Preparing for YEA Reporting

This section provides an overview of YEA Report Data JPN preparation.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Pre-load Inhabitant Tax JPN Page |

GPJP_RC_IH_MUN1 |

Update the municipality codes and recipient numbers by running the Pre-Load Inhabitant Tax process (GPJP_IHMUN1), which loads the employee, municipality, and recipient numbers for the object year into the Inhabitant Tax table. |

|

GPJP_IH_PYE_TAX |

View and correct recipient numbers after running the Pre-Load Inhabitant Tax process. |

|

|

GPJP_RC_YEALOAD |

Load the YEA report data. |

|

|

GPJP_YEA_TABLE |

View and update the YEA Data table. View results of the YEA Data Load process and update the Submit to Tax Office indicator and theSummary field. |

The Load YEA Table Application Engine process (GPJP_YEALOAD) loads an intermediate table that contains most of the data that is necessary for these reports: withholding tax, wage payment, legal payment summary, and withholding tax register.

Regardless of whether you use the self-service or manual method of collecting data, follow this sequence when preparing to report YEA data:

Update employee addresses if necessary.

If you collect YEA data through self-service transaction, you accomplish this step using the Employee Personal Information page and the Load YEA Self-Service Data process (GPJP_YEASSLD).

Run the Pre-Load Inhabitant Tax process (GPJP_IHMUN1) to preload municipality codes to the Inhabitant Tax table.

Update employee recipient numbers, if necessary, on the Maintain Inhab Tax Data JPN page.

Run the Load YEA Report Data JPN process (GPJP_YEALOAD).

Update the Submit to Tax Agent indicator and edit the summary, if necessary, on the YEA Report Data JPN page.

Use the Load Inhabitant Tax JPN page (GPJP_RC_IH_MUN2) to load inhabitant tax amounts from electronic file.

Run the Load Inhabitant Tax process to load the tax amounts from the municipality if you are using electronic file data.

Navigation:

.

Note: You must update and audit employee addresses and the Define Postal Codes JPN table before preloading data.

Use the Load YEA Report Data JPN (load year-end adjustment report data Japan) page (GPJP_RC_YEALOAD) to load the YEA report data.

Navigation:

This example illustrates the fields and controls on the Load YEA Report Data JPN page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

EmplID (employee ID) |

If you select an employee ID, the process updates the row of data for the selected employee only. |

Note: To load YEA data for terminated employees, access the process through the Termination Processing menu path.

Use the Rvw/Update YEA Report Data JPN page to view and update the YEA Data table.

Navigation:

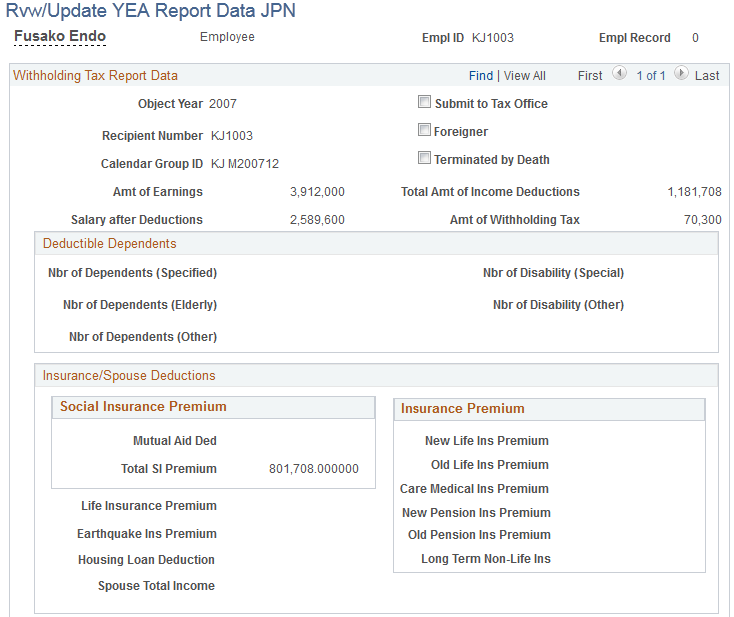

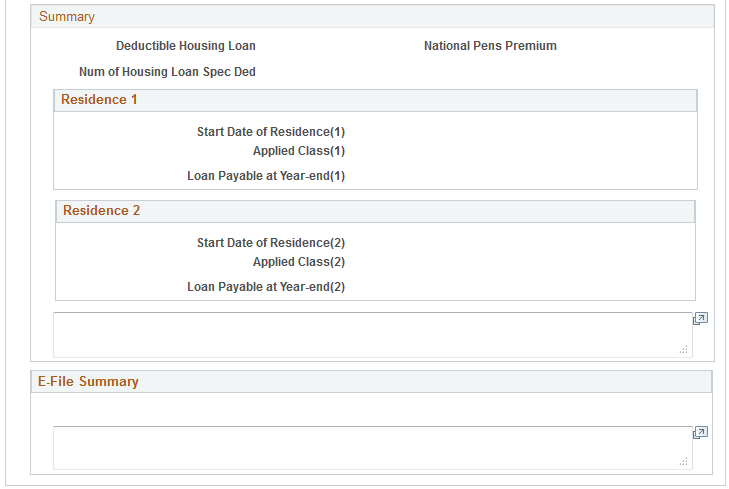

This example illustrates the fields and controls on the Rvw/Update YEA Report Data JPN page.

This example illustrates the fields and controls on the Rvw/Update YEA Report Data JPN page.

Field or Control |

Description |

|---|---|

Submit to Tax Office |

The system selects this check box if the KOU-type employee's gross income is over 5 million yen or the OTSU-type employee's gross income is over 500,000 yen (formula YE FM SUBMIT). The system does not verify whether the employee is an officer, retired, a disaster victim, or any of the other criteria for determining whether to submit the Withholding Tax report to the tax office. |

Summary |

The system enters deductible spouse and dependent identification, prior employment data, and the beginning date of residence (for employees who receive the housing acquisition special deduction). You can edit this data. Because of length limitations, the entire summary might not appear on the printed reports. |