Setting Up Control Budget Definitions

To set up control budget definitions, use the Budget Definitions (KK_BUDGET) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

KK_BUDG1 |

Define the budget's general parameters, including control ChartField, parents and children, associated budget definition, control options, Ruleset ChartField, and status. |

|

|

KK_BUDG7 |

Define the Ruleset ChartField values for each ruleset. |

|

|

KK_BUDG3 |

Specify the ChartFields and calendar to use to identify budgets for each ruleset. |

|

|

KK_BUDG8 |

Use with a Prior Year Adjustment ChartField that you defined on the Control Budget Options page to include both expired and unexpired adjustments. |

|

|

KK_BUDG9 |

Use to set budget status by budget periods. For a particular budget period you can open, have closed, put on hold, or change the status of a budget to a higher level by default. |

|

|

KK_BUDG4 |

Override and define budget options and attributes for particular control ChartField values. |

|

|

KK_BUDG5 |

Set up offset accounts for balancing source transaction and budget entries. This page is available only if the Entries Must Balance check box is selected on the Control Budget Options page. |

|

|

KK_BUDG6 |

Specify the account types and account value ranges to exclude from processing for this control budget definition. |

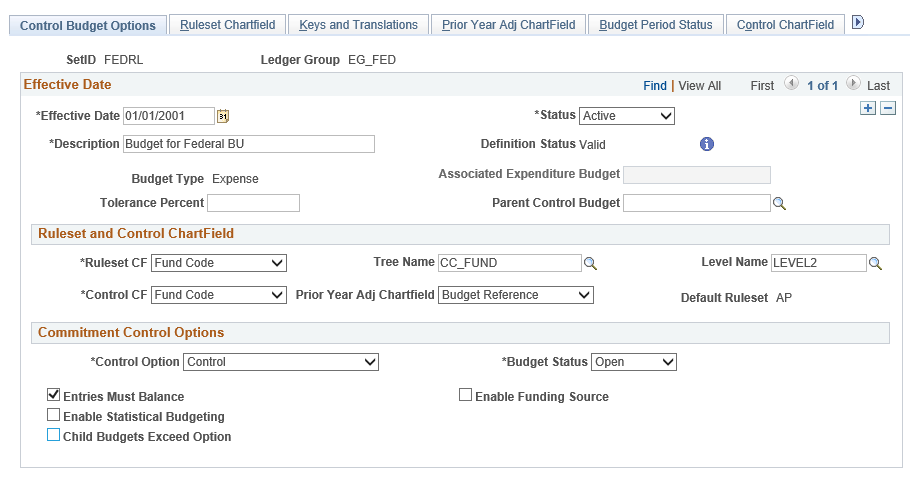

Use the Control Budget Options page (KK_BUDG1) to define the budget's general parameters, including control ChartField, parents and children, associated budget definition, control options, Ruleset ChartField, and status.

Navigation:

This example illustrates the fields and controls on the Control Budget Options page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Definition Status |

Displays the Definition status:

|

Budget Type |

Values are Revenue and Expense. The budget type is inherited from the ledger group definition. |

Associated Expenditure Budget |

For a revenue ledger group, select the expenditure ledger group whose limits are to be increased by revenue budgets in this budget definition (optional). You specify associated revenue and expenditure budgets on the Associated Budgets page. |

Tolerance Percent |

The percentage variance over budget allowed before the system creates an exception. You can override this value at lower definition levels. Note: Negative tolerances are not supported. |

Parent Control Budget |

If this budget definition is a child in a hierarchy of budget definitions, select its parent budget definition here. This establishes the connection between the two budget definitions, enabling the system to enforce the relationship. When you press Tab to exit this field, the system populates the budget definition with the parent's processing rules. Parents and children must share the same control, ruleset, and key ChartFields, although the children can have additional key ChartFields. Parents and children must use the same budget translation trees for the ChartFields that they share, with the parent budget's ChartField values on an equal or higher level than the child's. This ensures that each child budget is translated to its parent budget. |

Ruleset and Control ChartFields

Field or Control |

Description |

|---|---|

Ruleset CF |

Select the Ruleset ChartField and, optionally, the names of the tree and level where the Budget Processor should look for the ChartField values that are valid for the ruleset. For expenditure budget definitions with funding source control, the Ruleset ChartField must be the same as the Control ChartField. |

Control CF |

Enter the key ChartField that the Budget Processor uses to determine whether to enforce budget checking. |

