Understanding the Profit Sharing Processes

Understanding the Profit Sharing Processes

This chapter provides an overview of the profit sharing processes and discusses how to:

Run the eligibility and calculation processes.

Run the Process Interest and Payment application engine process.

Review the results of the processes.

Approve the reference period.

Understanding the Profit Sharing Processes

Understanding the Profit Sharing Processes

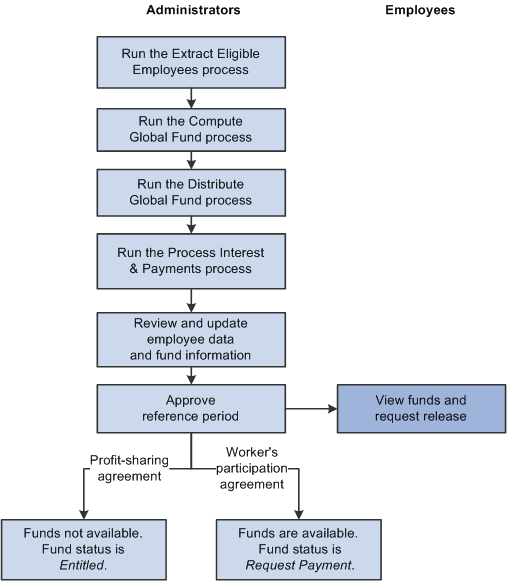

At the end of a reference period, the compensation administrator runs the profit sharing processes to calculate the global fund available and each employee's share of the fund. This diagram illustrates the steps involved in the profit sharing processes:

Profit sharing processes

The four profit sharing processes that must be run are:

Extract Eligible Employees.

This is the first process that you must run. It compiles a list of employees who are entitled to share the global fund. It also imports payroll information for eligible employees from PeopleSoft Enterprise Global Payroll for France or from a specified record in the database.

Compute Global Fund.

This process calculates the global fund available, based on the funding formulas defined in the agreement. For worker's participation agreements, there can be multiple formulas for different establishments or groups of employees (work units).

Distribute Global Funds.

This process divides the global funds calculated by the Compute Global Fund process and distributes the fund according to the distribution methods specified in the agreement definition.

Process Interest and Payment.

This is the final process that you must run. This process has a dual role: it completes the profit-sharing calculations and also processes payments. The process calculates deductions for employees' funds and calculates interest that is due for profit-sharing funds, using the Company Investment investment method. If you integrate your system with Global Payroll for France or another payroll system, the Process Interest and Payment process manages payments for profit sharing and worker's participation agreements.

Typically, you run the first three processes (Extract Eligible Employees, Compute Global Fund, and Distribute Global Funds) once for each reference period. However, you run the Process Interest and Payment process at intervals, because it processes payments, updates interest amounts and fund status, and calculates funds.

Compensation administrators can review the results of each process and make any adjustments necessary before running the next process in the sequence. The Member Entitlements component provides administrators with a view of the results generated by the eligibility and calculation processes. In addition, compensation administrators can rerun processes before moving on to the next stage.

See Also

Understanding Member Information and Fund Release Requests

Running the Eligibility and Calculation Processes

Running the Eligibility and Calculation ProcessesThis section provides overviews of the Extract Eligible Employees process, the Compute Global Fund process, and the Distribute Global Funds process, and lists prerequisites, common elements, and the pages used to run the eligibility and calculation processes.

Understanding the Extract Eligible Employees Application Engine Process

(HR_WP_ELIGIB)

Understanding the Extract Eligible Employees Application Engine Process

(HR_WP_ELIGIB)

The Extract Eligible Employees process is the first process that you run. The purpose of this process is to determine who is eligible for a share of the funding, and import for each eligible employee gross salary and a count of days worked.

For each agreement that you specify on the run control page, the process compiles a list of employees in the company and establishments specified in the agreement.

