Tracking Option Dispositions

This topic discusses how to track option dispositions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ST_OPTN_DISPOSN |

View a summary of an optionee's exercises and releases. From this page, you can access the Exercise Disposition and Release Disposition pages, where you enter dispositions. |

|

|

ST_EXER_DISPOSN |

Enter an exercise disposition. |

|

|

Exercise Disposition Payroll Data Page |

ST_EXER_PR_SBP |

View payroll details. |

|

ST_REL_DISPOSN |

Enter a release disposition. |

|

|

Release Disposition Payroll Data Page |

ST_REL_PR_SBP |

View payroll details. |

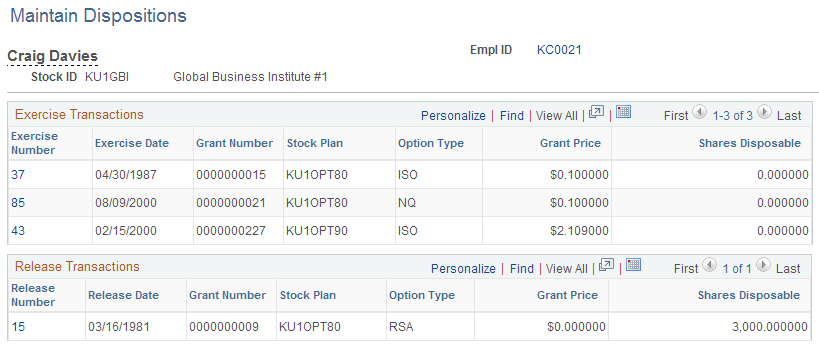

Use the Maintain Dispositions page (ST_OPTN_DISPOSN) to view a summary of an optionee's exercises and releases.

From this page, you can access the Exercise Disposition and Release Disposition pages, where you enter dispositions.

Navigation:

This example illustrates the Maintain Dispositions page.

Field or Control |

Description |

|---|---|

Exercise Number |

Click to access the Exercise Disposition page, where you can view exercise details and enter a disposition for the exercise. |

Shares Disposable |

Displays the number of shares that are available for disposal as of the current system date. |

Release Number |

Click to access the Release Disposition page, where you can view release details and enter a disposition for the release. |

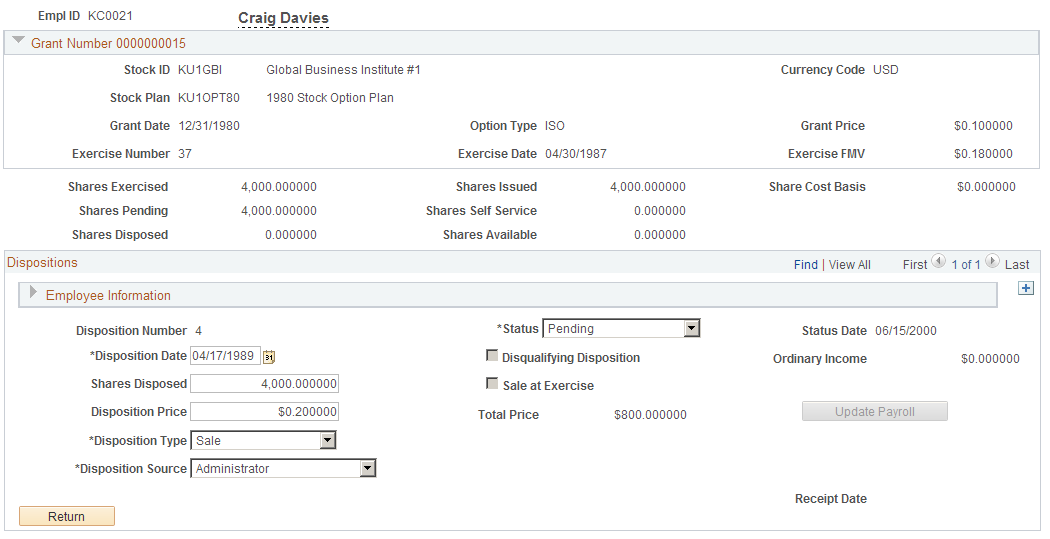

Use the Exercise Disposition page (ST_EXER_DISPOSN) to enter an exercise disposition.

