Running Year-End Reports

This section discusses running and withholding tax reports.

Note: Before running these reports, run the Load YEA Report Data process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPJP_RC_YEAWHRPT |

Run the Withholding Tax report (GPJPYE01). |

|

|

GPJP_RC_YEAWGRPT |

Run the Withholding Tax/Wage Payment report (GPJPYE01). |

|

|

GPJP_RC_YEA |

Run the Legal Payment Summary report (GPJPYE02). |

|

|

Wage Payment Summary Rpt JPN (wage payment summary report Japan) Page |

GPJP_RC_YEA |

Run the Wage Payment Summary report (GPJPYE03). |

|

Tax Difference Carry Over JPN Page |

GPJP_RC_IT_TXDIF |

Run the Tax Difference Carried Over from the Previous Year report (GPJPYE06). |

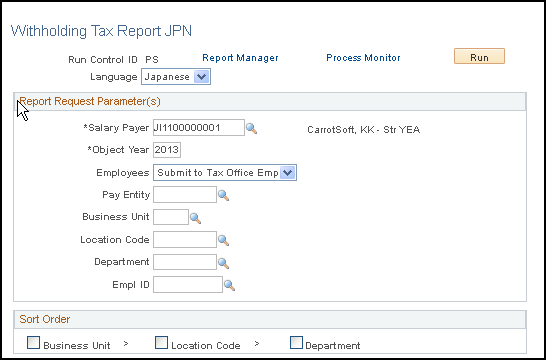

Use the Withholding Tax Report JPN (withholding tax report) page (GPJP_RC_YEAWHRPT) to run the Withholding Tax report (GPJPYE01).

Navigation:

This example illustrates the fields and controls on the Withholding Tax Report JPN page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Employees |

All Employees: Select to deliver the report to all employees after YEA has been processed. Submit to Tax Office Employees: Select if you deliver the report to the tax office. The process will select only the employees whose Submit to Tax Office check box on Rvw/Update YEA Report Data JPN page is selected. |

Note: To run the report for terminated employees, use the page from the Termination Processing menu. On writing to a file if there are more than 100 different municipal codes then the file will get split.

Use the Wage Payment Rpt JPN (wage payment report) page (GPJP_RC_YEAWGRPT) to run the Withholding Tax/Wage Payment report (GPJPYE01).

Navigation:

Deliver this report to municipalities after YEA has been processed. Municipal Code and Recipient Number are optional parameters. Use these to restrict the output.

Use the Legal Payment Summary Rpt JPN (legal payment summary report Japan) page (GPJP_RC_YEA) to run the Legal Payment Summary report (GPJPYE02).

Navigation:

This report displays amounts from the withholding tax reports for salary and bonus, as well as amounts from the retirement allowance withholding tax reports.