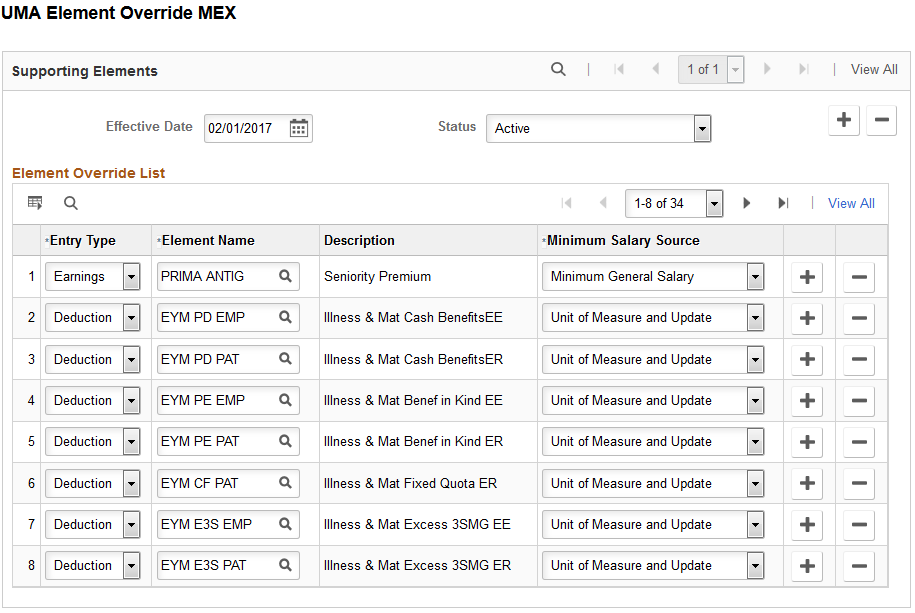

Use UMA Element Override MEX page (GPMX_UMA_SOVR) to define element overrides.

Navigation:

This example illustrates the fields and controls on the UMA Element Override MEX Page.

Field or Control |

Description |

|---|---|

Effective Date |

The date from which the defined element overrides are applicable. |

Status |

Status is Active and Inactive for the performance of this page |

Entry Type |

Define the type of input that will be override to the elements of the system.

|

Element Name |

Name of the element that the company uses to pay or discount the income of employees. |

Description |

Based on selected Element Name, description is populated. |

Minimum Salary Source |

The value to be used to override the selected element. Valid values are:

|

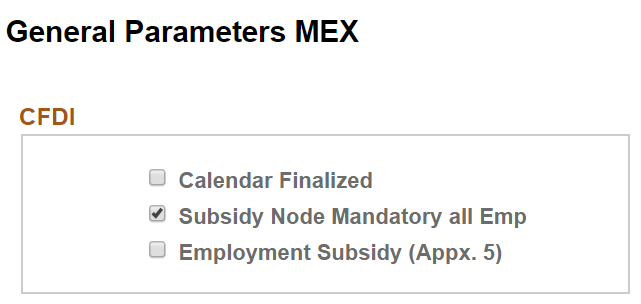

Use General Parameters MEX page (GPMX_CFDI_PARAM) to define whether electronic files (CFDI) and payslips must only consider Finalized Calendars.

Navigation:

This example illustrates the fields and controls on the General Parameters MEX page.

Field or Control |

Description |

|---|---|

Calendar Finalized |

Select the checkbox if the calendar Group ID on Create/Print Payslips MEX page must only display the finalized calendars. By default this option is unchecked. Note: Deselect the checkbox if the calendar Group ID on Create/Print Payslips MEX page must select all the calendars (regardless of whether they are finalized or not) |

Subsidy Node Mandatory all Emp |

Select the checkbox if the node ‘SubsidioAlEmpleo’ must be displayed for all employees (regardless of whether the Employment Subsidy are processed or not). This checkbox is selected by default. |