For each employee, the process:

Determines whether the employee is eligible as follows:

If you don't specify a minimum seniority on the Computation page (Define Agreement component), the system verifies that the employee worked for the company or establishment for at least one day during the reference period.

Calculates the employee's length of service, if you defined a minimum seniority for the agreement, using the employee's contract begin and end dates.

For employees with multiple contracts, the system calculates the total duration of all contracts during the reference period, and for the 12 months prior to the start of the reference period. Employees who don't meet the seniority criteria are not eligible for a share of the funds.

Note. If an employee is transferred to a different company during the reference period, and keeps the same contract number, the process adds the employee to the message log. You must check the list of transferred employees to determine whether they are eligible for profit sharing.

Imports eligible employees' gross pay and the number of days worked during the reference period.

These amounts are used later by the Distribute Global Funds process to calculate the employee's fund. Payroll data is imported from accumulators defined in Global Payroll for France or from a record populated with employee payroll information.

You define the location of payroll data when you set up the reference periods for the agreement. The process checks employees' job data to determine whether to import data from Global Payroll for France or the external record.

Calculates the employee's proration factor based on the number of days worked.

One of the distribution methods for dividing global funds between employees is based on the number of days that the employee worked during the reference period. The process calculates this proration factor by dividing the number of days worked by the total days, including weekend days, for the reference period (reference period end date through reference period begin date). You define the distribution methods on the Computation page.

Once this process is complete, the compensation administrator can review employees' gross salaries and proration factor, using the Member Entitlements page.

See Also

Defining Agreement Calculations

Understanding the Compute Global Fund Application Engine Process (HR_WP_GBLFND)

Understanding the Compute Global Fund Application Engine Process (HR_WP_GBLFND)

The Compute Global Fund process is the second process to run, and you must run it after the Extract Eligible Employees process. The purpose of the Compute Global Fund process is to calculate the global fund amounts for the agreements that you specify on the run control page. Once this process is completed, the compensation administrator reviews the calculated amounts using the Member Entitlements pages.

The global fund is the total amount that is available for distribution between eligible employees. It is based on your organization's accounting information. To calculate the global fund, the process uses these formulas specified on the Computation page (Define Agreement component):

Funding formula.

Global fund limit formula.

This formula defines the global fund limit. For worker's participation agreements, PeopleSoft delivers the statutory formula, KF20PCTMS, that checks whether the global fund is more than 20 percent of the total payroll. If the result of the funding formula exceeds this limit, the process sets the global fund amount to this limit and issues a warning message.

For profit-sharing agreements, the process compares the global fund with the result of these formulas, if you don't specify the legal formula LEGAL_RSP in the Funding Formula field:

The global fund limit formula.

There are four possible limit formulas: LEGAL_MAX1, LEGAL_MAX2, LEGAL_MAX3, and LEGAL_MAX4. If the result of your funding formula is above the selected global fund limit formula, the process sets the global fund to the limit and issues a warning message.

The LEGAL_RSP formula.

If the result of your funding formula exceeds the result calculated using the LEGAL_RSP formula, the process issues a warning message.

For profit-sharing agreements, there is only one funding formula and global fund limit formula per agreement. Therefore, the global fund is the same for all employees associated with that profit-sharing agreement.

However, for worker's participation agreements, it is possible to define formulas (and distribution methods) at the agreement, establishment, or work unit level. The Compute Global Fund process checks which formulas apply for each eligible employee and calculates the global fund amount according to those formulas. The process determines which formulas apply as follows:

The work unit formulas override the formulas defined at the agreement or establishment level.

Note. The process can only use one set of formulas. Therefore, you must make sure that employees belong to one work unit only for each agreement. Use the Group Member Overlap report to determine whether employees belong to more than one work unit.

The establishment formulas override the formulas defined at the agreement level.

The agreement level formulas apply if an employee doesn't belong to any of the work units or establishments listed on the Computation page.

Worker's Participation Example

Consider an example agreement, KF1. This agreement is for company GBL001, which includes establishments EST001, EST002, and EST003.

