Reviewing Pay Calculation Results

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PAY_CHECK_E |

(USA, USF) View detailed earnings information and totals for calculated taxes, deductions, and net pay. |

|

|

Paycheque Earnings Page |

PAY_CHECK_E |

(CAN) View detailed earnings information and totals for calculated taxes, deductions, and net pay. The (CAN) Paycheque Earnings page is similar to the (USA) Paycheck Earnings page. |

|

Paycheck Earnings: Additional Data Page |

PAY_CHECK_E1 |

(USA, USF) View paycheck earnings information that does not appear on the Paycheck Earnings page. |

|

Paycheque Earnings: Additional Data Page |

PAY_CHECK_E1 |

(CAN) View paycheck earnings information that does not appear on the Paycheque Earnings page. |

|

PAY_CHECK_T |

(USA, USF) View detailed tax information and totals for calculated earnings, deductions, and net pay. |

|

|

Paycheque Taxes Page |

PAY_CHECK_T |

(CAN) View detailed tax information and totals for calculated earnings, deductions, and net pay. The (CAN) Paycheque Taxes page is similar to the (USA) Paycheck Taxes page. |

|

PAY_CHECK_D |

(USA, USF) View detailed deduction information and totals for calculated earnings, taxes, and net pay. |

|

|

Paycheque Deductions Page |

PAY_CHECK_D |

(CAN) View detailed deduction information and totals for calculated earnings, taxes, and net pay. The (CAN) Paycheque Deductions page is similar to the (USA) Paycheck Deductions page. |

|

Review Paycheck Summary Page |

PAY_CHECK_SUMM |

(USA, USF) View information such as earnings, taxes, and deductions for a single paycheck. Research problems and respond to employee questions regarding a check without viewing multiple pages. |

|

Review Paycheque Summary Page |

PAY_CHECK_SUMM_CN |

(CAN) View information such as earnings, taxes, and deductions for a single paycheck. Research problems and respond to employee questions regarding a check without viewing multiple pages. |

|

Review FLSA Pay Data Page (review fair labor standards act pay data page) |

FLSA_PAY |

(USA, USF) View an employee's earnings by FLSA period. Only paycheck data eligible for FLSA calculation appears on this page. Before viewing this page, you must run the Pay Calculation COBOL SQL process (PSPPYRUN). |

|

Review/Print Online Check Page |

PAY_OL_CHECK_S |

(USA, USF, CAN) View the calculation results of the Online Check process. This page appears automatically each time that you submit an online check for calculation. |

After running the pay calculation, view the results of paycheck earnings, deductions, and taxes using the Review Paycheck pages in the Payroll for North America, Payroll Processing menu.

Each page displays different information for a check. For example, one page displays earnings data, while another displays deduction data. The pages also contain paysheet data so that you can access the pages by pay group, pay period end date, page number, and line number. You can also access Paycheck pages by employee ID or check number.

Note: Paycheck numbers are not assigned until you complete the confirmation process. The pages also displays the calculation status and the type of check that is being calculated.

You can't view the Paycheck pages for a check that you changed on the paysheets since the last time you ran the pay calculation. If you try, you receive a message stating that no records match your specified keys.

In other words, when you change an employee's pay data on the paysheets, the system doesn't immediately update the corresponding Paycheck page. It updates this information when you run the pay calculation. Until then, you cannot view the Paycheck page. This is to avoid the confusion that might arise if an employee's paysheet contains updated information and the Paycheck page contains information that is not updated.

