Adjusting for Asset Impairment

Use the Impairment (AM_IMPAIR) component or the CGU Impairment (AM_CGU_IMPAIR_RUN) component to perform impairment testing and create impairment adjustments to assets.

This topic provides an overview of impairment testing, lists the pages used for impairment testing.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

AM_IMPAIR |

Select criteria to search for assets that can potentially be impaired, to process potential impairment, and to create loss adjustments automatically. |

|

|

Cash Generating Unit Definition Page |

AM_CGU_DEFN_01 |

Review the CGU definition. |

|

More Filter Options Page |

AM_IMPAIR_CF_SEC |

Filter search criteria by selecting ChartFields: Operating Unit, Fund Code, Department, Program, Class Field, Budget Reference, Product, and Project. |

|

Impairment Comments Page |

AM_IMPAIR_COMMENTS |

Enter comments about this impairment. |

|

AM_CGU_IMP_RUN_CTL |

Allocate impairment losses to individual assets on a CGU basis. |

|

|

AM_REPORT1 |

View impairment losses and reversals online using the Cost and Depreciation online view. |

|

|

AM_IMP_RPT_RUN_CTL |

Generate reports by category or CGU ID of impaired asset values. |

PeopleSoft supports the requirements of International Accounting Standard (IAS) 36 by providing an impairment test worksheet.

A generally accepted principle is that long-lived assets should be subject to some form of recoverable amount constraint, that is, that the carrying amount of an asset does not exceed the amount that is recoverable from the future economic benefits that the asset is expected to generate. When the carrying amount of an asset exceeds its recoverable amount, the asset is described as impaired and the carrying value should be reduced to the recoverable amount. Therefore, assets should be subject to some type of impairment evaluation or test. The purpose of an impairment or recoverable amount test is to identify such assets and ensure that losses of future economic benefits are properly recognized in a timely manner (asset values are reduced in the statement of financial position, and expenses are recognized in the statement of financial performance).

In pursuance of this principle, the International Accounting Standards Board has defined IAS 36, This requires that you ensure that your assets are carried at no more than their recoverable value. IAS 36 provides a list of external and internal indicators of impairment as well as requirements for an impairment assessment strategy and frequency-of-asset impairment review. Only assets that are identified as 'potentially impaired' require an impairment assessment. If you have an indication that an asset may be impaired, then the enterprise is required to calculate the asset's recoverable amount.

Note: To assess whether any assets you have are subject to impairment review, consult the most current published IAS standards.

PeopleSoft also enables the definition of a Cash Generating Unit (CGU) and the association of CGUs with business units to further support impairment testing. Impairment losses can be allocated to individual assets on a CGU basis using the CGU Impairment utility. This batch process allocates CGU impairment data for each asset and stores the details in the INTFC_FIN table. You can also initiate the transaction loader (AMIF1000) to process and update asset tables automatically.

If an organization cannot determine recoverable value for an individual asset, it must identify the lowest aggregation of assets that generate largely independent cash flows. These aggregations of assets are called CGUs. CGUs are defined as the smallest identifiable group of assets that generates cash inflows from continuing use, and are largely independent of the cash inflows from other assets or groups of assets. CGU should be defined consistently from period to period. However, an asset that was previously part of a CGU but which is no longer used, should be excluded from the CGU and assessed for impairment separately.

If you are required to perform impairment evaluation, at a minimum, you should evaluate assets at each balance sheet date. You can test assets or CGUs for impairment at any time.

Impairment processing is enabled at the installation level. Impairments are then processed on assets that are contained within the business unit where impairment processing is selected. You can select asset categories, profiles, books, accounting entry template, CGUs, and individual asset IDs for impairment processing.

To process calculation of impairment, the system compares the following information:

Carrying amount: The net book value (NBV) of the asset as it is currently recorded in the accounts.

