Understanding Member Information and Fund Release Requests

Understanding Member Information and Fund Release Requests

This chapter provides an overview of member information and fund release requests, and discusses how to:

Review member information.

Report profit sharing.

Understanding Member Information and Fund Release Requests

Understanding Member Information and Fund Release Requests

This section discusses how to:

Process fund release requests.

Process terminated employees.

The Member Entitlements component (WP_PROFIT_SHARING) is central to administration of the profit sharing business process. Compensation administrators use the component to review and adjust the results of the profit sharing processes, to process fund release requests submitted by employees, and to track fund transfers. The system populates the Member Entitlement component with results of the profit sharing processes as follows:

After running the Extract Eligible Employees process, the component lists the employees who are eligible for profit sharing.

You can make the following changes before running the Compute Global Fund process:

Add or remove employees from the eligible employees list.

Modify some employee details such as the prorate factor and the employee salary.

After running the Compute Global Fund and Distribute Global Funds processes, the component includes the employees' profit sharing amount.

You can adjust the employee's fund before running the Process Interest and Payment process.

After running the Process Interest and Payment process, the component includes a breakdown of the deductions, gross, and net amounts for the employees' funds.

If interest is payable, this is also displayed for the employee.

Processing Fund Release Requests

Profit-sharing agreements do not allow for automatic payment of funds, except where the fund amount is below a defined threshold (the variable KFIMMED stores this threshold value). If an employee's fund amount is above the threshold, the employee must submit a request for fund release. These requests are reviewed and approved by the compensation administrator.

Employees can submit fund release requests only after the reference period status is Approved.

Note. Fund release requests only apply to agreements with Company Investment selected as the investment method. Fund releases for other types of investment are managed outside the system.

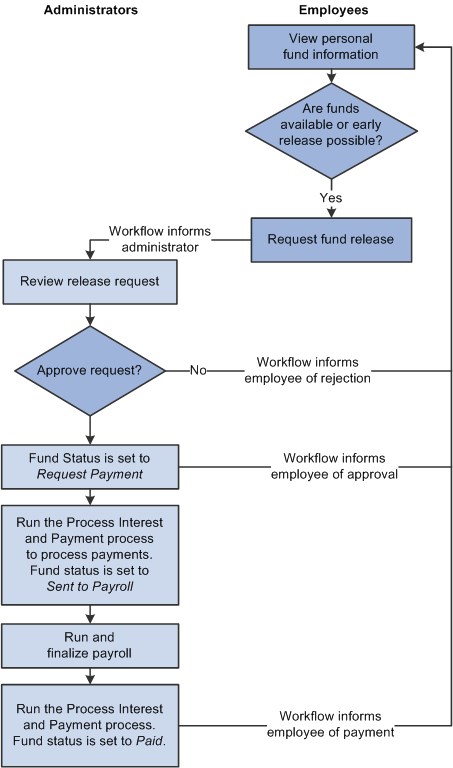

This illustration shows how fund releases are processed and when workflow is triggered:

Fund release request process

Processing Terminated Employees

When employees leave your organization, they can request a fund release, request fund transfer to the new company, or leave the fund unchanged.

Workflow keeps the compensation administrator informed of terminated employees as follows:

When the workforce administrator inserts a termination action into an employee's job data this triggers workflow if the employee is eligible for profit sharing.

An email notifies the employee that he or she is entitled to funds from a profit-sharing agreement. A worklist entry takes employees to the Fund Release page where they submit a release request. Alternatively, employees can go to the Agreement Personalization page where they enter details of the financial organization to which funds should be transferred.

Employees who want to transfer funds, enter the fund transfer information using the Agreement Personalization page.

This triggers an email to the compensation administrator (role HR Administrator FRA) with details of the employee ID, agreement ID, and period ID. The administrator organizes transfer of funds and records the transfer by updating the terminated employee's fund status to Posted to Account, using the Member Entitlement component.

See Also

Reviewing Member Information

Reviewing Member InformationThis section discusses how to:

Review member details.

View global fund calculation information.

View employee release details.

Pages Used to Review Member Information

Pages Used to Review Member Information|

Page Name |

Definition Name |

Navigation |

Usage |

|

WP_PSHRG_MAIN_TBL |

Compensation, Profit-Sharing FRA, Manage Profit Sharing, Member Entitlements, Member Entitlements |

Review the results of the profit sharing processes for a selected agreement. |

|

|

WP_PSHRG_EEDTL_SEC |

Click the View button on the Member Entitlements page. |

View the global fund formula used to calculate the selected employee's global fund. This page is available for worker's participation agreements only. |

|

|

WP_PSHRG_VSTDT_SEC |

Click the Release Detail button on the Member Entitlements page. |

View full details of the employee's profit sharing amount, interest (if applicable), and fund release requests. This page gives a breakdown of the gross amount, deductions, and net amount. You can adjust calculated amounts, if required, and approve or reject the employee's fund release requests. |

Reviewing Member Details

Reviewing Member Details

Access the Member Entitlements page (Compensation, Profit-Sharing FRA, Manage Profit Sharing, Member Entitlements, Member Entitlements).

After you run the Extract Eligible Employees process for a selected agreement, the system populates this page with employees who are eligible for a share of the global fund. The Extract Eligible Employees process compiles this list using the eligibility criteria specified in the agreement.

You can add or remove employees from the list of eligible employees if necessary. However, if you add employees manually you must enter their salary information. If you add an employee after running the Distribute Global Funds process, you must rerun the process or enter the employee's fund amount.

|

Release Request |

Select this check box if you want to search for employees who have requested a fund release. |

|

Period ID |

Displays the reference period for which the employee is eligible. |

|

|

Click the View button to view the computation level and funding formula that was used to calculate the global fund. This button is available for worker's participation agreements only. |

|

Prorate Factor |

Displays the proration factor calculated by the Extract Eligible Employees process by dividing the employee's working days by total working days in period. This factor is used later by the Distribute Global Funds process. One of the distribution methods for profit sharing is based on the number of days worked by the employee during the reference period. If you update the proration factor, the system displays a message warning you that the profit-sharing amount for the employee may not be consistent with the changed proration factor. If you have already run the Distribute Global Funds process, the employee's profit sharing is based on the previous value. In this case, you must manually update the profit-sharing amount or rerun the Distribute Global Funds process. |

|

Profit-Sharing Amount |

Displays the amount the employee will receive from profit sharing if you have run the Distribute Global Funds process for the reference period. To change the employee's fund amounts, click the Employee Release Detail button. |

|

Release Request |

This check box is automatically selected if the employee has submitted a fund release request. Once you approve or reject a request, the system deselects the check box. Click the Employee Release Detail button to view the request and approve or reject it. |

|

|

Click the Employee request detail button to check whether the employee has requested a fund release. |

Access the Member Entitlements page (Compensation, Profit-Sharing FRA, Manage Profit Sharing, Member Entitlements, Member Entitlements).

|

Employee Salary |

Displays the employee's salary. This information is imported from PeopleSoft Enterprise Global Payroll for France or from another payroll system when you run the Extract Eligible Employees process. |

|

(Max applied) (maximum applied) |

Displays the employee's salary, after the maximum limit is applied. This value is calculated by the Extract Eligible Employees process using the Individual Salary Limit Formula specified in the agreement. |

|

Global Fund |

Displays the global fund calculated by the Compute Global Fund process. |

Viewing Global Fund Calculation Information

Viewing Global Fund Calculation Information

Access the Global Fund Computation Level page (click the View button on the Member Entitlements page).

|

Reference Period |

Displays the period ID shown on the Member Entitlements page. |

|

View Agreement |

Click this link to view the agreement definition pages. |

Computation Level

Worker's participation agreements can have multiple formulas for calculating global funds. Formulas are defined for all employees associated with the agreement, for employees in specific establishments, or employees in specific work units. This group box displays the formula that applies to the selected employee.

|

Global Fund Formula |

Displays the funding formula used to calculate the employee's global fund. The funding formulas are defined on the Computation page (Define Agreement component). |

See Also

Defining Agreement Calculations

Viewing Employee Release Details

Viewing Employee Release Details

Access the Employee Release Detail page (click the Release Detail button on the Member Entitlements page).

Release Request

This group box appears if the selected employee has submitted a request to release funds. It is relevant for profit-sharing agreements only.

|

Release Request |

Indicates the type of fund release requested. Values are: Amount: Employee requested release of a specific amount shown in the Release Amount field. Total: Employee requested release of the entire fund. The total is shown in the Release Amount field. |

|

Release Date |

Displays the date when the employee submitted the fund release request. |

|

Event |

Displays the event that the employee selected for the fund request and the date on which the event occurred is shown in the Event Date field. |

|

Request Status |

Displays the status of the fund release request: New for a new request, Approved or Rejected. |

|

Approve |

Click to approve the request. This triggers workflow to notify the employee that the request is approved and changes the fund status to Request Payment. |

|

Reject |

Click to reject the request. This triggers workflow to notify the employee that the request was rejected. |

Profit Sharing Details

|

Profit-Sharing Gross Amount |

Displays the employee's fund calculated by the Distribute Global Funds process. |

|

Profit-Sharing Deductions |

Displays the deductions on the employee's fund that are calculated by the Process Interest and Payment process. |

|

Profit-Sharing Net Amount |

Displays the amount payable to the employee after deductions are made. |

|

Availability/Payment Date |

Displays the date that the employee is due to receive payment or the date on which funds become available as follows:

The date is defined by the Distribute Global Funds process and the Process Interest and Payment process. You can override it if Fund Status is one of these values: Entitled, Available, Request Payment, Error, or Canceled. |

|

Fund Status |

Displays the fund status that the Distribute Global Funds process and the Process Interest and Payment process have assigned, but you can change the status as required: Entitled: Indicates that the employee's fund has been calculated but the money is unavailable. This status applies to profit-sharing agreement types only. Available: Indicates that the employee's fund is available. For worker's participation agreements, the fund is available as soon as it is calculated. For profit-sharing agreements, funds are available after the end of the unavailability period defined for the agreement. Canceled: Cancels the profit-sharing amount. Use this status when you find an error in an employee's fund after running the Distribute Global Funds process. To correct such a problem, you cannot run the process again or delete the employee data. Instead, set the fund status to Canceled and insert a new row for the employee with the correct amount. Using the Canceled status you can track the cancellation and the manual adjustments. Sent to Payroll: Indicates that the Process Interest and Payment process has run and the profit-sharing amount has been sent to Global Payroll for France. Posted to Account: Indicates that funds have been transferred to an external organization. The financial organization is defined in the Define Agreement component. Terminated employees can override the default organization for transfer of their entitlement to their new company fund. Paid: Indicates that the payment has been processed by your payroll system. If you have Global Payroll for France installed and you're using Company Investment method, the Process Interest and Payment process sets the status to Paid when the payment is processed. If you have any other investment method, you must set the status to Paid manually when the payment is processed. Error: Indicates that the Process Interest and Payment process could not process the payment. Request Payment: Indicates that the funds are waiting to be processed. Transfer to Account: Indicates that funds are due to be transferred to an external organization. Once the transfer is complete, you need to set the status to Posted to Account to track the funds. |

Interest Payment Details

This group box appears for profit-sharing agreements with the Company Investment method selected. These amounts are calculated by the Process Interest and Payment process.

|

From Date and Thru Date |

Defines the period for which interest has been calculated. Interest is calculated yearly during the period when funds are unavailable. |

|

Interest Gross Amount |

The interest due on the global fund before deductions are taken. |

|

Deductions on Interest |

The deductions on the interest. |

|

Interest Net Amount |

The interest payable to the employee after deductions are made. |

|

Payment/Reinvestment Date |

Depending on the interest status, this field shows one of three dates: the date that the employee is due to receive the interest payment, the date on which the payment was made, or the date on which the interest is reinvested. |

|

Status |

Interest status. Values are: Canceled: Cancels the interest. Use this status when you find an error in an employee's interest after running the Distribute Global Funds process. To correct such a problem, you cannot run the process again or delete the employee data. Instead, set the interest status to Canceled and insert a new row for the employee with the correct amount. Entitled: Indicates that the interest has been calculated and is available. Reinvested: Indicates that interest has been added to the global funds and isn't paid immediately to the employee. Manual: Use this status when you enter the interest amount manually. Sent to Payroll: Indicates that the Process Interest and Payment process has run and the interest payment has been sent to Global Payroll for France. Paid: Indicates that the interest payment has been processed by your payroll system. The Process Interest and Payment process sets the status to Paid when the interest payment is processed. Error: Indicates that the Process Interest and Payment process could not process the interest payment. |

|

Option |

Displays the interest reinvestment method selected. This is either the default method for the agreement or the method selected by the employee. You can override the value. |

Reporting Profit Sharing

Reporting Profit Sharing

This section discusses how to run profit sharing reports.

Compensation administrators are responsible for providing all eligible employees with details of their profit sharing amount when these are calculated, or when an employee leaves the organization.

The Individual Profit Sharing report provides all the necessary information for individual employees. This is the same information that the employee can access online using the Request Fund Release option.

PeopleSoft also provides the Agreement Profit Sharing report for administrators. This report lists all the employees that are eligible for a selected agreement, or all eligible employees with the same fund status. This is a useful way to generate a list of employees who have requested a fund release, employees who are in error, or employees whose funds are to be transferred. The Agreement Profit Sharing report includes the following for each employee:

Status of the employees funds.

Gross and net profit sharing amount.

Deductions.

Investment method.

You can only run these reports if the status of the reference period is set to Computed, which means that the Compute Global Fund and the Distribute Global Funds processes have been run.

See Also

Viewing Personal Entitlements and Requesting Fund Release

Pages Used to Run the Profit Sharing Reports

Pages Used to Run the Profit Sharing Reports|

Page Name |

Definition Name |

Navigation |

Usage |

|

RUNCTL_WP_IND_RPT |

Compensation, Profit-Sharing FRA, Manage Profit Sharing, Individual Report, Individual Report |

Use this page to run the Individual Profit Sharing Report (WP0001FR). This report is delivered each year to employees to inform them of their entitlements. |

|

|

RUNCTL_WP_AGRT_RPT |

Compensation, Profit-Sharing FRA, Manage Profit Sharing, Agreement Report, Agreement Report |

Use this page to run the Agreement Profit Sharing Report (WP0002FR). |

Running Profit Sharing Reports

Running Profit Sharing Reports

Access the Agreement Report page (Compensation, Profit-Sharing FRA, Manage Profit Sharing, Agreement Report, Agreement Report).

|

Agreement ID |

Select the agreement on which you want to report. |

|

Reference ID |

Select the reference period for the report. |

|

Fund Status |

Select the status from the available values if you want to run the report for funds of a certain status. Otherwise, leave this field blank to include funds of all statuses. |

|

Employee ID |

Select the employee you want to report on or leave blank to run the report for all eligible employees. |