Setting Up Payroll Tables

To set up payroll tables, use the following components:

Companies (COMPANY_TBL)

Location (LOCATION_TBL)

Benefit Programs (BEN_DEF_PROG)

Pay Groups (PAYGROUP_TABLE)

Tax Locations (TAX_LOCATION_TBL)

State Tax Properties (STATE_TAX_TABLE)

Local Tax Properties (LOCAL_TAX_TABLE)

Workers' Comp Company Setup (FO_WC_CO_MOD)

Workers' Comp State Codes (FO_WC_STATE)

Workers' Comp State Rates (FO_WC_CO_STATE)

Workers' Comp by Job Code (FO_JOBCODE_PRD)

Use the pages described in this topic to set up the tables and processing rules that PeopleSoft Staffing Front Office will use to process information entered into the pages that make up the Applicant, Employee, and Assignment components.

This topic discusses how to:

Create or modify your payroll company.

You must define at least one company. If your PeopleSoft Staffing Front Office application integrates with PeopleSoft HCM, each employee must be associated with a company to pass payroll and human resource information to PeopleSoft Pay/Bill Management. In integrated environments, companies should be defined in HCM and synchronized with Financials through application messaging. Work with your human resources group to establish appropriate company values. The company value is global, not SetID-driven.

Note: If you have PeopleSoft Payroll for North America in addition to PeopleSoft Staffing Front Office, you only configure the tax tables in HCM.

Set up your company's benefit programs.

You must define at least one benefit program in PeopleSoft Staffing Front Office. Every employee must be associated with a benefit program in PeopleSoft Staffing Front Office to pass payroll and benefits information in PeopleSoft Pay/Bill Management. In integrated environments, benefit programs should be defined in HCM and are synchronized with Financials through application messages.

Create payroll processing groups.

You must define at least one pay group in PeopleSoft Staffing Front Office. Paygroups are set up by company, and are not driven by SetID. To enter a pay group, you must first create a company for payroll. In integrated environments, pay groups should be defined in HCM and synchronized with Financials via application messaging.

Define payroll tax locations.

You must define at least one tax location code in PeopleSoft Staffing Front Office. The values you specify are the individual taxing locations for payroll processing; payroll uses these codes. The tax location code value is global, not driven by SetID. In integrated environments, tax location codes should be defined in HCM and synchronized with Financials through application messaging.

Set up the state tax properties.

The information that appears in PeopleSoft Staffing Front Office is for reference purposes only. You should maintain the information in the application that you use for back-office transactions.

Set up for local tax properties.

Set up local withholding tax methods and rates.

Set up a locality's tax reporting requirements.

Set up a company's workers' compensation rules.

Associate a workers' compensation code with a state.

Establish rates for each of your workers' compensation codes.

Associate workers' compensation codes with job codes.

Note: If you are integrating with PeopleSoft Pay/Bill Management, these tables are set up in PeopleSoft HCM and are sent back to Financials through application messaging to be used when hiring employees and filling orders. These pages should not be accessible to users within PeopleSoft Staffing Front Office.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

COMPANY_TBL |

Define or modify your payroll company. If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging. |

|

|

LOCATION_TBL |

Define locations codes, including all address information. You must define at least one location in PeopleSoft Staffing Front Office. Location is a required field in PeopleSoft HCM. If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging. |

|

|

LOCATION_TBL2 |

Add details to a location definition. |

|

|

BEN_PROG_DEFN1 |

Define the benefit programs your organization offers. If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging. PeopleSoft HCM: Benefits Administration Building Automated Benefit Programs, Building Benefit Programs with the Benefit Program Table |

|

|

PAYGROUP_TABLE1 |

Define processing payroll groups. If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging. PeopleSoft HCM: Payroll for North America Setting Up Pay Groups, Defining Pay Groups |

|

|

TAX_LOCATION_TBL1 |

Define payroll tax locations. If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging. PeopleSoft HCM: Application FundamentalsSetting Up Payroll Tax Tables, (USA) Defining Tax Locations |

|

|

STATE_TAX_TABLE |

This setup page is used for prompts when capturing employee tax information in environments where PeopleSoft Staffing Front Office is used as a standalone application (PeopleSoft Pay/Bill Management is not installed). |

