Building Benefit Programs

To define benefit programs, use the Benefit Program Table (BEN_PROG_DEFN) component.

This section discusses how to define benefit programs and associate plan types with a benefit program.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BEN_PROG_DEFN1 |

Define basic benefit program information. |

|

|

BEN_PROG_DEFN2 |

Link plan types to the benefit program and add important information about plan types. |

|

|

BEN_PROG_DEFN3 |

Link a benefit program and plan type to rate and calculation rules. |

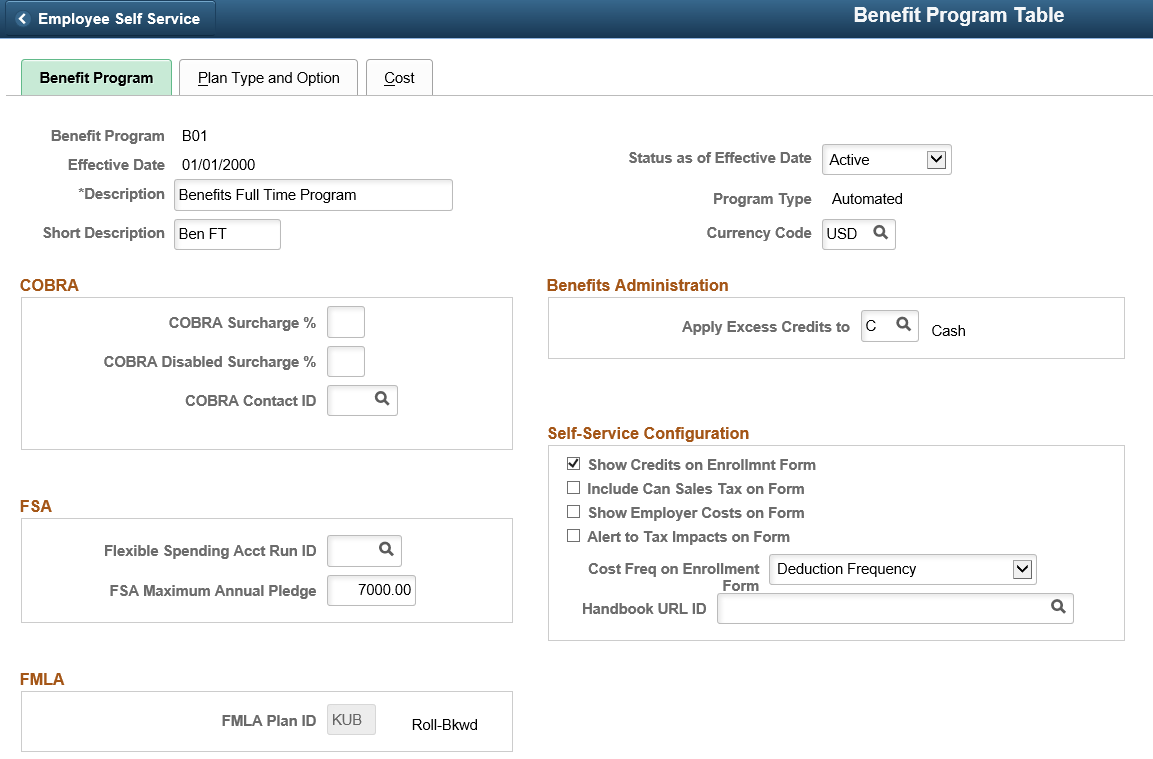

Use the Benefit Program Table - Benefit Program page (BEN_PROG_DEFN1) to define basic benefit program information.

Navigation:

This example illustrates the fields and controls on the Benefit Program Table - Benefit Program page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Effective Date |

The date the row in the table becomes effective. This date determines when you can view and change information. |

Status as of Effective Date |

Indicates whether a row in the table is Active or Inactive. Processes ignore benefit programs designated as Inactive, even if the effective date defines the program as current. |

Program Type |

The type of program can be Manual or Automated. If you are using only the Manage Base Benefits business process, this option is automatically set to Manual. If you activate Benefits Administration on the Installation Table, it is automatically set to Automated. |

Currency Code |

The type of currency that is used for this program's benefit and deduction calculations. |

COBRA

This group box defines the rules regarding the surcharge amounts that your organization imposes on COBRA (Consolidate Omnibus Budget Reconciliation Act) plans.