Recoverable amount: The higher of an asset's Net Selling Price (NSP) or its Value In Use (VIU):

The NSP is obtained from the sale of an asset in a bargained transaction between knowledgeable, willing parties with reference to the price of an active market and less the costs of disposal.

The VIU is the present value of estimated future cash flows that are expected to arise from the continuing use of an asset, and from its disposal at the end of its useful life, (for example, the sum of discounted cash flows).

The impairment worksheet can also apply an index to the carrying cost and calculates the potential NSP/VIU cost. The system compares the carrying amount value to the recoverable amount value to calculate the potential impairment. Any difference is the impairment loss.

An impairment reversal is required when a change has occurred in the estimates that are used to determine the impairment loss. In this case, the carrying amount of the asset is increased to the recoverable amount, where the recoverable amount does not exceed the original carrying amount.

You can also select impairment processing when running the Cost and Depreciation process.

To view impairment loss and reversal, use the Cost and Depreciation Summary page (AM_REPORT1). To generate reports of impairments, use the Asset Impairment report (AM_IMPAIR_RPT_RUN) component.

Note: Impairment testing prescribed by IAS 36 is not required in all countries.

See Understanding Asset Management Business and Cash Generating Units.

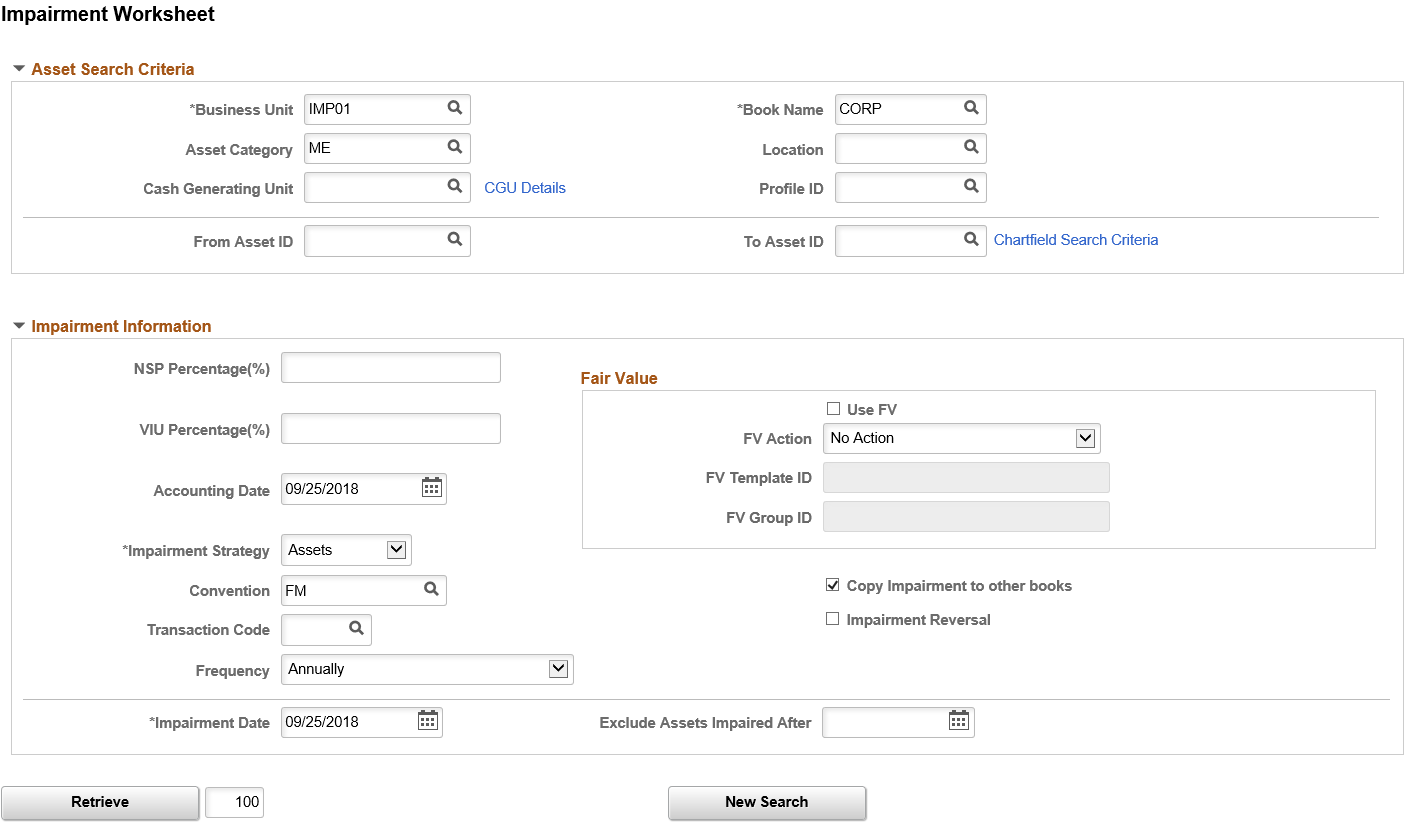

Use the Impairment Worksheet page (AM_IMPAIR) to select criteria to search for assets that can potentially be impaired, to process potential impairment, and to create loss adjustments automatically.

Navigation:

This example illustrates the fields and controls on the Impairment Worksheet page (1 of 2). You can find definitions for the fields and controls later on this page.

Enter the asset search criteria and impairment information.

Field or Control |

Description |

|---|---|

Business Unit |

Select the business unit (required). The business unit is supplied from the search dialog box. |

Book Name |

Select the book name (required). The Book Name field is initially supplied by the default book (when the book is enabled for impairment processing). The valid values include only books for which impairment processing enabled. |

Asset Category |

