Using Per Diem in PeopleSoft Fluid

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

EX_SHEET_LN_FL |

Enter per diem expenses. |

Use the Expense Entry page (EX_SHEET_LN_FL) to enter per diem expenses. Per Diem means the daily amount authorized to be spent in one day by an employee.

For information on setting up per diems, see Setting Up Per Diems, Setting Up PeopleSoft Expenses for Per Diem Processing

Navigation:

. Select the per diem expense type on the Expense Entry page.

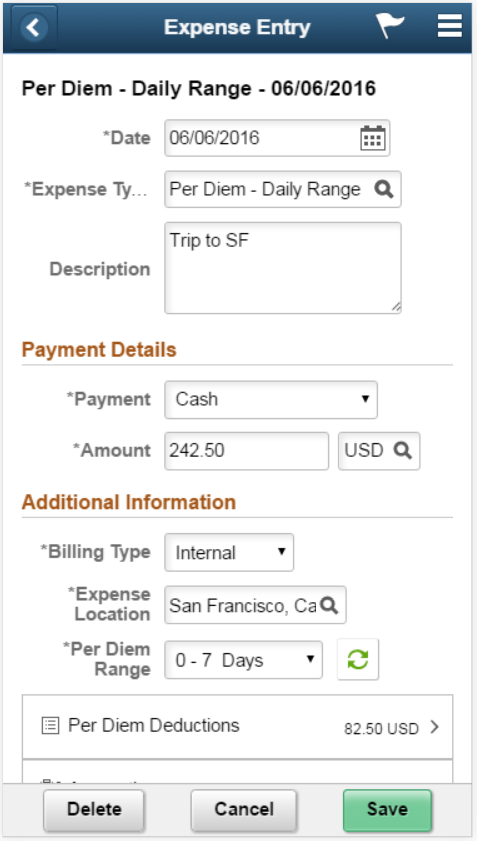

This example illustrates the fields and controls on the Expense Entry (Per Diem) page as displayed on a smartphone. You can find definitions for the fields and controls later on this page.

If your organization policy allows per diem reimbursement, you can enter it on this page including the per diem breakdown using daily or hourly rate. If per diem deduction is required for partial travel date, you may apply it on the entry.

Field or Control |

Description |

|---|---|

Per Diem — Daily Range |

Select for reimbursement if an employee is on a longer-than-normal business trip. If the per diem is setup with Daily Range, the Per Diem Range field is displayed for you to select. Once selected, the amount will be populated accordingly. |

Per Diem — Hourly Range |

Select for reimbursement based on a 24-hour period. If the per diem is setup with hourly range, Start time and End Time field will be displayed. Amount field is updated based on the number of hours specified on these fields. |

Per Diem — Location |

Select for reimbursement based on a location. Note: Each location can have only one category associated with it within the setID, expense type, country, and currency combination. The per diem amount is calculated based on the home country of the employee, base currency, setID and expense, and the location to which they traveled. |

Per Diem — Lodging |

Select for reimbursement if employees stay with family or friends while on business trips. (Some European countries use this as an employee bonus.) Note: There is no Per Diem deduction for Per Diem Lodging. Therefore, the Per Diem deduction section will not be displayed on the Expense Entry page. |

Per Diem Deduction Page

Use the Per Diem Deduction (EX_SHT_PERDIEM_SCF) page to select the qualified deduction percent, amount, or calculation code for the expense type.

Navigation:

Select Per Diem Deduction on the Expense Entry page.

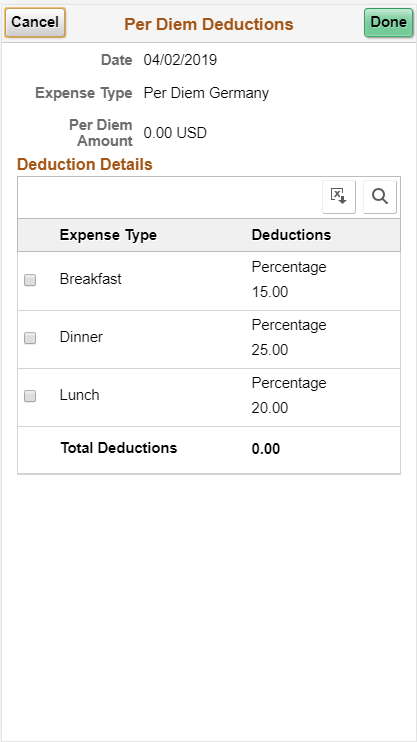

This example illustrates the fields and controls on the Per Diem Deduction page as displayed on a smartphone. You can find definitions for the fields and controls later on this page.

The option you select in the Per Diem Deduction page is applied to the per diem amount. If a deduction percent or amount results in an amount greater than the original per diem amount, then the per diem amount is set to 0.00 (zero) and a message is displayed by the system.

Field or Control |

Description |

|---|---|

Per Diem Deductions — Header |

Displays the Date, Per Diem Expense that you selected, and the per diem amount |

Per Diem Deductions — Deductions Details |

Displays the per diem deduction amount. |

|

Select to download the per diem deductions to Microsoft Excel spreadsheet. |

|

Select to find a string in the current page. |

Select Done to return to the Expense Entry page. The Per Diem Deduction section will be updated with the total amount deducted. The Amount field in the Expense Entry page displays the net amount. You will not be able to submit the expense report if the total expense amount after deduction is zero.