Processing Reconciliation Errors and Exceptions

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TR_AE_RUNCNTL |

Route exceptions to a user's worklist. Define the run parameters for the Reconciliation Exceptions process. |

|

|

BNK_RCN_CYC_STSA |

Determine whether a bank statement has reconciliation errors. Run the Auto Recon Errors report (FSX3002 [BI Publisher]). Use this report to view a list of all reconciliation errors for a bank statement. Run the Auto Recon Exceptions report (FSX3001 [BI Publisher]). Use this report to view a list of all transactions with exceptions for a bank statement. |

|

|

BNK_RCN_VUE_UNR |

Click to force automatic-reconciliation exceptions to reconcile. You can also create external transactions for bank-side transactions with no corresponding system-side transactions. |

|

|

Semi Manual Reconciliation Page |

BNK_RCN_SEMI_MAN |

Resolve exceptions using semi-manual reconciliation. Select a transaction on the bank side to match a transaction on the system side. See the Semi Manual Reconciliation Page for more information. |

|

TRA_EVENT_CAL_2 |

View the bank statement processing (BSP) accounting events that are scheduled for force-reconciled transactions. |

|

|

Transactions By Account Page |

BNK_RCN_ALL_GEN |

Search and review transaction reconciliation information by a defined bank account. You can also run the Account Register report (BI Publisher). See the Transactions By Account Page for more information. |

After completing the prerequisites, you can do the following using the Reconciliation Exceptions process (TR_RECON_EXC):

Notify users of exceptions.

Run error and exception reports.

Force exceptions to reconcile.

Resolve exceptions using semi manual reconciliation.

View accounting for forced reconciliations.

If you plan to route exceptions for automatic reconciliation to a user's worklist or email account, you must select Automatic in the Recon Method field, and choose either the Notification Framework or Workflow notification method for the bank account on the External Accounts - Reconciliation page.

Note: If you are using a reconciliation method other than automatic, the system sets the Recon Method field to No Workflow.

If you choose the Notification Framework method for automatic reconciliation, the Notification Registry definition for Bank Reconciliation Exceptions is delivered as system data and provides the integration between Treasury and the Notification Framework. You can allow users to override the worklist or email notifications on the Notification Registry page.

Information provided for system-level notifications can be changed in the Notifications System Overrides component. If required, you can modify the Email Notification and Worklist Notification details, on the System-Level Notifications page. Options to allow user overrides for worklist or email notifications must be selected on the Notification Registry page in order to enter notification details in at the system level. By default, the system notifies users with the Bank Manager role by worklist if any reconciliation exceptions are found. In order to trigger email notifications, you must enter user IDs or email addresses in the Override Email Notification section.

|

Description |

Process Name |

Process Category |

Navigation |

|---|---|---|---|

|

Notification Registry for Bank Reconciliation Exceptions |

TR_RECON _EXCEPTIONS |

BANK_RECON _EXCEPTIONS |

|

|

Notifications System Overrides for Bank Reconciliation Exceptions |

TR_RECON _EXCEPTIONS |

BANK_RECON _EXCEPTIONS |

|

See the product documentation for PeopleTools: Application Designer Developer's Guide, PeopleSoft Approval Framework, and PeopleSoft Events and Notifications Framework.

Use the Route Reconciliation Exception page (TR_AE_RUNCNTL) to route exceptions to a user's worklist.

Define the run parameters for the Reconciliation Exceptions process.

Navigation:

Select a bind variable name of either BNK_ID_NBR or BANK_ACCOUNT_NUM and enter a value.

Use the Automatic Reconciliation page (BNK_RCN_CYC_STSA) to determine whether a bank statement has reconciliation errors.

Run the Auto Recon Errors report (FSX3002). Use this report to view a list of all reconciliation errors for a bank statement.

Run the Auto Recon Exceptions report (FSX3001). Use this report to view a list of all transactions with exceptions for a bank statement.

Navigation:

Select either Errors or Exceptions in the Reports field, and then click Run Report.

Use the Automatic Reconciliation Exceptions page (BNK_RCN_VUE_UNR) to force automatic reconciliation exceptions to reconcile.

You can also create external transactions for bank-side transactions with no corresponding system-side transactions.

