Running Earnings Subject to Limits Reports

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PY_EARN_CAT |

Define earnings limit categories. |

|

|

PY_EARN_REDUCE_SBP |

Specify earnings codes and related information for earnings limit categories. |

|

|

RUNCTL_LIMIT_ERN |

Print Earnings Subject to Limits reports. |

The Employee FICA Threshold Limit Report (PAY032A) displays employees whose Social Security taxable wages and tips for a pay period is equal to or exceeds the threshold amount based on the paygroup’s pay frequency.

The threshold limits for the report are calculated as follows (the SQR is hardcoded with an annual amount that is used to calculate the threshold amounts):

Weekly: $104,000.00 / 52 = $2,000.00

Biweekly: $104,000.00 / 26 = $4,000.00

Semimonthly: $104,000.00 / 24 = $4,333.33

Monthly: $104,000.00 / 12 = $8.666.67

The report displays a row of data for an employee’s paycheck when it meets all these conditions:

The paycheck contains paylines with FICA Status of J (EE FICA Exmpt) or K (EE/ER FICA Exmpt).

The employee’s paycheck contains negative taxable grosses for tax classes 8A (FICA - EE Exempt) and 9A (FICA EE Tips Exempt).

The total of the sum of tax classes 8A and 9A multiplied by -1 is equal to or exceeds the threshold limit specified for the pay frequency of the pay group being processed.

For example, if the sum of tax classes 8A and 9A = -$4000; the total = -$4000 x -1 = $4000

This total amount is referred as the calculated taxable gross of the employee in this topic.

The report displays the employee’s calculated taxable gross in the Wages Subject to Threshold column, along with the corresponding paycheck page and line numbers, and a message indicating the pay frequency threshold limit that was met or exceeded.

Run PAY032A.SQR after pay calculation. The report can be run as many times as needed after each pay calculation run.

The Earnings Codes Subject to Limits Report (PAY032) is an estimate report that displays paycheck information for employees whose paid sick leave amount, paid family and medical leave amount, or paid sick leave hours for a pay period may exceed the predefined limits.

The report displays a row of data for an employee’s paycheck when it meets one or more of these conditions:

Paid sick leave or paid expanded family and medical leave earnings that may exceed the daily limit amount.

Paid sick leave hours that may exceed the maximum hour limit.

Part-time employees paid sick leave or paid expanded family and medical leave earnings that require manual review.

The report displays paid leave information such as the employee’s earnings amount for each paid leave earnings code, the special accumulator YTD amount for paid sick leave, the predefined daily limit on paid leave amount, the estimated pay period limit over a 2-week period, the total number of paid leave hours, the predefined maximum paid hour limit, and so on. Additionally, it lists messages for each employee’s paycheck to inform administrators the need to review, and if necessary, make adjustments to the paylines to ensure the proper payment. Messages include:

Estimated Daily Limit Amount Exceeded, which appears when the employee’s estimated daily pay exceeds the daily limit of the corresponding earnings code.

Estimated Pay Period Limit reduced to Maximum Yearly Earnings, an informational message that appears when the employee’s estimated pay period limit exceeds the yearly limit, and the system automatically reduces the estimated value to the maximum limit allowed by the corresponding earnings code in the Earnings Table component.

Estimated Category Hours Exceeded, which appears when the total number of paid leave hours is greater than the maximum number of hours allowed for the corresponding category.

FTE < 1.0 , an informational message that appears when the employee works part-time.

Because daily time is not tracked in the payroll system, the report provides messages when the daily limit earnings or the paid sick leave hours may exceed the limits on the current pay period. It’s the administrator’s responsibility to verify the information and adjust accordingly.

Important! All estimates on the report are based on the legislative requirements for full-time employees. Part-time employees are subject to pro-rated limits, which must be manually calculated and applied based on the employee’s work schedule.

Run PAY032.SQR after pay calculation for on-cycle and off-cycle payrolls. The report can be run as many times as needed after each pay calculation run.

Setting Up Earnings Limit Categories

Before running the Earnings Codes Subject to Limits report, you need to set up earnings limit categories and specify the maximum hour and amount limits that are used in the report:

Define a category for the qualified paid leave and specify the maximum number of leave hours allowed (if applicable) on the Earnings Limit Category Page.