Prior Year Adj Chartfield |

Use this field and the associated functionality to control and categorize processing against expired and unexpired upward and downward adjustments. Select a ChartField, typically Budget Reference, the value of which is used when you establish begin dates, expiration dates, and end dates for a budget using the Prior Year Adjustment Chartfield page that is located within this same component. The value selected can then be used to categorize a budget as open, unexpired, expired, or closed. All ChartFields supported in Commitment Control as budget keys are available. Note: Use this field in conjunction with Entry Event functionality to automatically generate budgetary entries for upward and downward adjustments of obligations against expired and unexpired budgets as required by United States Federal Government accounting. See Processing Transactions Against Budgets with Different Funding States. See Using Entry Event Codes for Upward and Downward Adjustments in Unexpired and Expired Funding. |

Default Ruleset |

The default Ruleset for any Ruleset ChartField values that you do not specify on the Ruleset ChartField page. You specify the default ruleset on the Ruleset ChartField page. |

Commitment Control Options

Field or Control |

Description |

|---|---|

Enable Statistical Budgeting |

Select to enable budget checking of non monetary statistical amounts to facilitate financial analysis and reporting. |

Entries Must Balance |

Select to have the system generate offset entries for every budget journal or transaction that it processes. The system uses the offset accounts specified on the Offsets page and balances by budget period and the balancing ChartFields that you selected when you established the Commitment Control ledger group. Deselect to make the system post budget entries as entered, with single-sided transaction entries posting when budget ledgers are updated. Note: Balancing, or offset, lines are not created on the budget journals, but are created during the posting process and are stored in the commitment control activity log. |

Child Budgets Exceed Option |

Select the check box to let the sum of child budgets exceed the parent budget limit when you enter budget journals. This option has no effect on budget checking of source transactions. Note: If you do not select the Child Budget Exceeds option, the system performs a validation each time you post a budget journal to ensure that the total across all child budget amounts in the child budget ledger does not exceed the parent budget amount. However, if more than one child definition is associated with a parent budget definition, the system does not add child budget amounts across child budget definitions to arrive at a total child budget amount to validate against the parent budget. Rather, the system views each child budget definition as the "same money" in "different slices," and it only validates the child budget amounts within the child budget definition for the budget journal. . Therefore, if you have more than one child budget definition associated with a parent budget definition, and those child budget definitions do not represent the "same money," your child budgets can exceed your parent budget even if you do not select the Child Budget Exceeds option. |

Field or Control |

Description |

|---|---|

Control Option |

Select the degree of budgetary control that you want for this budget definition. You can override this value at lower levels. |

SeeCommon Elements.

Field or Control |

Description |

|---|---|

Budget Status |

You can override this value at lower levels. |

Field or Control |

Description |

|---|---|

Funding Source Control |

If you decide to set up an expenditure budget definition with funding source tracking, select this option and, in the Revenue Track field, enter the revenue ledger group that tracks the funding source amounts. (You must have already established the revenue ledger group.) The related revenue budget definition is created automatically when you save the budget definition, with the same parameters as the expenditure budget definition, except for the following parameters:

Note: If you make subsequent changes to the budget definitions, they must be made manually. |

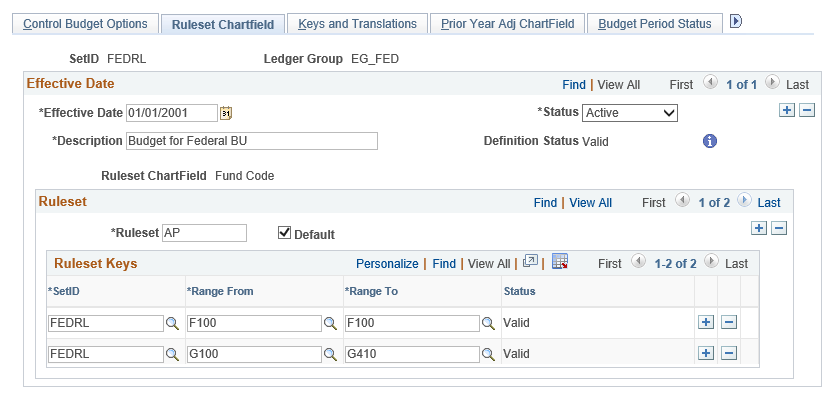

Use the Ruleset Chartfield page (KK_BUDG7) to define the Ruleset ChartField values for each ruleset.

Navigation:

This example illustrates the fields and controls on the Ruleset ChartField page. You can find definitions for the fields and controls later on this page.

Ruleset

Enter the ruleset name. Select Default for the ruleset to be used as the default for any Ruleset ChartField values that you do not specify on this page. If you only require one ruleset for your budget definition, you do not need to enter any values on this page.

Note: The Budget Processor also uses the default ruleset when budget checking a source transaction that has no value for the Ruleset ChartField. If Value Required is selected on the Keys and Translations page for the Ruleset ChartField, the Budget Processor issues a Key ChartField is Blank exception.