Select the asset category to search for assets by category. The valid values include only categories for which impairment processing is enabled. |

Location |

Select the asset location to search for assets by location. The valid values include only locations for which impairment processing is enabled. |

Cash Generating Unit |

Select from the valid CGUs for this business unit, book, profile, or category if you want to impair at the CGU level. |

Profile ID |

Select the asset profile ID to search for assets by profile. The valid values include only locations for which impairment processing is enabled. |

From Asset ID and To Asset ID |

Select an asset ID or a range of asset IDs to be included. |

ChartField Search Criteria |

Click the link to supply more filter options by ChartField to further narrow the search. |

NSP Percentage (%) (net selling price percentage) |

Apply and enter a net selling price percentage to determine the actual NSP. Net selling price is the amount that is obtainable from the sale of an asset in a bargained transaction (between knowledgeable, willing parties), less the costs of disposal. For example, suppose the net book value of an asset is 10,000.00 USD. But the NSP is equal to 8,000.00 USD. The NSP percent is equal to 80 percent. |

Copy Impairment to other books |

Select if you want the impairment carried over to other books. |

VIU Percentage (%) (value in use percentage) |

Enter the value in use percentage that you expect to determine the actual VIU amount. Value in use is the present value of estimated future cash flows that are expected to arise from the continuing use of an asset, and from its disposal at the end of its useful life. For example, suppose the net book value of an asset is 23,500.00 USD. But the VIU is unknown. You can apply a percentage that you expect , such as 70 percent, and the system will calculate the actual amount to be 16,450.00 USD. |

Impairment Reversal |

Select if the potential impairment is a reversal of a prior impairment adjustment. Note: This option appears only if impairment reversal is enabled for the business unit. |

Accounting Date |

Enter the accounting date of the impairment. |

Convention |

Select the depreciation convention. The valid values are derived from those that are defined for the business unit. |

Impairment Strategy |

Select the impairment strategy. Valid values are: Asset and CGU.

|

Frequency |

Select the frequency for performing the impairment test. the options include Yearly, Semiannually, Quarterly, Monthly, and Other |