Specify the earnings codes that are used for the category and the daily limit amount allowed on the Earnings Limit Table Page.

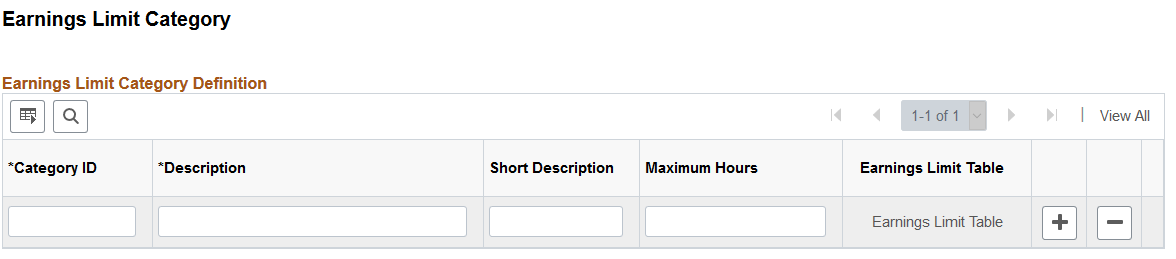

Use the Earnings Limit Category page (PY_EARN_CAT) to define earnings limit categories.

Navigation:

This example illustrates the fields and controls on the Earnings Limit Category page.

Field or Control |

Description |

|---|---|

Category ID, Description and Short Description |

Enter a unique identifier and descriptions for the paid leave category. |

Maximum Hours |

Enter the maximum number of leave hours allowed for the category, if applicable. |

Earnings Limit Table |

Click the link to access the Earnings Limit Table Page and specify applicable earnings codes and daily limits for the category. |

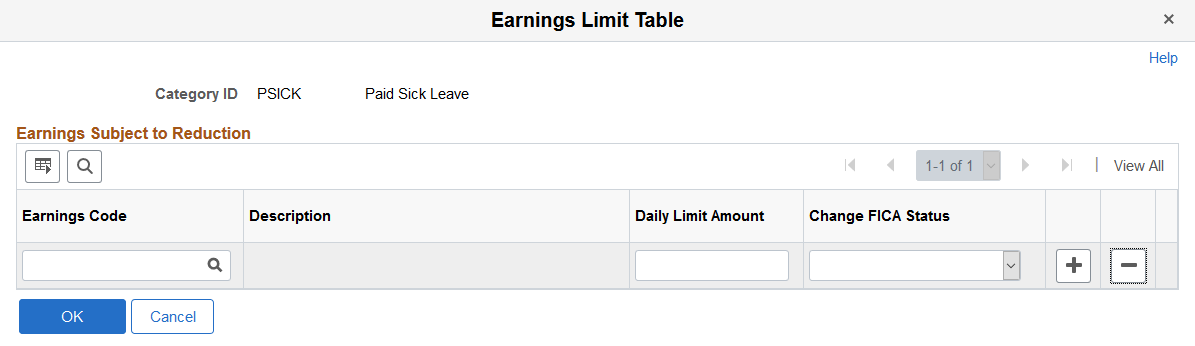

Use the Earnings Limit Table page (PY_EARN_REDUCE_SBP) to specify earnings codes and related information for earnings limit categories.

Navigation:

Click the Earnings Limit Table link on the Earnings Limit Category page.

This example illustrates the fields and controls on the Earnings Limit Category page.

Field or Control |

Description |

|---|---|

Earnings Code |

Specify one or more earnings codes that are used to pay for the corresponding paid leave category. |

Daily Limit Amount |

Enter the daily limit of the paid leave represented by the earnings code, if applicable. |

Change FICA Status |

Select the FICA status to be used for the earnings code. The value appears on the Additional Data page when you click the Additional Data link on a payline that has the earnings code. |

