Performing Account Analysis

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

FA_BNK_STMT_HDR |

Enter statement and analysis date information, and select a statement method. You can also view bank contacts. |

|

|

FA_BNK_STMT_RATE |

Enter rate information for statement fee codes |

|

|

FA_BNK_STMT_ANYL |

Enter balances, earnings and other totals. |

|

|

FA_BNK_STMT_BADJ |

Enter balance adjustment information. |

|

|

FA_BNK_STMT_SRVC |

Enter statement service charge information. |

|

|

FA_BNK_STMT_SADJ |

Enter adjustments to service charges found on the bank account analysis statement. |

|

|

Import Bank Statements Page |

BSP_IMPORT |

Submit an electronic request for bank statement information. See Automatically Importing Statement Information. See also the Import Bank Statements Page. |

|

FA_BNK_STMT_VALID |

Validate a statement against a fee structure. |

Once bank fee codes and structures have been set up, you can perform account analysis on your bank statements to verify fee charges and catch potential errors. EDI 822 statements can be entered either manually or automatically imported using PeopleSoft banking functionality. You use the Account Analysis pages to enter bank statement balance, service, and rate information, as well as balance adjustments and service adjustments, where necessary. After entering a statement, you can validate that statement to ensure correct volumes, balances, and charges. This should help decrease your research time into statement exceptions.

Using pages in this topic, you can:

Manually create statements.

Automatically import statement information.

Validate account analysis information.

Field or Control |

Description |

|---|---|

Adjustment Date |

Displays the balance adjustment or service charge adjustment entry date. |

Fee Code |

Displays the identifier code for the specified fee. |

Pay Method |

If you leave the Pay Method field blank, the system applies the charge to the balance compensable service charges.

|

Service Charge or Service Charge Amount |

Displays the service charges assessed to your account by the bank. |

This section discusses how to manually create statements:

Enter general statement information.

Enter statement rate information.

Enter balance compensation information.

Enter balance adjustment information.

Enter service charge information.

Enter service adjustment information.