Agreement KF1 has different formulas and distribution methods for these establishments and work units:

|

Computation Level |

Establishment or Work Unit |

|

Establishment |

EST001, EST002 |

|

Work Unit |

WU1, WU2, WU3 |

If an employee belongs to:

Establishment EST001 and work unit WU1, the system uses the formulas and distribution methods defined for work unit WU1.

Establishment EST002 but none of work units WU1, WU2, or WU3, the system uses the formulas and distribution methods defined for establishment EST002.

Establishment EST003, the system uses the formulas and distribution methods defined at the agreement level.

See Also

Understanding the Distribute Global Funds Application Engine Process

(HR_WP_SHARE)

Understanding the Distribute Global Funds Application Engine Process

(HR_WP_SHARE)

You run the Distribute Global Funds process after the Compute Global Fund process. Using the global fund amounts that are calculated by the Compute Global Fund process, and the payroll information previously imported by the eligibility process, the Distribute Global Funds process calculates each employee's share of the fund.

The process:

Calculates the employee's fund based on the distribution methods selected in the agreement definition.

If an employee's fund exceeds the limit specified by the individual allocation limit formula (if this is defined), the process sets the employee's fund to the maximum and issues a warning message.

Distributes any surplus, if the Immediate Re-share check box is selected on the Investment page (Define Agreement component).

If there is a surplus after the initial calculations, the process recalculates the employee funds as follows:

Employees whose funds are at the individual allocation limit are frozen.

For employees who are not frozen, the process recalculates funds, including the surplus amount.

If there is surplus at the end of this recalculation, the steps are repeated until the surplus is zero or the number of iterations is ten.

Sets the availability or payment date as follows:

For profit-sharing agreements, the availability date is determined by the unavailability duration defined in the agreement.

Payment date is set to the first day of the fourth month after the reference period end date plus unavailability duration. For example, if the reference period end date is December 31, 2001, and the unavailability duration is five years, the availability date is set to April 1, 2007.

For worker's participation agreements, the payment date is set to the current date (payment is available at the end of the reference period).

Normally, payments for this type of agreement should be made within seven months of the reference period end date. The process issues a warning message if the payment date is after this seven-month deadline.

Sets the payment status to Entitled for profit-sharing agreements, and to Request Payment for worker's participation agreements.

Note. The payment date is not a fixed date and can be overridden. For profit-sharing agreements, the payment date is changed for employees who request early release of funds. In addition, if you run the Process Interest and Payment process after the payment date calculated by the distribution process, the payment process sets the payment date to the current date.

See Also

Defining Agreement Calculations

Prerequisites

Prerequisites

The Extract Eligible Employees process runs only if these conditions are met:

The agreement has a status of approved.

A reference period is defined for the agreement.

Also, the process runs only after the reference period end date.

Contract data exists for your employees, if you defined eligibility criteria.

The process uses contract dates to calculate seniority.

Payroll information is set up.

The Extract Eligible Employees process imports employees' gross salary and total days worked from these sources:

Global Payroll for France.

Accumulators track employees' salaries and number of days worked. These must be included in your process lists and the payroll for the whole reference period must be finalized.

The record WP_EXT_PAYDATA, if an employee's payroll is not managed by Global Payroll for France.

You must ensure that this record is populated with employee payroll data.

If you installed Global Payroll for France, you should also set it up as follows before running the eligibility process:

Include the element group PAR EG PARTICIPAT in the employees' eligibility group.

Include the section PAR SE PARTICIP in the process list.

Before running the Compute Global Fund process, ensure that any variables associated with the funding and limit formulas are populated with the correct values for the reference period.

For the Distribute Global Funds process to run correctly, ensure that these variables are populated with the correct values for the reference period:

Variables associated with the individual allocation limit formula.

The KFMS variable ID (for worker's participation agreements only).

This variable determines the total salary used in the distribution calculation based on employees' salaries.

Note. Ensure that your variables are defined with the correct scope for the agreement.