Field or Control |

Description |

|---|---|

COBRA Surcharge % (COBRA surcharge percentage) |

Enter the percentage amount of the benefit cost that you want added to the benefit cost. For example, if the cost of medical coverage is 100 USD and the COBRA surcharge % is 30%, the cost for medical coverage for someone on COBRA would be 130 USD. |

COBRA Disabled Surcharge % (COBRA disabled surcharge percentage) |

If you want a different percentage amount for a disabled person, enter that percentage amount. If you leave the field blank, the surcharge amount entered in the COBRA Surcharge % field will be applied to a disabled person with COBRA coverage. |

FSA

For FSA (flexible spending account) Administration users. Use this group box to set up your organization's business rules for flexible spending accounts.

Field or Control |

Description |

|---|---|

Flexible Spending Acct Run ID (flexible spending account run ID) |

For FSA Administration users. Enter the FSA run ID that you created on the FSA Run Table. |

FSA Maximum Annual Pledge |

Enter the maximum amount that an employee can contribute across all flexible spending accounts within the Benefit Program for a plan year. |

FMLA

Use this group box to define the rules for processing under FMLA (Family Medical Leave Act).

Field or Control |

Description |

|---|---|

FMLA Plan ID (FMLA plan identification) |

Enter the FMLA plan ID that you created on the FMLA Plan Table. |

Benefits Administration

This group box is available if Benefits Administration is activated on the Installation Table. If you are using flexible credits, it is used to define how the system will process excess flexible credit amounts when an employee does not designate a rollover election during benefit enrollment.

Field or Control |

Description |

|---|---|

Apply Excess Credits to |

The system can convert excess flexible credit amounts to: C (Cash) D (FSA-Dependent Care) F (Forfeit Excess Credit) H (FSA-Health Care) R (FSA Retirement Counseling) S (Savings-401(k)) |

Self-Service Configuration

Use this group box to define the rules for displaying and processing the PeopleSoft eBenefits application pages.

Field or Control |

Description |

|---|---|

Show Credits on Enrollmnt Form (show credits on enrollment form) |

Select if you want credit amounts to appear on the enrollment form. If you do not offer flexible credits, you may not want this heading to appear on the form. |

Include Can Sales Tax on Form (include Canadian sales tax on form) |

Select if you want Canadian sales tax information to appear on the eBenefits Enrollment Summary page. |

Show Employer Costs on Form |

Select to display the employer's contributions (costs) on the enrollment form |

Alert to Tax Impacts on Form |

Select to alert the employee to any potential tax impacts (due to the employer's contributions) on the enrollment form. Most typically, this would be if a T-Tax (imputed income) component existed. |

Cost Freq on Enrollment Form (cost frequency on enrollment form) |

This defines how the cost of the benefits appears on the enrollment form. Values are Annual: Displays the costs as annual amounts. Deduction: Displays the costs as per-pay-period amounts. |

Handbook URL ID (handbook uniform resource locator identification) |

Enter the URL ID that connects to your benefit handbook. URL IDs are set up in the URL Table. |

