Working with India GST in PeopleSoft Receivables

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Receivables Definition - Accounting Options 2 Page |

BUS_UNIT_TBL_AR3 |

Specify the distribution codes used to create accounting entries for draft processing and refund processing. Enable GST processing on advance payments. See Defining Business Unit Defaults for Individual Business Units. |

|

Group Entry Tax Page |

GROUP_ENTRY_TAX |

Enter and calculate GST amounts for India. |

|

Accounting Entries Page |

GROUP_ENTRY3 |

Create accounting entries for one pending item at a time. Select GST field values for the (Account) Type field. |

|

Regular Deposit - Payments Page |

PAYMENT_DATA2 |

Enter details about each payment in a regular deposit. Validation for India GST compares the payment amount with the order amount and returns an error if the payment amount exceeds the order amount. |

|

Payment Worksheet Application Page |

PAYMENT_WS_IC |

Apply payments to selected items. Calculate GST taxes. |

|

PAYMENT_LINE_EXS |

Review GST tax calculations for an advance payment. |

Use the Accounting Entries page (GROUP_ENTRY3) to create accounting entries for one pending item at a time.

Navigation:

The Type field for accounting entry types on the Accounting Entries page is delivered with the following GST-related field values:

Integrated GST

IGST-Final: Select this option when an invoice is received against an order and processed via ARUPDATE for interstate transaction.

IGST-Intrm: Select this option for an interim entry against an advance or for an invoice received against an order and processed via ARUPDATE for interstate transaction.

IGST-Payable: Select this option for payable entry against an advance.

State GST

SGST-Final: Select this option when an invoice is received against an order and processed via ARUPDATE for Intrastate transaction.

SGST-Intrm: Select this option for an interim entry against an advance or when an invoice is received against an order and processed via ARUPDATE for Intrastate transaction.

SGST-Payable: Select this option for a payable entry against an advance.

Central GST

CGST-Final: Select this option when an invoice is received against an order and processed via ARUPDATE for Intrastate transaction.

CGST-Intrm: Select this option for an interim entry against an advance or when an invoice is received against an order and processed via ARUPDATE for Intrastate transaction.

CGST-Payable: Select this option for a payable entry against an advance.

Use the Regular Deposit - Payments page (PAYMENT_DATA2) to enter details about each payment in a regular deposit.

Navigation:

Validation for India GST compares the payment amount with the order amount and returns an error if the payment amount exceeds the order amount.

The Qual Code (qualifying code) field automatically displays Item (I) for the payment. If the payment is an advance, you must manually set the Reference Qualifier Code to Order Number (O) using the Payment Options page, then select the order number from the look-up.

Use the Payment Worksheet Application page (PAYMENT_WS_IC) to apply payments to selected items. Calculate GST taxes.

Navigation:

Field or Control |

Description |

|---|---|

Calculate GST on Advance |

Calculate GST taxes for advance payments and access the GST Taxes page, where you can review the calculations. You must calculate GST to save changes on the worksheet. |

After building the payment worksheet, the system allocates the advance amount on a pro rata basis for the inventory items in the payment worksheet. For an advance payment, the Type field automatically displays PR (pro rata) and is unavailable for editing.

Run the Receivables Update Application Engine process (ARUPDATE) to generate GST accounting entries.

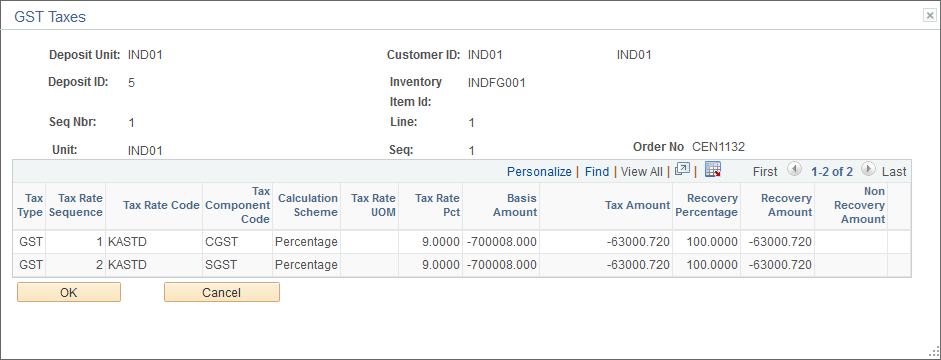

Use the GST Taxes page (PAYMENT_LINE_EXS) to review GST tax calculations for an advance payment.

Navigation:

Click the Calculate GST on Advance link for a payment on the Payment Worksheet Application page.

This example illustrates the fields and controls on the GST Taxes page.