(USA) Viewing and Adding Tax Classes

To view the tax class table, use the Tax Class Table component (PY_TAX_CLASS).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PY_TAX_CLASS |

Review delivered tax classes, and add additional tax classes if necessary. |

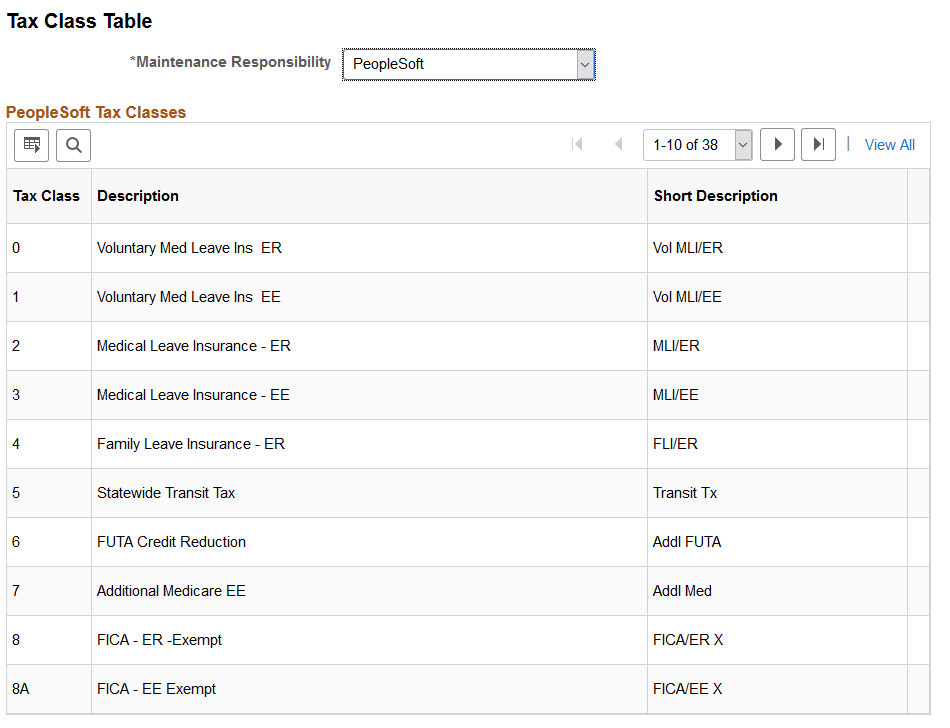

Use the Tax Class Table page (PY_TAX_CLASS) to review delivered tax classes and add additional tax classes if necessary.

Navigation:

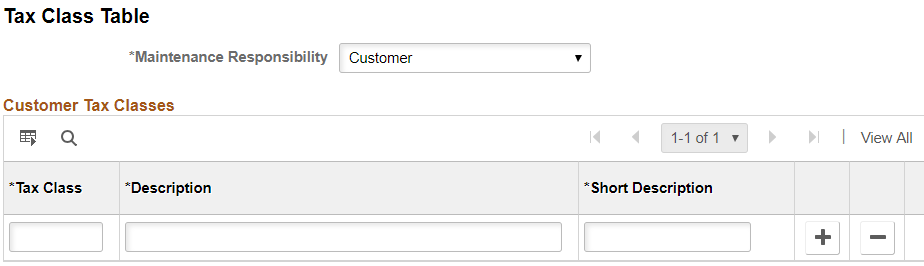

This example illustrates the Tax Class Table page for tax classes that customers maintain.

Field or Control |

Description |

|---|---|

Maintenance Responsibility |

Select PeopleSoft to view the PeopleSoft Tax Classes grid, which lists the tax classes that PeopleSoft delivers. This grid is read-only, so you cannot modify the delivered tax classes nor can you add new tax classes. Select Customer to view the Customer Tax Classes grid, where you can add and maintain additional tax classes. Important! If you add your own tax classes, you are responsible for all customizations that are necessary to use those tax classes. Simply adding a tax class to this table does not affect payroll processing. (Program Funding Configuration) An exception to this rule is when you create your own tax classes to use in Program Funding Configuration. No customizations are required to use customer-maintained tax classes for tax calculations, as well as payroll and tax reporting. However, the quarterly paid family and medical leave reports will only report tax details for PeopleSoft-maintained tax classes P01 - P04. |

Tax Class |

Displays a three-digit code for the tax class. All one-character codes are used by PeopleSoft. When you create your own tax class codes, you must use two-character or three-character codes where the first character is a number from 0 to 5. |