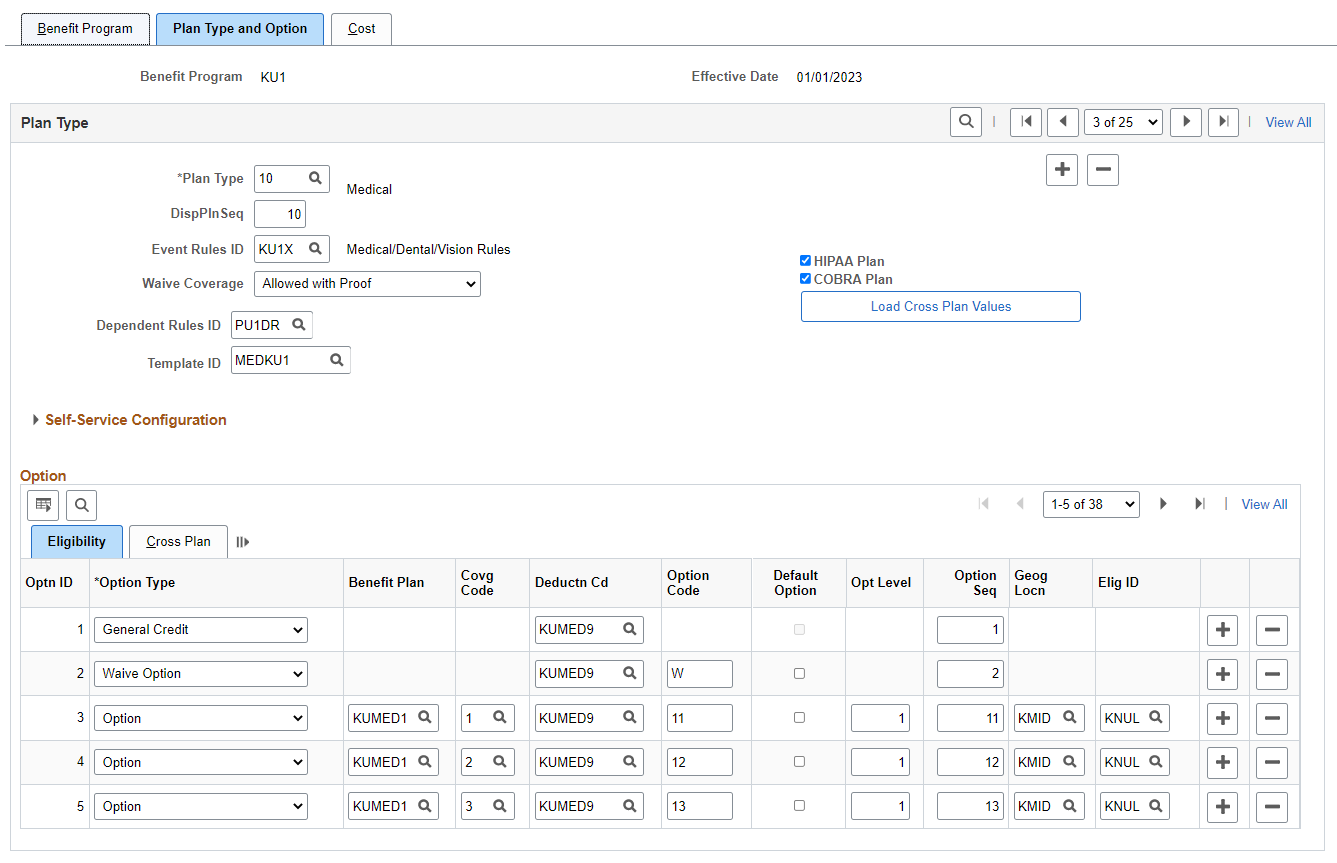

Use the Benefit Program Table – Plan Type and Option page (BEN_PROG_DEFN2) to link plan types to the benefit program and add important information about plan types.

Navigation:

This example illustrates the fields and controls on the Benefit Program Table – Plan Type and Option page. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Benefit Program Table – Plan Type and Option page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Plan Type |

Select the plan type that you want to add or display. |

DispPlnSeq (display plan sequence) |

For Benefits Administration users. Indicates the order in which benefit plans appear. The default value is the plan type. |

Event Rules ID |

For Benefits Administration users. Select an event rule that you want to link to this benefit plan. Event rules are set up on the Event Rules Table. |

Dependent Rules ID |

Select the dependent rule to be used when determining dependent age limits for this plan type. This field appears only for 1X (health) plan types. If you leave this field blank, the system uses the least restrictive options as the default limits:

