Reviewing and Adjusting Arrears Balances

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Arrears Balances Page |

BALANCES_ARREARS |

Review an employee's arrears balances. |

|

Arrears Balance Adjustments Page |

BALANCES_ARR |

Review the arrears balance from before and after the adjustment. |

|

ADJ_ARR_BAL1 |

Identify the deduction arrears for which you're adjusting balances. |

|

|

ADJ_ARR_BAL2 |

Change the employee's arrears balances. |

Typically, the system creates an arrears balance when an employee's net pay in a pay period is insufficient to cover a deduction (provided, that is, that you defined a deduction code in the Deduction table to allow arrears). You can also create a deduction arrears balance as a payback balance for recapture in the next pay period, such as for a draw.

The system will take any outstanding deduction arrears on the employee's next check - even if the next check is a separate check, a final check or a gross-up check. Once an amount had gone into arrears, the arrears processing cannot be stopped. The system will attempt to recover the arrears associated with this deduction code during subsequent payrolls, until the amount has been reduced to zero.

If the user doesn't want the arrears to be processed on a check, for example, a gross-up check, the arrears deduction can be overridden on the payline using the By Paysheet - One-Time Deductions Page. Select Arrears Payback in the One-Time Code field and leave the Flat/Addl Amount field blank. This setup will suppress the arrears deduction from being taken on the check.

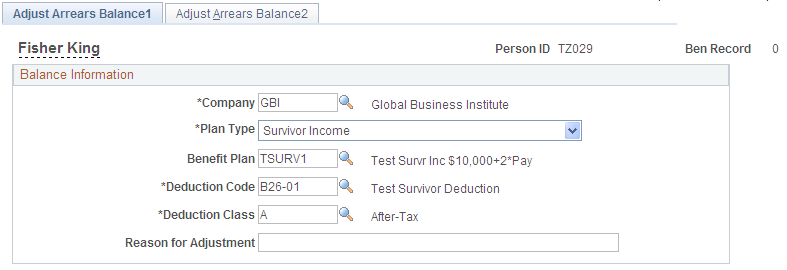

Use the Adjust Arrears Balance1 page (ADJ_ARR_BAL1) to identify the deduction arrears for which you're adjusting balances.

Navigation:

This example illustrates the fields and controls on the Adjust Arrears Balance1 page.

Identify the arrears balance that you want to adjust and enter an adjustment reason.

Note: Save this page to move to the next page. Selecting the Adjust Arrears Balance2 tab also takes you to the next page, but the fields are display only.

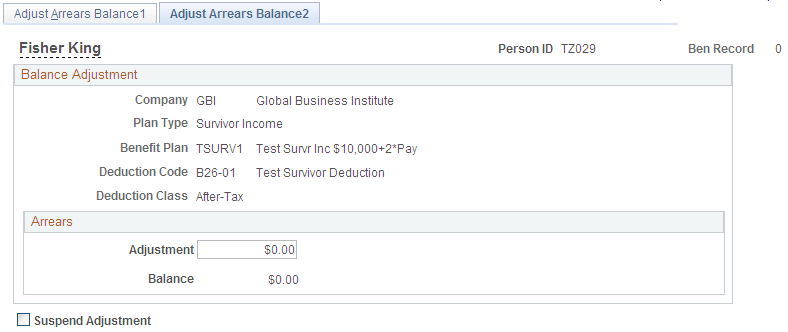

Use the Adjust Arrears Balance2 page (ADJ_ARR_BAL2) to change the employee's arrears balances.

Navigation:

This example illustrates the fields and controls on the Adjust Arrears Balance2 page.

Note: To access this page you must first enter identifying criteria on the Adjust Arrears Balance1 page and save it.

Field or Control |

Description |

|---|---|

Adjustment |

Enter the adjustment amount in this field. The system adds the amount that you enter to the balance. |