Ruleset Keys

Enter the SetID for each range of Ruleset ChartField values to which the Ruleset applies.

Note: The system performs validations that prevent you from including the same Ruleset ChartField value in more than one Ruleset.

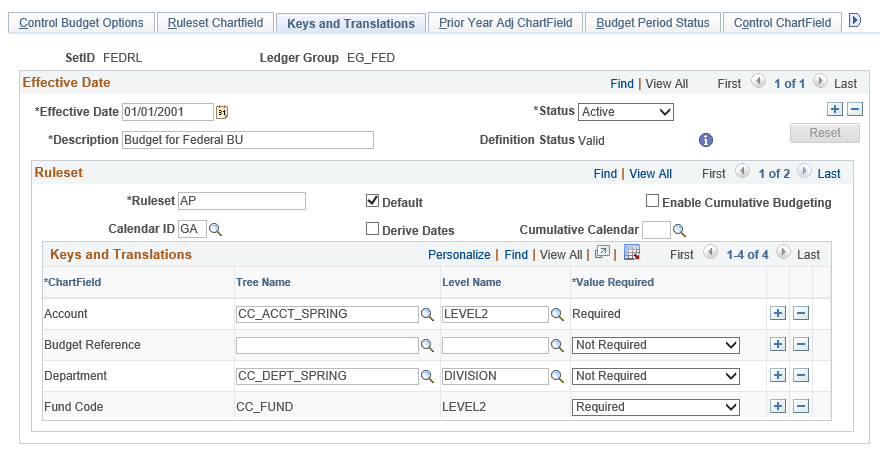

Use the Keys and Translations page (KK_BUDG3) to specify the ChartFields and calendar to use to identify budgets for each ruleset.

Navigation:

This example illustrates the fields and controls on the Keys and Translations page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Reset |

When you click the Reset button, all existing budget key and translation, ruleset, and control ChartField data is overridden on the child budget definition and replaced with data from the specified parent budget definition. If you have changed a parent since you established the parent and child relationship, you must update its children. Also, click Reset if you changed the child but want to set it back to the definition values of the parent. |

Ruleset

Field or Control |

Description |

|---|---|

Ruleset |

The rulesets that you entered on the Ruleset Chartfield page appear. |

Calendar ID |

Select the primary budget period calendar to specify the budget periods that are valid for the ruleset. If you do not specify a calendar ID for the ruleset, the entire budget is viewed as a single period. Whether or not you select a calendar ID, you can restrict valid dates for transactions to affect the budget. You set these restrictions on the Control ChartField page. Note: Do not select a calendar ID for budget definitions with funding source tracking. You can set budget begin and end dates for control ChartField values on the Control ChartField page. |

Enable Cumulative Budgeting |

Select to allow spending against the available balances in a defined range of budget periods when a transaction would otherwise exceed the balance in the current period. To make the Budget Processor obtain the range of budget periods that are available for cumulative budget checking, select Derive Dates and enter a cumulative calendar ID in the Cumulative Calendar field. A cumulative calendar is a budget period calendar that logically summarizes multiple budget periods in the Ruleset budget period calendar into single, larger periods. A calendar that is defined with annual budget periods, for example, can act as a cumulative calendar for a calendar that is defined with quarterly periods. When a source transaction is presented for budget checking, the Budget Processor:

|

Derive Dates and Cumulative Calendar |

If you select the Derive Dates check box, you must select a cumulative calendar. This option is available at three levels: Subtype, Control ChartField, and Budget Attributes. If you deselect the Derive Dates check box at any of the three levels, you must enter a cumulative date range for each affected budget combination. The dates are specified in the budget attributes either directly or budget journal entry. |

Keys and Translations

Field or Control |

Description |

|---|---|

ChartField |

Add a row for each key ChartField for the ruleset. If you do not intend to translate budget keys, clear the rest of the fields in the grid. You can limit the ChartField values that are valid for budgeting on the Control ChartField page and the Excluded Account Types page. Note: When funding source is enabled, only one key ChartField can be specified. It is typically project, but it can be any ChartField. For project expenditure budget definitions with funding source tracking enabled, the single ruleset key ChartField is Project ID—the same as the Ruleset ChartField and the Control ChartField. Project revenue budget definitions for funding source tracking can include one additional key ChartField besides the Project ID. |

Tree Name and Level Name |

If you use trees to translate transaction-level ChartField values to higher-level budget ChartField values, enter the tree name and level name of the budget ChartField values for each ChartField. If you specify a tree and level, then valid values for budgeting include all the tree nodes that are at or above the specified level (or rather, the indicated level and all higher levels). Valid values for source transactions at levels below the tree level that you specify roll up to the specified level for budget checking. |