Note: To generate COBRA event triggers during COBRA overage processing, the system uses the most restrictive settings from the dependent rules used by all of the 1X plan types under the benefit program (for example, the lowest age limits). The system uses these settings only when creating the initial COBRA event triggers. When the system processes the triggers to generate COBRA enrollments, it correctly applies the rules for specific plan types. |

|

Template ID |

Select a template ID if you want to compare plans during benefits enrollment for this plan type. Note: This is not applicable for Plan Type 01. For more information on defining plan comparison templates, see Comparison Template Page. |

HIPAA Plan (Health Insurance Portability and Accountability Act plan) |

This check box applies only to health plans. Select this check box if you want to designate that this plan be included in the HIPAA Report. |

Waive Coverage |

For Benefits Administration users. Select the option that defines whether and when employees are permitted to waive coverage for this plan type. |

COBRA Plan |

Select to designate which health plan types (limited to Plan Types 1x and 60) are COBRA-qualified plan types. If you make this plan type COBRA-qualified, enter an option code for each of your plans. Otherwise, the Option Code field will be unavailable. |

Load Cross Plan Values |

Click to automatically supply the cross-plan data for every option in this plan type. For Benefit Administration users only. |

Self-Service Configuration

Use this group box to define the rules for displaying enrollment and plan information on the eBenefits pages.

Field or Control |

Description |

|---|---|

Collect Dependent/Beneficiary |

Select this check box when you want the system to collect information pertaining to dependents and benefits and display that information on the eBenefit Summary and the eBenefit Detail Information pages. This works in conjunction with the Ignore Dep/Ben Edits check box on the Event Rules page. |

Collect Fund Allocations |

When this check box is selected, the system collects the information pertaining to savings plans and displays that information on the eBenefit Savings Summary and the Detail Information pages. |

Show if no choice |

This check box controls whether a plan type appears on the enrollment when the employee has no option to choose and cannot waive out of the option. A good example is paid vacation. Employees receive the benefit, but you don't display it on the enrollment form. If the check box is selected, the system displays the plan type in the enrollment form summary. When the check box is deselected, the system will not display the plan type. This setting is not relevant to 6x plans (flexible spending accounts) and 9x plans (vacation buy/sell), which are always shown in self-service. |

Handbook URL |

If you have a special handbook for this plan type, you can enter the URL ID. URL IDs are set up in the URL Table. |

Additional Summary Configuration

Use this group box to define the rules for displaying information on the fluid Benefit plan pages within Benefits Summary.

Field or Control |

Description |

|---|---|

Update Dependent Information check box |

This check box controls if updating dependent information is allowed or not. |

Update Beneficiary Designation check box |

This check box controls if changing the beneficiary allocations is allowed or not. |

Update Fund Allocations check box |

This check box controls if changing the fund allocations on 4X plans are allowed or not. |

Show Latest Deductions check box |

This check box controls if the latest deductions section (displaying deduction data from North America Payroll) should be shown or not. |

Update Beneficiary Information check box |

This check box controls if updating and adding beneficiary information is allowed or not. |

Update Savings Contributions check box |

This check box controls if changing the savings allocations on 4X plans are allowed or not. |

Show Plan Details check box |

This check box controls if drill down is available to show more details of a plan type or not. |