Impairment Date |

This is the transaction date on which the system calculates carrying cost (NBV). The depreciation for the impairment month is included in the NBV calculation. For example, if the impairment date is between December 12, 2003 and December 12, 2003, period 12 is included in the accumulated depreciation for the calculation: NBV=Cost-ACCUM

|

Exclude Assets Impaired After |

Enter the dates to exclude more recently impaired assets. |

Use FV(use fair value) |

Select to retrieve the fair values in the NSP amount or VIU amount fields instead of using the NSP Percentage(%) or VIU Percentage(%) fields for impairments. These fields become unavailable when selecting the Use FV field. If this check box is not selected, the fair values are retrieved from the NSP Percentage(%) or the VIU Percentage(%) fields for impairments. |

FV Action(fair value action) |

Select the action by which to update the fair value records from the NSP or VIU amount fields. Select from the following fair value actions:

|

FV Template ID(fair value template ID) |

Select an existing fair value template to populate the fair value fields. When the Retrieve button is pushed, the FV Template ID and Group ID in the Asset Search Results will be defaulted from the values in the Impairment Information section. |

FV Group ID(fair value group ID) |

Select when the valuation premise from the FV Template is In-Use. You can override the default value from the template. This field is unavailable if the valuation premise from the FV Template is In-Exchange. |

