Setting Up Locations

Use the following components to set up locations:

Country (COUNTRY_TABLE)

State (STATE_DEFN)

Location (LOCATION_TBL)

Country Statistics (COUNTRY_STAT)

Use the LOCATION_TBL_CI component interface to load data into the tables for these components.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

COUNTRY_DEFN |

Add or review country descriptions. |

|

|

ADDR_FORMAT_TABLE |

Select address fields for a country so that the system displays addresses in the appropriate format. |

|

|

STATE_DEFN |

Add or review a state or province code. |

|

|

LOCATION_TBL |

Define a location code, such as a branch office or shipping office. |

|

|

LOCATION_TBL2 |

Add details to a location definition. |

|

|

COUNTRY_STAT_PNL |

Enter country codes requiring reporting as well as reporting options for each country code that you specify. |

Use the Country Description page (COUNTRY_DEFN) to add or review country descriptions.

Navigation:

Field or Control |

Description |

|---|---|

2-Char Country Code (2-character country code) |

Enter a two-character country code to meet value added tax (VAT) requirements. The system appends the 2-character country code to the VAT registration ID, which is a 20-character number to meet VAT requirements. |

EU Member State (European Union member state) |

Select if the country is a member of the European Union. You must select this option to include a country in prompts for Intrastat reporting. |

Use the Address Format page (ADDR_FORMAT_TABLE) to select address fields for a country so that the system displays addresses in the appropriate format.

Navigation:

Field or Control |

Description |

|---|---|

Available |

Select to make the field available everywhere in the system. |

Label |

Enter the name of the field as it is to appear on the page. For example, change the value in the State field to Province or Department. |

Address 1, Address 2, Address 3, and Address 4 |

Select the address fields normally used by the country that you selected. |

Postal Search |

Select if you want the Postal Search link to appear on the Location Definition page. This link enables the user to find a postal delivery code. |

Number 1, Number 2, House Type, Field 1 Label, Field 2 Label, and Field 3 Label |

If you select these fields, they replace the Address 4 field on pages. |

Use the Location - State page (STATE_DEFN) to add or review a state or province code.

Navigation:

Field or Control |

Description |

|---|---|

Numeric Code |

Use to assign a number to a state or province for statistics and reports. |

State |

Enter a state abbreviation. |

Country |

Select a country. |

Description |

Enter a description for the state or locality. |

Use the Location Definition page (LOCATION_TBL) to define a location code, such as a branch office or shipping office.

Navigation:

This example illustrates the fields and controls on the Location Definition page. You can find definitions for the fields and controls later on this page.

Enter a description and populate the fields for the telephone and address information.

The address fields that appear are defined on the Address Format page.

Field or Control |

Description |

|---|---|

In City Limit |

Select if you use a third-party tax provider product and if you need to access additional city tax information. Note: The In City Limit is not used by the Vertex O Series tax solution. |

Alternate Character Set |

Click to access a page where you can enter or display (or both) field values in an alternate character set. This button appears only if you selected the Alternate Character check box on the User Preferences - Overall Preferences page. |

Address 2 and Address 3 |

If not used at this location, you can enter values in these fields to provide more information about the location, such as Printing Division or Western Annex. |

Address 4 |

The space available to display addresses on a page is limited. The Address 4 field will not appear if you select some of the optional address fields on the Address Format page, such as Number 1 or House Type. |

GeoCode |

This value is used by third-party tax applications to link a location definition to their tax calculation algorithms. If no geocode has been selected, this field displays a Lookup link. Clicking the geocode value or Lookup link accesses the Tax GeoCode Selection page, where you select a geocode value for the location definition. You must select a geocode for each location definition in order to integrate properly with your third-party tax application. Error messages that appear for this field are issued by the third-party application, and more information is provided in the third-party application documentation. |

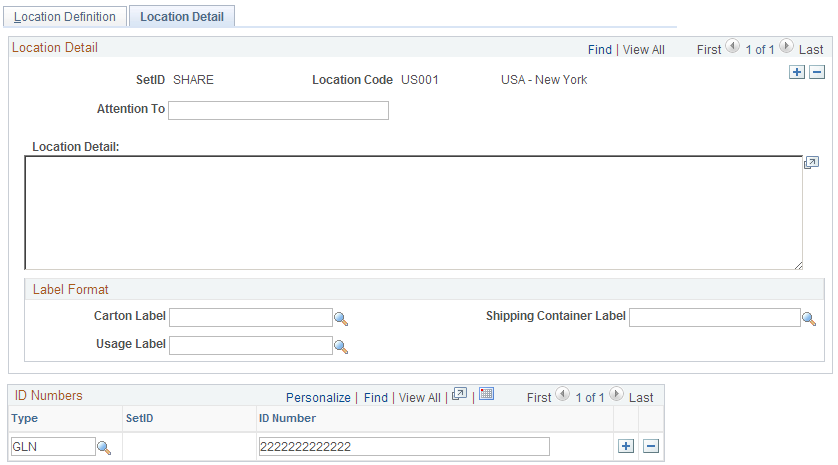

Use the Location Detail page (LOCATION_TBL2) to add details to a location definition.

Navigation:

This example illustrates the fields and controls on the Location Detail page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Attention To |

Enter the name that appears in the attention area of correspondence for this location. |

Location Detail |

Enter additional information that you want to maintain for this location. |

Carton Label |

Select the default format for printing carton labels for this location. |

Shipping Container Label |

Select the default format for printing shipping container labels for this location. |

Usage Label |

Select the default format for printing item usage labels for this location. |

ID Numbers |

Use this section to specify any additional types of identifiers for the location. The system supports a list of number types, such as GLN (a 13-digit numeric value) or DUNS number. Except for GLNs, other ID numbers entered here are not validated at save. The SetID field is not available for edit for all ID types. For each location specified in the system, you can only enter one ID number for any given type. |

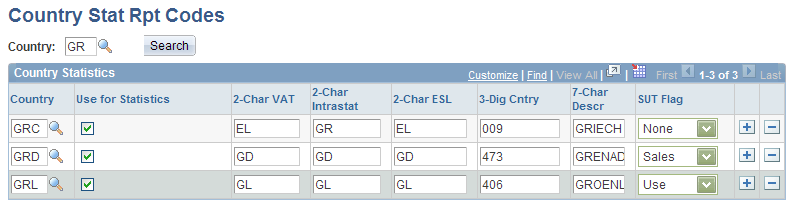

Use the Country Stat Rpt Codes (country statistics report codes) page (COUNTRY_STAT_PNL) to enter country codes requiring reporting as well as reporting options for each country code that you specify.

Navigation:

This example illustrates the fields and controls on the Country Stat Rpt Codes. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Use for Statistics |

If you select this check box, the country recognized by the International Standards Organization (ISO) is also recognized by the European statistical offices as a country. If Use for Statistics is not selected, the country is recognized by the ISO but not by the European statistical offices. If this is the case, the European statistical offices assume that the country is a part of another country for the purposes of producing statistical data such as the GNP. For example, for ISO, the Principality of Monaco has its own country code, while for statistical purposes, Monaco is assumed to be part of France, and therefore has the same statistical country code as France. |

2-Char VAT (two character value added tax) |

Enter a 2-character country code to meet special value added tax (VAT) requirements for certain countries. This is useful for some countries that are not using the ISO 3166 country code in conjunction with their VAT registration ID. When appending the 2-character country code to the VAT registration ID, Financials accesses this separate country code. The VAT registration ID is a 20-character number to meet VAT requirements. |

2-Char Intrastat (two character intrastat) |

Displays the country identifier for the European statistical offices. This code is printed on some of the Intrastat Layout forms. |

2-Char ESL (two-character European Sales List) |

Used for countries that are members of the European Union. This code is usually printed as part of the VAT Registration Information on the European Sales List (ESL). |

3-Dig Cntry (three-digit country) |

Used as a country identifier for the European statistical offices, the code is usually printed on the Intrastat report to identify source or destination countries to or from which goods are shipped. |

7-Char Descr (seven-character description) |

Used for the German international EFT layout to identify countries into or from which electronic funds are sent or received. |

SUT Flag (sales and use tax flag) |

Informational only. |