Defining Labor Agreements

This topic discusses how to set up labor agreements using the Labor Agreement ESP component (GPES_LBR_AGREEMENT).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPES_LBR_SENIORITY |

Define the details for calculating seniority earnings for the labor agreement. |

|

|

GPES_SEN_EARNINGS |

Assign an element name to a measurement for the labor agreement. |

|

|

GPES_LBR_XTRA_PD |

Define the details for the extra period payments as stated in the labor agreement. |

|

|

GPES_LBR_XTRA_ER |

Define the earnings that are eligible for extra period payments. |

|

|

GPES_LBR_BNF |

Define the periods and the percentages that employees receive for illness, accident-related, maternity, or risk-during-pregnancy benefits. The periods are established by the labor agreement. |

|

|

GPES_LBR_TERM |

Define daily salary and severance pay settings that the payroll process uses for terminations of the labor agreement. |

Each company is required to have at least one labor agreement and at least one professional category. Every employee is assigned to a labor agreement and a professional category on the Job Data component (JOB_DATA) in HR.

Before defining labor agreement information on the Labor Agreement component (HR_LABOR_AGRMNT) in PeopleSoft Global Payroll for Spain, you need to set up labor agreements and their associated categories on the Labor Agreement and Labor Agreement Categories pages in HR.

Because of data relationships, defining your data in the following order is important:

Define the Social Security scheme on the Social Security Scheme Table component and then the labor agreement on the Labor Agreement component in HR.

Define the labor agreement categories on the Labor Agreement Categories page in HR. Within the categories, specify the scheme ID and the social security work group, as well as FORCEM.

Define Global Payroll-specific information about the labor agreement, such as seniority calculation, definition of extra periods, and Social Security benefits on the Labor Agreement ESP component (GPES_LBR_AGREEMENT) in PeopleSoft Global Payroll for Spain.

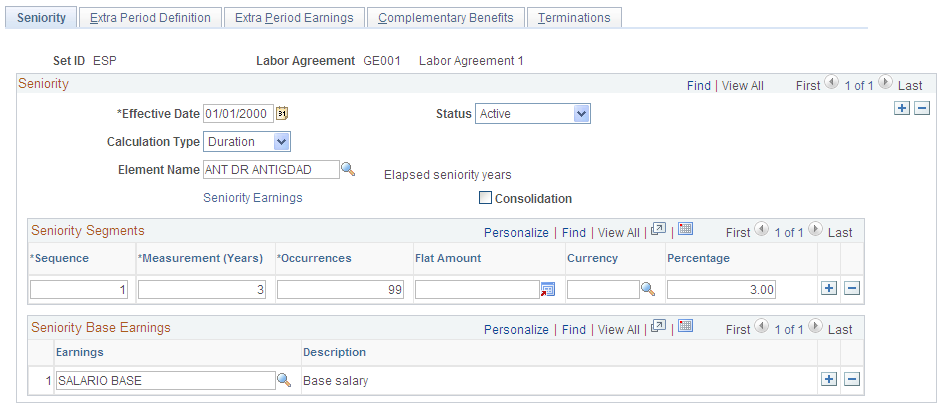

Use the Seniority page (GPES_LBR_SENIORITY) to define the details for calculating seniority earnings for the labor agreement.

Navigation:

This example illustrates the fields and controls on the Seniority page. You can find definitions for the fields and controls later on this page.

Seniority

Field or Control |

Description |

|---|---|

Calculation Type |

Select the calculation type that corresponds to seniority, either Duration or Formula. A calculation type is required for calculating employee seniority years. |

Element Name |

Enter the corresponding element for the seniority calculation. PeopleSoft Global Payroll for Spain delivers the ANT DR ANTIGDAD duration. To customize the way that the system counts seniority, implementers can use one of the following options:

|

Seniority Earnings |

Click to access the Seniority Earnings page. Use this page to assign seniority earnings to the seniority measurement for a labor agreement. |

Consolidation |

Select to consolidate the calculation in a single seniority earning. The sum of the previous seniority amounts will be assigned to the ANT CONSOLDA earnings element. This typically occurs when the labor agreement establishes a change in the measurement of seniority, for example, from trienniums to cuatrenniums. When this happens, the total previous seniority will appear as another earning called consolidated seniority (antigüedad consolidada) if you select the Consolidation check box. |

Seniority Segments

Sometimes a labor agreement indicates that seniority be calculated in different ways. Then, seniority is calculated in different segments. Use the Seniority Segments group box to define seniority calculations if segments are used.

