Reviewing and Adjusting Garnishment Balances

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BALANCES_GRN1 |

Review the garnishments that you have taken if you are garnishing an employee's wages. |

|

|

Garn Balance Adjustment Page |

BALANCES_GRN2 |

Review online adjustments to garnishment balances. |

|

Adjust Garnishment Balance 1 Page |

ADJ_GRN_BAL1 |

Specify which garnishment balances you're adjusting. |

|

ADJ_GRN_BAL2 |

Change garnishment balances. |

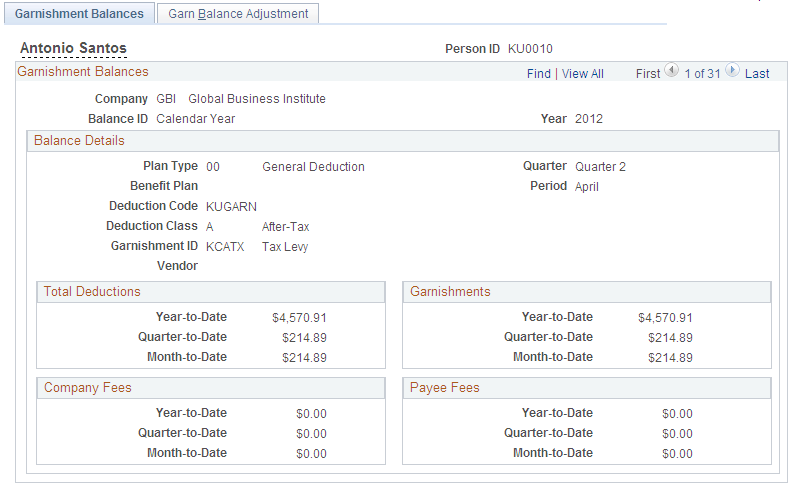

Use the Garnishment Balances page (BALANCES_GRN1) to review the garnishments that you have taken if you are garnishing an employee's wages.

Navigation:

This example illustrates the fields and controls on the Garnishment Balances page.

Field or Control |

Description |

|---|---|

Garnishments |

System-calculated limit processing results appear in this group box. If you have adjusted the garnishment balances, enter that value in the Limit Balance field on the Garnishment Spec Data 3 page . The Limit Amount and Limit Balance amounts on the Garnishment Spec Data 3 page may not correspond to the Quarter-to-Date or Month-to-Date garnishment balances that appear here if an employee has not satisfied the garnishment amount during the calendar year. For example, assume the employee has a garnishment limit amount set up for $1,000 in the current year. During the year, the employee has $700 deducted for the garnishment The Limit Amount and Limit Balance field values are not re-set when the new year begins. The employee satisfies the garnishment in the new year, so the Year-to-Date garnishment amount is $500.00, which does not match the Limit Amount and Limit Balance on the Garnishment Spec Data 3 page. |

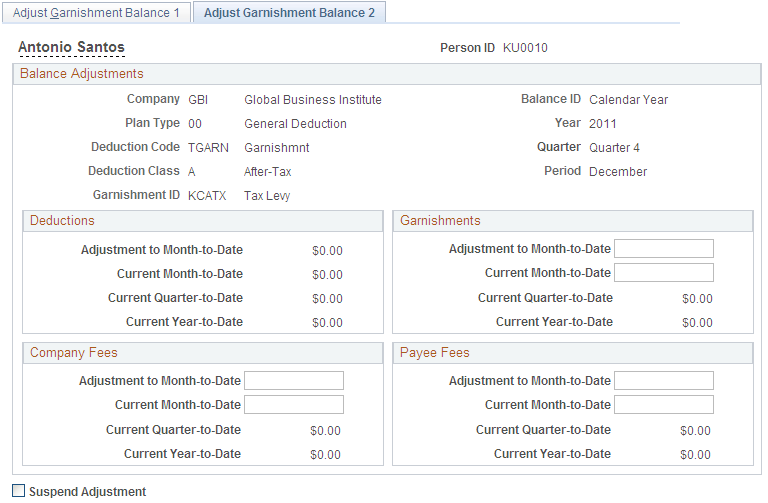

Use the Adjust Garnishment Balance 2 page (ADJ_GRN_BAL2) to change garnishment balances.

Navigation:

This example illustrates the fields and controls on the Adjust Garnishment Balance 2 page.

Note: To access this page you must first enter identifying criteria on the Adjust Garnishment Balance 1 page and save it.

Field or Control |

Description |

|---|---|

Deductions, Garnishments, Company Fees, and Payee Fees |

If you enter a new current month-to-date balance, the system calculates the adjustment to month-to-date; if you enter an adjustment to month-to-date, the system calculates the new current month-to-date. |