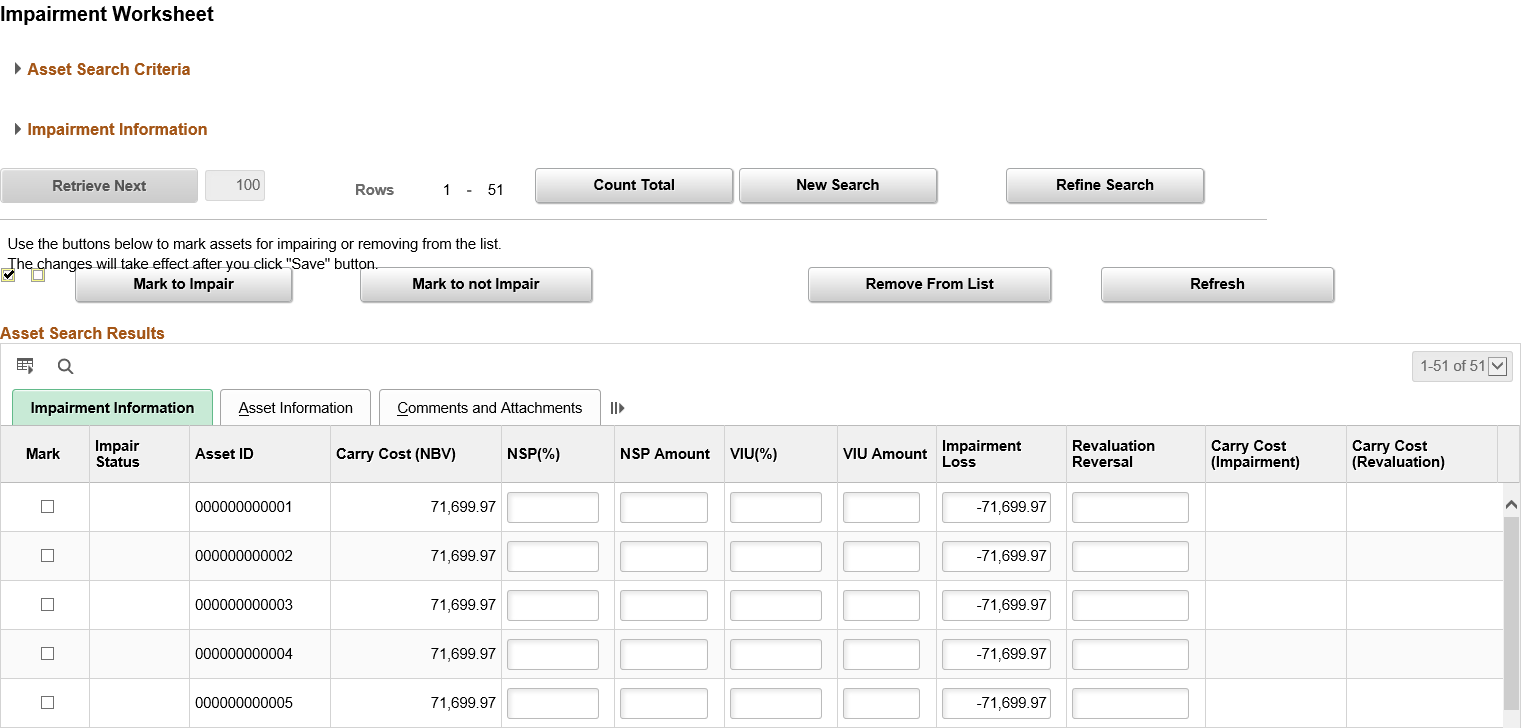

Asset Search Results

When you are finished entering search criteria and impairment information, initiate the retrieval process. On completion, the Search Criteria group box collapses. The Impairment Information group box is visible, but unavailable for entry. You can initiate a new search or refine search of your returned results.

This example illustrates the fields and controls on the Impairment Worksheet page (2 of 2). You can find definitions for the fields and controls later on this page.

The results of the assets matching the criteria that are entered are displayed in the Asset Search Results grid on the worksheet. The grid contains three tabs:

Impairment Information

Asset Information

Comments and Attachments

Use the buttons to mark assets to be impaired and assets not to be impaired, to remove assets from the list, and to refresh the page.

Note: Selected assets must already have been processed for depreciation and included in the load depreciation report table process before they are available to be reported in the impairment worksheet.

Impairment Information

This section enables you to select or exclude selected assets for impairment.

Field or Control |

Description |

|---|---|

Mark |

When you click the Check button, you will select all assets in the list. Use Mark to select the line. |

Mark to Impair |

Click Mark to Impair and the system will set Impair Status toImpair for all selected rows. |

Mark to not Impair |

Click Mark to Not Impair and the system will set Impair Status to Don't Impair for all selected rows. |

Mark to Update FV |

Click Mark to Update FV and the system will set Impair Status to FV for all selected rows. |

Remove From List |

Click Remove From Listto remove selected rows from Asset Search Results. |

Refresh |

Click Refresh to recalculate all impairment information. |

Impair Status |

Displays the status of selected assets to be impaired or not to be impaired. Impaired assets will be inserted into INTFC_FIN table and Impairment audit tables. Not impaired assets will be inserted into the impairment audit tables. |

Asset ID |

Displays the asset ID for all assets meeting the search criteria. |

Carry Cost (NBV) |

Displays the current carry cost (net book value) of the asset. |

NSP% |

Enter the net selling price percentage that is applied to the carry cost. |

NSP Amount |

Enter the NSP as an amount in the base currency. |

VIU% |

Enter the value in use percentage that is applied to the carry cost. |

VIU Amount |

Enter the VIU as an amount in the base currency. |

Impairment Loss |

Displays the calculated impairment loss, usually the disposal cost. Impairment loss = NBV- (greater than NSP or VIU). You can override this amount. |

Revaluation Reversal |

If this asset had a revaluation before, you need to reverse the revaluation before you allocate the loss. |

Carry Cost (Impairment) |

The remaining amount that is attributable to prior impairment loss. |

Carry Cost (Revaluation) |

The remaining amount that is attributable to prior impairment reversal. |

Comments |

Click the Comments link to access the Asset Comments page. Use this page to view or add relevant supporting comments to an asset transaction. |

Attachments |

Click the Attachments link to access the Asset Attachments page. You can view or add relevant supporting attachments to an asset transaction. |

When you have reviewed and selected assets to be impaired, save the worksheet. The saving process performs the following tasks:

The system creates a cost adjustment (with user define impairment loss cost type) for the impairment loss.

The system creates a cost adjustment (user defined impairment reversal cost type) for the impairment revaluation reversal.