Navigation:

Click Exceptions on the Automatic Reconciliation page.

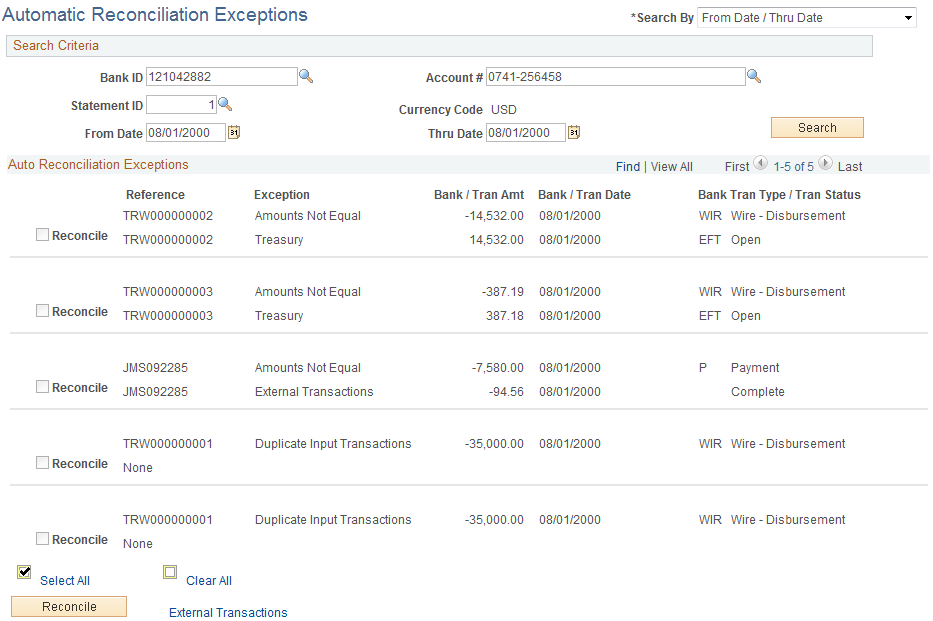

This example illustrates the fields and controls on the Automatic Reconciliation Exceptions page. You can find definitions for the fields and controls later on this page.

The page displays a combination of all potential matches based on date, amount, and reference ID number. Use your own judgement when you force items to reconcile. In some cases, transactions appear multiple times after being forced to reconcile, so you must be careful that you select the correct reconciled combination.

Note: Some automatic reconciliation exceptions may be the result of unbalanced payments in PeopleSoft Accounts Receivable. To remedy this, you should balance the payment on the Regular Deposit pages in Accounts Receivable.

Search Criteria

If you access this page by clicking the Exceptions link on the Automatic Reconciliation page, the exceptions for the selected bank's statements automatically appear in the grid. Otherwise, you must enter your search criteria and click Search.

Field or Control |

Description |

|---|---|

Search By |

Select how you want to search for transactions: by reference number or by date. The fields in the Search Criteria group box vary based on your selection. |

Auto Reconciliation Exceptions

For the system to force a transaction to reconcile, the transaction must match the following criteria. If the transaction does not match these criteria, the Force Reconciliation option is unavailable.

Note: These criteria are applicable only if you are using a Treasury application. If you are using the PeopleSoft force-reconciliation functionality with PeopleSoft Payables or PeopleSoft Receivables, the Force Reconciliation check box is always enabled.

You must have installed one or more of the Treasury applications, such as Cash Management, Deal Management, or Risk Management. The force-reconciliation functionality uses statement activity types for storing the accounting template and the source table (BNK_RCN_TRAN) information, from which the system creates the offset entries. However, the ability to define statement activity types is available only if you install a Treasury product.

The bank statement transaction must have a valid statement activity type on the Bank Transaction Entry page.

You must complete all three fields for the statement activity type that is associated with the bank statement transaction in the Force Reconciliation Options region of the Statement Activity Type page. These fields are Allow Force Reconciliation, Transaction Table, and Accounting Template ID.

You must select the Statement Accounting option on the External Accounts page. This ensures that the correct ChartFields for first-notice items, such as fees and interest, are established. In addition, when the system creates the offsetting external transaction, it sets the internal Build Accounting status to yes. This ensures that these transactions are properly built during the next Automated Accounting process (TR_ACCTG) run.

In addition, when forcing transaction pairs of unlike amounts to reconcile, the system automatically generates a balancing transaction. For example, if the bank statement amount is 100 USD and the system transaction amount is 99.99 USD, then the system creates a balancing transaction, which results in a credit in the amount of 0.01 USD. This credit is recorded in the table that is specified in the associated Statement Activity Type definition (either BNK_RCN_TRAN or CASH_FLOW_TR). If the system transaction is of a greater amount than the bank statement amount, then the system creates a debit and records it to the appropriate table. Using the preceding example, if the bank statement amount is 100 USD and the system transaction amount is 100.01 USD, then the balancing transaction is a debit of 0.01 USD.

In the Description field for each exception, details from the bank transaction file appear along with the reason that the transaction did not reconcile. Possible values are:

Field or Control |

Description |

|---|---|

Alignment Check |

Payables check that is used to align the printer. |

Amounts Not Equal |

Bank amount does not match system amount. |

Ambiguous Match |

An unreconciled, bank-statement transaction could match more than one unreconciled system transaction. This occurs most frequently when large tolerances are defined for the amount or date. An ambiguous match could also occur even with zero tolerances defined, however, if the reference IDs do not match. |

Currency |

The transaction currency was not defined (Accounts Receivable only). |

Currency Not Defined |

The transaction currency was not defined at the bank account level. |

Duplicate Input Transaction |

Duplicate bank transaction. A transaction appears more than once on a given statement with the same date, amount, and reference ID. (AR deposits are an exception to this.) Duplicate transactions are transactions that appear more than once on a given statement with the same date and amount (AR Deposits do not use ID's for matching). |

Duplicate Transaction |

Duplicate system transaction. |

Miscellaneous Transaction |

Miscellaneous transaction, such as bank fees or interest. |

Payee Names Not Equal |

Payee names don't match. |

Not Found In System |

Transaction is not found in the system. |

Null Transaction ID Ref |

Blank transaction ID. |

Overflow |

Overflow Payables check. |

Pending Reconciliation |

Prereconciled. |

Reconciled |

Already reconciled. |

Reprinted Check |

Reprinted payables check. |

Stop Check |

Check was issued a stop payment to the bank. |

Wrong Transaction Type |

Wrong transaction type for source. |

Tran Date Different <> Bank Clear |

System transaction date is different from the bank clear date. |

Unreconciled |

Not processed by the Bank Reconciliation process. |

Voided Check |

Payables void. |

To force a transaction to reconcile, select the transaction and click Reconcile.

Use the Semi Manual Reconciliation page (BNK_RCN_SEMI_MAN) to resolve exceptions using semi-manual reconciliation.

Select a transaction on the bank side to match a transaction on the system side.

Navigation:

If the Bank Reconciliation process could not reconcile a transaction, you can try to manually match transactions from the bank side to transactions on the system side, as long as the amounts match.

You can reconcile transactions only by matching one bank transaction to one system transaction (one to one) or one bank transaction to many system transactions (one to many). Select the transactions on each side that you want to reconcile, and click the Reconcile button.

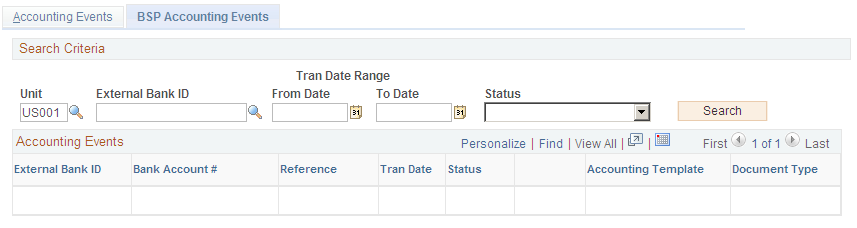

Use the BSP Accounting Events page (TRA_EVENT_CAL_2) to view the bank statement processing (BSP) accounting events that are scheduled for force-reconciled transactions.

Navigation:

This example illustrates the fields and controls on the BSP Accounting Events page. You can find definitions for the fields and controls later on this page.

To view all journal entries for transactions that were forced to reconcile, run the Automated Accounting (TR_ACCTG) process prior to accessing this page.