Processing Retirement Eligibility

This topic provides an overview of retirement eligibility and discusses how to process retirement eligibility.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ST_RUNCTL_STFS016 |

Run the Stock – Retirement Eligibility (ST_RET_ELIG) Application Engine process to update optionee retirement eligibility information. |

When you account for stock options, the valuation expense is distributed over the service period or vesting period of the option. However, if the optionee is eligible for retirement and the plan specifies that the options vest immediately upon retirement, then the service period ends as of the retirement eligibility date, and the remaining expense is due at that time. In this case, the total valuation expense is spread over the time from the grant date through the date of retirement eligibility.

The Stock – Retirement Eligibility (ST_RET_ELIG) Application Engine process determines which grants have met the retirement eligibility criteria or forecast eligibility criteria that you defined for the stock plan. The process evaluates each active grant in the system beginning on the grant date or the agreement date (depending on how you set up the stock option plan). Grants continue to be evaluated until the option either completely vests or expires.

For each grant being evaluated, the system compares the optionee's age and length of service with the retirement eligibility requirements and forecast eligibility requirements. When an optionee meets the eligibility criteria, the process updates the Retirement Eligible check box, the Retire Eligible Dt field, and the Forecast Retirement Eligible check box on the Maintain Grants - General page. Optionees are eligible for retirement when they meet either the normal retirement or early retirement conditions.

Note: You should process retirement eligibility daily. When an optionee becomes eligible for retirement, the Stock Option Valuation Expense Report (STFS007) processing changes. Even though the optionee has not actually retired, the expense is still accelerated and expense realized from the date of grant to the date of eligibility.

Vesting schedules are not modified when optionees become eligible for retirement; vesting modifications occur only when the optionee actually retires, and is part of the integration with PeopleSoft HR.

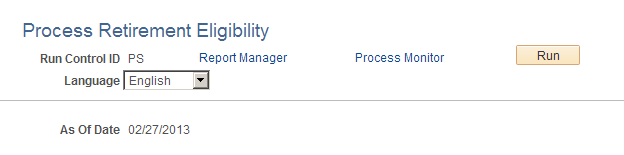

Use the Process Retirement Eligibility page (ST_RUNCTL_STFS016) to run the Stock – Retirement Eligibility (ST_RET_ELIG) Application Engine process to update optionee retirement eligibility information.

Navigation:

This example illustrates the Process Retirement Eligibility page.