Value Required |

The Account ChartField becomes Required by default and cannot be changed. Because all transactions require Account, the Account ChartField cannot be Optional or Not Required. Select one of these options for the other ChartFields:

By selecting Required for a key ChartField, you require the ChartField on all source transactions processed against control budgets. Any transactions that do not carry the required ChartField receive budget errors. If the Not Required option is selected and no value exists for the ChartField on a transaction, the transaction bypasses budget checking against the budget definition. If Optional is selected, the transaction line will pass the budget definition if the source transaction line has values for all required ChartFields, but has blanks or values for one or more ChartFields in the definition. Important! Select Required only for ChartFields that are common to all Commitment Control ledger groups. For example, you have an appropriation ledger group, an organization ledger group, and a project ledger group. Also assume that the project ledger group is defined with Project ID as the control ChartField, Ruleset ChartField, and key ChartField. Also assume that most source transactions that you budget check do not include Project ID. If you require values for Project ID, then the Budget Processor returns exceptions for source transactions that pass budget checking for the appropriation and organization budgets, because they fail the project budgets. If you do not require values for Project ID, but make Project ID optional, then source transactions that do not include Project ID bypass the project budgets—as they should—and pass budget checking for the remaining budget ledgers. |

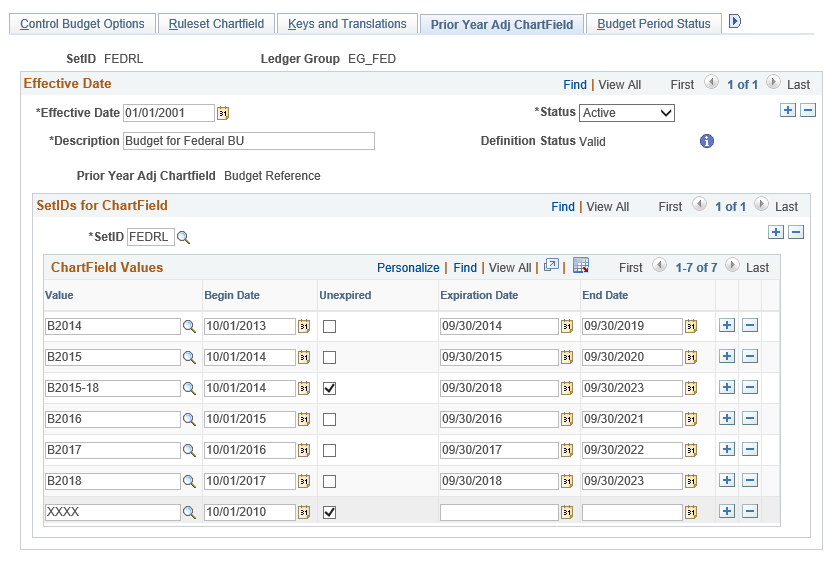

Use the Prior Year Adjustment ChartField page (KK_BUDG8) to use a Prior Year Adjustment ChartField that you defined on the Control Budget Options page to include both expired and unexpired adjustments.

Navigation:

This example illustrates the fields and controls on the Prior Year Adj ChartField page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Prior Year Adjustment ChartField |

Displays the Prior Year Adjustment ChartField value that you define on the Control Budget Options page within the budget definition. |

SetID |

Select a SetID to uniquely identify the set of ChartField values and dates that you enter here. |

Value |

Enter a value or multiple values that identify a valid budget year or years for United States Federal Government budgets. For a five-year budget or appropriation, the value might be BY2002-2006. |

Begin Date |

Enter the first date that a budget is available for obligation. For example, for a United States Government budget, the begin date for BY2002-2006 is October 1, 2001. |

Unexpired |

Select check box to indicate that the ChartField value is subject to unexpired upward and downward adjustments. |

Expiration Date |

Enter the last date that funds are available for obligation for this budget. For example, the five-year appropriation budget reference BY2002-2006 has the expiration date of September 30, 2006. The budget processor uses this date to categorize a budget as expired. When a budget is categorized as expired, transactions from Purchasing and Payables that affect the expired budget can optionally have their entries generated to appropriate United States standard general ledger (US SGL) budgetary accounts for expired budgets by the Entry Events generator. |