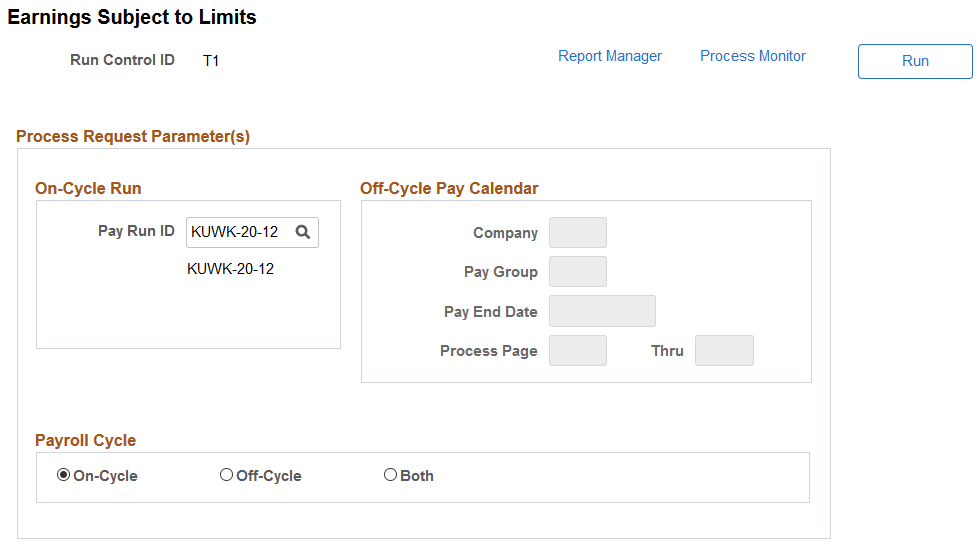

Use the Earnings Subject to Limits page (RUNCTL_LIMIT_ERN) to print Earnings Subject to Limits reports.

Navigation:

This example illustrates the fields and controls on the Earnings Subject to Limits page.

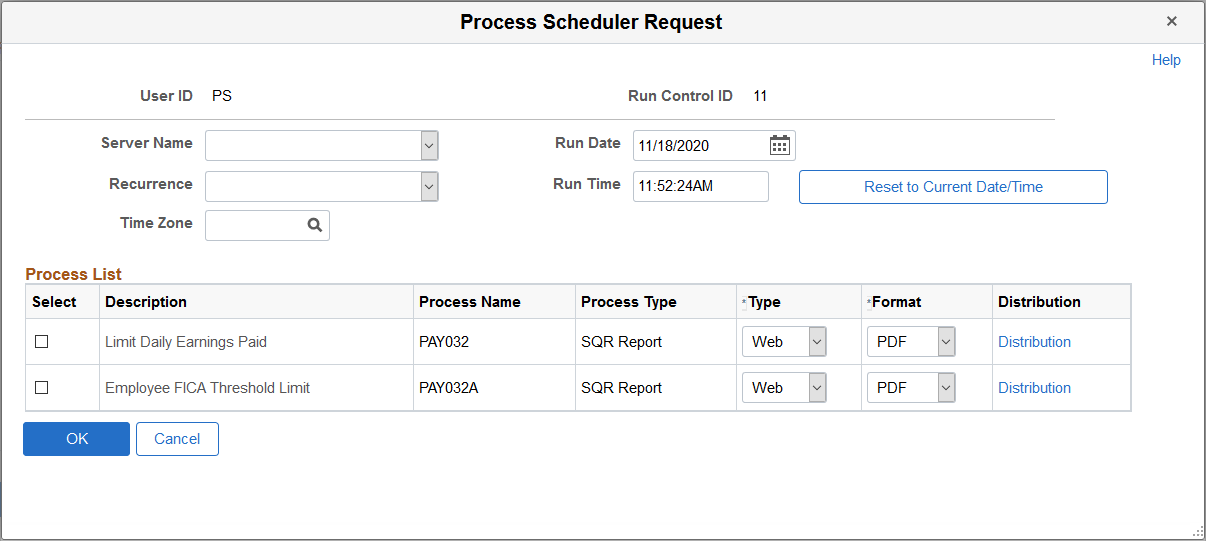

This example illustrates the fields and controls on the Earnings Subject to Limits - Process Scheduler Request page.

Select to run the PAY032, PAY032A, or both reports.