Setting Up Consolidation Sets

After you define consolidation relationships in your tree and specify intercompany elimination and minority interest sets, you are ready to define the options and controls that tell General Ledger how to process the consolidation.

To set up consolidation sets, use the Consolidation Set component (CONSOL_DEFINITION).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CONSOLIDATION1 |

Specify consolidation process options. |

|

|

CONSOLIDATION2 |

Specify which elimination and minority interest sets the consolidation will include. |

Use the Consolidation Set - Journal Options page (CONSOLIDATION1) to specify consolidation process options.

Navigation:

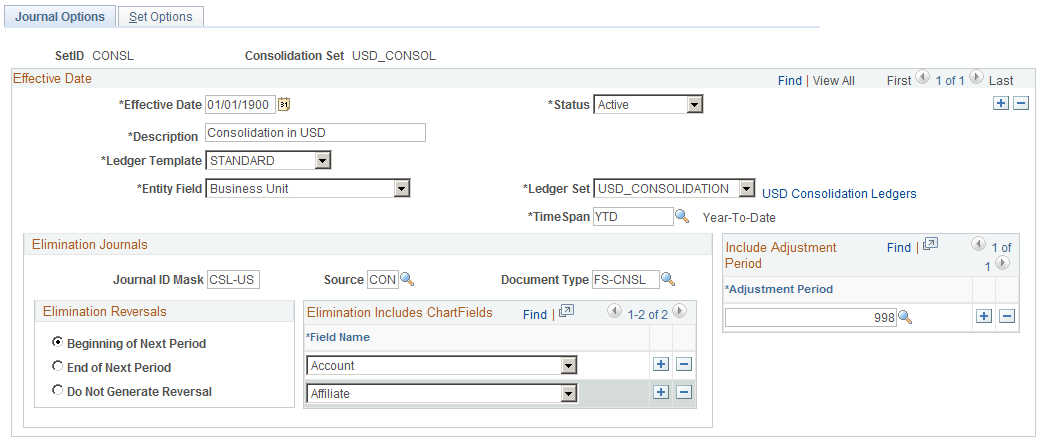

This example illustrates the fields and controls on the Consolidation Set - Journal Options page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Entity Field |

Select the consolidating entity field. This is usually the business unit, but you can consolidate based upon other fields, like Operating Unit. This field should be the same field upon which your consolidation tree is based. |

Business Unit |

When consolidating on other than BUSINESS_UNIT, General Ledger displays a Business Unit field that enables you to designate the business unit as the high order key in the consolidation. |

Ledger Set |

Specifies a combination of business units and ledgers that act as a centralized location for consolidations. |

TimeSpan |

Select a user-defined TimeSpan for which to process the consolidation. You can select to process year-to-date balances or quarterly and period balances (such as QTR1 , QTR2, QTR3, QTR4 or PER). If you select a year-to-date TimeSpan, the Consolidation Reversal option must be either Beginning of Next Period or End of Next Period; otherwise, the reversal option must be Do Not Generate Reversal. A warning message is issued if the reversal option is not appropriate for the selected TimeSpan. Note: Performance may be impacted when using a BAL or YTD TimeSpan due to increased volume of data when processing effective-dated ownership sets. Using quarterly or period TimeSpans improves performance. When upgrading from a previous release, be careful to use BAL as the TimeSpan, as Consolidations has historically processed BAL balances. |

Elimination Journals

Field or Control |

Description |

|---|---|

Journal ID Mask |

Enables you to specify a prefix for naming consolidation journals. A 10-character alphanumeric ID identifies journals. The system automatically appends the prefix that you specify to the journal IDs. For example, if you specify the journal ID mask to be ELIM, the elimination journal IDs might be ELIM0001, ELIM0002, and so on. Alternatively, the value NEXT causes General Ledger to assign the next available journal ID number automatically. It is very important to reserve a unique mask value for Consolidations to ensure that no other process creates the same journal ID. |

Source |

Any valid value from the Sources table entry that identifies the source of the consolidation journals. |

Document Type |

Required for consolidation journals if Document Sequencing is enabled. Document Sequencing requires that you have a document type for all of the journal entries that you create. |

In the following example, Department is the additional ChartField, and the elimination lines contain the following amounts:

|

ChartField Used in Eliminations - Account |

ChartField Used to Group By − Department |

Product |

Posted Total Amount |

|---|---|---|---|

|

1100001 |

100 |

XYZ |

100.00 |

|

2200001 |

100 |

XYZ |

- 80.00 |

|

1100001 |

200 |

NA |

200.00 |

|

2100001 |

200 |

NA |

-190.00 |

During Consolidations, the system generates journal entries that represent year-to-date (YTD) elimination amounts based on the type of account specified in the elimination set. For profit and loss accounts, the system totals the YTD amount based on the sum of periods 1 through n, and for balance sheet accounts periods 0 through n. To facilitate period-based reporting, General Ledger generates a reversing journal for the subsequent period. The resulting net amount on the elimination unit ledger represents the current period YTD amount less the reversal amount generated by the eliminations for the prior period.

