Generating a Payslip

This topic provides overviews of the payslip process and segmentation and payslips and discusses how to print payslips.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPES_RC_PAYSLIP |

Run the Payslip Report (GPESPYS1), which prints a payslip summary for each employee selected. |

|

|

Pay Entity List Page |

GPES_RC_PSLP_PE |

Print payslips for selected pay entities. |

|

Pay Group List Page |

GPES_RC_PSLP_PG |

Print payslips for selected pay groups. |

|

Department List Page |

GPES_RC_PSLP_DPT |

Print payslips for selected departments. |

|

Location List Page |

GPES_RC_PSLP_LOC |

Print payslips for selected locations. |

|

Payee List Page |

GPES_RC_PSLP_PY |

Print payslips for selected payees. |

The Create/Print Payslips ESP page launches a job (GPESPSLP) containing three processes in sequence:

The GPES_PAYSLIP Application Engine process gathers information and creates an intermediate table.

The SQR GPESPYS1 prints the payslip report and provides self-service related information if ePay is licensed.

The GP_EPAY Application Engine process uses the payslip report and self-service related information provided by the prior processes in this job to create self-service payslips for each payee. If ePay is not licensed, this process reports that ePay has not been licensed and will finish successfully.

Note: When running the GPESPSLP job, you can use the following type and format options with ePay: None and None (becomes Web and PDF by default), Web and PDF, or File and PDF. If using File and PDF, do not use a custom output destination from the Process Scheduler Request page.

Segmentation occurs when employees' details change during a payroll period and the change requires the system to recalculate certain elements (element segmentation) or all elements (period segmentation). When the system segments an employee's pay, this affects payslips. Oracle delivers an SQR report that manages segmentation as explained in this table.

Note: You need to review how you want to manage segmentation and show the results in your organization's payslips.

|

Segmentation Event Definition |

Segmentation Type |

Impact on Payslip |

|---|---|---|

|

CATEGORZN |

Element |

The system generates one payslip. For compensation, social security contributions, and bases, each slice is listed on a separate line. |

|

COMPANY |

Period |

The system prints a separate payslip each segment. |

|

COMP_RATE |

Element |

The system generates one payslip. Where an earning has multiple slices, each slice is listed on a separate line. |

|

F/P TIME |

Period |

The system prints a separate payslip each segment. |

|

HIRE/TERM |

Period |

The system prints a separate payslip each segment. |

|

PAY_GROUP |

Period |

The system prints a separate payslip each segment. |

|

PAY_SYSTEM |

Period |

The system prints a separate payslip each segment. |

|

RISK_CODE |

Element |

The system generates one payslip. For social security contributions and bases, each slice is listed on a separate line. |

|

TAX_LOCNT |

Element |

The system generates one payslip. IRPF deductions are listed on separate lines. |

Payslips and Reversals

Segmentation can affect retroactive processing when the system recalculates a segmented period and the segmentation dates of the original calculation don't match the segmentation dates of the recalculation. When segment dates and payment keys match, the system recalculates the original segments, subtracts the old value from the new value for each payroll element to determine retroactive deltas, and writes the new results to the output tables. When segment dates don't match, the system treats the old and new values as if they belong to separate segments. It creates reversal segments for each segment that existed in the original calculation and creates new recalculation segments. The reversal segments have no results because they do not go through gross-to-net processing. The new recalculated segments do go through gross-to-net processing and generate new values. The system writes these new values to the output result tables. For the purposes of calculating deltas, the originally calculated values are effectively zero.

When segments don't match during retroactive processing, the system applies special rules to payslip generation:

The system overrides the Retro Type defined on the Payslip Setup page to Multiple Payslips. Therefore, if the retroactive processing includes more than one month, the system generates one payslip for regular pay and separate payslips for each month that has retroactive pay.

The payslip for the month in which the segments don't match lists recalculated values instead of deltas.

Payslips and Corrections

Occasionally you need to rerun a finalized payroll to incorporate late changes. If you want those late changes to be included in monthly legal reports, you can run a correction calendar. Correction calendars recalculate the affected payroll run and provide a new set of results that the system includes in legal reporting such as the Model 111 or the FAN file. In regard to banking, the system generates a delta net amount to be paid that represents the difference between the recalculated net and the previously calculated net. When you select a calendar group for payslip generation, the system detects whether the calendar group is a correction. If it is, the system enables you to choose one of two printing options:

Print the deltas that the system calculated during the correction.

Print the recalculated values that resulted from the correction calculation.

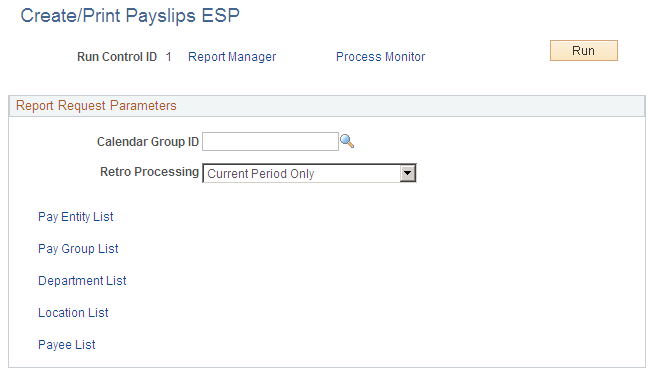

Use the Create/Print Payslips ESP page (GPES_RC_PAYSLIP) to run the Payslip Report (GPESPYS1), which prints a payslip summary for each employee selected.

Navigation:

This example illustrates the fields and controls on the Create/Print Payslips ESP page. You can find definitions for the fields and controls later on this page.

Before using this page, you must have set up a payslip on the Payslip Setup pages and run the payroll process.

Field or Control |

Description |

|---|---|

Calendar Group ID |

Select the calendar group that you want to process. You can select only from calendar groups that have been calculated or finalized. |

Retro Processing |

Select one of these values: Current Period Only: Include only regular payroll calculations in the payslip. Retro and Current Periods: Include both regular and retroactive payroll calculation in the report. Retro Periods Only: Include only retroactive payroll activities in the payslip. |

Correction Processing |

Select what type of payslip the system generates for correction calculations. Values are: Differences: Select to generate a payslip that lists the deltas that the system calculated during the correction. Recalculated: Select to generate a payslip that lists the recalculated values that resulted from the correction calculation. Note: This field appears only if your select a calendar group ID that includes payroll corrections. |

Pay Entity List |

Click to select one or more pay entities for processing. The system displays the Pay Entity List page. |

Pay Group List |

Click to select one or more pay groups for processing. The system displays the Pay Group List page. |

Department List |

Click to select one or more departments for processing. The system displays the Department List page. |

Location List |

Click to select one or more locations for processing. The system displays the Location List page. |

Payee List |

Click to select one or more payees for processing. The system displays the Payee List page. |