Establishing Accounting Templates

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TRA_TMPL_DETL |

Enter general accounting template and template line information. |

|

|

TRA_SUB_RULE |

Associate a defined substitution rule with an accounting template line. |

|

|

VAT Defaults Setup Page |

VAT_DEFAULTS_DTL |

Define value-added tax (VAT) default processing options for the specified accounting template. See the Accounting Templates Page. |

To define accounting templates, use the Accounting Templates component (ACCTG_TEMPLATES).

Use this component to:

Enter accounting template information.

Associate substitution criteria with accounting template lines.

Link templates with associated accounting events.

Use the Accounting Templates page (TRA_TMPL_DETL) to enter general accounting template and template line information.

Navigation:

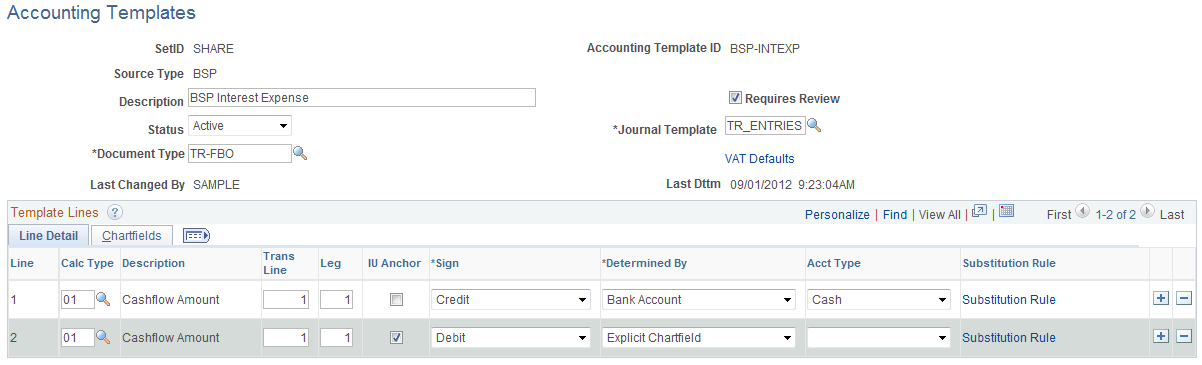

This example illustrates the fields and controls on the Accounting Templates page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Requires Review |

Select to force review of the accounting transactions that use this template. When you select this check box, the system assigns error-free accounting entries and a status of Provisional. To finalize the provisional entry, use the View/Approve Entries page to review and change the status to Final. If you do not select this check box, the system assigns error-free accounting entries using this template and a status of Final. |

Source Type |

Displays the source of the accounting entry, which can be BSP (bank statement processing), Deals, Fees, Hedge Accounting, Interest, EFT Requests, or Investment Pools. |

Status |

Indicate whether this accounting template is Active or Inactive. This determines which templates are available to users. The system selects only active accounting templates for display and use. This feature enables you to:

When an accounting template is marked inactive, it is not available for processing, but is retained for historical reference. If you need to review accounting entries processed by an inactive accounting template, the template is still present in the system. |

Document Type |

Select the document type to use as the basis for assigning document sequencing numbers to these types of transactions. |

VAT Defaults (value-added tax defaults) |

Click to access the VAT Defaults Setup page (VAT_DEFAULTS_DTL). The VAT Defaults Setup page is a common page used to set up VAT defaults for all PeopleSoft applications that process VAT transactions. On this page, you can define accounting template defaults as applicable. You must first specify one of the accounting lines as a VAT-applicable line to establish VAT defaults for this template. |

Line Detail Tab

Select the Calc Type (calculation type) to use on each template line—this varies depending on the source type. For deal-related calculation types, you must also specify a transaction line and leg of the deal.

The following table lists each available calculation type by source type.

|

Source Type |

Available Calculation Types |

|---|---|

|

Bank Statement Processing (BSP) |

Cashflow Amount |

|

Fees |

Cashflow Amount |

|

Deals |

Cashflow Amount |

|

Deals |

Deal Amount |

|

Deals |

Price |

|

Deals |

Purchased Interest |

|

Deals |

Interest Compounded into Principal |

|

Deals |

Interest Accrued |

|

Deals |

Mark to Market Gain |

|

Deals |

Mark to Market Loss |

|

Deals |

MTM Multi Currency Gain |

|

Deals |

MTM Multi Currency Loss |

|

Deals |

Forward Points |

|

Deals |

FX Deal Cashflow Amount |

|

Deals |

Forward Points Accrued |

|

Deals |

Maturity Interest |

|

Deals |

Maturity Principal |

|

Deals |

Maturity Multi Currency Gain |

|

Deals |

Maturity Multi Currency Loss |

|

Deals |

Amortized Discount / Premium |

|

Deals |

Sale Current Accounted Value |

|

Deals |

Premium Accrued |

|

Deals |

Sale Settlement |

|

Deals |

Sale Price (Clean) |

|

Deals |

Sold Accrued Interest |

|

Deals |

Gain/Loss on Sale |

|

Deals |

Multi Currency Gain on Sale |

|

Deals |

Multi Currency Loss on Sale |

|

Deals |

Accumulated MTM Gain/Loss |

|

Deals |

Bond Discount / Premium |

|

Deals |

Principal Payment |

|

Deals |

Interest Payment |

|

Deals |

Amounts Rolled Out |

|

Deals |

Principal Rolled Out |

|

Deals |

Interest Rolled Out |

|

Deals |

Amounts Rolled In |

|

Deals |

Principal Rolled In |

|

Deals |

Interest Rolled In |

|

Deals |

Write-Off Unamort Disc/Premium |

|

Deals |

Write-Off Unamort Fee |

|

Deals |

Day Delay Price |

|

Deals |

Day Delay Purchased Interest |

|

Deals |

Dividend Payment |

|

Deals |

FV Excluded Time Value G/L |

|

Deals |

CF Excluded Time Value G/L |

|

Deals |

FX Net Investment Excluded G/L |

|

Deals |

Fair Value Hedge Gain/Loss |

|

Deals |

Cash Flow Hedge Gain/Loss |

|

Deals |

FX Net Investment Gain/Loss |

|

Deals |

Not Hedge Designated Gain/Loss |

|

Hedges |

Fair Value Hedged Item G/L |

|

Hedges |

Firm Commitment to Carrying |

|

Hedges |

Amortize Adj to Carrying |

|

Hedges |

De-recognize Firm Commitment |

|

Hedges |

AOCI Adjustments |

|

Hedges |

AOCI Reclassify |

|

Hedges |

Will Not Occur-AOCI Reclassify |

|

Interest |

Cashflow Amount |

|

Investment Pools |

Cashflow Amount |

|

Investment Pools |

Interest Payment |

|

Investment Pools |

Mark-to-Market Gain/Loss |

|

EFT Requests |

Cashflow Amount |

Field or Control |

Description |

|---|---|

Trans Line (transaction line) |

For Deals source type, indicates the line from the deal instrument. All other sources have a default of 1. |

Leg |

Indicates the deal accounting leg number. |

IU Anchor (interunit anchor) |

Specify one line of the template as the anchor. This is a required field because the centralized processor uses it to generate interunit entries. The anchor line cannot be a line where the ChartField is determined by bank account. |

Sign |

Select the numerical sign for a transaction Credit, Debit, Keep Sign, or Rev Sign (reverse sign). |

Determined by |

Indicate how to inherit ChartField values for the specified template line. Values are: Bank Account: ChartField values are inherited from the bank account that is specified by the source transaction. Fields on the ChartField tab for this line are then disabled. Explicit ChartField: You define specific ChartField values on the ChartField tab. |

Acct Type (account type) |

If the ChartField is determined by bank account, then you must choose the General Ledger account type. For Treasury, select Cash Account. If the ChartField is determined by Explicit ChartField, then leave this field blank. |

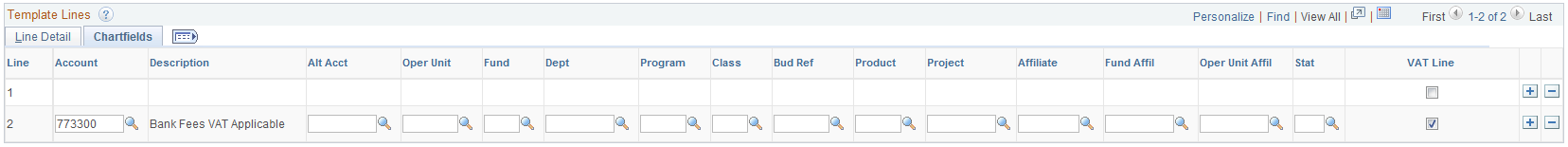

ChartFields Tab

Enter the appropriate ChartField values.

This example illustrates the fields and controls on the Chartfields tab of the Accounting Templates page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Stat (statistic) |

Select a statistics code for the specific accounting line. This field can be edited on the accounting entry. |

VAT Line (value-added tax line) |

Click to specify that VAT is applicable for this accounting line. You can specify VAT options only for accounts with:

|

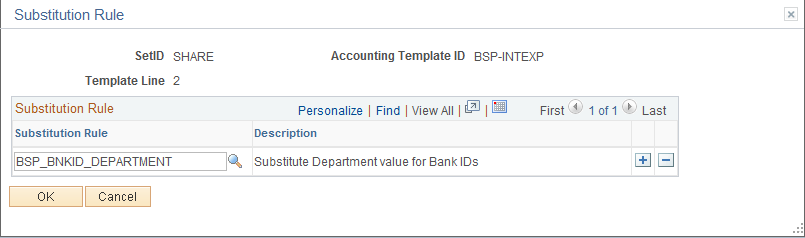

Use the Substitution Rule page (TRA_SUB_RULE) to associate a defined substitution rule with an accounting template line.

Navigation:

This example illustrates the fields and controls on the Accounting Templates - Substitution Rule page. You can find definitions for the fields and controls later on this page.

Use substitution rule functionality to make minor adjustments to templates without having to rebuild them. For example, you might require that certain departments perform deal accounting on deals by dealers by specifying criteria for each dealer's user ID. The substitution rule that addresses this need is assigned to the applicable accounting template lines here. In this example, the substitution rule ID applied is DEAL_OPERID_TO_DEPT, which was defined on the Substitution Rule Definition page.

Field or Control |

Description |

|---|---|

Substitution Rule |

Enter a predefined substitution rule to apply to the template line. You can have more than one substitute rule per template line. Substitution rules are set up on the Substitution Rule Definition page (). When multiple substitution rules are defined for a template line, the system validates that the Set ChartField value is unique within all of the associated substitution rules. |

Accounting events are linked with their corresponding accounting templates on various pages, as defined in this table:

|

Accounting Event Source |

Page Name |

Navigation |

|---|---|---|

|

Bank Statement items |

External Transactions |

Select the Transactions Detail tab, Accounting Template ID field. |

|

Deals |

Accounting Templates |

|

|

EFT Requests |

EFT Template |

Select the Origin tab, Template ID field. |

|

Letter of Credit, Deal, Facility, or Wire Fees |

Fee Codes |

Select the Expense Template or Accrual Template field. |

|

Hedges |

Deal Accounting |

|

|

Hedges |

Item Accounting |

|

|

Investment Pools |

Pool Information Participant Transactions Pool Position |

|