Reviewing and Adjusting Deduction Balances

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Deduction Balances Page |

BALANCES_DED1 |

(USA, USF) Review an employee's deduction balances. |

|

Deduction Balances Page |

BALANCES_CN_DED1 |

(CAN) Review an employee's deduction balances. |

|

Deduction Balance Adjustments Page |

BALANCES_DED2 |

(USA, USF) Review online adjustments to an employee's deduction balances. |

|

Deduction Balance Adjustments Page |

BALANCES_CN_DED2 |

(CAN) Review online adjustments to an employee's deduction balances. |

|

Adjust Deduction Balance 1 Page |

ADJ_DED_BAL1 |

(USA, USF) Identify the deduction for which you're adjusting balances. |

|

Adjust Deduction Balance 1 Page |

ADJ_CN_DED_BAL1 |

(CAN) Identify which deduction balances you want to adjust. |

|

ADJ_DED_BAL2 |

(USA, USF) Change deduction balances. |

|

|

Adjust Deduction Balance 2 Page |

ADJ_CN_DED_BAL2 |

(CAN) Change deduction balances. Note: The (CAN) Adjust Deduction Balance 2 page is the same as the (USA, USF) Adjust Deduction Balance 2 Page. |

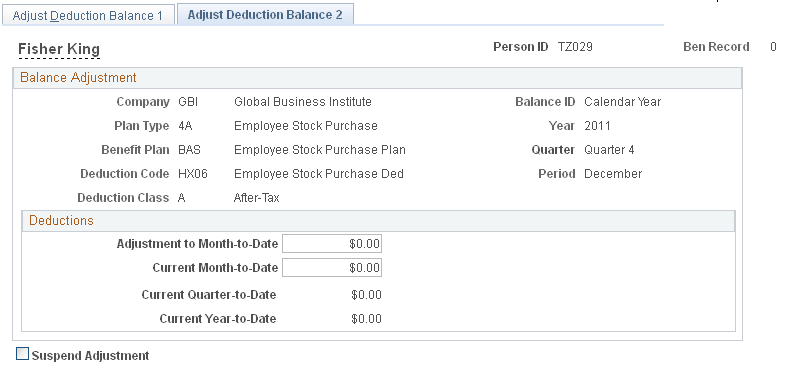

(USA, USF) Use the Adjust Deduction Balance 2 page (ADJ_DED_BAL2) to change deduction balances.

(CAN) Use the Adjust Deduction Balance 2 page (ADJ_CN_DED_BAL2) to change deduction balances.

Navigation:

This example illustrates the fields and controls on the Adjust Deduction Balance 2 page.

Note: To access this page you must first enter identifying criteria on the Adjust Deduction Balance 1 page and save it.

Field or Control |

Description |

|---|---|

Adjustment to Month-to-Date |

If you enter an adjustment, the system calculates the new current month-to-date. |

Current Month-to-Date |

If you enter a new current month-to-date balance, the system calculates the adjustment to month-to-date. |