Defining Recipients

To define deduction recipients and to select recipients' deposit schedules, use the Deduction Recipients BRA (GPBR_RECIPIENT) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPBR_RECIP_INFO |

Enter basic personal information of deduction recipients. |

|

|

RECIPIENT |

Define general and individual recipients for deductions. |

|

|

RECIPIENT_DEP_INFO |

Select recipients' deposit schedule. |

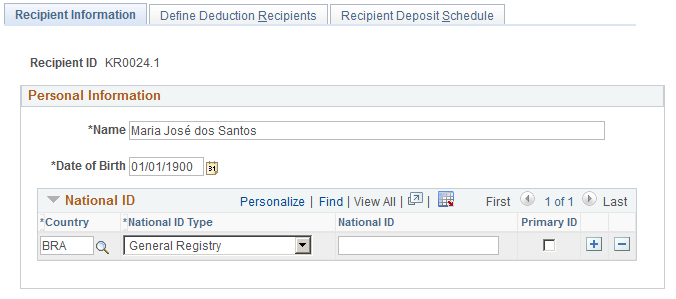

Use the Recipient Information page (GPBR_RECIP_INFO) to enter basic personal information of deduction recipients.

Navigation:

This example illustrates the fields and controls on the Recipient Information page.

Personal Information

Use this section to enter basic personal information of individuals who receive alimony payment through payroll. Information entered here is used in eSocial reporting.

Field or Control |

Description |

|---|---|

Name |

Enter the full name of the recipient. |

Date of Birth |

Enter the birth date of the recipient. |

National ID Type and National ID |

Select a national ID type, and enter the corresponding ID for the selected type. Enter one or more rows of national ID for the recipient. Supported national ID types include: CAIXA CPF - Person Registry (required) CTPS - Work Card Civil Registry ID Foreigner ID General Registry Health National Card Militar Certificate NIT Number New Born ID PASEP or PIS Voter Registration Card |

Primary ID |

Select to indicate that the corresponding national ID is the primary ID of the recipient. |

Use the Define Deduction Recipients page (RECIPIENT) to define general and individual recipients for deductions.

Navigation:

Use the Recipient Deposit Schedule page (RECIPIENT_DEP_INFO) to define general and individual recipients for deductions.

Navigation: