Defining Instrument Details

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

INSTR_DETAIL_TR |

Enter the specifics for an instrument. This page differs for each instrument base type. |

|

|

INSTR_ADHOC_ATR |

Assign extra notational attributes to your instrument. |

|

|

Notes |

INSTR_NOTES_PNL |

Enter detailed notes to describe the function of the instrument being created. See the Instrument Detail Page for more information. |

|

INSTR_FUTURE_SP |

Capture data that is specific to a particular futures contract. |

|

|

Help page for IAS Accounting |

INSTR_ACCTG_SP |

Determine the accounting treatment for the instrument based on factors related to hedging, the length of time benefits that will be acquired, its inclusion in a portfolio, and so forth. See the Instrument Detail Page for more information. |

Field or Control |

Description |

|---|---|

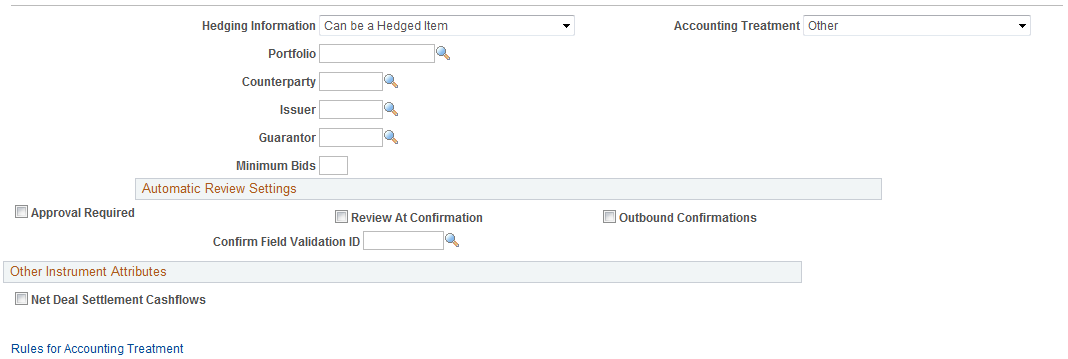

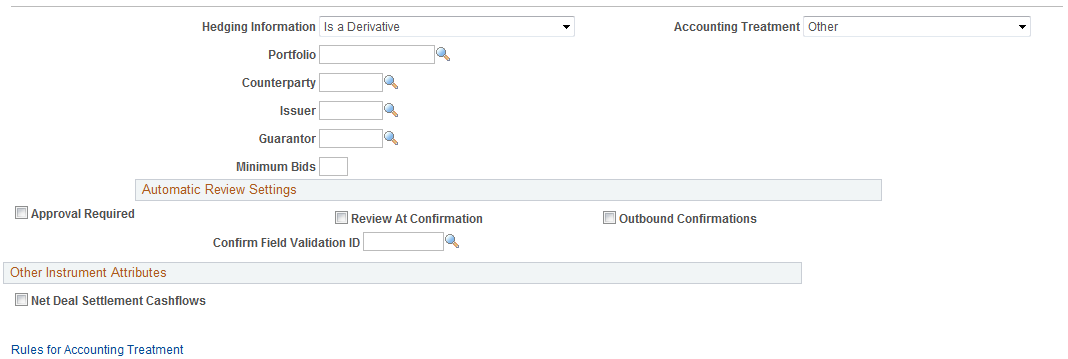

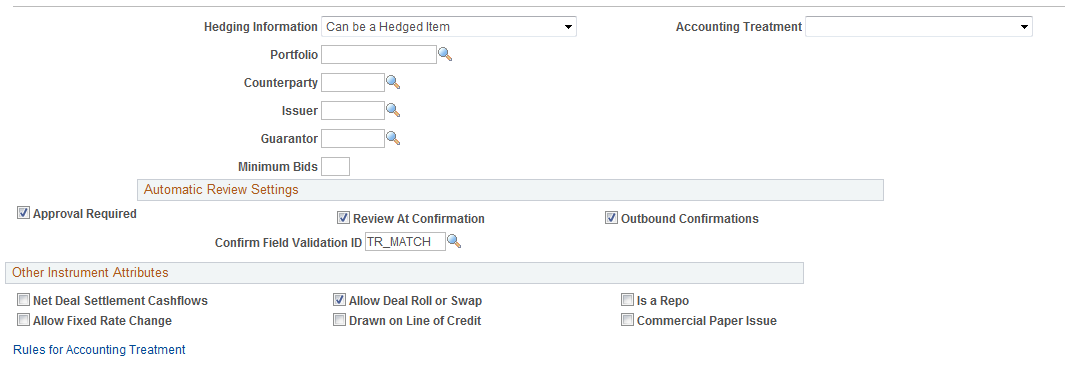

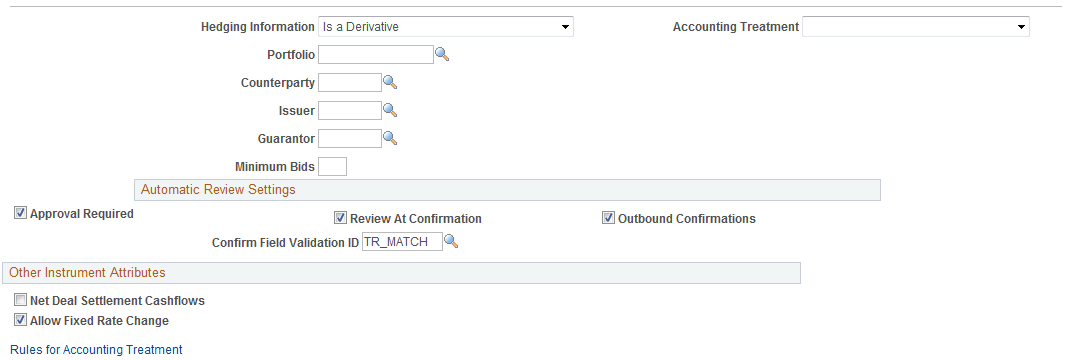

Accounting Treatment |

Select a default accounting treatment for deals created from this instrument. You can modify this setting at the deal level. Values are:

This field is primarily for audit purposes—the specified value does not affect the processing. The system processes accounting for an accounting treatment using templates assigned to events on the Accounting Templates page. This means that if you assign the same templates to accounting events on different accounting treatments, the system processes the treatments exactly alike. |

Copy from existing instrument |

Click to copy details and accounting templates from another instrument to the current instrument viewable in the Details region. If a base type has already been chosen for the existing detail line, then the instrument that you choose here is added in additional lines on the detail of the new instrument. If you have not chosen a base type for the existing line on the main page, then the instrument that is copied from is updated on the existing line. This feature is particularly useful for creating complex instruments (for example, adding a option to a bond instrument). |

Allow Deal Roll or Swap |

Select to indicate that deals that you create using this instrument can be rolled forward or used in a swap. |

Allow Fixed Rate Change |

If selected, fixed rate deals that you create using this instrument can have the rate modified. In addition, if you create an interest rate swap instrument and leave this check box deselected, the Reset Rate Set check box on the Reset Rates page is disabled for any deals created from this instrument. You cannot change the established fixed rate for these swap deals. |

Amort Method (amortization method) |

Select the method for amortizing the principal to zero or an end principal:

|

Approval Required |

Select if this instrument requires management approval before contract closure with the counterparty. |

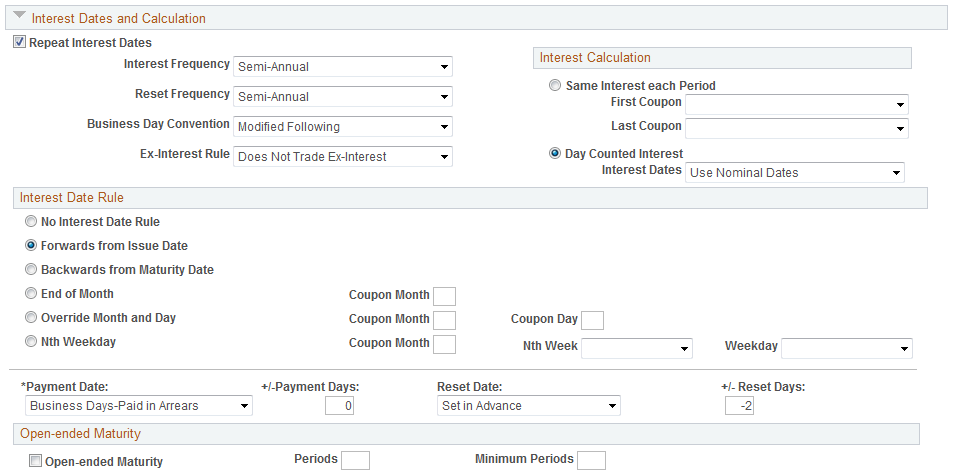

Business Day Convention |

For the purposes of calculating interest, a business day convention is used for establishing the beginning and end of interest periods. The options are:

|

Commercial Paper Issue |

Select when creating IRP (Interest Rate Physical) instruments that will use a commercial paper issue facility. See Understanding Commercial Paper and Line of Credit Facilities. Important! If you select both the Drawn Line of Credit check box and the Commercial Paper Issue check box in the Other Instrument Attributes on the Define Instrument, Instrument Detail page and the Define Instrument Templates page when you save the page an error message will appear stating that an instrument cannot be defined for both Line of Credit and Commercial Paper. You can select only one of these check boxes when defining an instrument. |

Confirm Field Validation ID |

If you intend to use automated inbound confirmations, enter the confirmation field validation. |

Currency |

You can create instruments with predefined currency values. This is useful if you enter into many similar foreign exchange deals—for example, if you buy Japanese Yen and sell United States dollars—you can create an instrument with predefined values to reduce data entry. Any currency values that you specify at the instrument level can be overwritten at the deal level. |

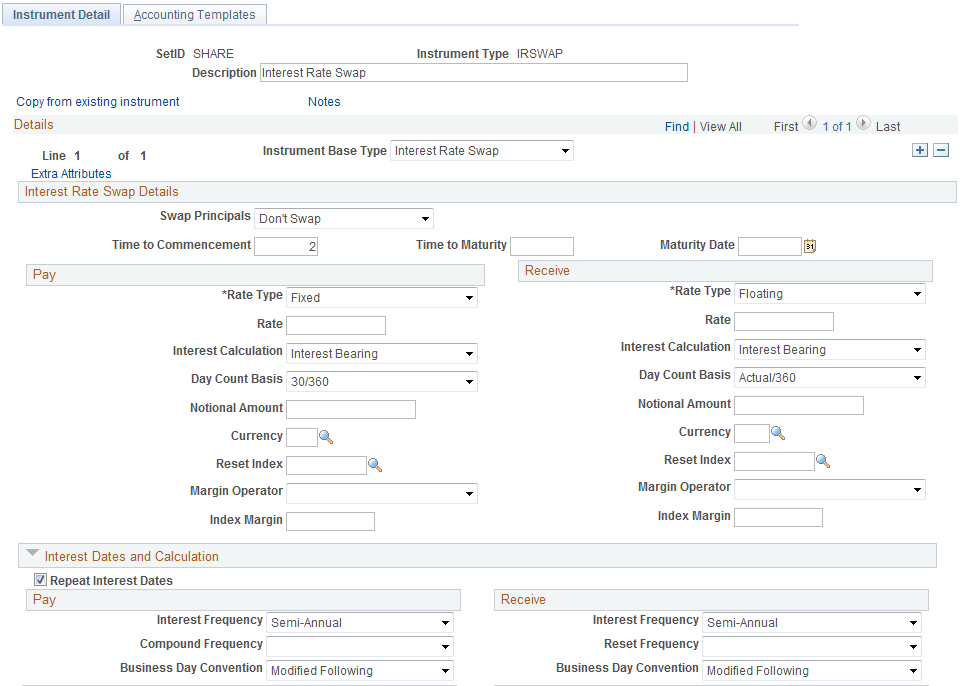

Day Count Basis |

Select a day count basis. Values are: 30/360: Assumes that a year consists of 12 months with an equal length of 30 days. A special rule applies when dealing with the end of a month. 30E/360: Assumes that a year consists of 12 months with an equal length of 30 days. Also known as Euro 30/360. Note: The difference between the 30/360 calculation and the 30E/360 calculation occurs when a period ends on the 31st but did not start on the 30th or 31st. In this case, the 30/360 calculation uses the 31st day as equal to 31, while the 30E/360 calculation uses the 31st day as equal to 30. For example, using the 30/360 calculation, the period starting December 1 and ending December 31 contains 30 days. Using the 30E/360 calculation, however, the same December time period contains only 29 days. Actual/360: Assumes that a year consists of 360 days, but the months are counted as actual calendar days. Actual/365: Assumes that a year consists of 365 days, but the months are counted as actual calendar days. Actual/Actual: Assumes that the number of days between two dates is the actual number of calendar days. |