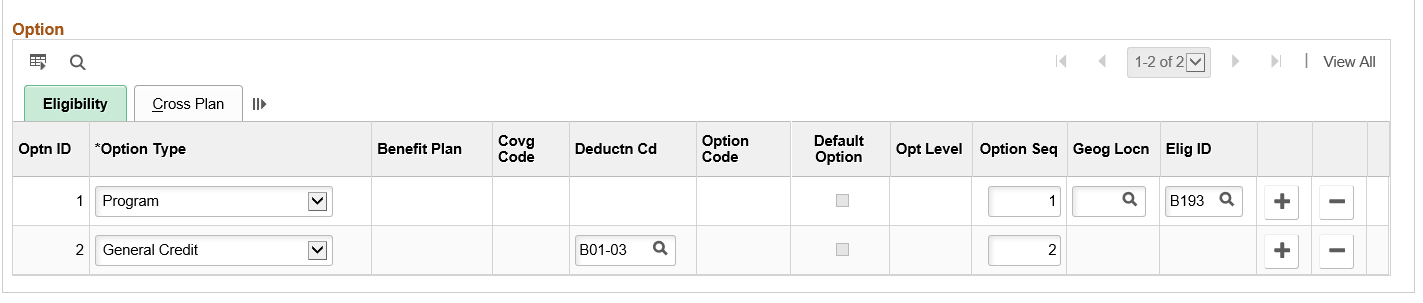

Option – Eligibility Tab

Enter the options that are available to the employee for the designated plan type in this section.

Field or Control |

Description |

|---|---|

Optn ID (option ID) |

As you define options for each of the plan types that are offered, the system automatically enters the option ID. |

Optn Type (option type) |

Each option row needs to have an option type designation. The Manage Base Benefits business process enables you to select from the following list of values: O: At least one option is required per plan type, except for plan type 01. Plan type 01 is used only for Benefits Administration. It is also called the Program level of the benefits program and is used only by programs that run in conjunction with Benefits Administration. G: Designates that this option is a general credit and used only in Benefits Administration. P: This is used only for plan type 01. It designates that this is a program and is required for automated benefit programs. Only one P row is allowed per benefit program. W: Designates that waiving coverage is an option and is used only in Benefits Administration. |

Benefit Plan |

Enter the code for a benefit plan that was defined on the Benefit Plan Table. If it is something other than a health plan, provide added detail in one of the various benefit plan detail pages. |

Covrg Code (coverage code) |

This applies only to health plan types. Indicate the level of coverage for health plans. This is a required field for those plan types. Coverage codes are defined on the Coverage Code Table. |

Deductn Cd (deduction code) |

Links the deduction code to the option. |

Option Code |

This field is available if the COBRA Plan check box is selected, or if this is a Benefits Administration (Automated) benefit program. |

Default Option |

Applies to Benefits Administration. Select this check box if you want this option to be used as the default when the Benefits Administration process validates, loads, or finalizes participant elections. The default option is the benefit plan option that is given to employees who do not make an election and is used if the associated event rule has a default method of Option or Current Else Option. Plan type defaults are used as substitutes for a participant's election when you finalize the event. Here are some guidelines for setting default options:

|

Opt Level (option level) |

Applies to Benefits Administration. Option level refers to the level of benefits coverage provided by the option. For example, suppose you're setting up a set of supplemental life options that will enable employees to choose a coverage of 1, 2, 3, or 4 times their annual salary. Set option level values for these options of 1, 2, 3, and 4, respectively. The option level values are used by the system during event processing. The event rule, linked to the plan type to which these options belong, checks the option level when evaluating its change level rules. When an employee elects new coverage, the system compares the option level of the employee's new option election in that plan type with the employee's current option election. If the new election violates the associated event rule's Participate and Waive change level rules, the system rejects the employee's benefit option selection. If, for example, the associated event rule's maximum number of change levels is 2, the system prevents employees from changing their coverage more than two option levels in either direction. Therefore, an employee with coverage equal to 1 times her annual salary would not be allowed to select coverage equal to 4 times her annual salary during open enrollment. |

Option Seq (option sequence) |

Applies to Benefits Administration. Indicates the order in which benefit options appear. The default value is the plan type. |

Geog Locn (geographic location) |

Applies to Benefits Administration. If you want to link a geographic location rule to this option, enter the code. Geographic location rules are set up on the Geographic Location Table. |

Elig ID (eligibility ID) |

Applies to Benefits Administration. If you want to link an eligibility rule to this option, enter the eligibility rule ID. Eligibility rules are created on the Eligibility Rules Table. |

Option – Cross Plan Tab

This tab is only for Benefit Administration users.