End Date |

Enter the last date that payments can be processed against the budget. The budget is in effect closed on this date and the system does not allow processing against the budget. For example, for a United States Federal Government budget, assume that the end date is five years after the expiration date. Then, for a single year appropriation BY2002, the end date is September 30, 2007. For BY2002-2006 the end date is September 30, 2011. Both budgets would be closed on their respective end dates. The United States Federal requirement is that payments for closed budgets can be processed against the current budget, but payments cannot exceed one percent of budget. The 1 percent that is set aside of current-year budget for prior-year obligations is handled by manually creating a separate budget in the current year for the amount. Invoices that are received after the budget is closed would be recorded against the 1 percent budget in the current year. See Using Entry Event Codes for Upward and Downward Adjustments in Unexpired and Expired Funding. See Processing Transactions Against Budgets with Different Funding States. |

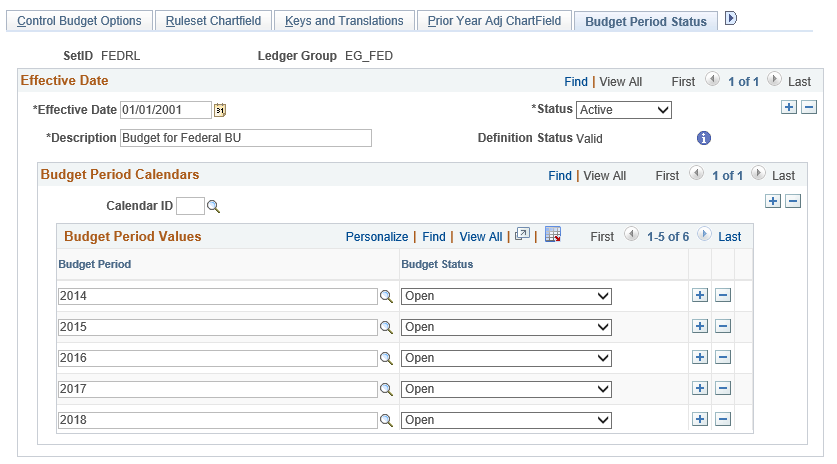

Use the Budget Period Status page (KK_BUDG9) to use to set budget status by budget periods.

For a particular budget period you can open, have closed, put on hold, or change the status of a budget to a higher level by default.

Navigation:

This example illustrates the fields and controls on the Budget Period Status page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Calendar ID |

Select the budget period calendar encompassing the budget periods for which you are setting a manual budget status. |

Budget Period |

Select budget periods within the calendar ID for which you are changing the status. |

Budget Status |

You can set the budget status manually on the Budget Definitions - Control Options page, the Budget Definitions - Budget Period Status page, the Budget Definitions - Control ChartField page, or the Budget Attributes page. Status that is set on the Budget Period Status page is second in the hierarchy to that set on the Control Options page. It can be overridden at lower levels. Use this option to set the status for one or more budget periods within a budget calendar. Possible values are:

|

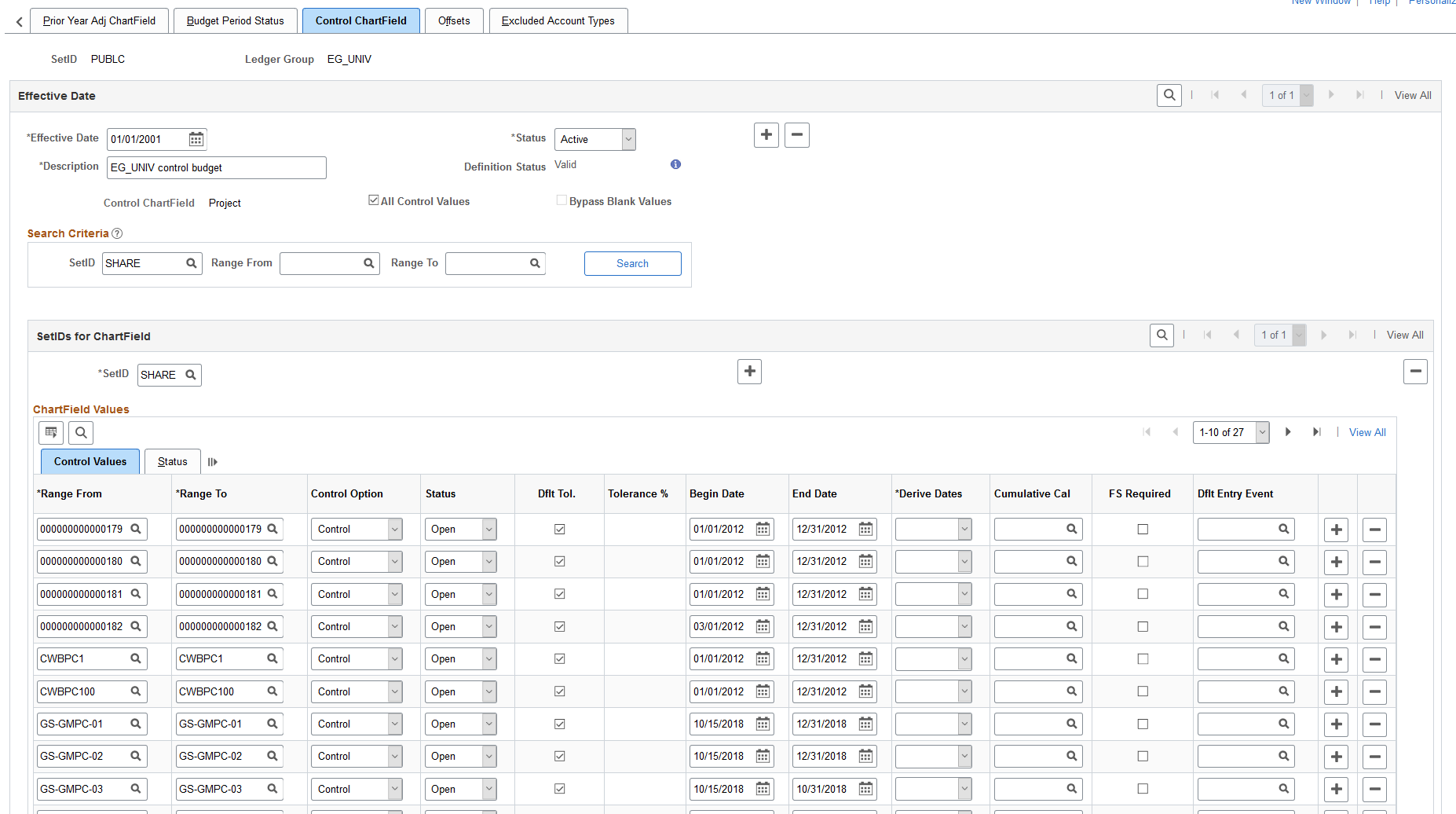

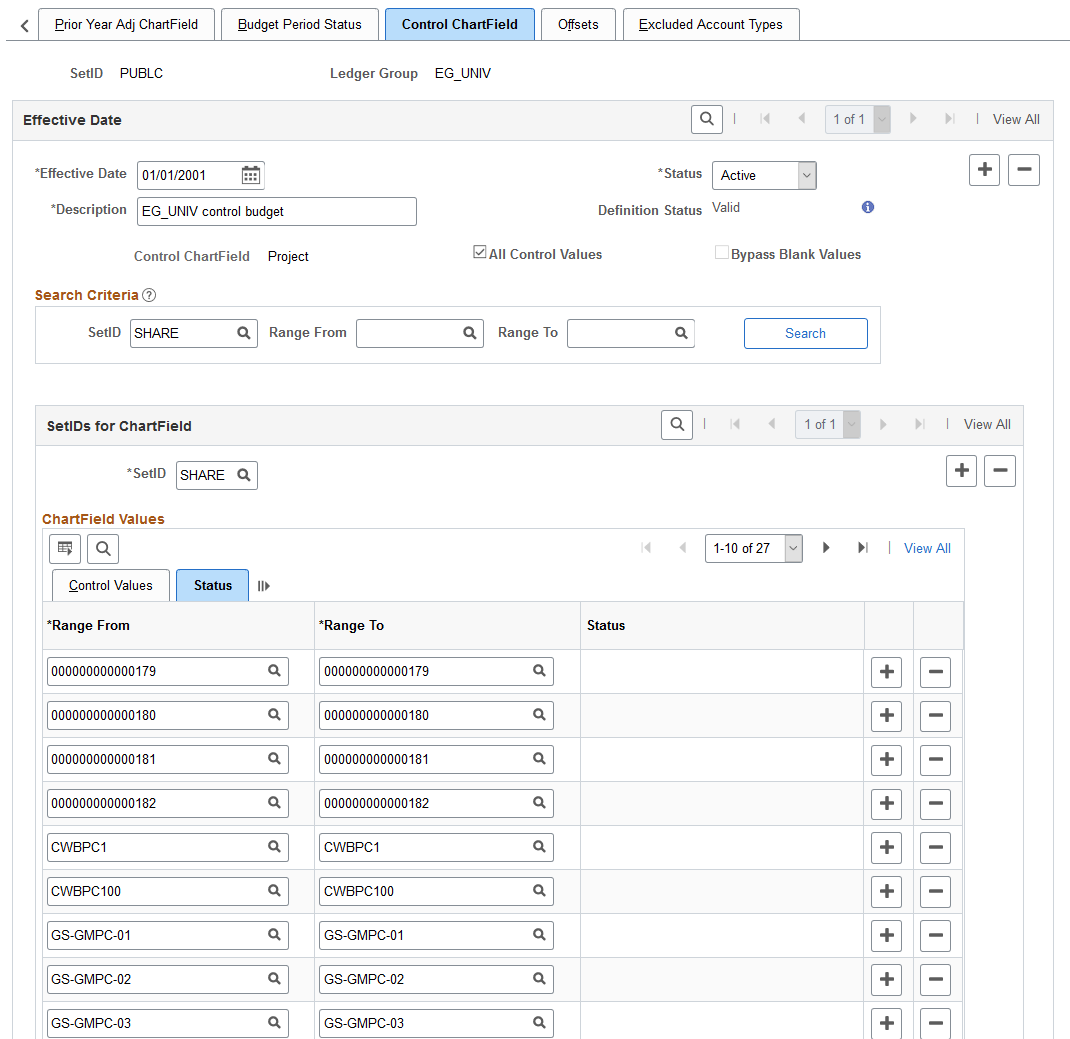

Use the Control ChartField page (KK_BUDG4) to override and define budget options and attributes for particular control ChartField values.

Navigation:

This example illustrates the fields and controls on the Control ChartField page. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Control ChartField — status page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

All Control Values |

Select to enable all ChartField values for the control ChartField at or above the tree level that you entered on the Keys and Translations page for budgeting. If you want to enable only certain control ChartField values for budget-checking purposes, deselect the All Control Values check box and specify your control ChartField values in the ChartField Values grid on this page. |

Bypass Blank Values |

This option is only available when the All Control Values check box is not enabled and the budget definition includes a controlled value range. When the All Control Values check box is enabled, the Budget Processor includes all control ChartField values, including blanks. When you select the Bypass Blank Values check box, the Budget Processor ignores transaction lines with blank control ChartField values. When this check box is deselected, the Budget Processor includes transaction lines with blank control ChartField values, even if the budget definition includes control ChartField ranges and the All Control Values option is not enabled. |

Search Criteria

Use this section to search for ChartField control values. Refine your search results using the SetID and Range From/To fields. Leave all values empty to return all ChartField control values. Results are displayed in the ChartField Values section.

Note: Oracle-PeopleSoft recommends that you review all existing ChartField Control values before adding new ones.

ChartField Values

Enter ChartField values both to specify values for budget checking (if you deselected the All Control Values check box), and to override the default tolerance, status, or other attributes for a specific ChartField value, whether or not you selected All Control Values.

The options that you select here override the defaults that you defined on the Control Budget Options page. You can, in turn, override these for specific business unit or budget combinations in the Budget Attributes component.

Field or Control |

Description |

|---|---|

Range From and Range To |

Enter a range of ChartField values that share control options. To enter one value, repeat it in both fields. |

Control Option |

The control options are described in the common elements topic. |