See Also

Common Elements Used in This Section

Common Elements Used in This Section|

Agreement ID |

Select the agreements that you want to process. |

|

Reference Period |

Select the reference periods that you want to process. |

|

Re-Initialize? |

Select to override existing results. If you have previously run the process for the selected agreement and reference period, the system overrides the results, and any manual adjustments that you made will be lost. If you don't select this check box, and you have previously run the process for the agreement and reference period, the process doesn't run, and a warning is added to the log file. |

Pages Used to Run the Eligibility and Calculation Processes

Pages Used to Run the Eligibility and Calculation Processes|

Page Name |

Definition Name |

Navigation |

Usage |

|

RUNCTL_WP_ELIG |

Compensation, Profit-Sharing FRA, Compute Profit-Sharing, Extract Eligible Employees, Extract Eligible Employees |

Run the Extract Eligible Employees process for selected agreements and reference periods. |

|

|

RUNCTL_WP_FUND |

Compensation, Profit-Sharing FRA, Compute Profit-Sharing, Compute Global Fund, Compute Global Fund |

Run the Compute Global Fund process to calculate the global funds available. You must run it after you have identified eligible employees using the Extract Eligible Employees process. |

|

|

RUNCTL_WP_COMP |

Compensation, Profit-Sharing FRA, Compute Profit-Sharing, Distribute Global Funds, Distribute Global Funds |

Run the Distribute Global Funds process to calculate each eligible employee's share of the global fund. You can run this process only after you have run the Extract Eligible Employees process and the Compute Global Fund process. |

Running the Process Interest and Payment Application Engine Process

(HR_WP_PAYMT)

Running the Process Interest and Payment Application Engine Process

(HR_WP_PAYMT)This section provides an overview of the Process Interest and Payment process, lists prerequisites, and discusses how to run the Process Interest and Payment process.

Understanding the Process Interest and Payment Application Engine Process

(HR_WP_PAYMT)

Understanding the Process Interest and Payment Application Engine Process

(HR_WP_PAYMT)

The Process Interest and Payment process is the final process that you run before you approve the reference period. The Process Interest and Payment process calculates deductions and interest, and processes payments. The process is run at least once a year, but is most likely run at intervals during the year to process employee fund releases. Fund status and interest amounts are more accurate if you run the process often throughout the year.

This process:

Calculates deductions for employees' funds, and the net global fund after deductions have been deducted from the gross amounts.

Profit sharing and worker's participation amounts are liable to CSG and CRDS deductions. The rates of these deductions are stored in the variables KFCSG (for CSG) and KFCRDS (for CRDS).

Calculates interest for employees whose profit-sharing agreements have an investment method of Company Investment.

Interest is calculated yearly on employees' funds during the period that funds are unavailable. The interest rate is defined in the agreement definition and employees can select to reinvest interest or receive interest payments.

Note. For worker's participation agreements, interest payments are paid only in exceptional circumstances when payment of funds is delayed. The Process Interest and Payment process does not calculate interest for this agreement type.

Calculates deductions on interest payments, and the net interest amount.

Interest payments are liable to CSG, CRDS, and Participation Sociale deductions. The rate of the Participation Sociale deduction is stored in the variable KFSOC.

Sets the reference period status to Computed.

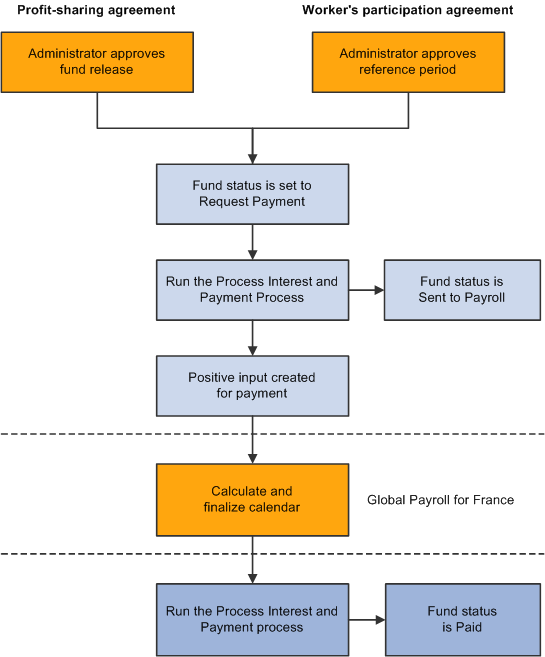

Processes payments for profit-sharing funds with Company Investment as the investment method and worker's participation funds with Employee's Bank Account as the investment method.

Payments are processed only if the reference period is Approved and the fund status is Request Payment. The process changes the fund status to Sent to payroll.

Receives information from Global Payroll for France or another payroll system about the status of payments previously sent, and updates fund status accordingly.

Payments that were processed successfully are assigned a status of Paid. If a payment was not processed, the process changes the fund status to Error.

Workflow occurs when the Process Interest and Payment process updates employees' fund status to:

Available or Paid, which triggers an email to employees informing them that their funds are available or paid.

Error, which triggers an email to the compensation administrator who must investigate the error.

See Setting Up Workflow for Profit Sharing.

Integrating with Global Payroll for France

If you installed Global Payroll for France, you can use it to automatically process payments. The following diagram illustrates the payment processing with Global Payroll for France:

Overview of payment processing

Integrating with Other Payroll Systems

To integrate the Manage French Profit Sharing business process with a payroll system other than Global Payroll for France, you must set up the integration points that enable payment information to be exchanged.

See Interactive Services Repository in the Implementation Guide section on My Oracle Support.

Prerequisites

Prerequisites

Before you run the Process Interest and Payment process for the first time for a reference period, you must run these processes:

Extract Eligible Employees.

Compute Global Fund.

Distribute Global Funds.

Page Used to Run the Process Interest and Payment Application Engine

Process (HR_WP_PAYMT)

Page Used to Run the Process Interest and Payment Application Engine

Process (HR_WP_PAYMT)|

Page Name |

Definition Name |

Navigation |

Usage |

|

RUNCTL_WP_PAYMT |

Compensation, Profit-Sharing FRA, Compute Profit-Sharing, Process Interest & Payment, Process Interest & Payment |

Run the process for a selected agreement and reference period. |

Running the Process Interest and Payment Application Engine Process

(HR_WP_PAYMT)

Running the Process Interest and Payment Application Engine Process

(HR_WP_PAYMT)

Access the Process Interest & Payment page (Compensation, Profit-Sharing FRA, Compute Profit-Sharing, Process Interest & Payment, Process Interest & Payment).

|

Agreement ID |

Select the agreement for which you want to run the process. |

|

Reference Period |

Select the reference period for which you want to run the process. |

Calendar List

|

Pay Group |

The system populates this field with the pay groups for all eligible employees, based on the selected agreement and reference period. Check the list of pay groups, and add additional pay groups if there were changes since you ran the Extract Eligible Employees process. For example, you need to add pay groups if:

|

|

Calendar ID |

Select the calendar for each pay group selected. |

Reviewing the Results of the Processes

Reviewing the Results of the Processes

When you run any of the profit sharing processes, you must check the message log generated by the process for errors or warning messages. Navigate to the message log from the run control pages as follows: Process Monitor, Details, View Log/Trace.

You can view the results of the process by using the Member Entitlement component, which lists the eligible employees and the results of the calculations.

See Also

Approving the Reference Period

Approving the Reference Period

When you have run all of the profit sharing processes and you are satisfied with the results, you must change the status of the reference period to Approved. Use the Reference Period component to change the status. Navigate to the component as follows: Compensation, Profit-Sharing FRA, Review Reference Period, Reference Period.

Note. Employees cannot view their profit-sharing funds until you change the reference period status to Approved.

See Also