Field or Control |

Description |

|---|---|

Sequence |

Indicate the order of the various segments. |

Measurement (Years) |

Enter the number of years in which you measure seniority. Typical values are 3 (for triennium) or 4 (for cuatrennium). PeopleSoft Global Payroll for Spain delivers measurements for trienniums and cuatrenniums, but you can also create your own measurements. |

Occurrences |

Define how many times the occurrence of the seniority will occur. For example, you could pay the first 3 trienniums as 5 percent and the next cuatrennium as a flat amount. |

Flat Amount |

Enter the flat amount of the seniority earnings in a segment. Some labor agreements define seniority earnings as flat amounts, rather than a percentage of some earnings. |

Currency |

Select the currency in which the seniority flat amount is entered. |

Percentage |

Enter the percentage of the base earnings in a segment. Some labor agreements define seniority earnings as a percentage of base earnings, rather than flat amounts. |

Seniority Base Earnings

Field or Control |

Description |

|---|---|

Earnings |

If the seniority is defined as a percentage, select the earnings elements used as the base to calculate seniority. |

Example: Calculating Seniority Over Segments

Assume that a labor agreement establishes that employees will receive seniority earnings according to this schedule:

|

Number of Years |

Seniority Earnings |

|---|---|

|

1–3 (triennium) |

6 EUR per month |

|

3–6 (triennium) |

6 EUR per month |

|

6–9 (triennium) |

9 EUR per month |

|

9–13 (cuatrennium) |

12 EUR per month Employees receive seniority earnings after 3 years with the company. During the next three years, employees receive 6 EUR monthly. In addition, for year 7 to year 9, employees receive 12 EUR monthly (6 EUR for the first triennium and 6 EUR for the second triennium.) |

Here is what an employee will typically receive for seniority earnings:

Employees will receive 0 EUR per month from year 0 to year 3.

Employees will receive 6 EUR per month from year 3 + 1 month to year 6.

Employees will receive 12 EUR per month from year 6 + 1 month to year 9.

Employees will receive 21 EUR per month from year 9 + 1 month to year 13.

Employees will receive 33 EUR per month from year 13 + 1 month to year 17.

Here is how you can set up the seniority earnings in PeopleSoft Global Payroll for Spain:

Sequence 1:

Measurement = 3

Occurrences = 2

Flat Amount = 6 EUR

Sequence 2:

Measurement = 3

Occurrences = 1

Flat Amount = 9 EUR

Sequence 3:

Measurement = 4

Occurrences = 99

Flat Amount = 12 EUR

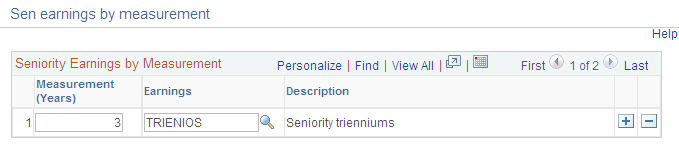

Use the Sen Earnings by Measurement (Seniority Earnings by Measurement) page (GPES_SEN_EARNINGS) to assign an element name to a measurement for the labor agreement.

Navigation:

Click the Seniority Earnings link on the Seniority page.

This example illustrates the fields and controls on the Seniority Earnings by Measurement page. You can find definitions for the fields and controls later on this page.