|

|

LOCAL_TAX_TABLE1 |

Define geographical area information for local taxing authorities. Use this page for prompts when capturing employee tax information in environments where PeopleSoft Staffing Front Office is used as a standalone application (PeopleSoft Pay/Bill Management is not installed). |

|

|

LOCAL_TAX_TABLE2 |

Define local withholding tax methods and rates. Use this page for prompts when capturing employee tax information in environments where PeopleSoft Staffing Front Office is used as a standalone application (PeopleSoft Pay/Bill Management is not installed). |

|

|

LOCAL_TAX_TABLE3 |

Define a locality's tax reporting requirements. Use this page for prompts when capturing employee tax information in environments where PeopleSoft Staffing Front Office is used as a standalone application (PeopleSoft Pay/Bill Management is not installed). |

|

|

FO_WC_CO_MOD |

Define the workers' compensation companies that you want to use to determine bill and pay rates in margin calculations. If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging. |

|

|

FO_WC_STATE |

Associate workers' compensation codes to states. If you populate the workers' compensation control tables, your PeopleSoft Staffing Front Office users do not need an in-depth understanding of workers' compensation regulations to create an order. If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging. |

|

|

FO_WC_CO_STATE |

Set up the applicable workers' compensation rates that your company pays in each state in which your employees work. The system uses this rate in the margin calculation to determine optimal pay and bill rates for orders and assignments. If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging. |

|

|

FO_JOBCODE_PRD |

Associate job codes with workers' compensation codes for the states in which your organization conducts business. If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging. |

See also the PeopleSoft Human Resources documentation.

Use the Company page (COMPANY_TBL) to define or modify your payroll company.

If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging.

Navigation:

After you enter an ID to define the company, select an Effective Date and enter a Description.

Use the Benefit Program page (BEN_PROG_DEFN1) to define the benefit programs your organization offers.

If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging.

Navigation:

Field or Control |

Description |

|---|---|

Status as of Effective Date |

Enter the current status of this benefit program: Active or Inactive. |

Currency Code |

Enter the default currency code for the benefit program. |

If you do not offer benefits, set up a program for no benefits. The benefit program value is global, not driven by SetID.

Use the Pay Group page (PAYGROUP_TABLE1) to define processing payroll groups.

If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging.

Navigation:

Enter the date the pay group is effective, and then enter a short and long description.

Use the Tax Location page (TAX_LOCATION_TBL1) to define payroll tax locations.

If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging.

Navigation:

Select the current Status of the tax location code (Active or Inactive) and enter a long and short description.

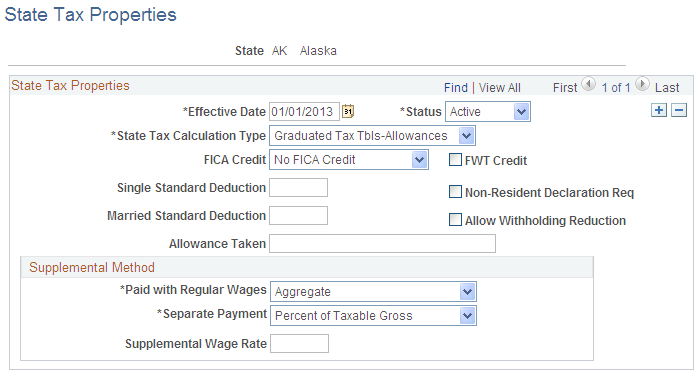

Use the State Tax Properties page (STATE_TAX_TABLE) to this setup page is used for prompts when capturing employee tax information in environments where PeopleSoft Staffing Front Office is used as a standalone application (PeopleSoft Pay/Bill Management is not installed).

