(USA) Reviewing and Adjusting U.S. Tax Balances

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Tax Balances Page |

BALANCES_TAX1 |

Review an employee's federal, state, and local tax balances. |

|

Tax Balance Adjustments Page |

BALANCES_TAX2 |

Review online adjustments to an employee's tax balances. |

|

ADJ_TAX_BAL1 |

Identify the tax for which you're adjusting balances. |

|

|

ADJ_TAX_BAL2 |

Change tax balances. |

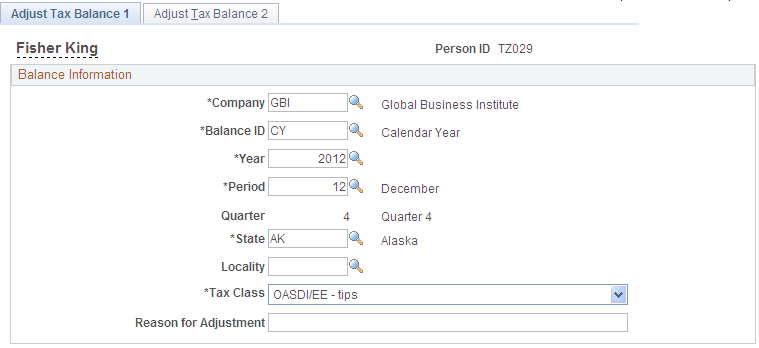

Use the Adjust Tax Balance 1 page (ADJ_TAX_BAL1) to identify the tax for which you're adjusting balances.

Navigation:

This example illustrates the fields and controls on the Adjust Tax Balance 1 page.

Identify the tax balances that you want to adjust and enter an adjustment reason.

Field or Control |

Description |

|---|---|

State |

Enter $U if you're adjusting federal tax balances. Enter $E if you're adjusting advanced Earned Income Credit balances. |

PA EIT Work PSD Code and PA EIT Residence PSD Code (Pennsylvania Earned Income Tax work and residence Political Subdivision codes) |

(These fields appear only when the state is Pennsylvania.) Under PA Act 32, you must identify the employee's work locality and residence locality for each Pennsylvania local Earned Income Tax (EIT) amount withheld from an employee. Note: To save the page, you must enter both codes when the Year is 2012 or greater, Locality is not blank, and Tax Class is Withholding. |

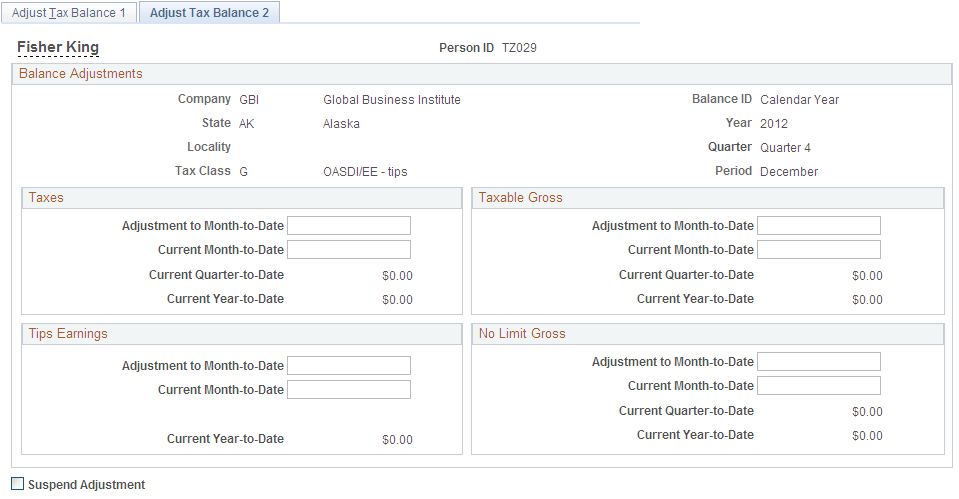

Use the Adjust Tax Balance 2 page (ADJ_TAX_BAL2) to change tax balances.

Navigation:

This example illustrates the fields and controls on the Adjust Tax Balance 2 page.

Note: To access this page you must first enter identifying criteria on the Adjust Tax Balance1 page and save it.

Field or Control |

Description |

|---|---|

Taxes, Taxable Gross, Tips Earnings and No Limit Gross |

If you enter a new current month-to-date balance, the system calculates the adjustment to month-to-date; if you enter an adjustment to month-to-date, the system calculates the new current month-to-date. |