PeopleSoft Global Payroll for Spain delivers trienniums and cuatrenniums, but you can create a different seniority measurement by adding a new earning with the same characteristics as one of the existing seniority earnings. If you define a new earning for a new seniority measurement, add it on the Seniority Earnings page. Make sure that you define the new earning with the Category field set to BAS and the Custom Field5 field set to 5–ANTIGDAD. You must also add the new seniority earning to the correct accumulators. Use the definition of the delivered elements TRIENIOS and CUATRIENIOS as a basis, but update these accumulators in the following way:

Include the following accumulators in the Rate component for the seniority earning:

TAX AC ANTIG VLR S

CLI AC DEV ABSRBLE

Include the seniority earning in the following accumulators:

CLI AC BASE SS D

CLI AC SAL BRUTO

CLI AC ING DIN FJO

Field or Control |

Description |

|---|---|

Measurement (Years) |

Enter the number of years in which you measure seniority. Typical values are 3 (for triennium) or 4 (for cuatrennium). |

Earnings |

Select the earnings element that corresponds to the Measurement (Years) field. |

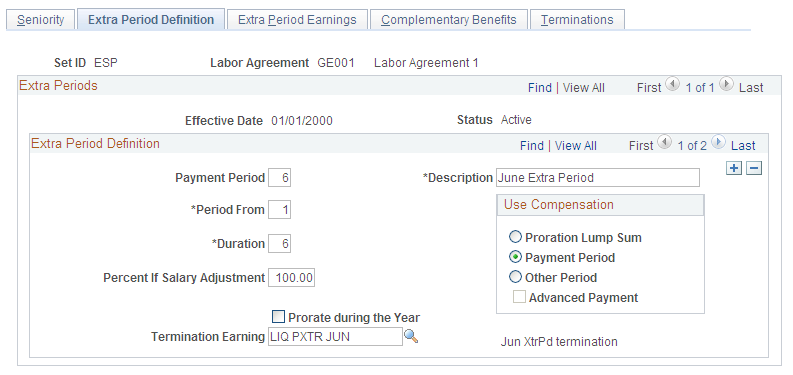

Use the Extra Period Definition page (GPES_LBR_XTRA_PD) to define the details for the extra period payments as stated in the labor agreement.

Navigation:

This example illustrates the fields and controls on the Extra Period Definition page. You can find definitions for the fields and controls later on this page.

Extra Period Definition

Use this group box to define the conditions for extra period payments.

Field or Control |

Description |

|---|---|

Payment Period |

Specify the month in which the extra period amount is paid. For example, if you enter 6, the extra period amount will be paid in June. |

Period From |

Enter the month of the year when the extra period contribution time frame begins. For example, if you enter 1, the contribution time frame begins in January. The Period From and Duration fields apply only to extra period payments that are not prorated. For extra period payments that are not prorated, a contribution time frame exists. The time frame is determined by a beginning period (defined in the Period From field) and a duration (defined in the Duration field). |

Duration |

Enter the number of months of the contribution period. For example, if you enter 6, the contribution lasts 6 months. |

Prorate during the Year |

Select to pay the extra period earnings every month as part of the regular pay period, and not as a unique payment. The extra period earnings will be prorated as 1/12 of the extra period payment. Note: If you select this check box, the Payment Period, Period From, and Duration fields become display-only. Because the extra period payment is prorated over 12 months, the Payment Period field is automatically defined as 0, the Period From field is automatically defined as 1, and the Duration field is defined as 12. |

Percent If Salary Adjustment |

This field specifies the overall extra period percentage. For example, if you enter 50 percent, the extra period payment is 50 percent of the normal extra period payment, irrespective of the earning percentages that you specify on the Extra Period Earnings page. This field is used for employees whose salary is adjusted to gross or net only. The employees' gross or net annual salary is defined in their personal agreement and this value is stored in the Target Compensation Rate field on the Job Data - Compensation page. |

Termination Earning |

Select the earnings element that corresponds to the extra period termination payment specified by the labor agreement. When employees are terminated, they are paid for the portion of the extra period payment that they have been accumulating. An employee receives proportional compensation, depending on the number of days worked in the extra period time frame. If an extra period is paid before the end period of the contribution and an employee leaves before the end of the contribution time frame, the system calculates the amount that the employee was overpaid. In this case, the termination earnings are negative. |

