Understanding How to Maintain the Inhabitant Tax Table

The Inhabitant Tax table (GPJP_IH_PYE_TAX) includes effective-dated rows for each employee who is paying inhabitant tax. This row includes employee ID, employment record number, recipient number, individual number, municipality code, previous employment last month, and special collection amount. Inhabitant Tax will be deducted only from one Job Record of an employee for each payment that the employee receives.

To determine an employee's inhabitant tax, the system first creates a relationship between the postal code in which employees live and the municipalities that charge inhabitant tax. This requires a correlation between the municipality table and the postal code table. The Blank Municipality Audit Report query identifies postal codes that are not associated with municipality codes. After this relationship is established, a connection exists between the employee and the municipality.

When the employee-municipality relationship has been identified, you can create the Inhabitant Tax table. You will populate the table with tax amounts either by loading data electronically using the Load Inhabitant Tax process (GPJP_IHMUN2) or by entering the data manually.

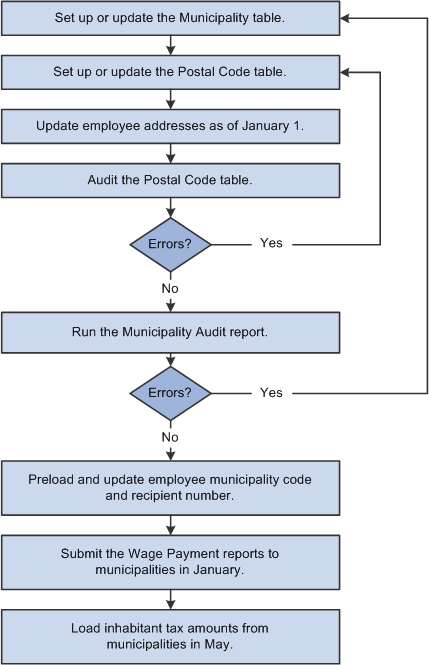

This diagram illustrates the process of maintaining the Inhabitant Tax table:

The following list provides more details about maintaining the Inhabitant Tax table:

Associate municipality codes with tax establishments and taxpayer-specified numbers on the Municipality table.

Associate municipality codes with postal codes on the Define Postal Codes JPN page.

Update employee addresses as of January 1 of the object year.

Run the Blank Municipality Audit Report query to identify postal codes that do not have a municipality code in the Japan Postal Code table.

Add missing municipality codes to the Define Postal Codes JPN page.

Run the Municipality Audit Rpt JPN report to check for invalid postal codes in employee addresses.

Correct errors that are reported by the audit report.

Rerun the audit report until all errors are corrected.

Correct all errors before you run the Pre-Load Inhabitant Tax process (GPJP_IHMUN1).

Run the Pre-Load Inhabitant Tax process.

The process loads each employee's municipality code and recipient number into the Inhabitant Tax table with the effective date of June 1 of the object year.

Edit recipient numbers and employment record number for the object year on the Maintain Inhab Tax Data JPN page, if necessary.

Send updated wage payment reports with summary to each municipality by the end of January of the object year.

Load employee inhabitant tax amounts and individual numbers that are provided by the municipality in May of the object year.

To load data from a printed list, manually enter tax amounts on the Maintain Inhab Tax Data JPN page.

To load data from an electronic file, use the Load Inhabitant Tax process (GPJP_IHMUN2).