(USA) Specifying Parameters for Quarterly Tax Reporting

To specify parameters for quarterly tax reporting, use the Tax Reporting Parameters component (TAX_RPT_PARAMETERS).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TAX_RPT_PARAMETERS |

(USA) Set up parameters for quarterly tax reporting. |

|

|

MMREF_PARAMETERS |

(USA) Set up customer contact parameters for quarterly tax reporting. |

|

|

PY_NY_NO_SWT_DPB |

(NY) Identify benefit deductions that are subject to U.S. federal taxation but are not included in the New York definition of taxable wages. |

(USA) Use the Quarterly Tax Reporting Parameters page (TAX_RPT_PARAMETERS) to set up parameters for quarterly tax reporting.

Navigation:

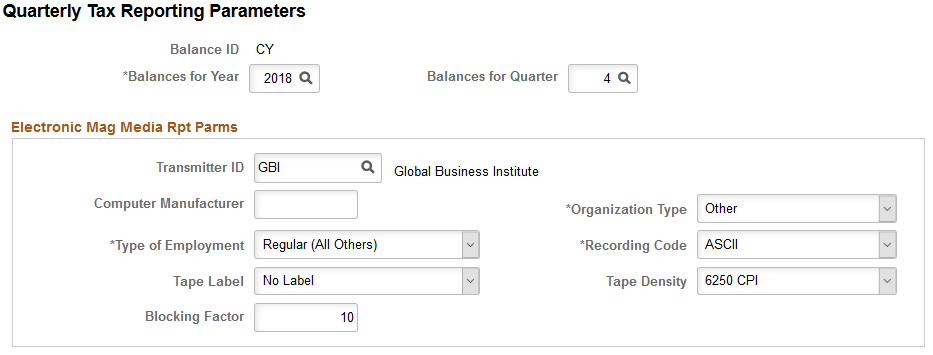

This example illustrates the fields and controls on the Quarterly Tax Reporting parameters page.

Field or Control |

Description |

|---|---|

Balances for Year |

The value you enter here defines the reporting period. |

Balances for Quarter |

The value you enter here defines the reporting period. |

Electronic Mag Media Rpt Parms

Field or Control |

Description |

|---|---|

Transmitter ID |

Enter the Company ID of the company transmitting W-2s for tax reporting. This is used in a multi-company environment when a single company acts as the transmitter for all companies in the organization. |

Computer Manufacturer |

Enter the name of the manufacturer, such as IBM, Compaq, or Digital that makes the computer you use to create the magnetic media (such as diskette or tape) for tax reporting. |

Organization Type |

Select Government or Other. |

Type of Employment |

Select Agriculture, Federal, Medicare Qualified Government Employee, Military, Railroad, or Regular (All Others). |

Recording Code |

Select ASCII or EBCDIC. |

Tape Label |

Select the type of tape label. |

Tape Density |

Select the tape density. |

Blocking Factor |

Enter the blocking factor. |

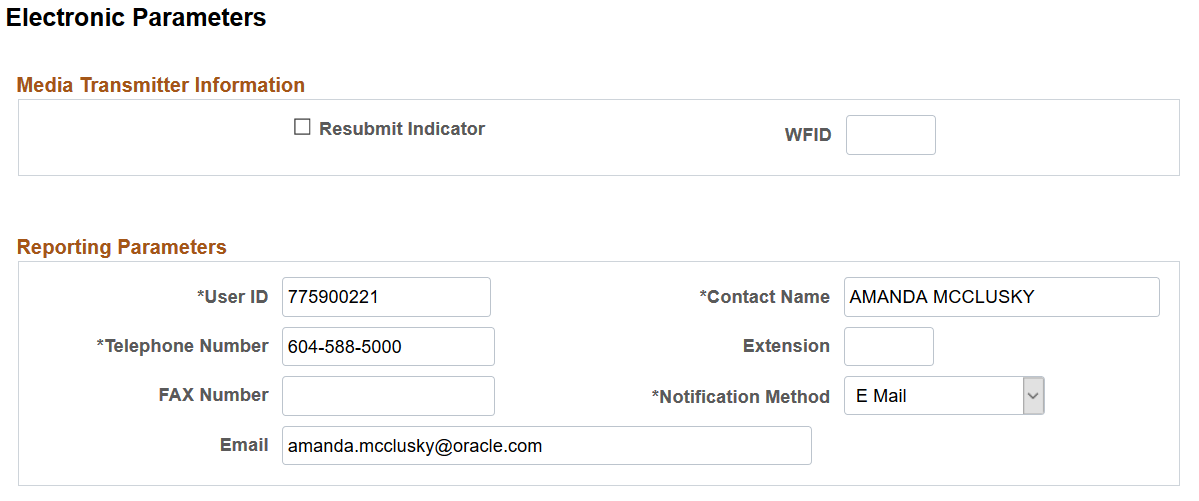

Use the Electronic Parameters page (MMREF_PARAMETERS) to set up customer contact parameters for quarterly tax reporting.

Navigation:

This example illustrates the fields and controls on the Electronic Parameters page.

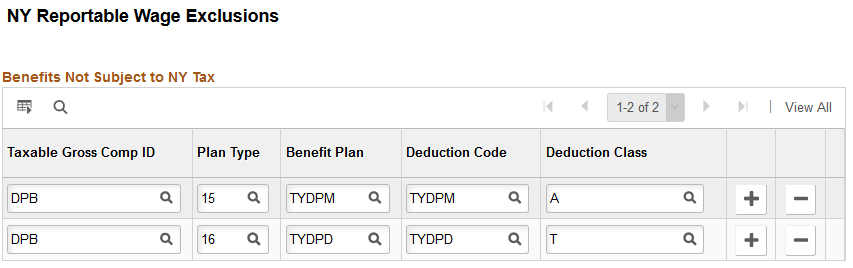

(NY) Use the NY Reportable Wage Exclusions page (PY_NY_NO_SWT_DPB)to identify benefit deductions that are subject to U.S. federal taxation but are not included in the New York definition of taxable wages.

Navigation:

This example illustrates the fields and controls on the NY Reportable Wage Exclusions page.

YTD values for deductions entered on this page are excluded from the total federal taxable wages reported as annual gross wages subject to withholding in the 1W record when TAX810NY is run for the quarter ending December 31. The values entered on this page when year-end data records are loaded must match identically the values entered on this page when TAX810NY is run for the quarter ending December 31.