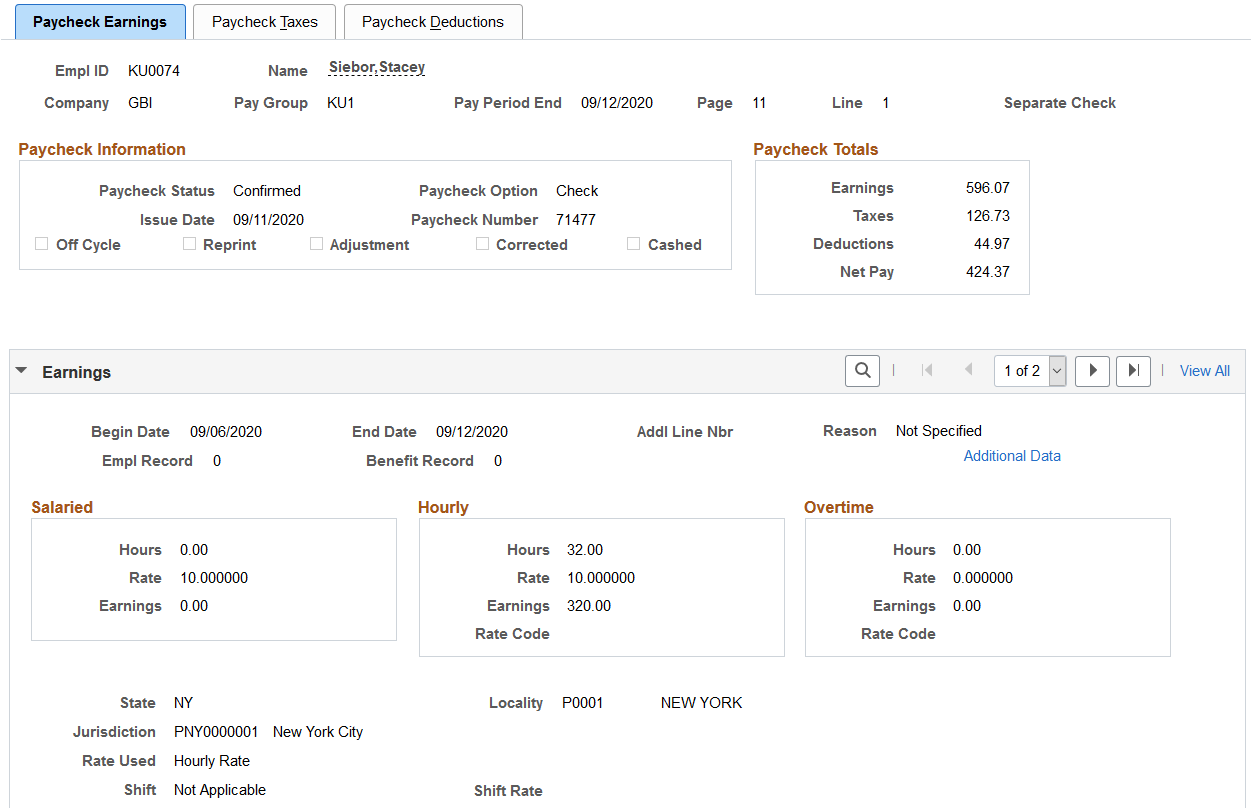

(USA, USF) Use the Paycheck Earnings page (PAY_CHECK_E) to view detailed earnings information and totals for calculated taxes, deductions, and net pay.

Note: (CAN) The Paycheque earnings page is similar to the U.S. version.

Navigation:

This example illustrates the fields and controls on the Paycheck Earnings page (1 of 2).

This example illustrates the fields and controls on the Paycheck Earnings page (2 of 2).

Paycheck Information

Field or Control |

Description |

|---|---|

Off Cycle |

Selected if the payment was processed in an off-cycle payroll. |

Reprint |

Selected if the Check Reprint COBOL SQL process (PSPRPRNT) was used to renumber the check. |

Adjustment |

Selected on the reversal check and the adjustment check processed by the Reversal/Adjustment COBOL SQL process (PSPPYREV). If processing a reversal only, this indicator is selected on the check reversal. |

Corrected |

Selected by the Retro Distribution DB Update PSJob process (HPRETDST) during commitment accounting retroactive distribution processing. This indicator is not related to the payroll adjustment process. |

Cashed |

Selected by the Check Reconciliation SQR Report process (PAY015A) when the check has been cashed. |

(CAN) Province

The province shown on the Paycheque Earnings page is the province of employment.

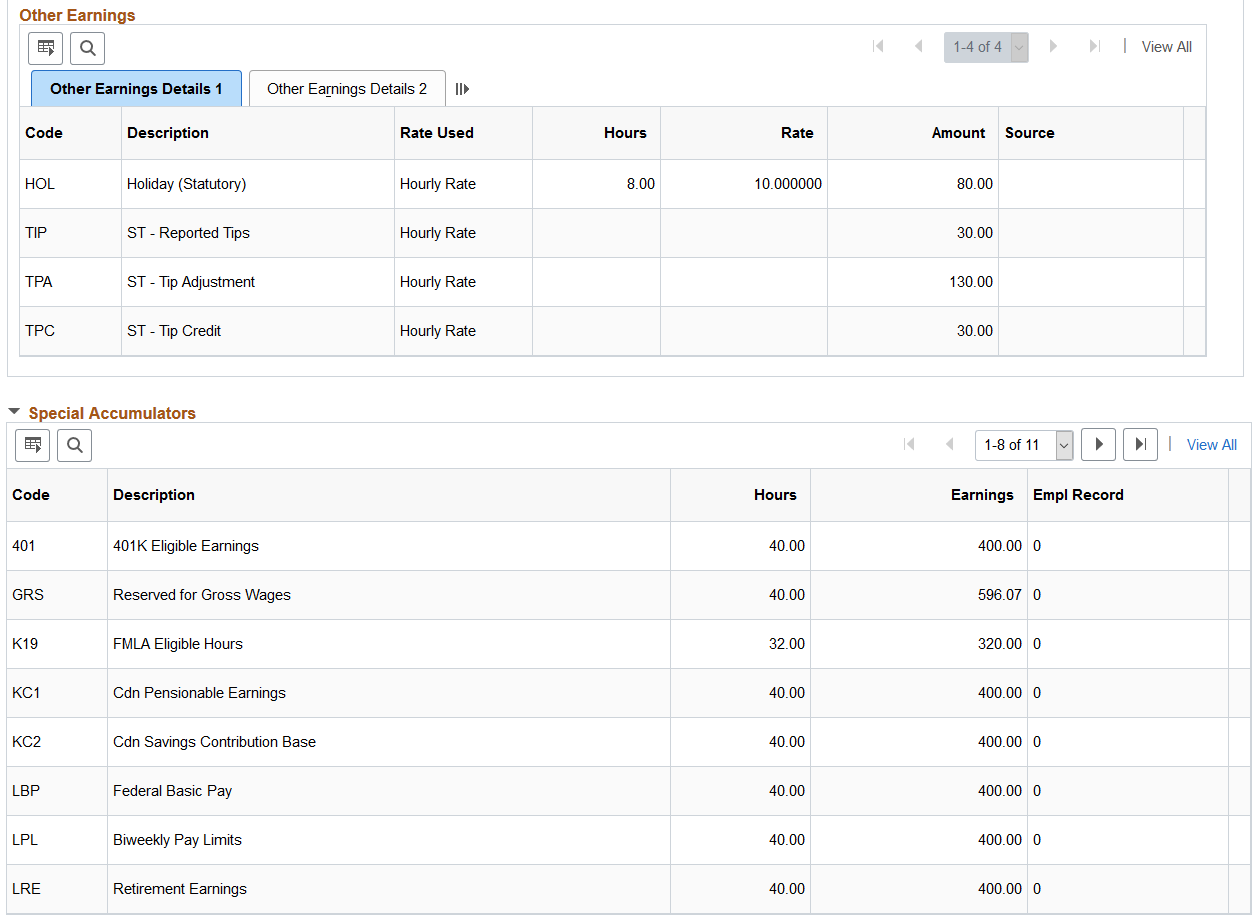

(USA, USF) Use the Paycheck Taxes page (PAY_CHECK_T) to view detailed tax information and totals for calculated earnings, deductions, and net pay.

Note: (CAN) The Paycheque Taxes page is similar to the U.S. version.

Navigation:

Payroll for North AmericaPayroll Processing CANProduce PayrollReview Paycheque

This example illustrates the fields and controls on the Paycheck Taxes page.

Note: (CAN) The Paycheque Earnings page is similar to the U.S. version.

(USA and USF) State

Field or Control |

Description |

|---|---|

Taxable Gross Adjustments |

Click this link on the Tax Details 2 tab, to access the Taxable Gross Adjustments page where you can view state deduction taxable gross adjustments. |

(CAN) Province

Field or Control |

Description |

|---|---|

Taxation Province |

Displays the employee's taxation province. |

Employment Province |

If the employee is taxed in a province other than the employment province, this field displays the employment province. |

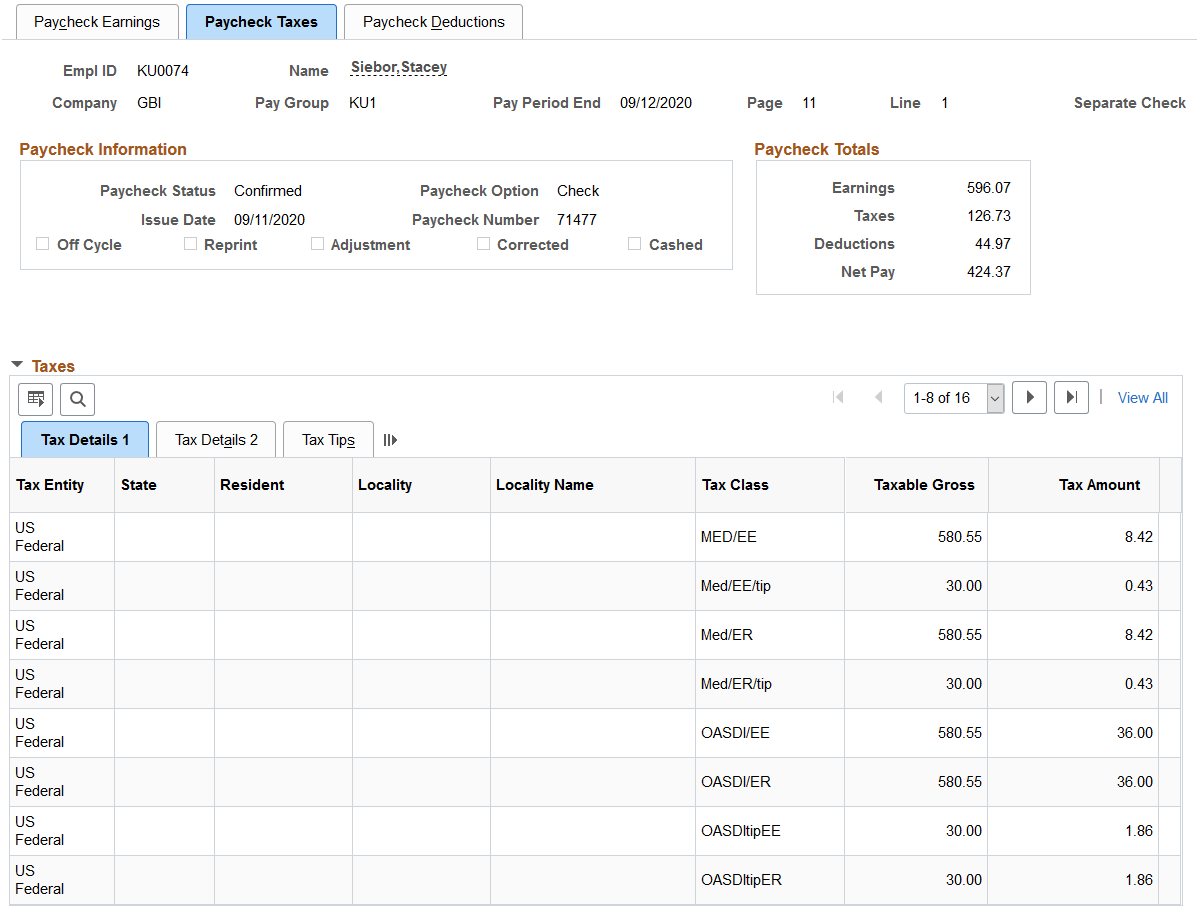

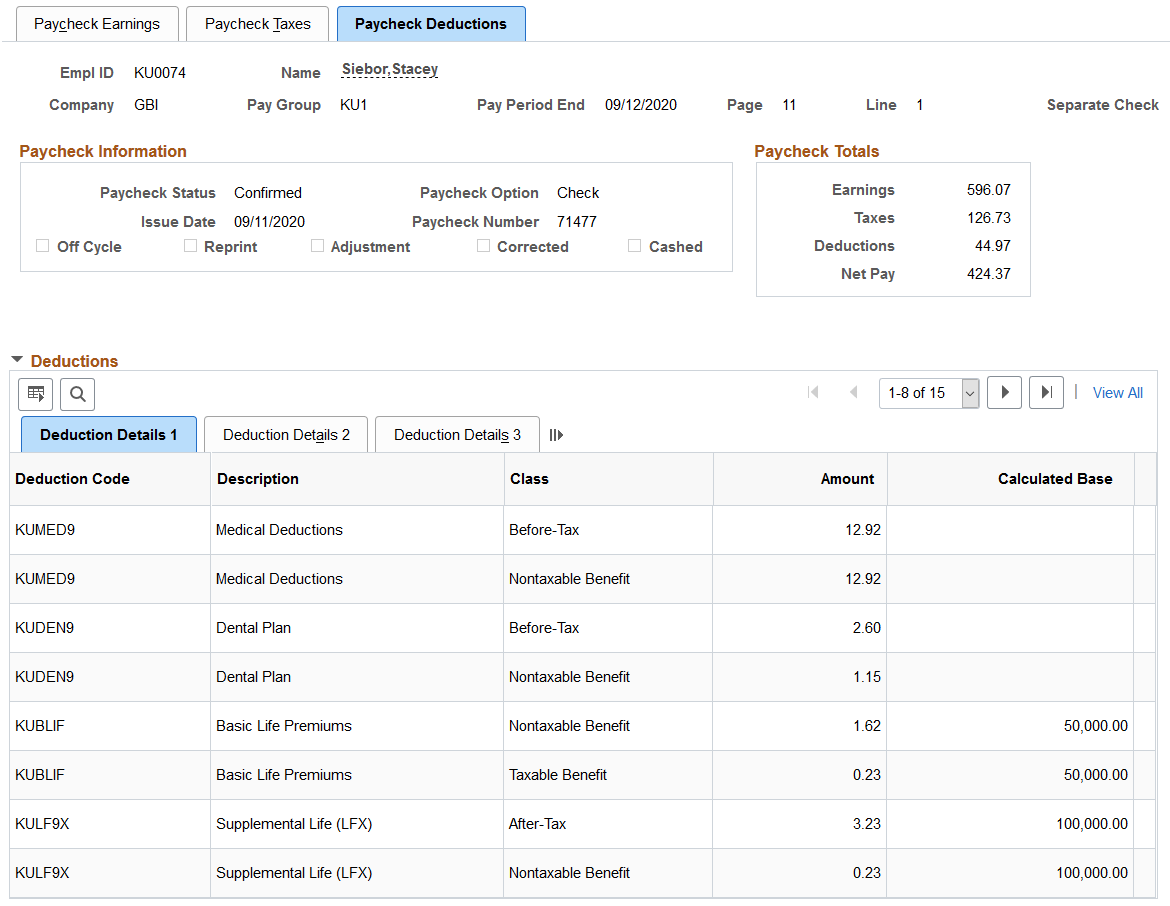

(USA, USF) Use the Paycheck Deductions page (PAY_CHECK_D) to view detailed deduction information and totals for calculated earnings, taxes, and net pay.

Note: (CAN) The Paycheque Deductions page is identical to the U.S. version, with the addition of sales tax amounts.

Navigation:

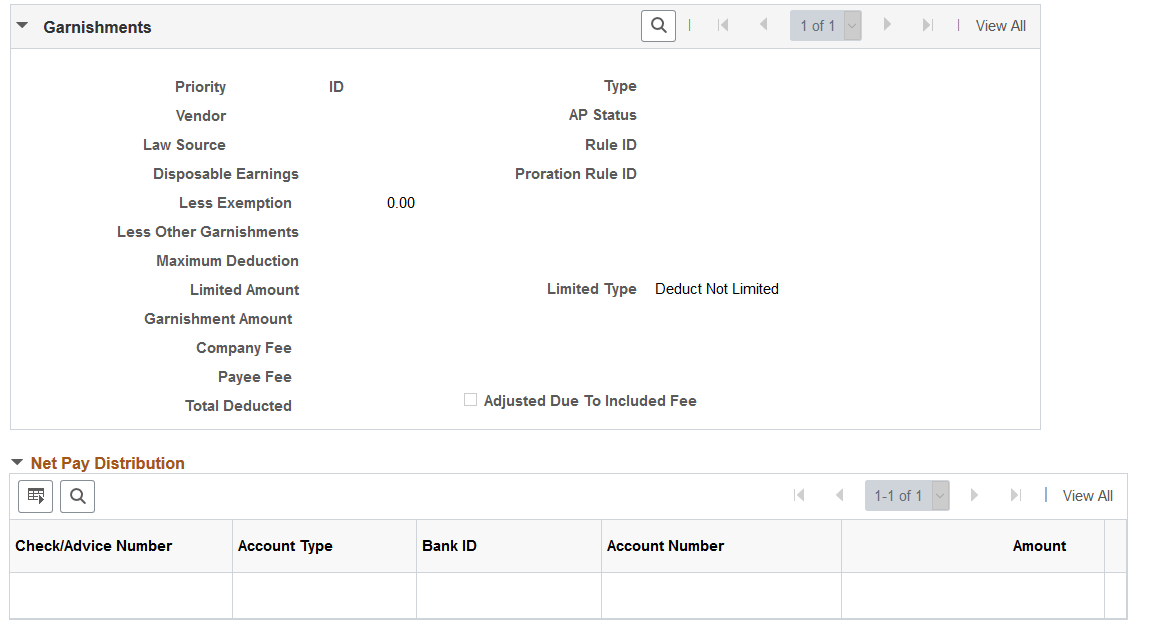

This example illustrates the fields and controls on the Paycheck Deductions page (1 of 2).

This example illustrates the fields and controls on the Paycheck Deductions page (2 of 2).

Note: When an employee has child support orders from two or more states, the system uses the Garnishment Proration process to select the maximum deduction that provides the most money for the children. For example, if state A has a maximum deduction of 1200 USD, and state B has a maximum deduction of 900 USD, the system uses the maximum deduction of 1200 USD for both child support orders.

Field or Control |

Description |

|---|---|

Maximum Deduction |

Displays messages indicating the presence or absence of limitations placed on the garnishment after the system calculated the maximum deduction: Deduct Not Limited: Indicates that no further limitations were placed on the garnishment. Deduct Limited by Calculation: Indicates that the deduction was limited by one of the deduction calculation amounts or percentages from the Garnishment Spec Data 4 or 5 pages. Deduct Limited by Total Amount and Deduct Limited by Monthly Amount: Indicate that the system used the limitations from the Garnishment Spec Data 3 page. Deduction Limited by Proration: Indicates that the deduction was limited by the proration rule displayed in the Prorate Rule ID field. |

Adjusted Due To Included Fee |

If the system adjusted the calculation for fees included in disposable earnings, this check box is selected. There are two ways the system takes fees:

Specify whether to include the company and payee fees in disposable earnings on the Garnishment Spec Data 3 page. If the sum of the calculated garnishment amount and the fee is greater than the maximum allowed (disposable earnings minus exemptions), the system makes an adjustment. If you take the fees on top of the disposable earnings, then the fees that the system takes have no impact on the garnishment amount. For example, if the system determines that you can take a garnishment of 177.00 CAD, and you have fees that are not included in the disposable earnings, then the garnishment amount remains 177.00 CAD. However, if the order specifies that you take 5.00 CAD for the company fee, but that fee must be included in disposable earnings, then the system adjusts the amount to be garnished and selects the Adjusted Due To Included Fee check box. If the system has adjusted the garnishment amount based on a percentage of the deduction, the Adjusted Due To Included Fee check box is selected, and the garnishment amount differs from the maximum deduction amount by the amount of the adjustment. |

(USA, USF) Use the Review FLSA Pay Data (review Fair Labor Standards Act pay data) page (FLSA_PAY) to view an employee's earnings by FLSA period. Only paycheck data eligible for FLSA calculation appears on this page.