Elimination Reversals

Field or Control |

Description |

|---|---|

Beginning of Next Period, End of Next Period orDo Not Generate Reversal |

Indicate whether you want to generate elimination reversal entries for the beginning of the next period, the end of the next period, or not generate a reversal at all. The system directs the journal entries to the respective elimination units as specified in the consolidation tree. |

Elimination Includes ChartFields

Select the ChartFields that you want to include in elimination. The ChartFields that are defined for a consolidation definition relate to the ChartFields that are specified for the elimination set:

If elimination set ChartFields provide more detail than consolidation definition ChartFields, the system summarizes the elimination journal entries at the level of detail defined by the elimination set.

For example, if you specify Account as the consolidation definition and Account and Project for your elimination set, the system includes account and project detail when it summarizes elimination journal entries.

If consolidation definition ChartFields provide more detail than elimination set ChartFields, the system expands the elimination journal entries, summarizing at the level of detail defined by the consolidation definition.

For example, if you specify Account, Department, and Product as the consolidation definition and Account and Project as the elimination set, the system expands the elimination journal entries to include account, department, and product detail when it summarizes them.

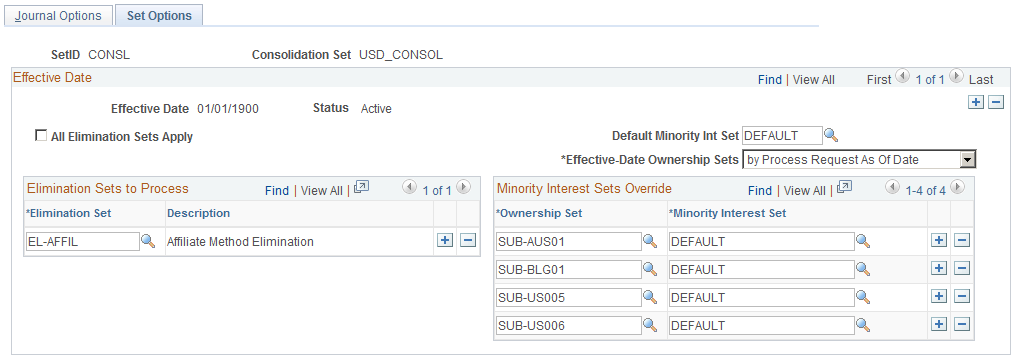

Use the Consolidation Set - Set Options page (CONSOLIDATION2) to specify which elimination and minority interest sets the consolidation will include.

Navigation:

This example illustrates the fields and controls on the Consolidation Set - Set Options page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

All Elimination Sets Apply |

Select to indicate that you want to use all of the elimination sets that are defined for the SetID when processing this consolidation set. |

Default Minority Int Set (default minority interest set) |

Specifies which minority interest set to use for the calculation. Based on the Subsidiary Ownership setup, Consolidations includes all parent and subsidiary sets, provided that all entities involved are within the consolidation scope (the consolidation tree). |

Effective-Date Ownership Sets |

Select one of the following options for the effective dates that dictate to which period of the fiscal year the Ownership Sets apply:

Note: The journal entries that are created by the Consolidation process are dated as of the process request date, regardless of the effective date of the ownership sets. To illustrate the Period End Date(s) option, assume that you are running the Consolidation process through June 30, 2009. Additionally, assume that there are two effective-dated ownership sets with one dated January 1, 2009 and the other dated April 15, 2009. Given these effective dates, the Consolidation process applies the Ownership Set that is effective from January 1 to periods 1 through 4 balances, and uses the April 15 Ownership Set for periods 5 through 6 balances. If using the Process Request As Of Date option, the Consolidation process applies the April 15 ownership set for all periods that are included in the consolidation. |

Elimination Sets to Process

Field or Control |

Description |

|---|---|

Elimination Set |

If you want to use only a portion of the elimination sets, specify the sets by adding rows in this section. |

Minority Interest Sets Override

Field or Control |

Description |

|---|---|

Ownership Set |

Associated with the minority interest set for consolidation set override purposes. |

Minority Interest Set |

Specifies the minority interest set on a certain ownership set for consolidation set override purposes. This override can be useful, for example, when you use different equity accounts for certain subsidiaries, and thus define separate minority interest sets. |