Processing Security Mark-to-Market Values

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TR_SEC_MTM_RUNCNTL |

Run the Security Mark-to-Market Application Engine process (TR_SEC_MTM) to generate reevaluated rates and update the current market value and book value of securities involved in your current deals. |

After capturing deals involving securities, use the Security Mark-to-Market Application Engine process (TR_SEC_MTM) periodically to update security market rates. You should import current market values first, using the Security Market Values Import page, to ensure that the deals are updated with the latest market rates and values.

The Securities process provides a table (Security Mark Value) for the security in which current market prices can be stored. The Security Mark-to-Market Application Engine process (TR_SEC_MTM) uses these stored prices to calculate the current market value as of a certain date (for example, January 31, February 28). A corresponding book value is also calculated where appropriate. The new book value calculations incorporates any unamortized fee amounts associated with the deal. These calculations and their storage provide for an accurate unrealized gain/loss calculation in the automated accounting process. The existing Mark to Market Gain and Mark to Market Loss calculation types are used to determine the Unrealized Gain/Loss.

For more information about available calculation types, see Establishing Accounting Templates.

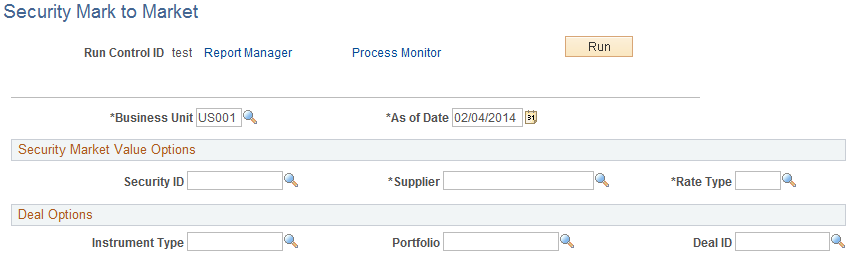

Use the Security Mark to Market page (TR_SEC_MTM_RUNCNTL) to run the Security Mark-to-Market Application Engine process (TR_SEC_MTM) to generate reevaluated rates and update the current market value and book value of securities involved in your current deals.

Navigation:

This example illustrates the fields and controls on the Security Mark to Market page.