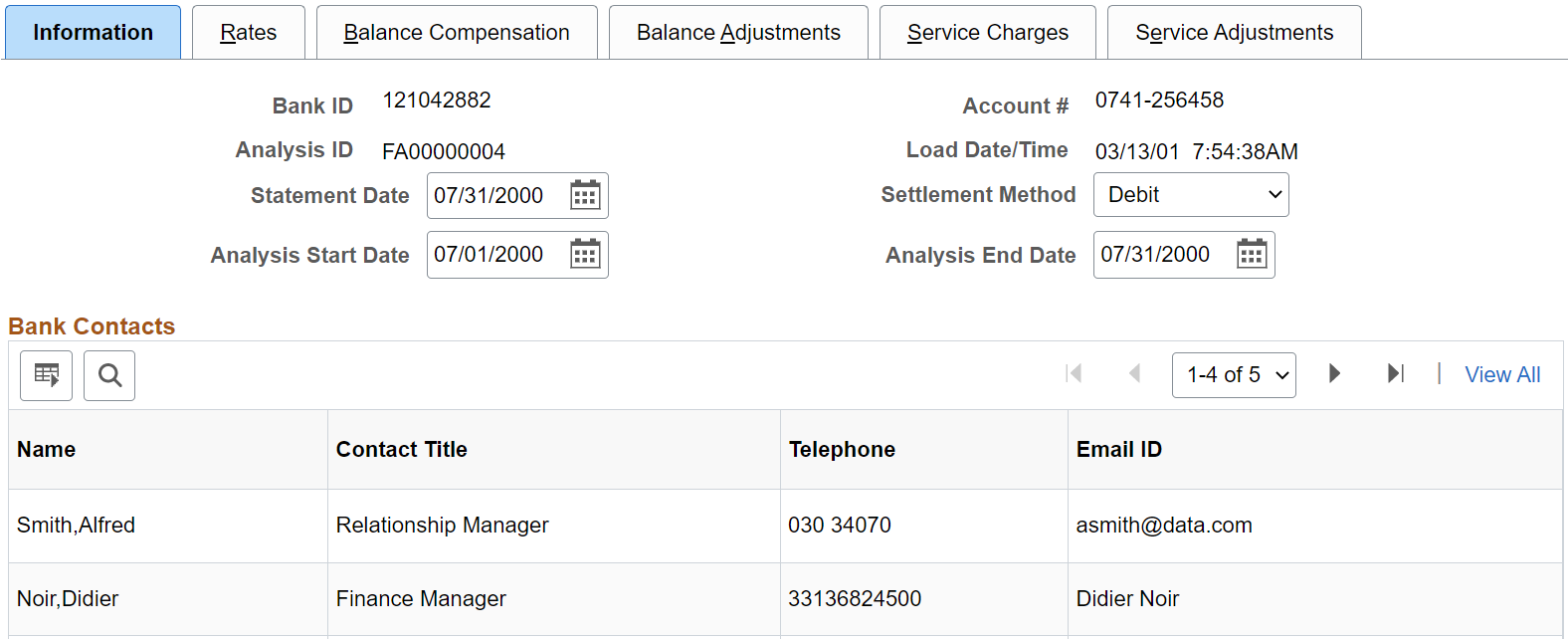

Use the Fee Statements - Information page (FA_BNK_STMT_HDR) to enter statement and analysis date information, and select a statement method.

You can also view bank contacts.

Navigation:

This example illustrates the fields and controls on the Fee Statements - Information page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Statement Date |

Enter the date the statement is created or imported. |

Settlement Method |

Select Debit or Invoice. |

Bank Contacts

This information is associated with the Bank ID and Account #. The fields display the information you entered on the Financial Contacts page.

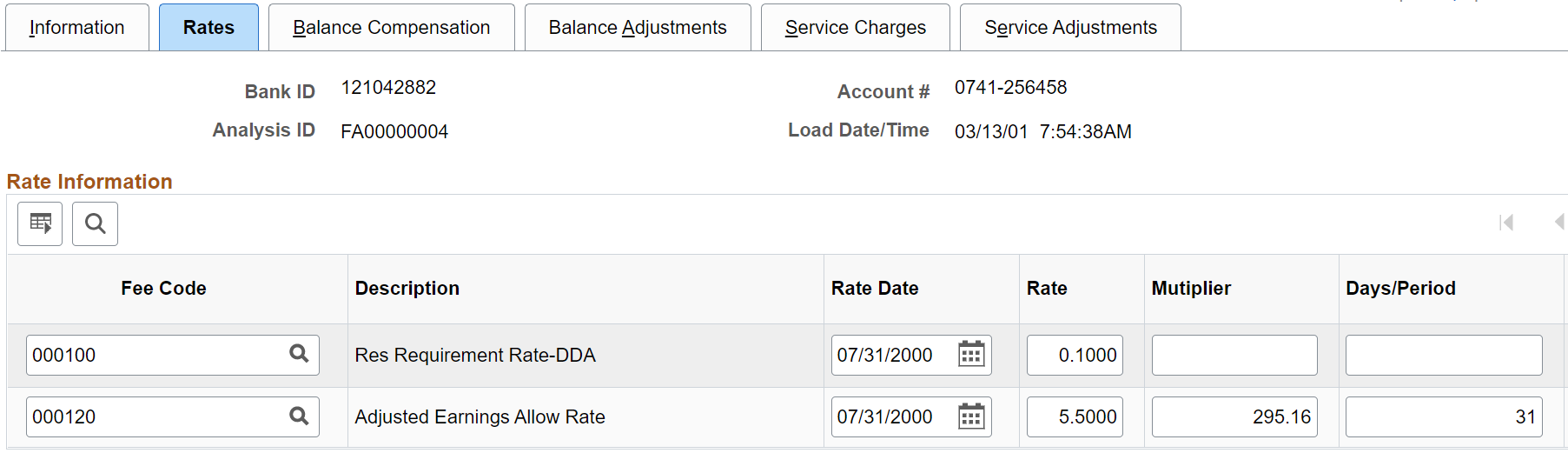

Use the Fee Statements - Rates page (FA_BNK_STMT_RATE) to enter rate information for statement fee codes.

Navigation:

This example illustrates the fields and controls on the Fee Statements - Rates page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Rate Date |

Enter the effective date for the Rate. |

Rate |

Enter a rate in decimal format. Rates can be any type, such as earnings rates for the current and next period, or reserve rates. |

Multiplier |

Specify a service multiplier, in decimal format. |

Days/Period |

Enter the number of days in the analysis period, generally 30 or 31. |

Days/Year |

Enter the number of days in the year, generally 365 or 366. |

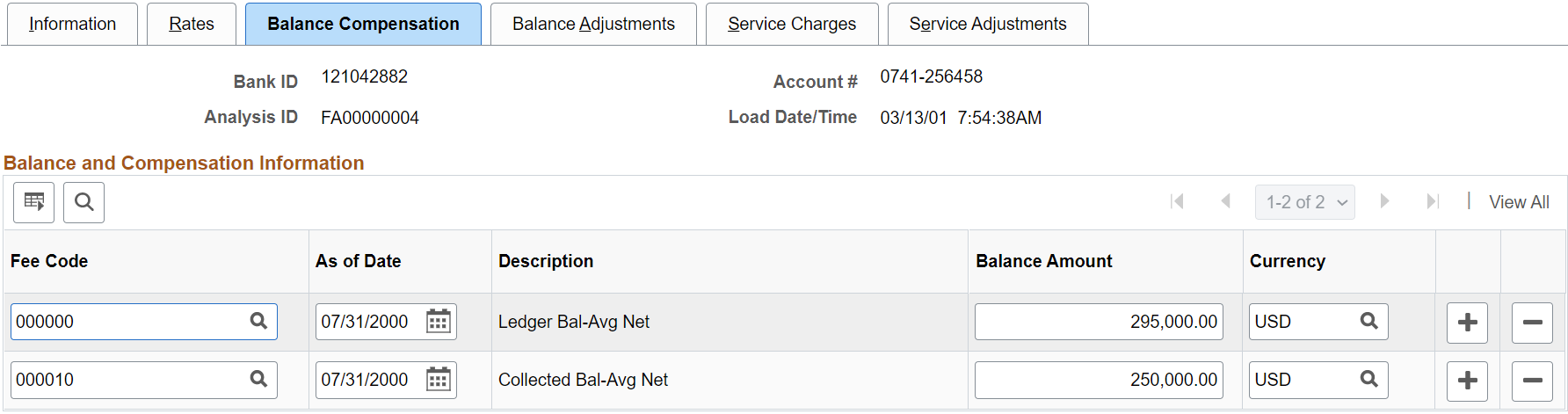

Use the Fee Statements - Balance Compensation page (FA_BNK_STMT_ANYL) to enter balances, earnings and other totals.

Navigation:

This example illustrates the fields and controls on the Fee Statements - Balance Compensation page. You can find definitions for the fields and controls later on this page.

You enter balances, earnings allowance, and service charge summary information for a specified account on this page.

Field or Control |

Description |

|---|---|

Balance Amount |

Enter the final balance amount for the indicated Fee Code from the 822 Statement. |

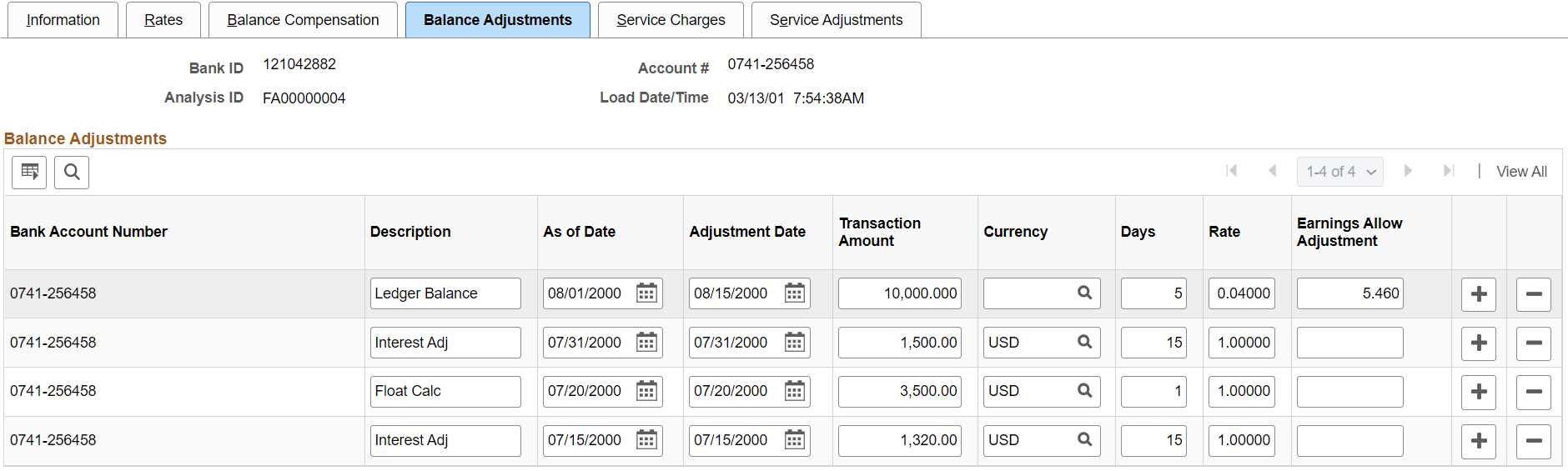

Use the Fee Statements - Balance Adjustments page (FA_BNK_STMT_BADJ) to enter balance adjustment information.