Note: Before viewing this page, you must run the Pay Calculation COBOL SQL process (PSPPYRUN).

Navigation:

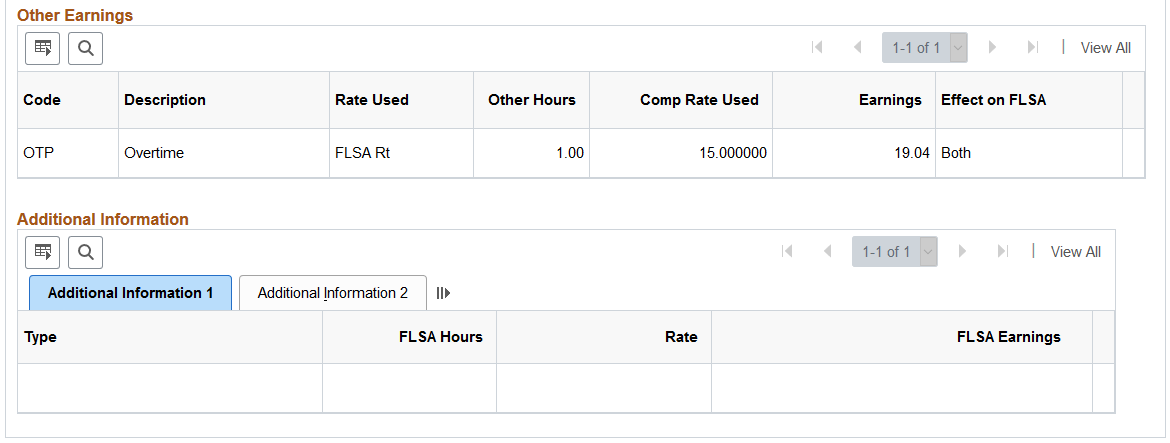

This example illustrates the fields and controls on the Review FLSA Pay Data page (2 of 2).

Most of the fields on this page are identical to those on the Paysheet page. This topic documents only the additional fields.

Note: For employees in multiple jobs, earnings from jobs that belong to pay groups for which FLSA is not required and jobs not having an FLSA status of nonexempt are not visible on the page.

See Setting Up for FLSA Calculation.

Dynamic Field Display for FLSA Rate and Alternative Rate

When Alternative Overtime processing has been used, the Alternative Rate field label and rate will dynamically display on the employee's pay check inquiry pages instead of FLSA Rate.

Field or Control |

Description |

|---|---|

Rate Used |

Displays the rate used to calculate overtime. When the overtime has been calculated by the alternative method, the rate is displayed with the label Alternative Rate rather than FLSA Rate. |

Additional Information

Information in the first column identifies the type of calculation. Values are:

Field or Control |

Description |

|---|---|

Pay Period Average Reg Earns (pay period average regular earnings) |

Provides additional information when the annualized allocation of standard hours and rate for regular earnings does not reflect the actual hours and rate worked for a monthly or semimonthly period. The following fields are populated: FLSA Hours (Fair Labor Standards Act hours), Rate, FLSA Earnings, (Fair Labor Standards Act earnings), Days in Period, Work Day Hours, and Pay Period Earn (pay period earnings). |

Basic Formula Earnings |

Provides information to help compute the Basic Formula FLSA Rate for salaried employees. The following fields are populated: Days in Period, Work Day Hours, and Pay Period Earn. |

Weekly Wage Equivalent |

Provides information to compute the weekly wage equivalent when calculating for semimonthly and monthly salaried employees with fixed or unspecified hours. For fixed hours calculations, the FLSA Hours field displays the standard hours. For unspecified hours calculations, the FLSA Hours field is empty because the actual hours in pay check is used. For both fixed and unspecified hours calculations, the FLSA Earns field displays the weekly wage equivalent earnings. |