(USF) Reclassifying Receivables Accounting Entries, Direct Journal Accounting Entries, and Open Items

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PAR224_ARENTRIES |

Change the fund associated with posted accounting entries. You can reclassify the entire stream of the transaction. The reclassification entries are recorded in the PS_ITEM_DST table with a sequence number starting from 600. You can also change the BETC and accounting date. |

|

|

PAR224_DIRJRNL |

Identify accounting entries for direct journals and reclassify the entries to correct the fund. The reclassification entries are recorded in the PS_PAY_MISC_DST table with a line number starting from 600. You can also change the BETC and accounting date. |

|

|

Transfer Selection Page |

PAR224_TRANSFER |

Create a new worksheet or add items to a transfer worksheet. |

|

Worksheet1 Page |

TRN_WORKSHEET1 |

Select the items to transfer. |

|

Worksheet2 Page |

TRN_WORKSHEET2 |

Override the default receivable distribution code. |

|

Transfer Action Page |

TRN_ACTION |

Select a posting action for a worksheet. Also use this page to delete a worksheet, create accounting entries online for the worksheets, or to delete accounting entries. |

To set up agency location codes (ALCs) and government-wide accounting (GWA) reporting options for reporting, use the Agency Location component (AGENCY_LOC_CD). Select the CTA check box on the Installation Options - Receivables Page. Once you see the Billing ALC field on the Receivables Options - General 1 Page, you can set the ALC to be a GWA Reporter for Receivables.

To create CTA reports, use the CTA Report Definition component (SF224_SF1220_DEFN). You can also create the Partial SF224 using this component.

The U.S. Treasury’s FMS-224 and Partial 224 processes were renamed Classification Transactions and Accountability (CTA). See Understanding Federal Government and Statutory Reports for more information.

The PeopleSoft Receivables Cash Reclassification is used to reclassify cash transactions from one Treasury Symbol (Fund Code) to another.

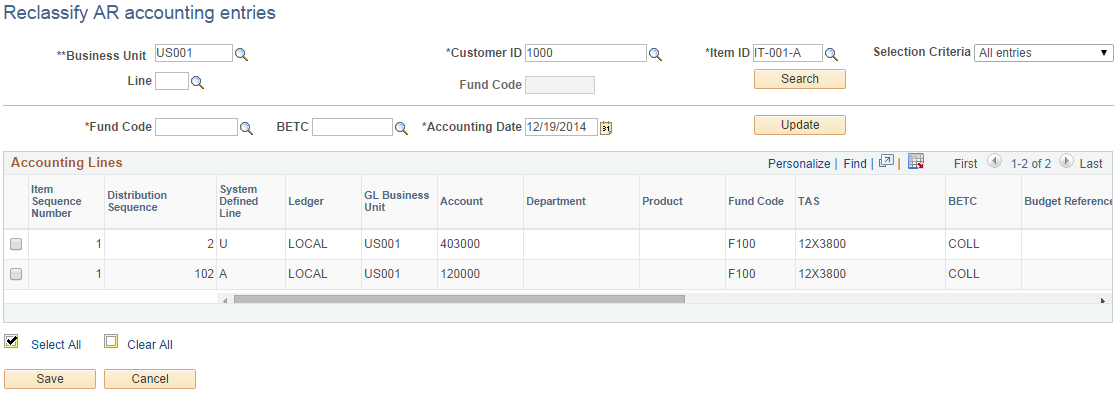

Use the Reclassify AR accounting entries page (PAR224_ARENTRIES) to change the fund associated with posted accounting entries.

You can reclassify the entire stream of the transaction. The reclassification entries are recorded in the PS_ITEM_DST table with a sequence number starting from 600. You can also change the BETC and accounting date.

Navigation:

This example illustrates the fields and controls on the Reclassify AR accounting entries page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Item Search |

Click to display the accounting lines that match the entered business unit, item ID, customer ID, fund code, and accounting date. |

Selection Criteria |

Select the types of entries to display in the Accounting Lines area. the values are All Entries and Reclassification Entries. |

