Setting Up SAM Processing

This section provides an overview and discusses how to of set up System for Award Management (SAM) Processing.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

INSTALLATION_FD |

Enable SAM processing for suppliers or customers. |

|

|

MAINTAIN_USF_CODES |

Maintain government mandated code types. |

|

|

VNDR_ID1 |

Enter identifying information for a supplier, including the supplier name and short name, classification, SAM status, persistence, withholding and VAT eligibility, relationships with other suppliers, duplicate invoice checking settings, and additional identifying elements required for reporting to government agencies. |

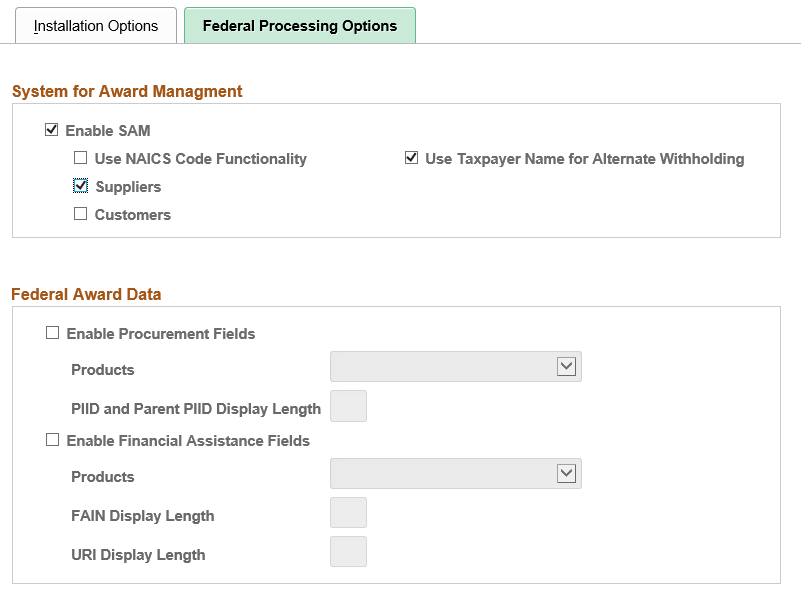

Use the Federal Processing Options page (INSTALLATION_FD) to enable SAM processing for suppliers or customers.

Navigation:

This example illustrates the fields and controls on the Federal Processing Options page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Enable SAM |

Select to enable SAM processing for the implementation. |

Use NAICS Code Functionality (North American Industry Classification System) |

Select to indicate that your PeopleSoft Payables implementation already has updated NAICS codes, and that the system should use these updated codes for SAM processing on the Standard Industry Codes table (Set Up Financials/Supply Chain, Common Definitions, Customers, Standard Industry Codes). |

Suppliers |

Select to allow users to create suppliers from SAM data. Note: If unselected, the Use Taxpayer Name for Withholding field appears as display-only. |

Customers |

Select to allow users to create customers from SAM data. |

Use Taxpayer Name for Withholding |

Select to enable the PeopleSoft system to compare the name entered in the SAM Taxpayer Name field with the name entered in the PeopleSoft Supplier information. If a value is entered in the SAM Taxpayer Name field and is different from the value entered in the Supplier Name field on the Identifying Information Page then the Load SAM process updates the Withholding Alternate name field on the Supplier Information - Address Page for all addresses, after truncating the number of characters to forty (40). A message is displayed when the Withholding Alternate Name is updated and when the SAM Taxpayer Name is truncated if the update was performed during the on-line creation of a supplier. The Summary Messages section of the Inquire SAM File Information Page is updated with the changes mentioned above if the update was performed in the Load process. |

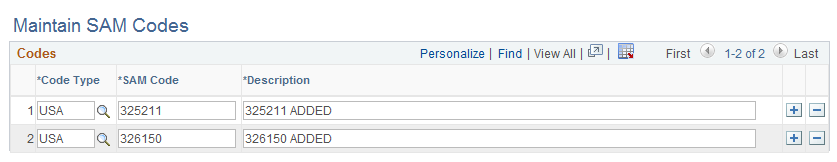

Use the Maintain SAM Codes (MAINTAIN_USF_CODES) page to maintain government mandated code types with the corresponding SAM code and description for your installation, which is used instead of using pre-defined NAICS codes on the Standard Industry Codes table.

Navigation:

.

.

This example illustrates the fields and controls on the Maintain SAM Codes page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Code Type |

Select a code type from the following, and enter the corresponding SAM code and description:

|

Use the Supplier - Identifying Information page (VNDR_ID1) to define SAM status for a supplier.

Navigation:

Field or Control |

Description |

|---|---|

SAM Status |

Select the applicable registration status:

Note: If the Federal agency data has expired and a supplier already exists for this entity the SAM status will be set to Expired. |