Field or Control |

Description |

|---|---|

Optn ID (option identification) |

As you define options for each of the plan types that are offered, the system automatically enters the option ID. |

Covrg Code (coverage code) |

This applies only to health plan types. Indicate the level of coverage for health plans. It is a required field for those plan types. Coverage codes are defined on the Coverage Code Table. |

Deductn Cd (deduction code) |

Links the deduction code to the option. |

Option Code |

Displays the information created in the Eligibility section. |

Cross Plan Type |

If a cross-plan requirement exists for this option, enter the other plan type that must have an enrollment. |

Cross Benefit Plan |

This field is for automated benefit programs and indicates that enrollment in this option depends upon enrollment in a particular benefit plan entered in the Cross-Plan Type field. |

Coverage Limit |

This field is for automated benefit programs and indicates that coverage is limited to a percentage of the employee's coverage amount in the other plan type. |

Check Dependents |

This field is for automated benefit programs and tells the system to check the dependent's enrollment in this plan against the dependent enrollments in the other plan type. |

The following chart shows you how to fill out the Plan Type and Option page for plan types 01 through 9x:

|

Field |

Value for Plan Type 01 |

Value for Plan Types 1x–9x |

|---|---|---|

|

Plan Type |

01 (Plan type 01 not allowed within Base Benefits) |

1x−9x |

|

Display Plan Sequence |

NA |

Not allowed |

|

Event Rules ID |

NA |

Not allowed |

|

Waive Coverage |

NA |

Not allowed |

|

COBRA Plan |

NA |

Allowed for plan types 1x and 6x |

|

HIPAA Plan |

NA |

Allowed for 1x plan types |

|

Option Type |

NA |

O - Only option type allowed for plan types 1x–9x |

|

Benefit Plan |

NA |

Required |

|

Coverage Code |

NA |

Required for plan type 1x, Not allowed for plan types 2x–9x |

|

Default Option Indicator |

NA |

Not allowed |

|

Deduction Code |

NA |

Required |

|

Option Sequence |

NA |

Not allowed |

|

Option Code |

NA |

Not allowed, unless plan type 1x or 60 has been designated as a COBRA plan, in which case the option code is required. |

|

Option Level |

NA |

Not allowed |

|

Geographic Location Table ID |

NA |

Not allowed |

|

Eligibility Rules ID |

NA |

Not allowed |

|

Cross-PlanType |

NA |

Not allowed |

|

Cross-Plan |

NA |

Not allowed |

|

Cross-Plan Limit Percentage |

NA |

Not allowed |

|

Cross-Plan Dependent |

NA |

Not allowed |

Note: NA stands for "not applicable".

