Creating the Withholding Tax Report for Terminated Employees

This section discusses how to load, review YEA report data for terminated employees.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPJP_RC_YEALOAD |

Run the process to load YEA data for terminated employees. |

|

|

GPJP_YEA_TABLE |

View results of the YEA Data Load process for terminated employees. View data and update the Submit to Tax Office indicator and Summary field. |

|

|

GPJP_RC_YEAWHRPT |

Print the Withholding Tax report for terminated employees. If the final payment for the employee included year-end processing (termination due to death), then the Withholding Tax report shows the result of YEA. |

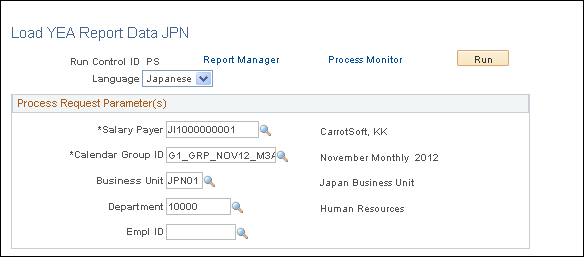

Use the Load YEA Report Data JPN page (GPJP_RC_YEALOAD) to run the process to load YEA data for terminated employees.

Navigation:

This example illustrates the fields and controls on the Load YEA Report Data JPN page. You can find definitions for the fields and controls later on this page.

Note: This page is similar to the Load YEA Report Data page that is accessed through the Year-End Processing menu path. To load YEA data for terminated employees, you must access the page through the Termination Processing menu path. The system compares the termination date with different dates depending upon the type of payment being made. For salary, the system compares the termination with the period end date. If the termination occurs before the period end date, the system considers the employee terminated. For bonus, the system considers the employee terminated if the effective date occurs before the payment date.

Field or Control |

Description |

|---|---|

Calendar Group ID |

Select the calendar group ID of the final salary or bonus payment. |

Business Unit, Department, and EmplID, are optional parameters that you can use to create YEA report data for terminated employees who belong to a specific business unit or department, or for a specific employee.

Use the Rvw/Update YEA Report Data JPN page (GPJP_YEA_TABLE) to view results of the YEA Data Load process for terminated employees.

View data and update the Submit to Tax Office indicator and Summary field.

Navigation:

View results of the YEA Data Load process and update the Submit to Tax Office indicator and the Summary field.

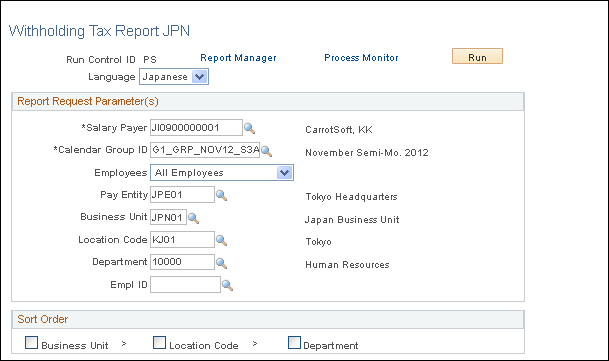

Use the Withholding Tax Report JPN page (GPJP_RC_YEAWHRPT) to print the Withholding Tax report for terminated employees.

If the final payment for the employee included year-end processing (termination due to death), then the Withholding Tax report shows the result of YEA.

Navigation:

This example illustrates the fields and controls on the Withholding Tax Report JPN page. You can find definitions for the fields and controls later on this page.

Note: This page is similar to the Withholding Tax Report JPN page that is accessed through the Year-End Processing menu path. To print the Withholding Tax report for terminated employees, you must access the page through the Termination Processing menu path.

Field or Control |

Description |

|---|---|

Calendar Group ID |

Select the calendar group ID of the final salary or bonus payment. |

Employees |

Select whether to print the report for all terminated employees or only those with Submit to Tax Office selected on the Rvw/Update YEA Report Data JPN page. |

Pay Entity, Business Unit, Location, Department, and EmplID, are optional parameters that you can use to narrow the selection to a group of terminated employees or a specific employee.

The Sort Order group box enables you to sort the report by business unit, location code, and department.

Note: You must run the Load YEA Report Data JPN process before printing this report.