Use Compensation

If the extra period payment is not prorated, use these options to define how the payment is calculated:

Field or Control |

Description |

|---|---|

Proration Lump Sum |

Select to base the extra period payment on employees' earnings during the contribution time frame. The earnings that contribute to extra period payments are defined on the Extra Period Earnings page. For example, if the extra period payment is for the January to June time frame, the system calculates the extra period payment by accumulating the specified extra period earnings for each month of this time frame. |

Payment Period |

Select to base the extra period payment on the employee's contributing earnings for the payment period. For example, if Payment Period is 6 (June), the extra period payment is calculated based on contributing earnings for June. |

Other Period |

Select to base the extra period payment on employee's contributing earnings from the payment period you designate. |

Advanced Payment |

Select this check box if the extra period payment is paid to the employees before the contribution time frame end period. The system displays this check box if the payment period is before the end of the contribution time frame. If you don't select this check box, the extra period is paid in the next year. For example, if you define the contribution time frame as July to December and enter 1 (January) in the Payment Period field, the system needs to know whether the employee is paid in the January before the contribution time frame end period or in the January after the end of the time frame. If you deselect the Advanced Payment check box, the employee is paid in the January of the following year. |

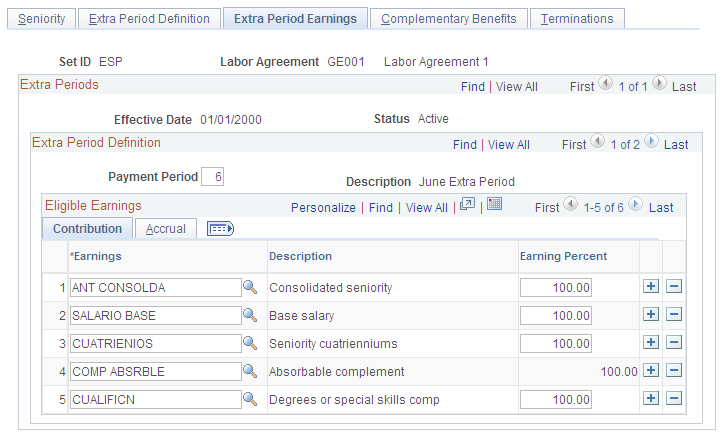

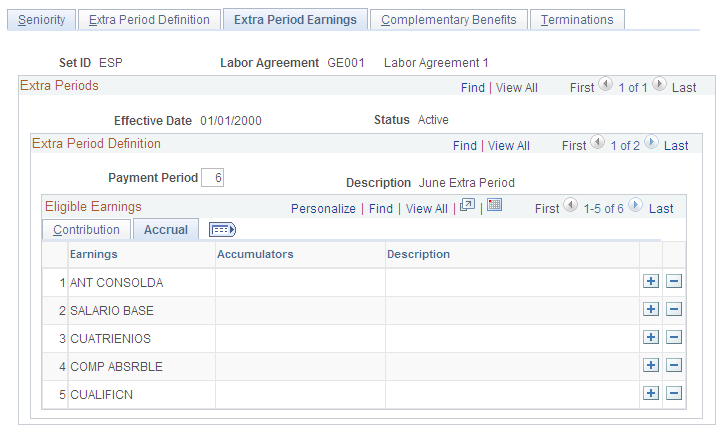

Use the Extra Period Earnings page (GPES_LBR_XTRA_ER) to define the earnings that are eligible for extra period payments.

Navigation:

This example illustrates the fields and controls on the Contribution tab of the Extra Period Earnings page. You can find definitions for the fields and controls later on this page.

Extra Period Definition

Use this group box to define the earnings that contribute towards the extra period payments that you defined on the Extra Period Definition page. All extra periods can have the same earnings or you can vary the contributing earnings for each extra period.