Navigation:

This example illustrates the fields and controls on the State Tax Properties page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

State |

Enter the state for which you are creating or modifying information. |

State Tax Calculation Type |

Select the type of tax calculation that is required by the state:

|

FICA Credit (Federal Insurance Contributions Act credit) |

Select a value to indicate whether the state gives credit for FICA during calculation of state income tax withholding: Act. FICA, NO FICA, or Prorate. |

FWT Credit (federal withholding tax credit) |

Select this check box to indicate whether the state gives credit for FWT during calculation of state income tax withholding. |

Single Standard Deduction |

Enter the standard deduction amount for single tax filers. |

Non-Resident Declaration Req (non-resident declaration required) |

Select this check box to indicate whether the state requires a non-resident declaration for non-resident employees. |

Married Standard Deduction |

Enter the standard deduction amount for married tax filers. |

Allow Withholding Reduction |

Select this check box to indicate whether the state allows a reduction amount to be computed in the state withholding calculation. Note: Currently, this field applies to Connecticut only. |

Allowance Taken |

Enter the amount tax filers are allowed to deduct from their taxes. |

Supplemental Method

Field or Control |

Description |

|---|---|

Paid with Regular Wages and Separate Payment |

This PeopleSoft application delivers the required selection:

|

Supplemental Wage Rate |

Enter the rate at which supplemental wages should be calculated. |

See the product documentation for PeopleSoft HCM: Application Fundamentals

“Setting Up Payroll Tax Tables”, “Viewing Standard Deductions, Allowance Amounts, and Supplemental Taxes”.

Use the Local Tax Table1 page (LOCAL_TAX_TABLE1) to define geographical area information for local taxing authorities.

Use this page for prompts when capturing employee tax information in environments where PeopleSoft Staffing Front Office is used as a standalone application (PeopleSoft Pay/Bill Management is not installed).

Navigation:

Field or Control |

Description |

|---|---|

Maintenance Responsibility |

Select Customer if your organization will maintain the locality; otherwise, select PeopleSoft. |

Local Jurisdiction |

Define for the tax entity:

|

Partial Indicator (PA Only) (partial indicator [Pennsylvania only]) |

Select this check box to indicate if multiple municipalities apply to a single school district for any Pennsylvania locality. |

Locality Name |

Enter the municipality name from the register (except for school district entries, which are school district names). Combined jurisdictions end with M+SD. |

Other Locality Name |

For Pennsylvania localities, combined entries display the school district name. |

School dist code (PA only) (school district code [Pennsylvania only]) |

Enter the appropriate school district for any Pennsylvania locality. |

“Setting Up Payroll Tax Tables,” (USA) Updating Local Tax Information.

Use the Local Tax Table2 page (LOCAL_TAX_TABLE2) to define local withholding tax methods and rates.

Use this page for prompts when capturing employee tax information in environments where PeopleSoft Staffing Front Office is used as a standalone application (PeopleSoft Pay/Bill Management is not installed).

Navigation:

Local Tax Information

Field or Control |

Description |

|---|---|

Local Tax Calculation Type |

Select the calculation method used to determine the amount of local income tax withheld:

|

Withhold On Work Locality Only |

Select to have taxing authorities consider only the wages earned in that locality as taxable for resident taxes. If the employee does not work in the locality, the tax authority does not take resident taxes. |

Graduated Tax Table Code |

This option takes effect if the locality requires that the system reference tax tables during calculation, as they do for New York City, Yonkers, and Maryland counties, for example. The graduated tax table code that you enter here links the record to the appropriate entry in the PeopleSoft Federal/State Tax Table, where tax rates are stored. |

Tax Class |

Enter the appropriate tax class, such as Excise, Local ER, or Occ Priv. Tax classes identify different taxes that share certain characteristics. |

Low Gross |

Enter the minimum taxable gross for the bracket. |

Minimum Tax |

If a particular type of tax has a minimum limit, enter that amount. |

Maximum Tax |

If a particular type of tax has a maximum limit, enter that amount. |

Annual Exemption |

If the tax has an annual exemption, enter the amount. |

Tax Rates

Field or Control |

Description |

|---|---|

Resident |

Enter the tax rate for residents of the locality. |

Nonresident |

Enter the tax rate for non-residents of the locality. |

See the product documentation for PeopleSoft HCM: Application Fundamentals

“Setting Up Payroll Tax Tables,” (USA) Updating Local Tax Information.

Use the Local Tax Table3 page (LOCAL_TAX_TABLE3) to define a locality's tax reporting requirements.