Day Counted Interest |

Select to have the system use the actual number of days between interest dates to calculate interest payments. |

Drawn on Line of Credit |

Select when creating IRP (Interest Rate Physical) instruments that will draw on a line of credit facility. Important! If you select both the Drawn Line of Credit check box and the Commercial Paper Issue check box in the Other Instrument Attributes on the Define Instrument, Instrument Detail page and Define Instrument Templates page, when you save the page an error message will appear stating that an instrument cannot be defined for both Line of Credit and Commercial Paper. You can select only one of these check boxes when defining an instrument. See Establishing Line of Credit and Commercial Paper Facilities. |

Ex-Interest Rule |

Defines how the instrument is traded with or without interest and how interest is calculated for the instrument. Applies to commodities or equities traded in the middle of the period. The options are:

|

Extra Attributes |

Click to access the Extra Attributes page used to define additional instrument features. |

First Coupon Period |

You must select a value for this field if you selected the Same Interest for each Period option. Define the term for the first interest payment. The options are:

|

Rate Type |

Indicate whether the interest rate for this instrument is fixed or floating. If the rate is fixed, enter a value in the Rate field. If it's floating, enter a value in the Reset Index field. |

Hedging Information |

Select from the options listed below if you use your instrument in a hedge accounting relationship:

|

Index Margin |

For interest calculations, the index margin is the value added to the reset index, or the value by which the reset index is multiplied. Use the Margin Operator field to specify whether the interest calculation involves adding or multiplication of the index margin value. |

Interest Calculation |

Select an interest calculation from the Interest Date and Calculations region: Same Interest each Period: The system uses a fixed amount to calculate interest payments, regardless of the number of days between interest dates. Select options from the First Coupon and Last Coupon fields. Day Counted Interest: The system uses the actual number of days between interest dates to calculate interest payments. Select an option from the Interest Dates field. |

Interest Calculation |

Select the method in the IRP or IR Swap Details region to use to calculate interest: Discount to Yield: Refers to discount securities that are quoted using a money market yield. This method uses the rate to derive the settlement amount. The difference between the settlement amount and the par amount is the interest. Interest Bearing: Refers to interest-bearing instruments. This method calculates interest for each period and pays interest on each period end date. Straight Discount: Refers to money market instruments that are quoted on a straight discount or discount rate basis. This method uses the rate to calculate a discount amount, and then subtracts this amount from the par amount to obtain the purchase price or settlement amount. |

Interest Date Rule |

Select an interest date rule used to define how interest is calculated and when payments will be paid. Depending on the values that you select in this list, complete the related fields. Values are:

|

Interest Dates |

Select from these values: Use Actual Interest Dates: The actual interest dates (the interest dates after adjusting for nonbusiness days and weekends) determine the amount of the interest payment. Use Nominal Dates: The nominal interest dates (the interest dates before adjusting for nonbusiness days and weekends) determine the amount of the interest payment. |

Interest Frequency |

Select an interval that reflects the cash flow frequency for the deal. Values are Annual, At Maturity, Every 28 Days, Every 35 Days, Every 49 Days, Monthly, Quarterly, Semi-Annual, and Weekly. In the Compounds field, define how frequently this interest interval compounds. Values are Annual, At Maturity, Every 28 Days, Every 35 Days, Every 49 Days, Monthly, Quarterly, Semi-Annual, and Weekly. |

Is a Commercial Paper Issue |

Select if the instrument is a commercial paper facility. |

Is a Repo (repurchase) |

Select to indicate that deals created using this instrument are available for use in a repurchase agreement. |

Issuer and Guarantor |

Enter the issuer of the security and the entity that backs up the issued security. These fields are required only if the following conditions are met:

|

Last Coupon Period |

You must select a value for this field if you selected the Same Interest for each Period option. Define the term for the last interest payment. The options are:

|

Margin Operator |

Select the operation—add or multiply—by which the reset index is acted upon by the index margin to calculate the adjusted rate. |

Market/Exchange |

Enter the exchange where the commodity or equity is traded. |

Minimum Bids |

Enter the number of minimum bids required for this instrument. |

Net Deal Settlement Cash Flows |

Select this check box if your instrument has more than one instrument base type or contains an interest rate swap, and you require that cash flow from one instrument base type or swap leg net with cash flow from another instrument base type or swap leg. |

Nth Week |

Specify the monthly coupon period end date. Select from these four values: First, Fourth, Second, or Third. Also select a specific weekday. |

Outbound Confirmations |

Select to designate that these instrument deals be selected in the automated outbound confirmations procedure and forwarded to the counterparty for review. |

Payment Date |

Select from the following options and enter a value in the +/- Payment Days field.

|

Portfolio |

Enter the collection of securities to which the instrument deals belongs. |

Rate |

Enter the interest rate for this instrument. |

Rate Type |

Select whether the interest rate for this instrument is fixed or floating. If you select Fixed, enter the rate. If you select Floating, enter the reset index for the floating rate. |

Reset Date |

Select from these options and enter a value in the +/- Reset Days field. Set in Arrears: Indicates that the reset date is equal to the interest date that marks the end of the interest period. Set in Advance: Indicates that the reset date is equal to the interest date that marks the beginning of the interest period. |

Reset Frequency |

Specify the reset parameter for the interest calculation. Field values ending in the suffix -comp indicates the interest compounds (per the field value time period). Values are Annual, At Maturity, Daily, Every 28 Days, Every 35 Days, Every 49 Days, Monthly, Quarterly, Semi-Annual, Weekly, and the appropriate -comp value. |

Reset Index |

Enter a reset index for this instrument, for example, LIBOR (London Interbank Offer Rate). |

Review At Confirmation |

Select if you want to require your confirmation staff to review these instrument deals. |

Same Interest each Period |

Select to have the system use a fixed amount to calculate interest payments, regardless of the number of days between interest dates. |

The fields on the Instrument Detail page change depending on instrument base type.

Use the Instrument Detail page to define instrument details for these instrument types:

Commodities

Equities

FX deal physicals

Futures contracts

Generic deals

Interest rate physicals (IRP)

Interest rate swaps (IR Swap)

Options

There are two ways to define an instrument:

Define the instrument based on an existing instrument type.

Create a new one founded on a base instrument type and using a unique name.

Which ever way you chose to start, you must define the details of the instrument.

Using an Existing Instrument Type

To define an instrument using an existing instrument type:

On the Define Instruments search page, click Find an Existing Value.

Select an existing instrument type from the Instrument Type drop-down menu.

Once you specify the instrument type, the Instrument Detail page displays the appropriate detail attributes.

Creating a Unique Instrument Type

To create a new instrument type:

On the Define Instruments search page, click Add a New Value.

In the Instrument Type field, enter a name value, and click Add.

On the Instrument Detail page, select Instrument Base Type.

Once you specify the instrument base type, the Instrument Detail page displays the appropriate detail attributes.

Defining the Instrument Details

Whether defining an instrument based on an existing instrument type or creating a new one, once you are on the Instrument Detail page, you must:

Complete the page fields for that specific instrument type.

(Optional) Click the Extra Attributes link to add extra attribute information for the deal.

For a futures contract, click the Delivery Dates link to add a schedule of delivery and trade dates.

Use the Instrument Detail page (INSTR_DETAIL_TR) to enter the specifics for an instrument.

This page differs for each instrument base type.

Navigation:

Field or Control |

Description |

|---|---|

Notes |

Click the Notes link to access the Notes page (INSTR_NOTES_PNL), where you can enter detailed notes to describe the function of the instrument being created. For example, when creating an instrument with an accounting treatment of Other, you can enter detailed information about that unique accounting treatment on the Notes page. |

Rules for Accounting Treatment |

Click the Rules for Accounting Treatment link on an Instrument Detail page to access the Help page for IAS Accounting (INSTR_ACCTG_SP), where you can determine the accounting treatment for the instrument based on factors related to hedging, the length of time benefits that will be acquired, its inclusion in a portfolio, and so forth. |

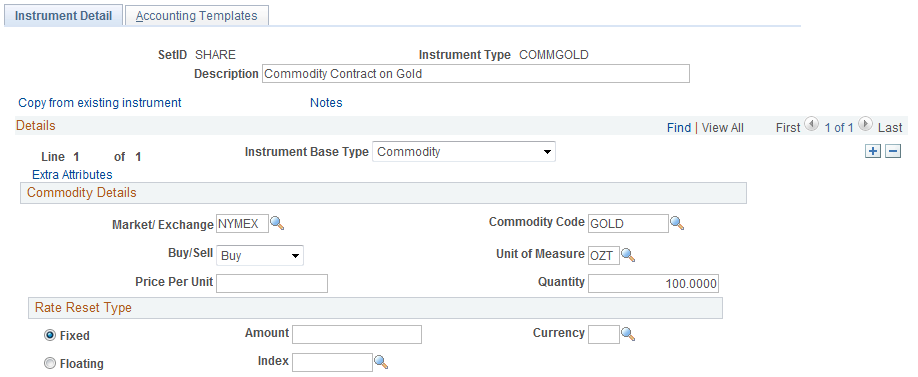

Use the Instrument Detail page (INSTR_DETAIL_TR) to enter the specifics for commodities deals.

This page differs for each instrument base type.

Navigation:

This example illustrates the fields and controls on the Instrument Detail page – for commodities deals (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Instrument Detail page – for commodities deals (2 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Instrument Base Type |

Select Commodity. |

Commodity Details

Field or Control |

Description |

|---|---|

Commodity Code |

Enter the exchange code for the commodity being traded. |

Buy/Sell |

Specify whether the instrument being created is for deals that will buy or sell a commodity. |

Unit of Measure |

Specify a unit of measure most commonly used for trading the specified commodity. |

Price Per Unit |

Enter a price per unit of measure for the commodity. |

Quantity |

Enter the quantity of the commodity being traded. |

Rate Reset Type

Field or Control |

Description |

|---|---|

Fixed |

Select to specify a fixed rate of return on the commodity investment—entered in the Amount field. |

Amount |

Enter the monetary value based on the price per unit multiplied by the quantity of the commodity. |

Floating |

Select for deals that will be based on a floating rate of interest. |

Index |

Select the market for which thee floating rate index is based. |

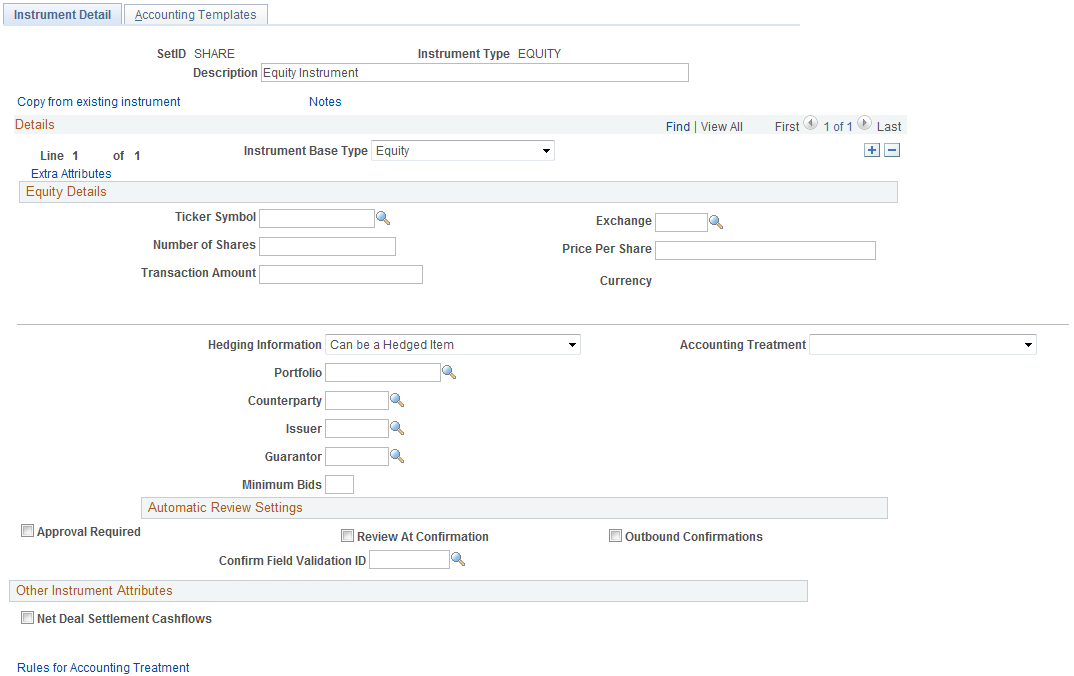

Use the Instrument Detail page (INSTR_DETAIL_TR) to enter the specifics for an equity deal.

This page differs for each instrument base type.

Navigation:

This example illustrates the fields and controls on the Instrument Detail page – for an equity deal. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Ticker Symbol |

Enter the stock exchange symbol that is used in trading the particular corporation's shares. |

Exchange |

Enter the stock exchange with which the corporation is listed. |

Number of Shares |

Enter the number of shares being traded. |

Price per Share |

Enter the price of a single share of stock. |

Transaction Amount |

Enter the monetary total of the transaction based on the number of shares being sold multiplied by the price per share. |

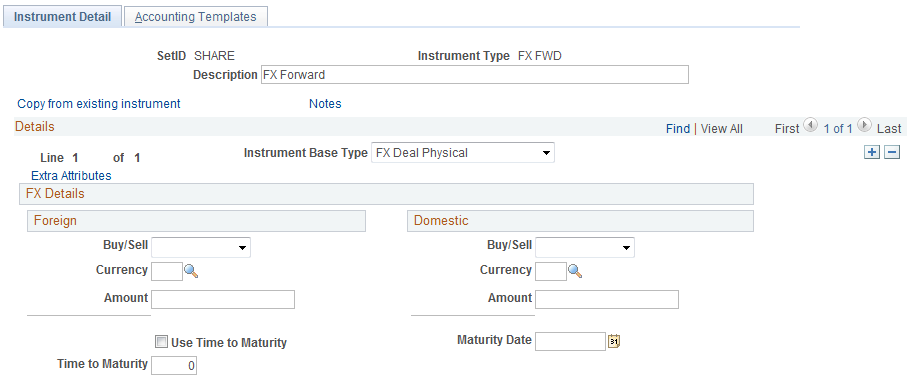

Use the Instrument Detail page (INSTR_DETAIL_TR) to enter the specifics for a foreign exchange deal physical.

This page differs for each instrument base type.

Navigation:

This example illustrates the fields and controls on the Instrument Detail page – for foreign exchange deal physicals (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Instrument Detail page – for foreign exchange deal physicals (2 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Instrument Base Type |

Select FX Deal Physical. |

Buy/Sell |

A FX deal physical instrument has a buy side and a sell side. Once you select Buy or Sell in the field for one region, the system makes the corresponding selection for the other region when you save the instrument. |

Use the following fields to automatically assign a value for the Maturity Date field on the Deal Detail page when you use an FX deal physical.

Field or Control |

Description |

|---|---|

Use Time to Maturity |

Select to use the Time to Maturity field. If the check box is selected, the system uses the Time to Maturity value to calculate the deal maturity date, based on these scenarios:

If the deal maturity date has no default value, leave the field blank. |

Maturity Date |

Enter the date the deal matures and ends. |

Note: Enter data for both the buy and sell side of the FX deal physical, whether both regions are Foreign, or one region is Foreign and the other Domestic.

Use the Instrument Detail page (INSTR_DETAIL_TR) to enter the specifics for a futures contract.

This page differs for each instrument base type.

Navigation:

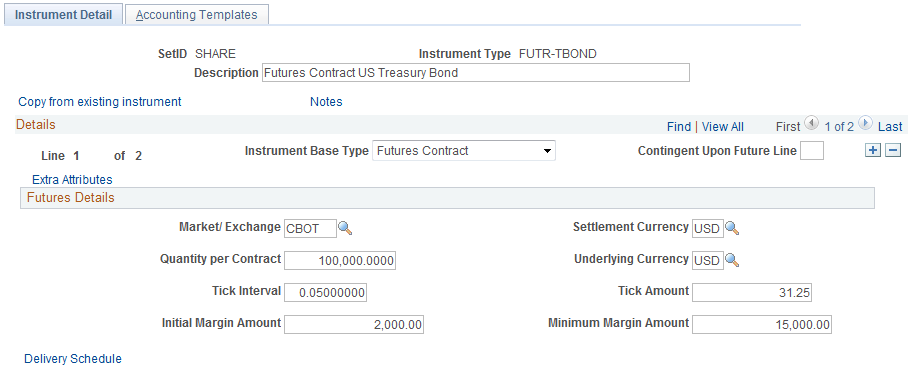

This example illustrates the fields and controls on the Instrument Detail page – for a futures contract (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Instrument Detail page – for a futures contract (2 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Instrument Base Type |

Select Futures Contract. |

Settlement Currency |

Enter the final settlement currency of the futures contract. |

Quantity per Contract |

Enter quantity of the commodity being traded. |

Underlying Currency |

Enter the currency of the underlying deal on which the futures contract is built. |

Tick Interval |

Enter the smallest allowable increment of price movement for a futures contract, expressed as a decimal. |

Tick Amount |

Enter the smallest allowable increment of price movement for a futures contract, expressed as a monetary amount. |