Field or Control |

Description |

|---|---|

Payment Period |

This is the month when the extra period is paid. The system populates this field from the Extra Period Definition page. |

Eligible Earnings: Contribution Tab

Field or Control |

Description |

|---|---|

Earnings |

Select the earning elements that you want to make eligible for the extra period. |

Earning Percent |

Enter the percentage of the earning that contributes to the extra period payment. For example, if you enter 100 in this field, the earning is paid in full in the extra period payment. If you enter 50, 50 percent of the earning amount is used to calculate the extra period payment. If you select an earning that is identified as an absorbable complement (complemento absorbible), this field is populated from the Percent If Salary Adjustment field on the Extra Period Definition page. |

Eligible Earnings: Accrual Tab

Access the Extra Period Earnings page: Accrual tab

This example illustrates the fields and controls on the Accrual tab of the Extra Period Earnings page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Accumulators |

For extra periods during which the Calculation Option field is Proration Lump Sum, use this field to specify the accumulator that stores all the monthly contributions during the extra period time frame. |

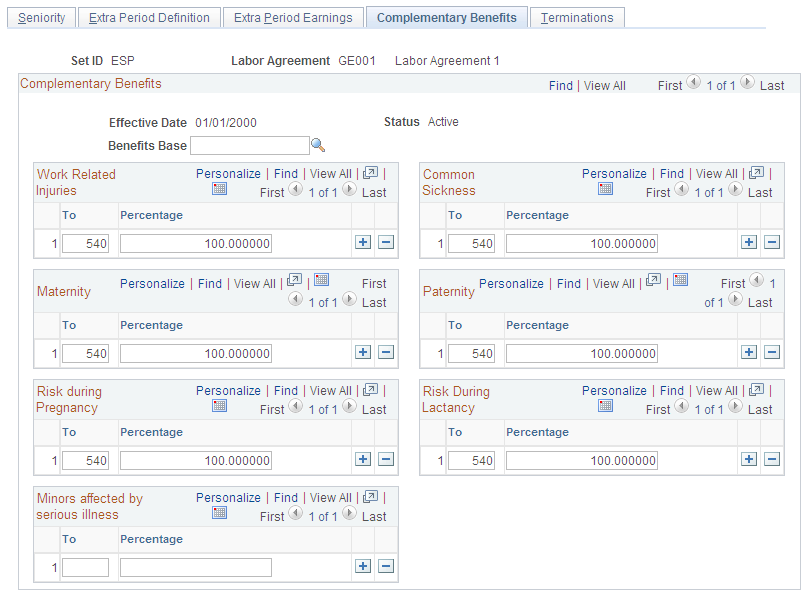

Use the Complementary Benefits page (GPES_LBR_BNF) to define the periods and the percentages that employees receive for illness, accident-related, maternity, or risk-during-pregnancy benefits.

The periods are established by the labor agreement.

Navigation:

This example illustrates the fields and controls on the Complementary Benefits page. You can find definitions for the fields and controls later on this page.

Complementary Benefits

Use the Complementary Benefits page to define the benefits employees receive if they have a work-related injury, common sickness, maternity leave, or risk during pregnancy leave. Employees receive two types of benefits: legal benefits paid by the social security authority (Subsidio IT, Subsidio AT, Subsidio RE, Subsidio MT, and Subsidio CM) and employer-paid complementary benefits (Prestación Complementaria IT, Prestación Complementaria AT, Prestación Complementaria RT, Prestación Complementaria MT, and Prestación Complementaria CM). On this page, you define the basis for calculating benefits, and the percentage of the benefits base that an employee receives as benefits. The system automatically calculates the percentage that is paid by the employer and by Social Security.

Field or Control |

Description |

|---|---|

Benefits Base |

Select the accumulator that the system uses as the basis for calculating employees' daily complementary benefits. If no accumulator is specified, the system uses the following accumulators converted to a daily value:

If you want to use gross salary as the basis, you could use the accumulator AJB AC DEV BAS S, which stores the total of all daily values for all basic earnings. Or you can define your own accumulator to use for this purpose. |

Work Related Injuries

Use this group box to define the total statutory and complementary benefits received for work-related injuries. The difference between common sickness and work-related injuries is that for work-related injuries, the statutory benefit is 75 percent starting from day 1.