Navigation:

Click an exercise number on the Maintain Dispositions page.

This example illustrates the Exercise Disposition page.

Disposition Information

Field or Control |

Description |

|---|---|

Disposition Date |

Enter the sale or transfer date. The date must be greater than or equal to the exercise date. The system displays the current date as the default value. If the optionee is an insider and the date is during a blackout period, the system displays a warning. |

Disqualifying Disposition |

Selected if the option type is ISO or ISO/SAR, the option was exercised in shares, and the sale date does not meet the holding period requirements in the governing body rules for IRS 422 plans. |

Ordinary Income |

If the transaction is a disqualifying disposition and the Disqualifying Disposition check box is selected, the system calculates and displays the ordinary income. |

Shares Disposed |

Enter the number of shares that were disposed. |

Sale at Exercise |

Selected if the shares were sold at exercise, such as in a same day sale or sell to cover transaction. Modify these dispositions using the Exercises component. |

Disposition Price |

Enter the disposition price. The exercise FMV defined on the Exercises - General page is the default. |

Total Price |

Displays the grant price multiplied by the number of shares sold. |

Disposition Type |

Select Sale (default) or Transfer. |

Disposition Source |

Select how the disposition was reported. Values are: Administrator, Self Service, and Third Party. Administrator is the default. |

Receipt Date |

Displays the date on which the disposition receipt was run. |

Update Payroll |

Click to send the ordinary income to Payroll for North America. |

Sent to Payroll Date |

Displays the date on which the transaction was sent to Payroll for North America or the manual payroll report was run for disqualifying dispositions with ordinary income. Click the date to access the Exercise Disposition Payroll Data page, where you can view payroll details. |

Reversal Date |

Displays the date on which the manual Reverse Disqualifying Disposition report was run. |

Use the Release Disposition page (ST_REL_DISPOSN) to enter a release disposition.

Navigation:

Click a release number on the Maintain Dispositions page.

This example illustrates the Release Disposition page.

Grant Information

The system displays stock information related to the release that you selected.

Field or Control |

Description |

|---|---|

83b Election |

If the optionee filed an 83b election at the time of exercise, the system selects this check box. |

Employee Information

The system displays employee information as of the disposition date.

Disposition Information

Field or Control |

Description |

|---|---|

Disposition Date |

Enter the sale or transfer date. The date must be greater than or equal to the release date. The system displays the current date as the default value. If the optionee is an insider and the date is during a blackout period, the system displays a warning. |

Disqualifying Disposition |

Selected if the option type is ISO or ISO/SAR, the option was exercised in shares, and the sale date does not meet the holding period requirements in the governing body rules for IRS 422 plans. |

Sale at Release |

Selected if the shares were sold at release, such as in a same day sale or sell to cover transaction. Modify these dispositions using the Releases component. |

Ordinary Income |

If the transaction is a disqualifying disposition and the Disqualifying Disposition check box is selected, the system calculates and displays the ordinary income. |

Disposition Price |

Enter the disposition price. The exercise FMV, which you can change, is the default. |

Disposition Type |

Select Sale or Transfer. Sale is the default. |

Receipt Date |

Displays the date on which the disposition receipt was run. |

Disposition Source |

Select how the disposition was reported. Values are: Administrator, Self Service, and Third Party. Administrator is the default. |

Update Payroll |

Click to send the transaction to payroll. |

Sent to Payroll Date |

Displays the date on which the transaction was sent to Payroll for North America or the manual payroll report was run for disqualifying dispositions with ordinary income. Click the date to access the Release Disposition Payroll Data page, where you can view payroll details. |

Reversal Date |

Displays the date on which the manual Reverse Disqualifying Disposition report was run. |