Initial Margin Amount |

Enter the initial margin amount paid for this futures contract. |

Minimum Margin Amount |

Enter the minimum margin amount required by the broker. |

Delivery Schedule |

Click this link to enter contract details. |

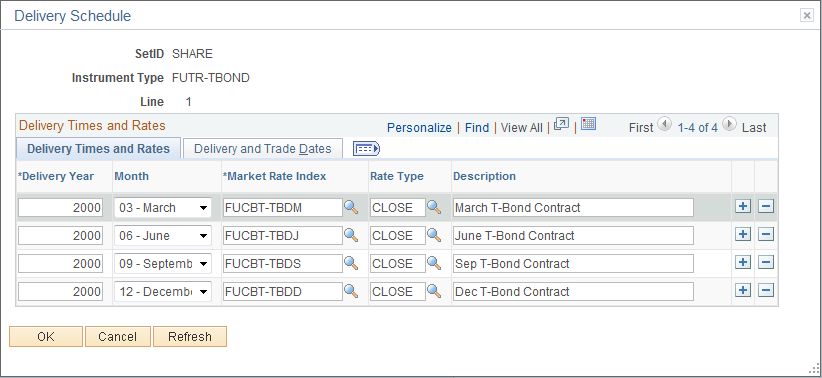

Use the Delivery Schedule page (INSTR_FUTURE_SP) to capture data that is specific to a particular futures contract.

Navigation:

Click the Delivery Schedulelink on an Instrument Detail page for a futures contract.

This example illustrates the fields and controls on the Delivery Schedule page. You can find definitions for the fields and controls later on this page.

Delivery Times and Rates

Field or Control |

Description |

|---|---|

Delivery Year and Month |

Enter the month and year that the contracts are delivered and can no longer be traded. |

Market Rate Index |

Select the market rate index referenced when the contract is delivered. |

Rate Type |

Select the type of rate that, combined with the market rate index, determines the price of the delivered contract. |

Delivery and Trade Dates

Field or Control |

Description |

|---|---|

First Trade Date and Last Trade Date |

Enter the first and last allowable trading dates of the futures contract. |

First Delivery Date and Last Delivery Date |

Enter the actual first and last dates the futures contracts transactions are completed. |

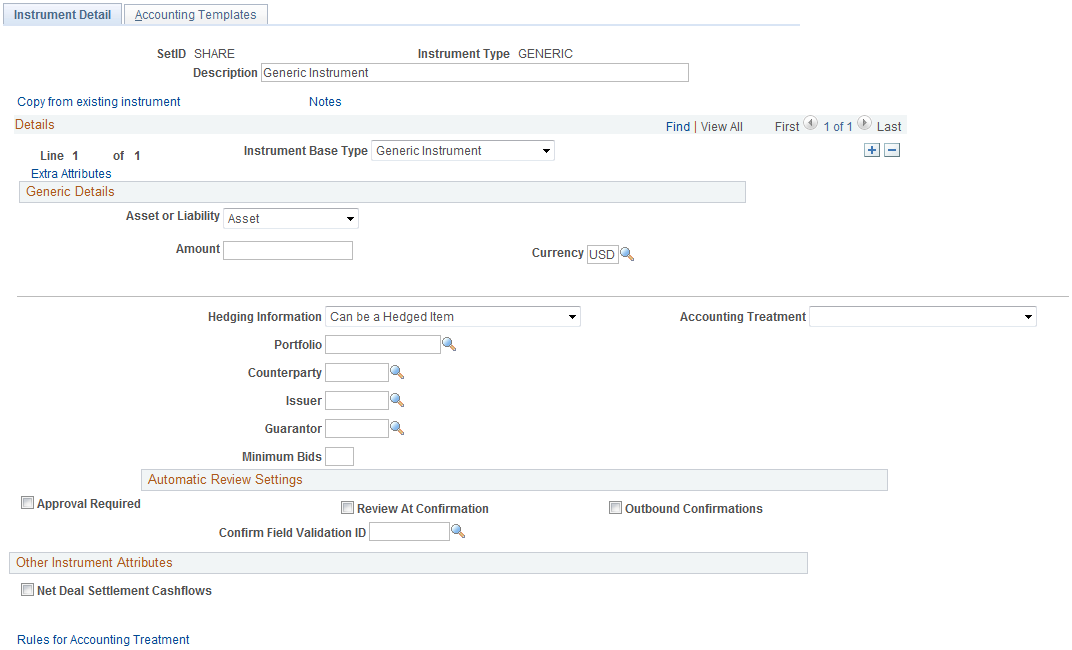

Access the Instrument Detail page for a generic instrument

This example illustrates the fields and controls on the Instrument Detail page – for a generic deal. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Instrument Base Type |

Select Generic Instrument. |

Asset or Liability |

Select whether the deal is for an asset or a liability. |

Amount |

Enter a monetary amount for the deal. |

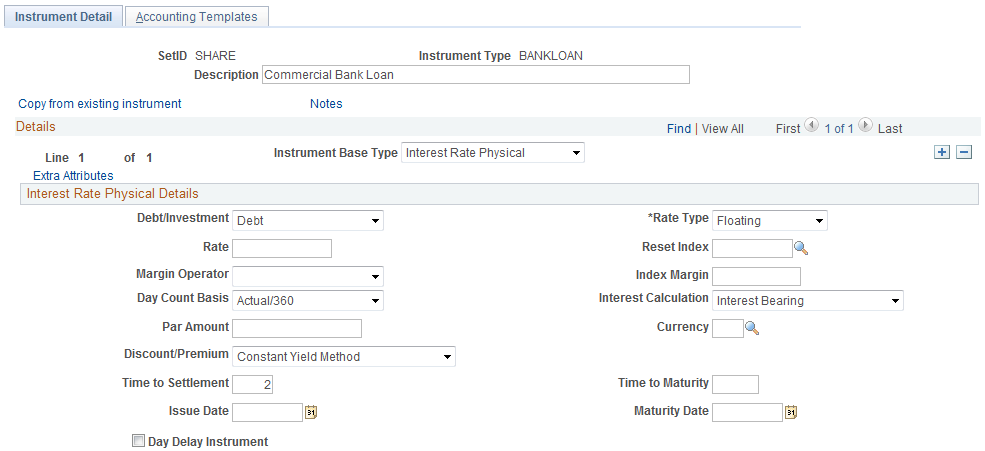

Access the Instrument Detail page for an interest rate physical instrument

This example illustrates the fields and controls on the Instrument Detail page – for an interest rate physical deal (1 of 3). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Instrument Detail page – for an interest rate physical deal (2 of 3). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Instrument Detail page – for an interest rate physical deal (3 of 3). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Instrument Base Type |