Field or Control |

Description |

|---|---|

To |

Define the period for the benefit (usually the number of days up to a certain day). For example, if you enter 4 in the first row, then from days 1–4 (up to day 4) of absence, the employee receives a specified percentage. If you enter 5 in the second row, then for day 5, the employee receives another specified percentage. If you enter 10 in the third row, then from days 6–10, the employee receives another specified percentage. |

Percentage |

Define the percentage of the benefit base that an employee receives in benefits. For example, if you enter 100, employees receive 100 percent of the benefit base during the specified period. Note: This percentage is a combination of statutory and complementary benefits. The statutory benefit is based on a percentage of common contingency or the professional contingency bases. The complementary benefit is a percentage of the base that you specified in the Benefits Base field. |

Common Sickness

Use this group box to define the total statutory and complementary benefits received for common sicknesses or nonwork-related accidents.

For descriptions of the To and Percentage fields, see the discussion for the Work Related Injuries group box.

Maternity

Use this group box to define the total statutory and complementary benefits received for maternity leave.

For descriptions of the To and Percentage fields, see the discussion for the Work Related Injuries group box.

Paternity

Use this group box to define the total statutory and complementary benefits received for paternity leave.

For descriptions of the To and Percentage fields, see the discussion for the Work Related Injuries group box.

Risk during Pregnancy

Use this group box to define the total statutory and complementary benefits received for risk during pregnancy.

For descriptions of the To and Percentage fields, see the discussion for the Work Related Injuries group box.

Risk during Lactancy

Use this group box to define the total statutory and complementary benefits received for risk during lactancy.

For descriptions of the To and Percentage fields, see the discussion for the Work Related Injuries group box.

Minors Affected by Serious Illness

Use this group box to define the total statutory and complementary benefits received for absence due to minor care.

For descriptions of the To and Percentage fields, see the discussion for the Work Related Injuries group box.

Example: Complementary Benefits

When an employee cannot work due to a common sickness, nonwork-related accident, work-related accident, maternity leave, or risk during pregnancy he or she does not receive any compensation; however, the law requires that the employee receive social security benefits. Employees receive a percentage of the benefits base that depends on the number of days the employee is absent.

This table specifies the statutory percentage of the daily contribution base of the previous pay period that an employee should receive depending on the number of days the employee is absent from work due to a common sickness:

|

Days |

Percentage of Social Security Contribution Base Received |

|---|---|

|

1–3 |

0% |

|

4–20 |

60% |

|

21 up to 540 (the legal maximum) |

75% |

In addition to the statutory percentages, a company can choose to pay additional benefits, known as complementary benefits.

For example, assume that your company has a labor agreement with the following rules for IT benefits (for common sickness or nonwork-related accidents):

From day 1 through day 10, employees receive 100 percent of the benefits contribution base.

From day 11 through day 25, employees receive 90 percent of the benefits contribution base.

So the following breakdown of benefits received is:

|

Days |

Type of Benefit |

Total Percentage of Benefits Base |

|---|---|---|

|

1–3 |

Statutory: 0% Complementary: 100% |

100% |

|

4–10 |

Statutory: 60% Complementary: 40% |

100% |

|

11–20 |

Statutory: 60% Complementary: 30% |

90% |

|

21–25 |

Statutory: 75% Complementary: 15% |

90% |

|

26 and on |

Statutory: 75% Complementary: 0% |

75% |

Note: Statutory benefits are calculated as a percentage of the common contingency or the professional Social Security contingency bases. For complementary benefits, your organization can base the calculation on other amounts, using the Benefits Base field. For example, you could use employees' gross salary (as a daily rate) from the previous month as a basis for calculating benefits.

On the Complementary Benefits page, you'll define the periods (number of days) and the corresponding percentages for a benefit. In our example, these parameters would be defined in the following way:

To field = 10, Percentage field = 100.

To field = 25, Percentage field = 90.

Use the Labor Agreement ESP - Terminations page to define daily salary and severance pay settings that the payroll process uses for terminations of labor agreements.