Status |

Budget status:

See the section Common Elements |

Dflt Tol. (default tolerance) |

Select to apply the over-budget tolerance percentage from the Control Budget Options page to this row. |

Begin Date and End Date |

Enter values for either or both of these dates to restrict budget journal entries to budget periods that are at least partially within these dates. This also restricts source transactions to those whose budget dates fall within these dates. For example, assume that the budget date is equal to the accounting date, and the budget calendar is composed of 12 monthly budget periods, beginning with January. If the begin date is February 15, 2000, and no end date is specified, budget journal entries for budget periods 2 and 3 are postable, but those for period 1 are invalid. A purchase order with an accounting date of February 14, 2000 fails, but a purchase order with an accounting date of February 16, 2000 passes, assuming that funds are available. The End Date field affects transactions similarly. Note: You can also use these fields to restrict time periods for budget definitions without assigned budget period calendars, such as those with funding source tracking. |

Derive Dates |

Described in the common elements topic. |

Cumulative Cal (cumulative calendar) |

Described in the common elements topic. |

FS Required (funding source required) |

This option is applicable only to budget definitions that have funding source control enabled on the Control Budget Options page. Deselect to disable funding source control for the row. Note: You must enable funding source control on the Control Budget Options page and select this check box for specific control ChartField values before you can allocate funding sources to the values using the Funding Source Allocation page. |

Dflt Entry Event (default entry event) |

Select an entry event to support processing for generated parent budgets when applicable. The field is applicable only when entry events have been enabled at the installation level. This field is used by the budget posting process to populate the entry event for the system-generated parent budget when the use default entry event option has been selected and the entry event is either optional or required by the parent budget definition. See Generate Parent Budgets, Budget Adjustments, and Budget Transfers Automatically. See Generating Parent Budgets, Budget Adjustments and Budget Transfers Automatically. |

Status

Field or Control |

Description |

|---|---|

Status (Line status) |

Displays the budget status:

|

Use the Offsets page (KK_BUDG5) to set up offset accounts for balancing source transaction and budget entries.