Navigation:

This example illustrates the fields and controls on the Fee Statements - Balance Adjustments page. You can find definitions for the fields and controls later on this page.

You can correct balance information for a specific account number.

Field or Control |

Description |

|---|---|

Transaction Amount |

Enter the adjustment transaction amount. |

Days |

Indicates the number of days the balance adjustment is outstanding. For example, 10,000 USD for five days. |

Rate |

Displays the adjustment rate expressed as a decimal. |

Earnings allow Adjustment |

Enter the actual dollar amount being charged or reimbursed to the account by the bank. |

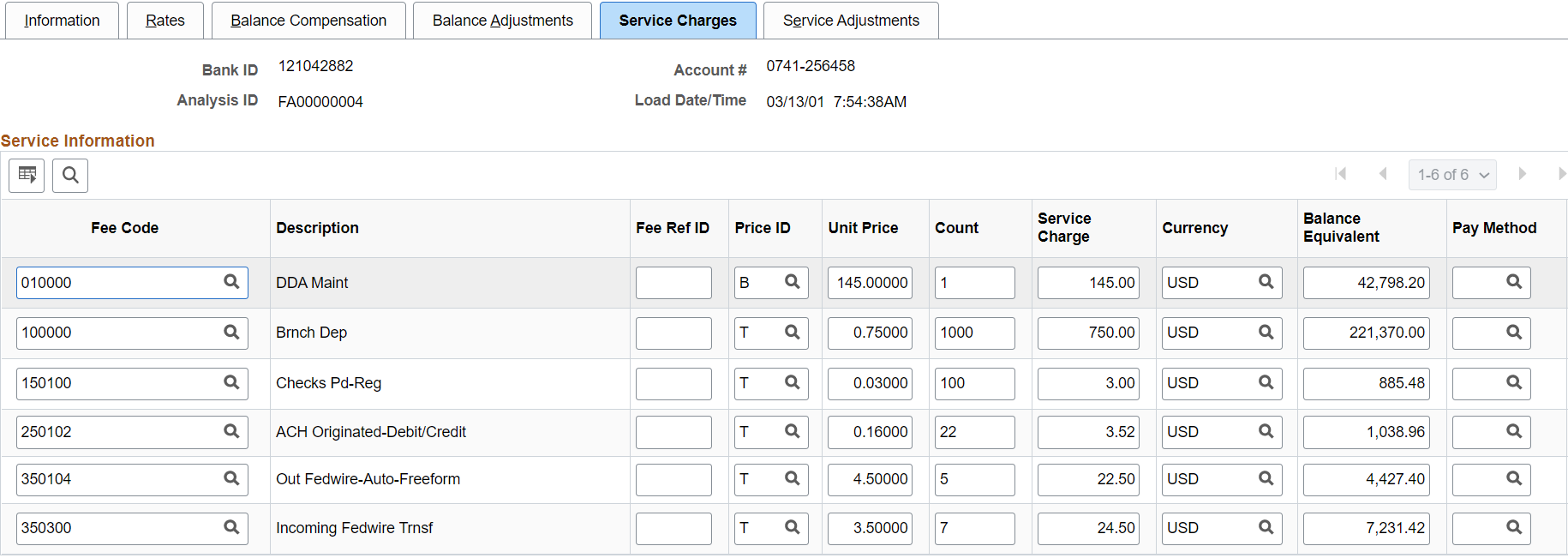

Use the Fee Statements - Service Charges page (FA_BNK_STMT_SRVC) to enter statement service charge information.

Navigation:

This example illustrates the fields and controls on the Fee Statements - Service Charges page. You can find definitions for the fields and controls later on this page.

Enter service charges from the bank account analysis statement on this page.

Field or Control |

Description |

|---|---|

Price ID |

Refers to the fee calculation type. Select from the following:

|

Unit Price |

Enter the unit price per fee item. |

Count |

Enter the number of statement items for each fee code. |

Balance Equivalent |

Enter the account's balance equivalent, as defined by the bank. |

Note: If you use Flat Fee for the Price ID, the service charge equals the unit price. If you want the service charge to equal the unit price multiplied by the count, you must use Tiered Price for the Price ID.

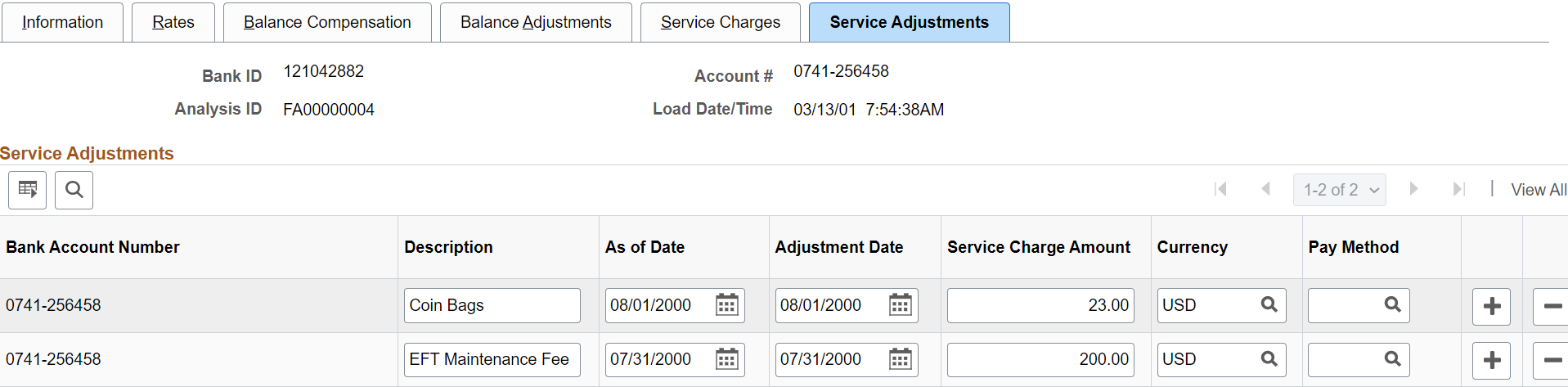

Use the Fee Statements - Service Adjustments page (FA_BNK_STMT_SADJ) to enter adjustments to service charges found on the bank account analysis statement.

Navigation:

This example illustrates the fields and controls on the Fee Statements - Service Adjustments page. You can find definitions for the fields and controls later on this page.

Use this page to apply any adjustments to service charges found on the bank account analysis statement.

Field or Control |

Description |

|---|---|

Payment Method |

Select from the following options:

|

Use PeopleSoft banking functionality to automatically import bank statement data from your financial institution to the account analysis application tables. Once the data are in the system, you can view and edit statement information on the Fee Statements - Balance Adjustment and Fee Statements - Service Adjustment pages.

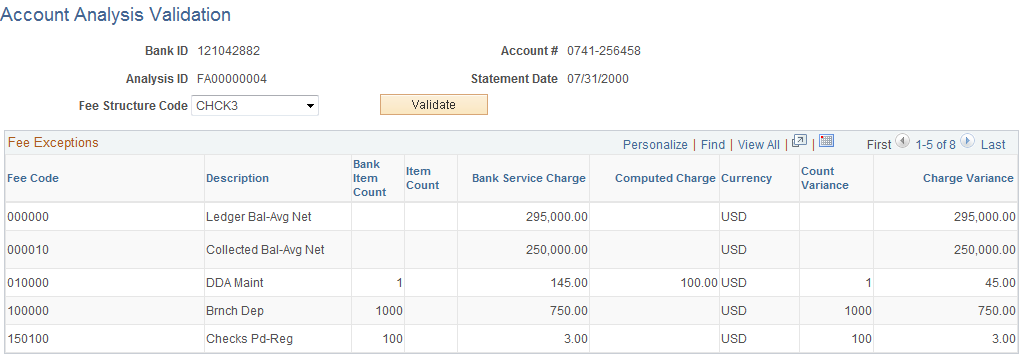

Use the Account Analysis Validation page (FA_BNK_STMT_VALID) to validate a statement against a fee structure.

Navigation:

This example illustrates the fields and controls on the Account Analysis Validation page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Fee Structure Code |

Select a fee structure code and click the Validate button. All exceptions, where the system does not match your bank statement, display in the Fee Exceptions grid. The types of exceptions appear according to column heading. The grid will indicate what type of exception was encountered and the amount of the discrepancy |

Count Variance |

Displays the difference between the Bank Item Count and your organization's Item Count. |