Use this page for prompts when capturing employee tax information in environments where PeopleSoft Staffing Front Office is used as a standalone application (PeopleSoft Pay/Bill Management is not installed).

Navigation:

Tax Reporting

Field or Control |

Description |

|---|---|

Locality Short Name |

Enter a name for the locality. |

Tax Reporting |

Select the interval required by the locality for tax reporting: Annual, Monthly, or Quarterly. |

W2 Print Name |

Enter the name that you want to print on the W2 form. |

W2 Mag Media Code (W2 magnetic media code) |

Enter the magnetic media code for the W2s you will be printing. |

Employee Detail Required |

Select this check box to require employee detail. |

See the product documentation for PeopleSoft HCM: Application Fundamentals

“Setting Up Payroll Tax Tables,” (USA) Updating Local Tax Information.

Use the Workers' Comp Company Setup (Workers' Compensation Company Setup) page (FO_WC_CO_MOD) to define the workers' compensation companies that you want to use to determine bill and pay rates in margin calculations.

If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging.

Navigation:

Field or Control |

Description |

|---|---|

Status |

Select the status of the workers' compensation company. |

Company Modifier |

Enter the number by which you want to multiply workers compensation rates for employees hired in this company. |

Use the Workers' Comp State Codes (Workers' Compensation State Codes) page (FO_WC_STATE) to associate workers' compensation codes to states.

If you populate the workers' compensation control tables, your PeopleSoft Staffing Front Office users do not need an in-depth understanding of workers' compensation regulations to create an order. If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging.

Navigation:

Enter the Workers' Comp Code that you want to associate with the state, and then enter a long and short description.

Note: Oracle recommends you have a workers' compensation specialist set up the information in this table.

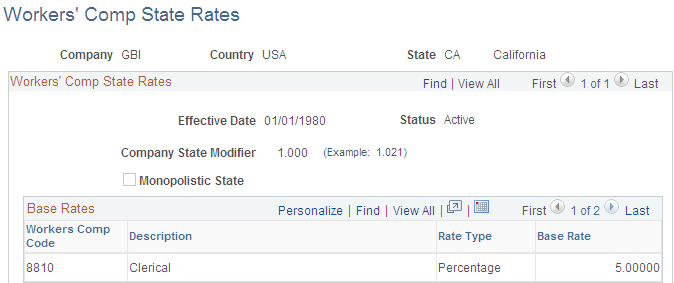

Use the Workers' Comp State Rates (Workers' Compensation State Rates) page (FO_WC_CO_STATE) to set up the applicable workers' compensation rates that your company pays in each state in which your employees work.

The system uses this rate in the margin calculation to determine optimal pay and bill rates for orders and assignments. If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging.

Navigation:

This example illustrates the fields and controls on the Workers' Comp State Rates page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Status |

Select either Active or Inactive. |

Company State Modifier |

If you have a company factor to be applied to premiums in this state, enter the value here. This value overrides the company modifier. |

Monopolistic State |

Select this check box to override the modifier with a value of 1. This selection results in the modifier having no effect on the workers' compensation calculation. |

Note: Viewing the Workers' Comp Rates page is dependent upon setting up values in the Workers' Comp Company Setup and Workers' Comp State Code pages.

Base Rates

Field or Control |

Description |

|---|---|

Workers Comp Code |

Select the workers' compensation code that you want associated with the chosen Company, Country, and State. |

Rate Type |

Select either Per Hour or Percentage. |

Base Rate |

Enter a percentage or the hourly rate to represent the workers' compensation rate you pay in the state. |

Use the Workers' Comp by Job Code (Workers' Compensation by Job Code) page (FO_JOBCODE_PRD) to associate job codes with workers' compensation codes for the states in which your organization conducts business.

If you have PeopleSoft Staffing Front Office and PeopleSoft Pay/Bill Management installed, configure this table in HCM and synchronize it with Financials through application messaging.

Navigation:

This example illustrates the fields and controls on the Workers' Comp by Job Code page. You can find definitions for the fields and controls later on this page.

Enter the Country, State, and Workers Comp Code that you want to associate with the Job Code.