Employment Subsidy (Appx. 5) |

Select the checkbox if you want to show the payroll amount process for employment subsidy element in the node OtrosPagos. This is the default option. |

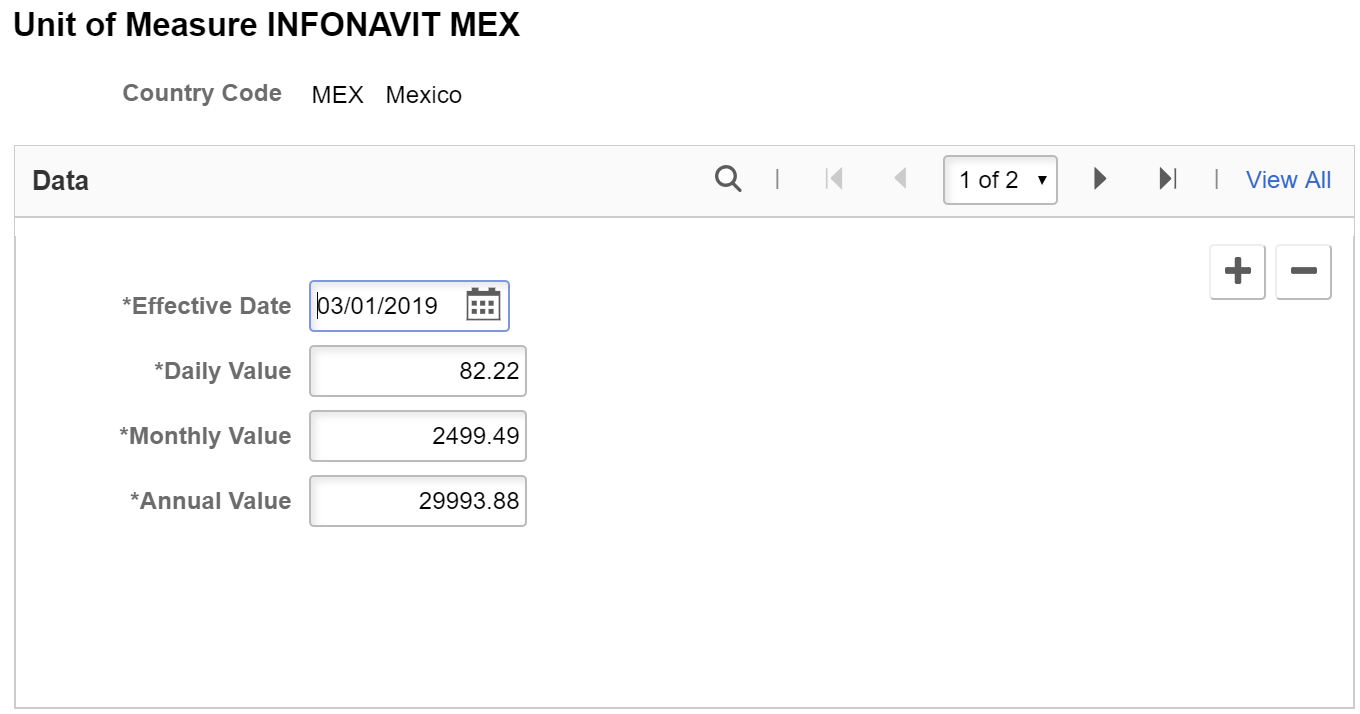

Use the Unit of Measure INFONAVIT MEX page to view the daily, monthly and annual values exclusive to INFONAVIT for the system elements and calculation processes that use this value for INFONAVIT purpose.

Navigation:

This example illustrates the fields and controls on the Unit of Measure INFONAVIT MEX page.

Field or Control |

Description |

|---|---|

Country |

Refers to the country Mexico. |

Effective Date |

The date from which the UMI will come into effect. |

Daily Value |

The daily value of the UMI designated by the government. |

Monthly Value |

The monthly value of the UMI designated by the government. |

Annual Value |

The annual value of the UMI designated by the government. |