Valuing Stock Purchases

This topic provides an overview of the procedures for the stock purchase valuation process and discusses how to value stock purchases.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ST_RUNCTL_STFS005 |

Produce the Estimate Contributions report to help you estimate future contributions for the valuation process. |

|

|

ST_OFFER_VALUE |

Run the valuation process. |

|

|

FAS 123 Purchase Expense Page |

ST_RUNCTL_STFS004 |

Creates the FAS 123 Purchase Expense report, which calculates the fair value expense using estimated or actual contribution data. |

For stock purchases, the system estimates the fair value of the entire offering based on the fair market value of the stock on the offering begin date or the first grant date.

To value stock purchases:

Produce the Estimate Contributions report.

The Estimate Contributions report calculates the actual contributions for a stock offering.

For each employee associated with the stock plan and offering ID you select, the report lists the grant date, purchase date, and total actual contributions for confirmed stock purchases. It also reports the total and average contribution for all employees.

This information helps you estimate future contributions for the stock offering, which you must enter before launching the Valuation process.

Run the valuation process to calculate the fair value per share.

After you estimate contributions for a stock offering, you create an offering ID and launch the online process to value the offering. The system uses the Black-Scholes Model to calculate the value per share for each valuation period. Valuation periods are determined by the valuation method:

For the single valuation method, the stock offering is valued as a whole. The valuation period runs from the offering begin date to the offering end date.

For the multiple valuation method, the stock offering is valued for each purchase date, and can have more than one valuation period. The valuation period runs from the purchase begin date to the purchase end date.

Because there is only one valuation for each stock offering, the valuation record is not effective-dated. You cannot revalue stock purchase offerings.

The value per share is calculated based on the stock purchase plan's valuation plan type.

Use the Estimate Contributions Report page (ST_RUNCTL_STFS005) to produce the Estimate Contributions report to help you estimate future contributions for the valuation process.

Navigation:

Field or Control |

Description |

|---|---|

Change Percent |

If you complete this field, the system first calculates the actual contributions for the stock offering and then increases or decreases the result by the percentage you specify. For example, if you think that contributions for a future offering will be 10% higher than the current contributions, enter 10. You can enter a positive or negative number in this field. |

Use the Create Offering Valuation page (ST_OFFER_VALUE) to run the valuation process.

Navigation:

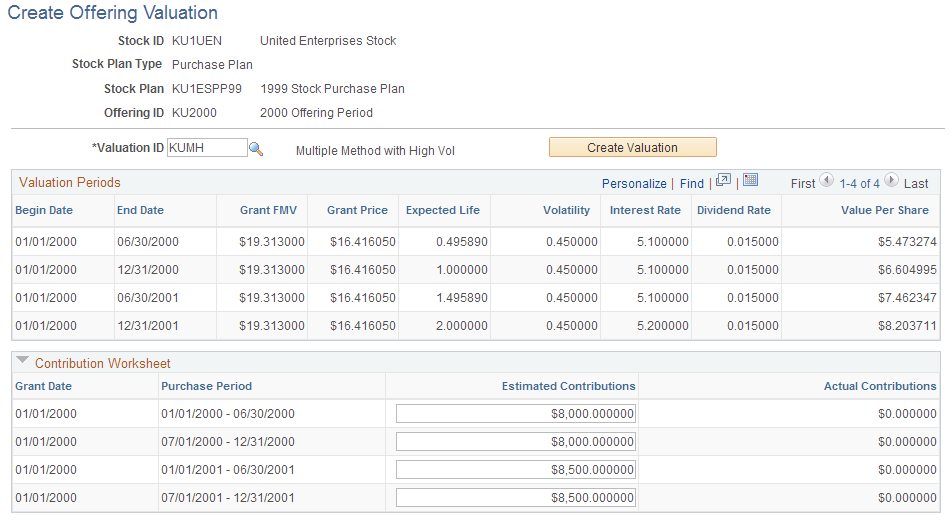

This example illustrates the Create Offering Valuation page.

To run the Valuation process for a stock offering:

Select the Valuation ID.

Enter the estimated contribution for each purchase period.

The Contribution Worksheet group box lists, for each grant date with an offering, the purchase periods to be processed. At the beginning of an offering, enter the total estimated contributions for each purchase period that is associated with the grant. You can use the Estimate Contributions report to help determine the figures that you enter. The Actual Contributions field displays any actual contributions that have been made for each grant date/purchase period combination that is confirmed.

Click the Create Valuation button to begin the process.

The Valuation Periods group box displays the results of the Valuation process.