The transaction date and the impairment date are inserted and is the same for this transaction.

If you do not provide an accounting date, the system looks for the last day of the open period and books the transaction against that date. This date is validated against the open period.

The system commits all validations at the time of the save.

Upon saving the worksheet, the system places the actual adjustment in the staging table INTFC_FIN.

The system loads the adjustment in the main asset tables when the transaction loader (AMIF1000) is run.

The system automatically triggers the transaction loader (AMIF1000) to load the transactions if this option has been selected.

The system validates that the impairment date is less than or equal to the accounting date.

When the impairment reversal box is checked, the system processes impairment reversal instead of impairment loss.

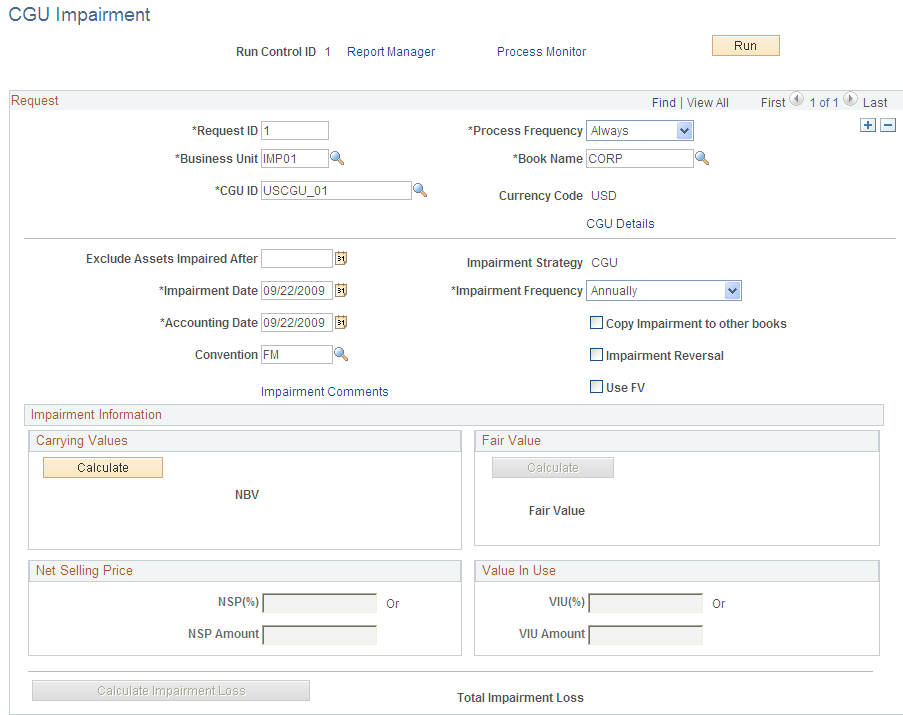

Use the CGU Impairment page (AM_CGU_IMP_RUN_CTL) to allocate impairment losses to individual assets on a CGU basis.

Navigation:

This example illustrates the fields and controls on the CGU Impairment page. You can find definitions for the fields and controls later on this page.

Complete the applicable fields. When satisfied with the criteria, click Run. The batch process allocates CGU impairment data to each asset.

Request

Field or Control |

Description |

|---|---|

Business Unit |

Select the business unit (required). The business unit is supplied from the search dialog box. |

Book Name |

Select the book name (required). The book is initially supplied by the default book (when the book is enabled for impairment processing). The valid values include only books for which impairment processing is enabled. |

Currency Code |

The currency code as defined for the Book. |

CGU ID |

Select from the valid CGUs for this business unit, book, profile, or category if you want to impair at the CGU level. |

Exclude Assets Impaired After |

Enter dates to exclude more recently impaired assets. |

Impairment Information

Field or Control |

Description |

|---|---|

Impairment Date |

Enter the date of the asset impairment. This is the transaction date on which the system calculates carrying cost (NBV). The depreciation for the impairment month is included in the NBV calculation. The system uses the current date by default. |