Select Interest Rate Physical. |

Interest Rate Physical Details

Field or Control |

Description |

|---|---|

Debt/Investment |

Specify whether the instrument is for debt raising or is an investment. Values are Debt or Investment. (Optional) Select Investment to fill in the Issuer and Guarantor fields on the Instrument Detail page. |

Par Amount |

Enter the nominal monetary amount for the security. |

Discount/Premium |

This field is available for entry when you select Interest Bearing in the Interest Calculation field. It determines how to account for and treat the discount or premium that is associated with an interest rate physical. Discount to Yield and Straight Discount are values only if you deselect the Repeat Interest Dates check box or if the instrument's interest rate is Floating. Select whether you amortize by straightline or constant yield to amortize the bond's discount (or premium). This also affects the calculation method for calculating interest accruals. Select from these values:

|

Time to Settlement |

Enter the number of business days between the deal transaction date and the deal settlement date. |

Time to Maturity |

Enter the number of calendar days between the deal settlement date and the deal maturity date. |

Issue Date |

Enter the date that the instrument is issued. |

Maturity Date |

Enter the date that the deal matures. |

Day Delay Instrument |

Select to indicate that deals using this instrument are processed using day delay accounting. The system logs deals on the trade date (transaction date on Deal Header page) but does not settle them until the settlement date (settlement date on the Dates Detail page). |

Interest Dates and Calculation

Field or Control |

Description |

|---|---|

Repeat Interest Dates |

Select the check box if the interest rate physical transaction has multiple interest payments. |

Open-Ended Maturity

Field or Control |

Description |

|---|---|

Open-Ended Maturity |

Select this check box if the instrument has no maturity date. For deals using this instrument type, the system builds out cash flow dates (to a maximum of three months) and accrues the amount on a daily basis. Enter the number of future periods to build. In the Minimum Periods field, enter the minimum number of rows remaining before the system builds more rows. For example, if the period is 12, and the minimum periods are 3, then when 10 period rows are filled with data, 12 more rows are built. |

Periods |

Enter the total number of interest periods to be built at one time for this instrument. |

Minimum Periods |

Enter the minimum number of interest periods that must pass before new periods can be built for this instrument. |

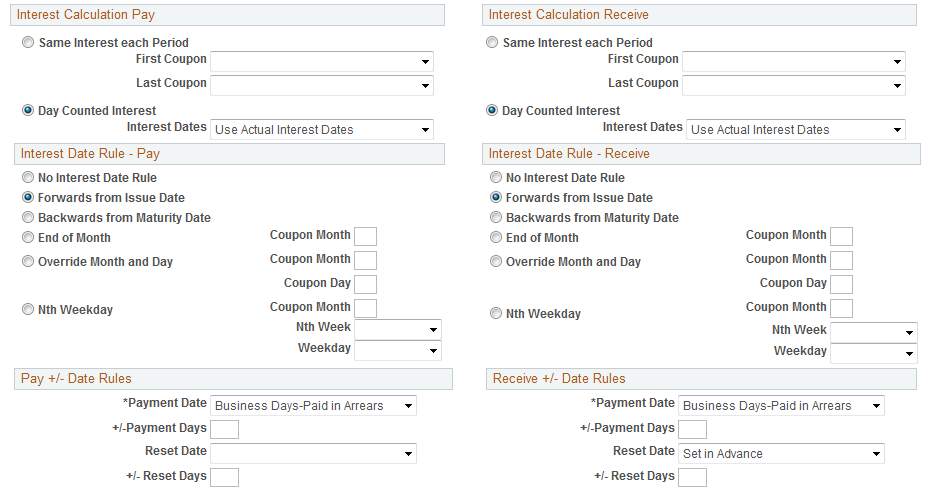

Access the Instrument Detail page for an interest rate swap

This example illustrates the fields and controls on the Instrument Detail page – for an interest rate swap (1 of 3). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Instrument Detail page – for an interest rate swap (2 of 3). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Instrument Detail page – for an interest rate swap (3 of 3). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Instrument Base Type |

Select Interest Rate Swap. |

Important! In configuring forward rate agreement instruments, do not select Discount to Yield from the Interest Calculation field drop-down menu, as these are not discount instrument types.

Selecting this check box causes calculation errors in any deals created from this instrument.

Interest Rate Swap Details

Field or Control |

Description |

|---|---|

Swap Principals |

Select when to swap principals. Certain field values require a corresponding accounting template to ensure correct cash flow processing. Values are:

See Understanding Interest Rate Swap Cash Flows and Accounting Templates. |

Time to Commencement |

Enter the number of actual days or number of business days from the trade date to the effective date of the swap. |

Time to Maturity |

Enter the number of actual days from the commencement date (or trade date) to the maturity date of the swap. |

Maturity Date |

Enter the date of termination for the underlying swap transaction. |

Interest Dates and Calculations

Field or Control |

Description |

|---|---|

Repeat Interest Dates |

Select if the interest rate swap has multiple interest cash flows (a swap). Deselect if the interest rate swap has a single interest cash flow (for example, a forward rate agreement). |

Pay/Receive

Fields for interest rate swaps exist for both the Pay and Receive regions, but they are discussed only once in this section. Data entry for both sets of fields is required.

Field or Control |

Description |

|---|---|

Notional Amount |

Enter the specified monetary amount for this instrument. This amount is the principal amount on which the exchanged interest payment calculations are based for an interest rate swap. |

Compound Frequency |

Define at what interval the interest compounds. |

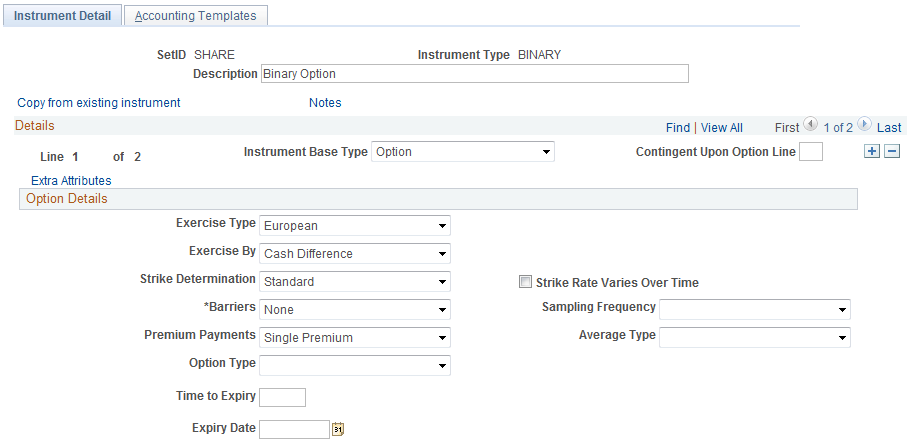

Access the Instrument Detail page for an option or an option - binary payoff

This example illustrates the fields and controls on the Instrument Detail page – for options - binary payoff (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Instrument Detail page – for options - binary payoff (2 of 2). You can find definitions for the fields and controls later on this page.

Note: This section discusses instrument details for both options and options - binary payoff. Use the options - binary payoff instrument base type in conjunction with the option instrument base type to enter binary options (also called digital options). The application pages for these instruments are identical with the exception of the additional Binary Option Details section. In the example above, Details Line 1 of 2 is an option, and line 2 of 2 is an option - binary payoff.

Option Details

Field or Control |

Description |

|---|---|

Instrument Base Type |

Select Option. |

Contingent Upon Option Line |

Use to associate an option with its underlying payoff transactions. Enter the line number of the option detail line of each payoff transaction or the detail line that is contingent upon the exercise of the option. For example, suppose that line 2 is contingent on line 1, you enter 1 in the Contingent Upon Option Line field for line 3. |

Exercise Type |

Select an exercise type. Values are: American: Can be exercised on any date between the start date and expiry date. European: Can be exercised only on the expiry date. Bermudan: Can be exercised on a predefined range of dates. |

Exercise by |

Select from the following values: Cash Difference: Settles the option by the cash difference. Delivery of Payoff: The payoff transaction is dealt at the specified payoff transaction rate. |

Strike Determination |

Select the price determinant to apply to the payment that is due. Some options require sampled historical prices or rates to determine their payoffs. For example, an Asian option with monthly sampling uses monthly data point to determine the average underlying price. The options are: Asian - Average Price: Pays the difference between the average underlying price over a specified period and the strike price. This option requires sampled historical prices or rates to determine the payoff. Enter values for Sampling Frequency and Average Type. Asian - Average Strike: Pays the difference between the underlying price and an average strike price over a specified period. This option requires sampled historical prices or rates to determine the payoff. Enter values for Sampling Frequency and Average Type. Hindsight: Pays the holder the best payoff between the spot price, sampled over time, and the fixed strike price. This option requires sampled historical prices or rates to determine the payoff. Enter a value for Sampling Frequency. Lookback: Pays the holder of a call the difference between the spot price at maturity and the lowest spot price over an observation period. The payoff for a put is the highest spot price observed, less the spot price at maturity. This option requires sampled historical prices or rates to determine the payoff. Enter a value for Sampling Frequency. Standard: Provides the holder the right to purchase or sell the underlying asset at a specific price on or before a specified date. |

Strike Rate Varies Over Time |

Select to enable the Strike Rate field on the Deal Detail page during deal capture. The Strike Rate Varies Over Time check box is available only for American or Bermudan exercise types. |

Barriers |

If you select Single, the Barriers button becomes enabled at deal capture, and a single Barrier row appears; if you select Double, two barrier rows appear at deal capture. |

Sampling Frequency |

Define the time interval between taking your first sample price and taking your second sample price. To compute an average for this field, select from the following values: Continuous: Assumes that prices are being averaged on a continuous, real-time basis. Daily: Assumes that price sampling is being performed on a daily basis. Monthly: Assumes that prices are being taken on a monthly basis. Weekly: Assumes that price sampling occurs every seven days. |

Premium Payments |

Select Single Premium to enable a premium payment row at deal capture. Select Multiple Premiums to enable multiple premium payment rows at deal capture. |

Average Type |

If the value of the Strike Determination field is Asian - Average Price or Asian - Average Strike, then select the average type to determine what method to employ for calculating an average for the selected sampling frequency. Values are: Arithmetic: Assumes that a price is sampled at finite points in time. Geometric: Assumes that a price is sampled on a continuous basis. |

Option Type |

If the payoff transaction (the Instrument Detail line that has this option in the Contingent Upon Option Line field) is an interest rate swap, then specify the type for this option. Select Cap/Floor or Swaption to determine how the option affects the swap: Cap/Floor: Applies the option individually to each interest period. Upon exercise, exercise only the current interest period, and the option remains static for the remaining periods. Swaption: Applies the option to the entire swap. Upon exercise, the option expires, and the swap becomes active. |

Time to Expiry |

Enter the number of days until the option expires. |

Expiry Date |

Enter the last day that the option can be exercised. The date that you enter here is automatically assigned the to the same field on the Deal Detail page for a deal with an instrument base type of option. |

Binary Option Details

Field or Control |

Description |

|---|---|

Amount |

Enter the amount of the payoff. |

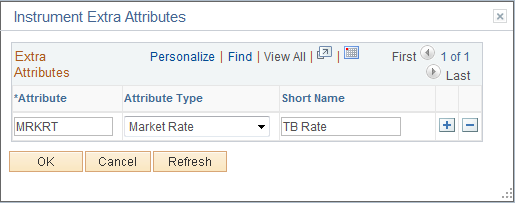

Use the Instrument Extra Attributes page (INSTR_ADHOC_ATR) to assign extra notational attributes to your instrument.

Navigation:

Click the Extra Attributes link on the Instrument Detail page.

This example illustrates the fields and controls on the Instrument Extra Attributes page. You can find definitions for the fields and controls later on this page.

If the delivered instrument component does not contain all the data fields that you require, you can define extra fields to capture this data. These extra attribute fields appear on the Deal Capture component and are memo-only fields that are not used in any deal processing.

Field or Control |

Description |

|---|---|

Attribute |

Enter a five-character, alphanumeric code for the attribute. |

Attribute Type |

Specify a value: Date, Market Rate, Small Integer, or Small Character. |

Short Name |

Enter a name for the attribute. |