Viewing and Updating Data for Work Accidents and Occupational Illness Certificates

Wage certificates for the payment of a daily allowance for industrial accidents or occupational illness are printed on Cerfa documents registered under the number 11137-01 and published by the Ministry for Employment and Solidarity (CNAMTS).

See Absence Elements for Illness.

Note: For payees who join or leave the company mid-year, manually enter the data necessary to produce the certificate.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPFR_ATMP_1 |

Generate the data needed to produce certificates for work accidents and occupational illness. |

|

|

GPFR_ATMP_2 |

Display the payee's earnings during the reference period. This page pertains to industrial accidents and occupational illness. |

|

|

GPFR_ATMP_3 |

Display and update information about salary upholding, apprenticeships, and lost wages for industrial accidents and occupational illness. |

|

|

GPFR_ATMP_4 |

Enter the information that the social security agency needs to pay the social security allowance to your organization, rather than directly to the payee. This information applies to industrial accidents and occupational illness. |

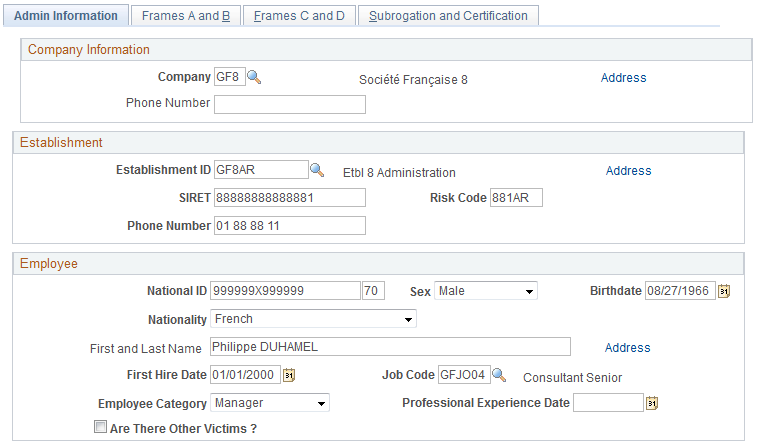

Use the Admin Information page (GPFR_ATMP_1) to generate the data needed to produce certificates for work accidents and occupational illness.

Navigation:

This example illustrates the fields and controls on the Accident/Illness Cert FRA - Admin Information page. You can find definitions for the fields and controls later on this page.

Note: You must run the Illness/Maternity Certificate Application Engine process (GPFR_ILL_AE ) using the Extract Certificates Data FRA component before accessing the pages in the Accident/Illness Cert FRA component.

Company Information

Field or Control |

Description |

|---|---|

Company |

Displays the payee's company on the date of the accident. |

Phone Number |

Displays the phone number for the company. |

Address |

Click this link to access the Company Address page, which displays the address of the company that you selected. |

Establishment

This group box displays information about the establishment at which the employee works, as entered in HR.

Field or Control |

Description |

|---|---|

Establishment ID |

Displays the establishment with which the employee was associated on the original date of the absence. |

SIRET |

Displays the SIRET identification number for the establishment. |

Risk Code |

Displays the risk code for the establishment. |

Phone Number |

Displays the establishment's phone number. |

Address |

Click this link to access the Establishment Address page, which displays the address of the establishment that you selected. |

Employee

Field or Control |

Description |

|---|---|

National ID |

Displays the payee's national ID followed by the key. |

Sex |

Displays the payee's gender: Female, Male , or Unknown. |

Birthdate |

Displays the payee's date of birth. |

Nationality |

Displays the payee's nationality: EEC Resident, French, or Other. |

Address |

Click this link to access the Employee Address page, which displays the employee's address. |

First Hire Date |

Displays the date on which the employee was first hired. |

Job Code |

Displays the employee's job code. |

Employee Category |

Displays a category: Executive, Manager, or Workman. |

Professional Experience Date |

Displays the employee's years of seniority in the job. |

Are There Other Victims |

For work accidents, select this check box if another person was injured in the accident. |

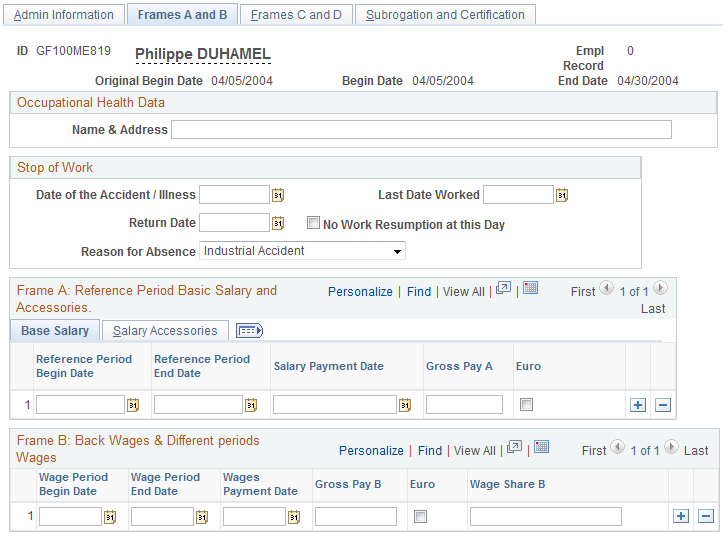

Use the Frames A and B page (GPFR_ATMP_2) to display the payee's earnings during the reference period.