Impairment Strategy |

CGU: Impairment based on all assets that are part of CGU definitions. The impairment strategy CGU appears by default when you are processing impairment in batch mode. |

Copy Impairment to other books |

Select if you want the impairment carried over to other books. PeopleSoft Asset Management copies the impairment amount to other books in the ledger group as long as the Keep Ledgers in Sync (KLS) option is selected. If the option Copy to Other Books is checked, PeopleSoft Asset Management copies the same amount to the books with impairment amount selected, for books that do not point to the ledger group. Depending on the selection of these options, when Copy Zero Impair/Revalue Rows is checked, then the system copies zero impairment data in all the remaining books. For example: Suppose you have a business unit with six books (A, B, C, D, E, F), with the first three books, A, B and C pointing to a ledger group, the ledger group is synchronized with the general ledger business unit and book B is pointing to the primary ledger. However, the other three books, D, E and F do not point to general ledger and books A, B, C, and E have the impairment option enabled. PeopleSoft Asset Management processes impairment loss against the primary book B. The system then copies the impairment loss to book A and book C because they are in the same ledger group regardless of the status of the optionsCopy Impairment to other books and Copy Zero Impair/Revalue Rows . If Copy Impairment to other books is selected, the system copies the same impairment loss to book E because the impairment option is selected for that book. If the Copy Zero Impair/Revalue Rows option is selected, the system copies zero impairment loss into book D and F. If theCopy Impairment to other books option is not selected andthe Copy Zero Impair/Revalue Rows option is selected, the system copies zero impairment rows to books D and F. When both options are not selected, the system does not copy any impairment or revaluation row to books D, E and F. See Setting Up Cross-Application Installation Options, :Asset Management Page”. See Creating PeopleSoft Asset Management Cash Generating Units. |

Accounting Date |

Enter the accounting date of the impairment. |

Impairment Frequency |

Select the frequency for performing the impairment test. The options include Yearly, Semiannually, Quarterly, Monthly, and Other |

Impairment Reversal |

Select for the system to process impairment reversal instead of impairment loss. Click the Calculate button to compute the net book value, prior impairment loss, and prior revaluation reversal. Click the Calculate Impairment Loss button to calculate the total impairment loss. Note: This option is available only if impairment reversal is enabled for the business unit. |

Convention |

Select the depreciation convention. The valid values are derived from those that are defined for the business unit. |

Use FV(use fair value) |

Select to retrieve fair values that were previously captured. This selection enables the Fair Value group box and disables the Carrying Values group box. Note: You are not allowed to update fair values using the CGU impairment process. |

Carrying Values

The NBV is the equivalent to the carrying value.

Click the Calculate button to retrieve the current NBV for the selected assets.

Fair Value

Field or Control |

Description |

|---|---|

Fair Value |

Click the Calculate button to retrieve the current fair value for the selected assets. |

Net Selling Price

Field or Control |

Description |

|---|---|

NSP Percentage (%) (net selling price percentage) |

Enter the net selling price percentage. For example, suppose the net book value of an asset is 10,000.00 USD. But the net selling price (NSP) is equal to 8,000.00. The NSP percent is equal to 80 percent. Net selling price is the amount obtainable from the sale of an asset in a bargained transaction (between knowledgeable, willing parties), less the costs of disposal. |

NSP Amount) (net selling price) |

Enter the net selling price amount. |

Value In Use

Field or Control |

Description |

|---|---|

VIU % (value in use percentage) |

Enter the value in use percentage. Value in use is the present value of estimated future cash flows that is expected to arise from the continuing use of an asset, and from its disposal at the end of its useful life. For example, suppose the net book value of an asset is 10,000.00 USD. But the VIU is equal to 7,200.00 USD. The VIU percent is equal to 72 percent. |

VIU Amount |

Enter the value in use amount. Value in use is the present value of estimated future cash flows that are expected to arise from the continuing use of an asset, and from its disposal at the end of its useful life. |

Click the Calculate Impairment Loss button to compute total impairment loss.