This page is available only if the Entries Must Balance check box is selected on the Control Budget Options page.

Navigation:

This example illustrates the fields and controls on the Offsets page. You can find definitions for the fields and controls later on this page.

If you selected Entries Must Balance on the Control Budget Options page, you must enter a default account value for at least one SetID in the Budget Entry Offsets grid. You must also enter a source transaction offset account for each source transaction type that affects this budget definition.

You can enter a source transaction offset row with a blank source transaction type value. This can serve as a default. When the budget processor runs, it looks for a specific entry for the source transaction type that is being processed. If a row is not found, it looks for a blank row and if it finds a blank row, it uses the specified offset account to create the balancing line or lines.

Note: Balancing, or offset, lines are not created on the budget journals but are created during the posting process and are stored in the commitment control activity log.

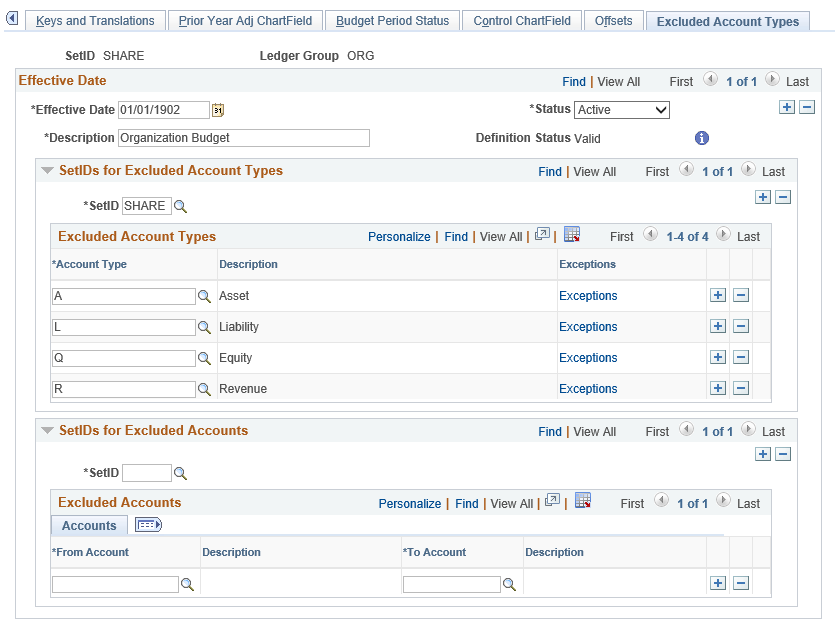

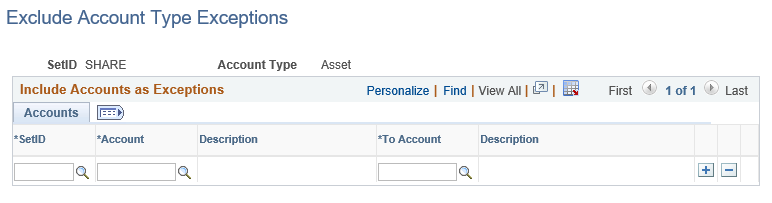

Use the Excluded Account Types page (KK_BUDG6) to specify the account types and account value ranges to exclude from processing for this control budget definition.

Navigation:

This example illustrates the fields and controls on the Excluded Account Types page. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Excluded Account Types Exceptions. You can find definitions for the fields and controls later on this page.

Note: For a particular SetID and account type, you can specify ranges of accounts to be included in budget checking.

SetIDs for Excluded Account Types

Field or Control |

Description |

|---|---|

SetID |

Select a SetID for which you want to exclude all accounts for an account type for budget processing. |

Excluded Account Types |

Select the account types that you want to exclude from budget processing against this Commitment Control ledger group. |

Exceptions |

Click this link to access the Exclude Account Type Exceptions page where you can include ranges of account values that would otherwise be excluded from budget checking. |

SetIDs for Excluded Accounts

Field or Control |

Description |

|---|---|

SetID |

Select a SetID for which you want to exclude just some accounts from among the included account types from budget processing. |

Excluded Accounts |

Specify the ranges of account values for a particular SetID in the From Account and To Account fields that are to be excluded from budget checking. |

Example of Excluded Account and Types

For an expenditure budget definition, you exclude all asset, liability, and equity accounts from budget checking by selecting them in the Excluded Account Types grid. If you also want to exclude inventory transactions from budget checking, you enter your inventory expensed accounts in the Excluded Accounts grid.