This page pertains to industrial accidents and occupational illness.

Navigation:

This example illustrates the fields and controls on the Accident/Illness Cert FRA - Frames A and B page: Base Salary tab. You can find definitions for the fields and controls later on this page.

Common Page Information

Field or Control |

Description |

|---|---|

Date of the Accident/Illness |

Displays the date of the accident or the first medical observation (for an occupational illness). This is the same date entered in the Original Begin Date field on the Absence Event Entry page. |

Last Date Worked |

Enter the last date that the payee worked. Please note that you must enter the date yourself, it does not display by default. |

Return Date |

Enter the date on which the payee returned to work, if applicable. |

No Work Resumption at this Day |

If the payee has not yet returned from the absence, select this check box. |

Reason for Absence |

Displays the reason for the absence as recorded on the Absence Event Entry page: Industrial Accident or Occupational Illness. |

Frame A: Reference Period Basic Salary and Accessories

Frame A displays the payee's monthly gross earnings for each month.

Base Salary Tab

The base salary represents the paid and unpaid earnings during the reference period, including any wages that were upheld during this period.

Field or Control |

Description |

|---|---|

Reference Period Begin Date |

Displays the begin date of the earliest segment in the selected period. |

Reference Period End Date |

Displays the end date of the latest segment in the selected period. |

Salary Payment Date |

Displays the date on which the payee was paid. |

Gross Pay A |

Displays the employee's gross pay. |

Euro |

This check box is selected automatically if the salary is paid in euros. |

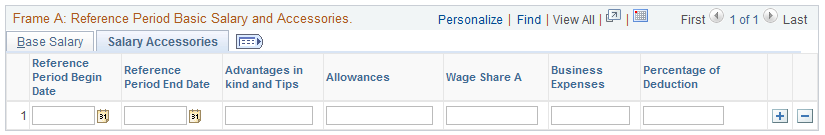

Salary Accessories Tab

Access the Salary Accessories tab.

This example illustrates the fields and controls on the Accident/Illness Cert FRA - Frames A and B page: Salary Accessories tab. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Reference Period Begin Date |

Displays the begin date of the earliest segment in the selected period. |

Reference Period End Date |

Displays the end date of the latest segment in the selected period. |

Advantages in Kind and Tips |

Displays the benefits in kind (avantages en nature) and tips (pourboires) not included in the base gross salary. |

Allowances |

Displays any allowances, premiums, or gratuities not included in the base gross salary. |

Wage Share A |

Displays the wage share of the contributions that correspond to the gross amount declared in columns 4, 5, and 6 of the certificate. |

Business Expenses |

Displays the amount of previously paid business expenses that are subject to contributions (that is, that are not part of the payee's standard gross pay). |

Percentage of Deduction |

Displays a supplemental deduction percentage if the payee's job qualifies for an additional deduction (journalists, for example). |

Frame B: Back Wages & Different Periods Wages

Frame B displays any back wages or wages that were paid to the payee at different intervals than the basic pay. For example, it might show a quarterly allowance (earned during the period from January 1 to March 31) that was paid in the March payroll.

Field or Control |

Description |

|---|---|

Wage Period Begin Date |

Displays the begin date of the period to which the amount in the Gross Pay B field applies. |

Wage Period End Date |

Displays the end date of the period to which the amount in the Gross Pay B field applies. |

Wages Payment Date |

Displays the date on which the payee was paid the processed gross. |

Gross Pay B |

Displays the gross amount of the employee's earnings. |

Euro |

This check box is selected automatically if the salary is paid in euros. |

Wage Share B |

Displays the wage share of the contributions that correspond to the gross amount declared in column 12 of the certificate. |

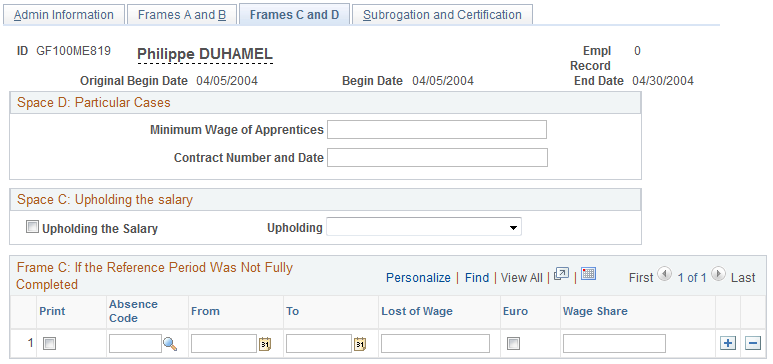

Use the Frames C and D page (GPFR_ATMP_3) to display and update information about salary upholding, apprenticeships, and lost wages for industrial accidents and occupational illness.

Navigation:

This example illustrates the fields and controls on the Accident/Illness Cert FRA - Frames C and D page. You can find definitions for the fields and controls later on this page.

Space D: Particular Cases

Field or Control |

Description |

|---|---|

Minimum Wage of Apprentices |

If the payee is an apprentice or trainee, enter the minimum wage for the category, level, or qualified employment in which the apprentice or the trainee would normally have been classified at the end of the training period or apprenticeship. |

Contract Number and Date |

If the payee is an apprentice, enter the number and date of the employment contract. |

Space C: Upholding the Salary

Field or Control |

Description |

|---|---|

Upholding the Salary |

Select this check box if you upheld the payee's salary. |

Upholding |

If you selected the Upholding the Salary check box, indicate the type of salary upholding: Integral Upholding or Partial Upholding. |

Frame C: If the Reference Period Was Not Fully Completed

Frame C displays information only if the reference period was not completed because of the absence.

Field or Control |

Description |

|---|---|

|

Select to print the row. |

|

Absence code |

Displays the reason for the absence. The following are valid values: MAL: Illness. MLD: Long-term illness. AT: Industrial accident. MAT: Maternity. CHOM: Total unemployment. FERM: Closing of establishment. COP: Vacation pay. ABS AUT: Authorized unpaid vacation. SN: National service. ABA: Authorized absence. Other absence codes you have defined. |

From |

Displays the begin date of the leave. |

To |

Displays the end date of the leave. |

Lost Wages |

Displays the wages lost during the absence period, if the salary was not upheld for this absence. |

Euro |

This check box is selected automatically if the salary is paid in euros. |

Wage Share |

Displays the portion of the employee's contributions that were lost because of the leave. |

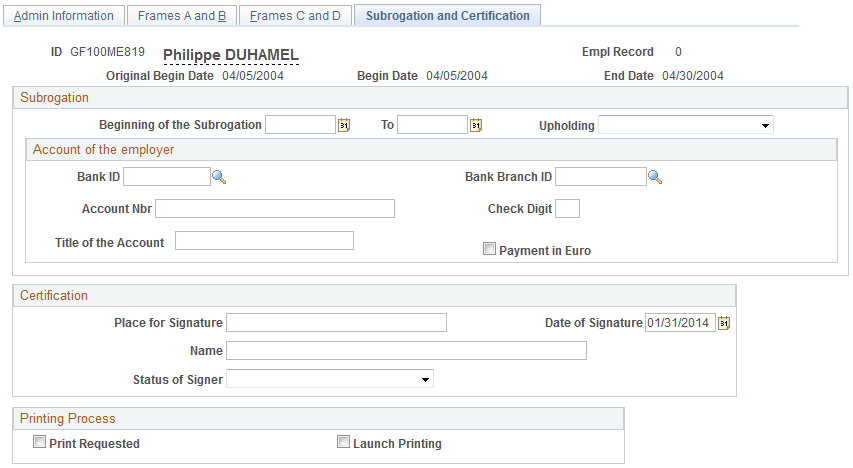

Use the Subrogation and Certification page (GPFR_ATMP_4) to enter the information that the social security agency needs to pay the social security allowance to your organization, rather than directly to the payee.

This information applies to industrial accidents and occupational illness.

Navigation:

This example illustrates the fields and controls on the Accident/Illness Cert FRA - Subrogation and Certification page. You can find definitions for the fields and controls later on this page.

Subrogation

Field or Control |

Description |

|---|---|

Beginning of the Subrogation |

Enter the begin date for which you are submitting a claim for subrogation. |

To |

Enter the end date for which you are submitting a claim for subrogation. |

Upholding |

Select Integral Upholding or Partial Upholding. |

Account of the employer

Field or Control |

Description |

|---|---|

Bank ID |

Enter the bank ID that the social security agency should use to deposit the funds. |

Bank Branch ID |

Enter the bank branch ID that the social security agency should use to deposit the funds. |

Account # (account number) |

Enter the account number that the social security agency should use to deposit the funds. |

Check Digit |

Enter the digit of the check that the social security agency should use to deposit the funds. |

Title of the Account |

Enter the title of the bank account into which the funds are to be transferred. |

Payment in Euro |

Select if you want to receive the allowance in euros. |

Certification

The values of the fields in the Certification group box can be predefined on the Certification page, which you access by clicking the Certification by the Employer link on the Extract Certificates Data FRA page You can also enter the certification information directly on the Subrogation and Certification page.

See Certification Page.

Printing Process

Field or Control |

Description |

|---|---|

Print Requested |

Indicates whether a certificate has been printed for the absence. This check box is selected automatically if a certificate has been printed. |

Launch Printing |

When you select this check box, the Launch button appears. Click this button to access the Certificates Report FRA page and print the certificate. |