This section discusses how to view and report impairment losses and reversals.

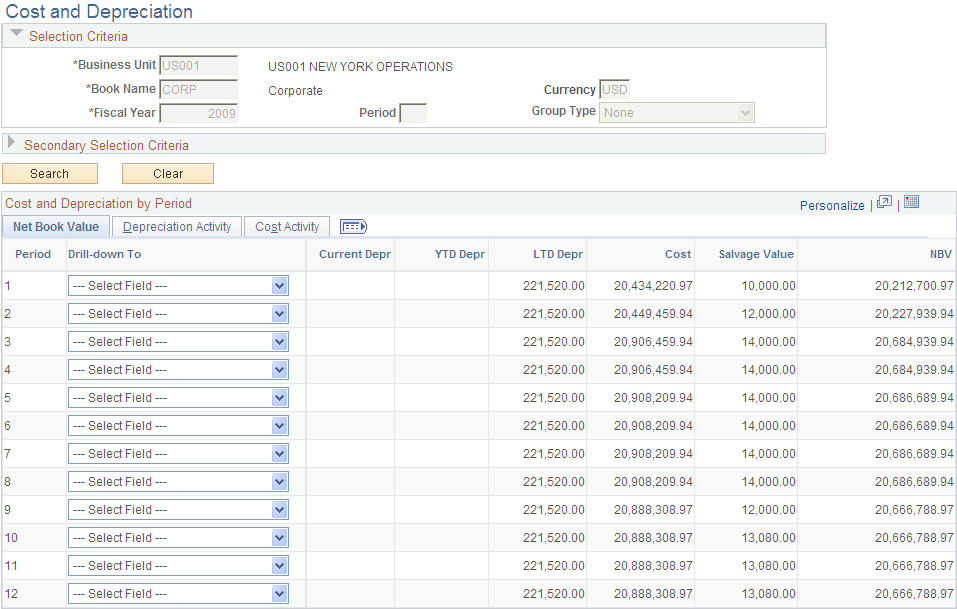

Viewing Impairment Loss Online

Use the Cost and Depreciation page (AM_REPORT1) to view impairment losses and reversals online using the Cost and Depreciation online view.

Navigation:

This example illustrates the fields and controls on the Cost and Depreciation page. You can find definitions for the fields and controls later on this page.

Use the Cost and Depreciation online view to review impairment transactions. Search by business, book name, and fiscal year (all required) or search by selected secondary ChartField criteria.

Select to drill down to details for each period by asset ID, accumulated depreciation account, fixed asset account, asset category, asset profile, department, operating unit, product or project.

Reporting Asset Impairment Activity

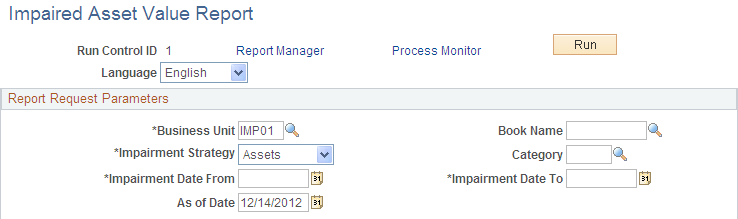

Use the Impaired Asset Value Report page (AM_IMP_RPT_RUN_CTL) to generate reports by category or CGU ID of impaired asset values.

Navigation:

This example illustrates the fields and controls on the Impaired Asset Value Report page. You can find definitions for the fields and controls later on this page.

Enter the report criteria for the report. You can have the report output sorted by asset category or by asset CGU ID. You can see the report formats in the Reports topic.

The business unit, impairment strategy and impairment date are required for the report.

Note: You must run the load depreciation report process for the dates on which you plan to evaluate the assets or CGU in order to perform the impairment.

See Transaction Reports.