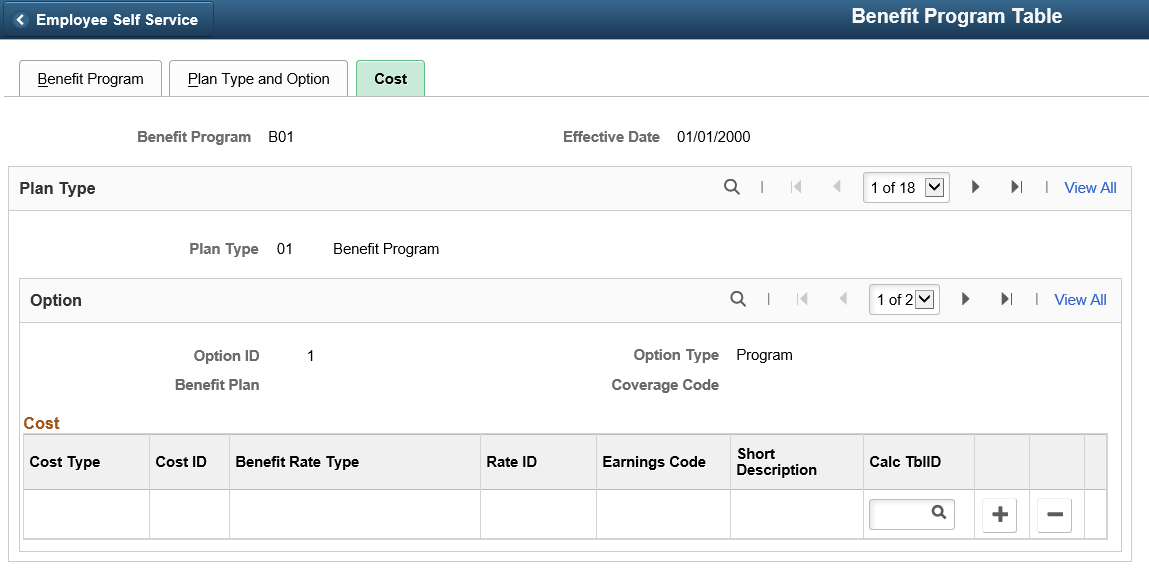

Use the Benefit Program Table - Cost page (BEN_PROG_DEFN3) to link a benefit program and plan type to rate and calculation rules.

Navigation:

This example illustrates the fields and controls on the Benefit Program Table - Cost page. You can find definitions for the fields and controls later on this page.

Cost

Use this group box to identify the rate and calculation rules for each benefit program and option combination.

Field or Control |

Description |

|---|---|

Cost Type |

Identifies the cost type for this plan type and benefit option combination. For Base Benefits, the value is always Price. The system calculates deductions for employees who select this option according to the deduction code linked to this benefit option. For Benefits Administration, the value can be Price or Credit. When you define a cost type as a credit, you must enter the appropriate earnings code. Use the earnings code to tell the system how to calculate the flexible credit earnings for a participant. Use a different earnings code for each benefit plan type within a benefit program. The system assigns the frequency of the additional pay based on the deduction code that you identify for this benefit option. |

Cost ID |

When you enter a new cost row, this value is assigned automatically by the system and cannot be updated. |

Benefit Rate Type |

Identifies the type of rate (flat amount, age-graded, and so on) associated with this plan type and benefit option combination. |

Rate ID (rate identification) |

Identifies which specific rate table is linked with this plan type and benefit option combination. You need the identification number because you may have established multiple tables for a particular rate type. Only plan types 01 through 3X can use rates. |

Earnings Code |

Applies only to credits. Identifies the earning code that might be tied to the plan type. |

Calc TblID (calculation table identification) |

Identifies the calculation rule linked to the plan type and benefit option combination. |

Rate Availability by Plan Type

This table lists the rates types that you use for each plan type:

|

Plan Type |

Flat Rate |

Age-Graded |

Service Rate |

Percent of Salary |

|---|---|---|---|---|

|

01 |

For Benefit Administration only. |

For Benefit Administration only. |

For Benefit Administration only. |

For Benefit Administration only. |

|

1X |

Yes |

Yes |

Yes |

Yes |

|

2X |

Yes |

Yes |

Yes |

Yes |

|

3X |

Yes |

Yes |

Yes |

Yes |

|

4X−9X |

Not Used |

Not Used |

Not Used |

Not Used |

For some plan types, you will need to specify the proper Calculation Rules Table identification to ensure that the appropriate calculation rules are applied.

You don't have to indicate rates and calculation rules for all plan types. Certain rate types, on the other hand, require calculation rules.

Rate and Calculation Rule Requirements by Plan Type

This table lists the rate tables and calculation rules that you can use for different plan types:

|

Plan Type |

Rate Tables |

Calculation Rules Table |

|---|---|---|

|

01 |

Required |

Dependent on rate type. |

|

1x |

Required |

Required |

|

2x |

Required |

Required |

|

3x |

Required |

Required |

|

4x |

No |

Required |

|

5x |

No |

Required (reserved for future use), but not applied during calculations. |

|

6x |

No |

Not Used |

|

7x |

No |

Not Used |

|

8x |

No |

Not Used |

|

9x |

No |

Not Used |

Calculation Rule Requirements for Rate Types

Calculation rules are required for age-graded, flat-amount, salary-percentage, and service rate types.