Update |

Click this button to generate new accounting entries for the selected accounting lines after you have entered the appropriate fund code, BETC, and accounting date. The system generates reversal entries for the selected accounting lines and creates new accounting entries with the following attributes:

|

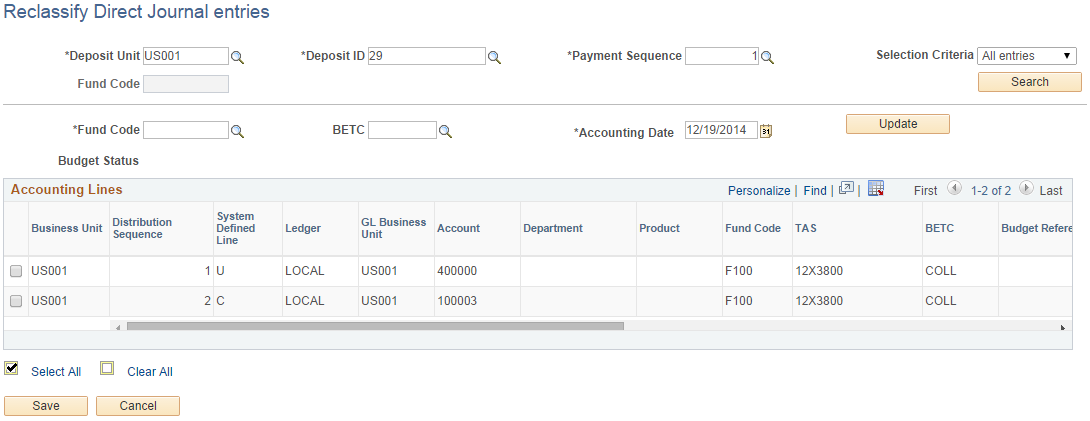

Use the Reclassify Direct Journal entries page (PAR224_DIRJRNL) to identify accounting entries for direct journals and reclassify the entries to correct the fund.

The reclassification entries are recorded in the PS_PAY_MISC_DST table with a line number starting from 600. You can also change the BETC and accounting date.

Navigation:

This example illustrates the fields and controls on the Reclassify Direct Journal entries page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Search |

Click to display the accounting lines that match the entered deposit unit, payment sequence, fund code, and accounting date. |

Selection Criteria |

Select the types of entries to display in the Accounting Lines area. the values are All Entries and Reclassification Entries. |

Accounting Date |

Enter the accounting date to be used on the new reclassification entries. If no date is entered, it will default to the current date. The budget date will be set to the same date as the accounting date. |

Update |

Click this button to generate new accounting entries for the selected accounting lines after you have entered the appropriate fund code, BETC, and accounting date. The system generates reversal entries for the selected accounting lines and creates new accounting entries with the following attributes:

|

Commitment Control and Reclassification of Receivables Accounting Entries

In order for Journal Generator to process reclassification entries, the entries must have a valid budget check status. If you are using Commitment Control, run the Revenue Estimate Application Engine Process (AR_REV_EST) to create the source transactions for the revenue entries in the control budgets. Make sure to select the Send Transactions Generated option on the Revenue Estimate run control page to run the Budget Processor automatically immediately following the revenue estimate process. Once this process is complete and the reclassification transactions have been budget checked successfully, run the Journal Generator process to create GL journals for the reclassification transactions.

For more information about running the Revenue Estimate Process, and reviewing and correcting revenue estimate entries, see Performing Commitment Control Processing.

This section discusses how to:

Build a transfer worksheet for reclassifying receivables items.

Reclassify open receivables items.

Modify the distribution code.

Choose an action for a receivables reclassification worksheet.

Building a Transfer Worksheet for Reclassifying Receivables Items

Use the Transfer Selection page (PAR224_TRANSFER) to create a new worksheet or add items to a transfer worksheet.

Navigation:

Enter your customer and reference selection criteria.

Field or Control |

Description |

|---|---|

Build |

Click to build a worksheet that reclassifies an open item. |

Reclassifying Open Receivables Items

Use the Worksheet1 page (TRN_WORKSHEET1) to select the items to transfer.

Navigation:

Field or Control |

Description |

|---|---|

Sel (select) |

Select the items to reclassify. |

Modifying the Distribution Code

Use the Worksheet2 page (TRN_WORKSHEET2) to override the default receivable distribution code.

Navigation:

Field or Control |

Description |

|---|---|

Dist ID AR (receivables distribution code) |

Override the default distribution code that was assigned to the business unit. For reclassification, use the RECLASSIFY distribution code. |

Choosing an Action for a Receivables Reclassification Worksheet

Use the Transfer Action page (TRN_ACTION) to select a posting action for a worksheet.

Also use this page to delete a worksheet, create accounting entries online for the worksheets, or to delete accounting entries.

Navigation: