Overtime Pay Calculations on Flat Sum Bonus Payments

This topic lists the formula and several examples for overtime pay calculation on flat sum bonus payments:

Overtime pay calculation on flat sum bonus payment (Option 1 - overtime paid with one earnings code).

Overtime pay calculation on flat sum bonus payment (Option 2 - overtime paid with two earnings codes).

Overtime pay calculation on adjusted flat sum bonus payment.

Overtime pay calculation on flat sum bonus payment that spans multiple pay periods.

To calculate the overtime pay on a flat sum bonus, the system first calculates the regular bonus rate using this formula:

Note: Number of Regular Hours = Hours associated with earnings codes that have the Category for FLSA field value set to Regular.

Then, the overtime pay on flat sum bonus is calculated using this formula:

Note: Overtime pay is typically set up in two ways in Payroll for North America, one with one earnings code, and the other with two. The option 1 example describes the overtime pay calculation using one earnings code, which is the common method. The option 2 example describes the overtime pay calculation using two earnings codes: OTP to pay for the straight time hours, and OTQ for the premium portion only.

In this example, suppose that on the Overtime on Flat Sum Bonus Table Page:

Overtime earnings code OTP (time-and-one-half) is mapped to overtime on flat sum bonus earnings code OT3.

Overtime earnings code DBT (double-time) is mapped to overtime on flat sum bonus earnings code OT4.

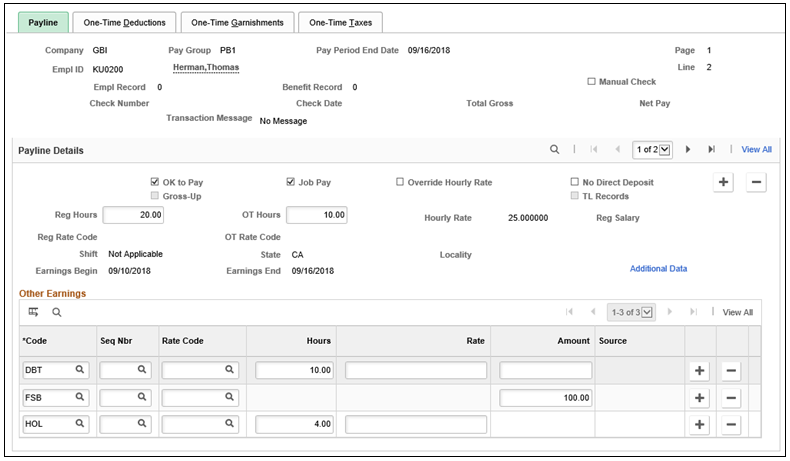

The user enters information such as flat sum bonus, overtime and double time hours to the payline:

Term

Definition

Current Pay Period

09/10/2018 - 09/16/2018

FLSA Period

09/10/2018 - 09/16/2018

Flat Sum Bonus (FSB)

$100

Reg Hours

20 hours

Holiday Hour (HOL)

4 hours

HOL (holiday) earnings code is set up to reduce regular hours, and is not subject to FLSA (Category for FLSA = Excluded)

OT Hours

10 hours

Double Time Hour (DBT)

10 hours

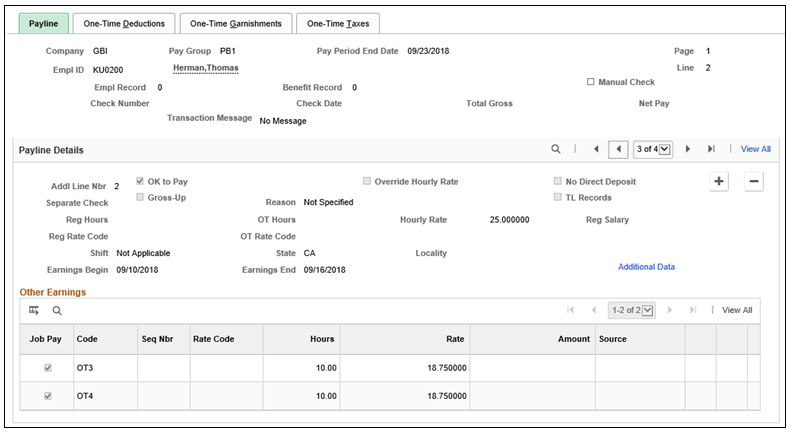

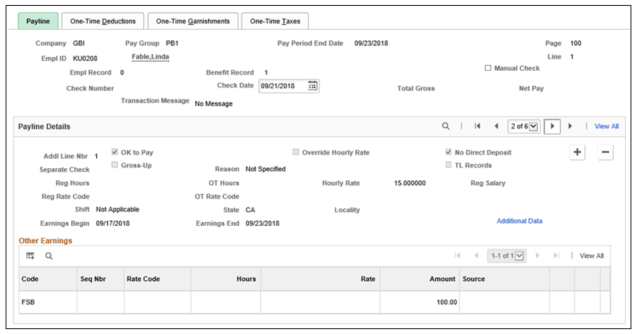

This example illustrates the fields and controls on the Payline page where flat sum bonus information is inserted.

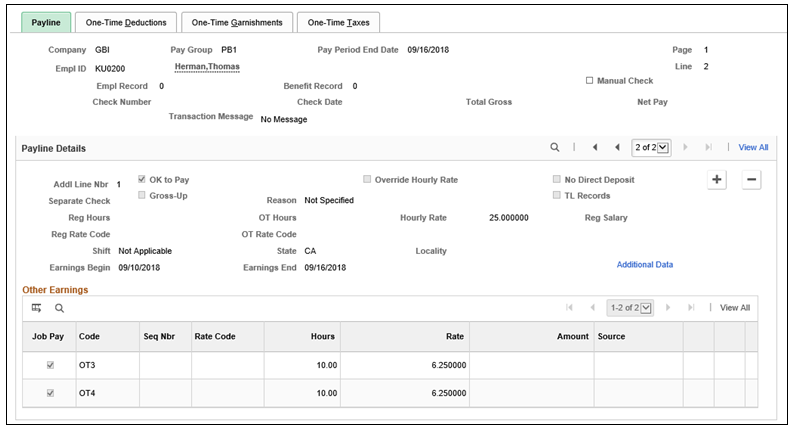

The system calculates the regular bonus rate in Pay Calculation, and inserts a new payline that contains the mapped earnings codes OT3 and OT4 in the Other Earnings section. Each earnings code row displays the corresponding number of hours, and the calculated regular bonus rate before the multiplication factor is applied, which is $6.25 ($100 / 16).

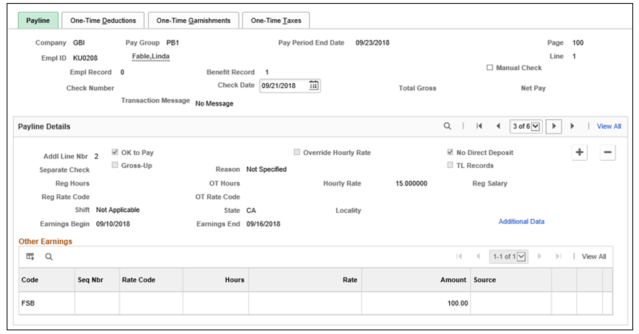

This example illustrates the fields and controls on the Payline page where mapped overtime codes, hours and calculated bonus rate are displayed.

This payline is system-generated and is not editable.

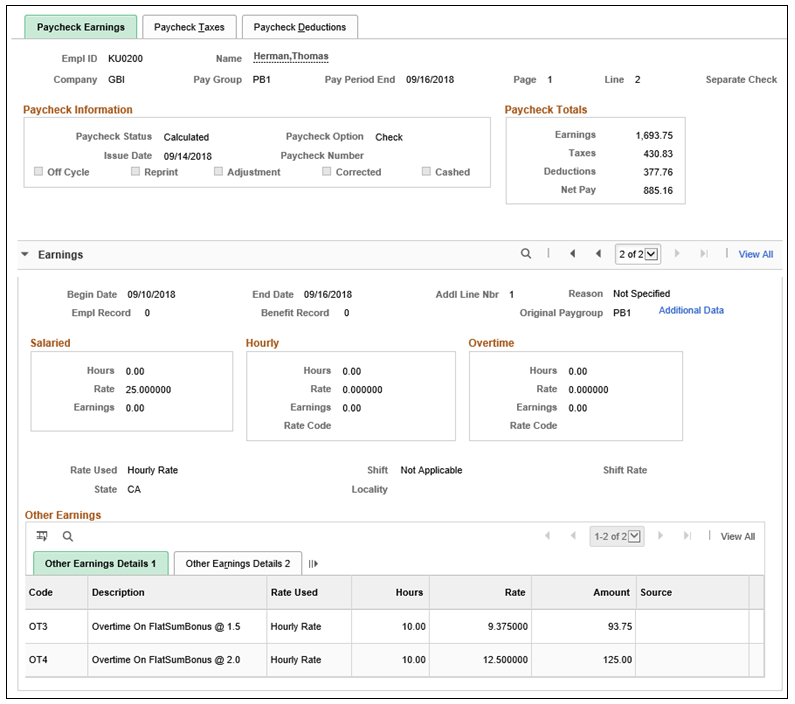

The paycheck displays the calculated hourly rate with the multiplication factor applied and amount for each of the Overtime on Flat Sum Bonus earnings codes OT3 and OT4:

Time-and-one-half (1.5) Overtime Pay on Flat Sum Bonus (OT3):

$6.25 x 1.5 x 10 = $93.75

Double-time (2.0) Pay on Flat Sum Bonus (OT4):

$6.25 x 2 x 10 = $125.00

This example illustrates the fields and controls on the Paycheck Earnings page where the calculated hourly rates (multiplication factor applied) and amounts for overtime on flat sum bonus are displayed.

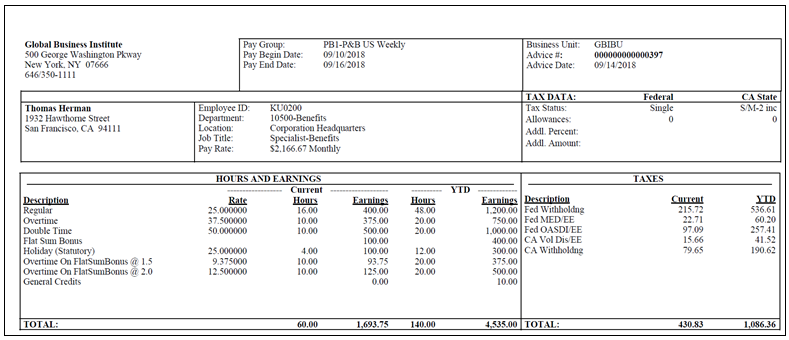

Detail lines for the Overtime on Flat Sum Bonus calculations are displayed in the PDF version of the paycheck as follows:

This example illustrates the PDF version of the paycheck where overtime pay on flat sum bonus is displayed.

In this example, suppose that on the Overtime on Flat Sum Bonus Table Page:

Overtime earnings code OTP (straight time) is mapped to overtime on flat sum bonus earnings code OT3.

Setup for the OTP earnings code:

Payment Type: Hours Only

Effect on FLSA: Both Hours and Amount

Multiplication Factor: 1.0

Category for FLSA: Overtime

Regular Pay Included: [Cleared]

Overtime earnings code OTQ (half-time) is mapped to overtime on flat sum bonus earnings code OT4.

Setup for the OTQ earnings code:

Payment Type: Both Hours and Amount OK

Effect on FLSA: None

Multiplication Factor: 0.5

Category for FLSA: Overtime

Regular Pay Included: [Cleared]

The user enters information such as flat sum bonus, straight time overtime and half time overtime to the payline:

Term

Definition

Current Pay Period

12/30/2018 - 01/05/2019

FLSA Period

12/30/2018 - 01/05/2019

Flat Sum Bonus (FSB)

$245

Reg Hours

40 hours

OT Hours - Straight Time (OTP)

3.5 hours

OT Hours - Half Time (OTQ)

3.5 hours

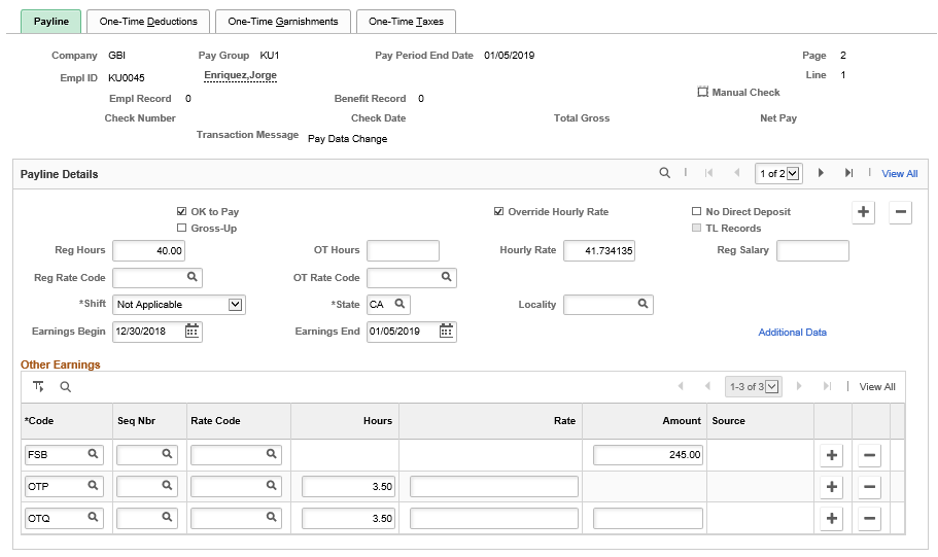

This example illustrates the fields and controls on the Payline page where flat sum bonus and overtime information is inserted.

The system calculates the regular bonus rate, which is $6.125 ($245/40) in this example, in Pay Calculation.

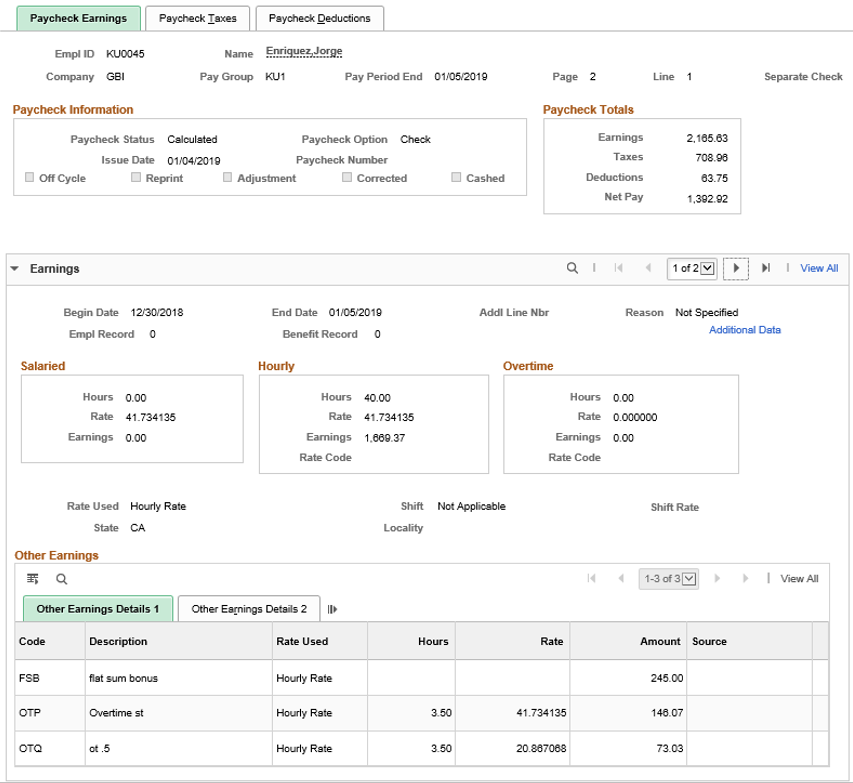

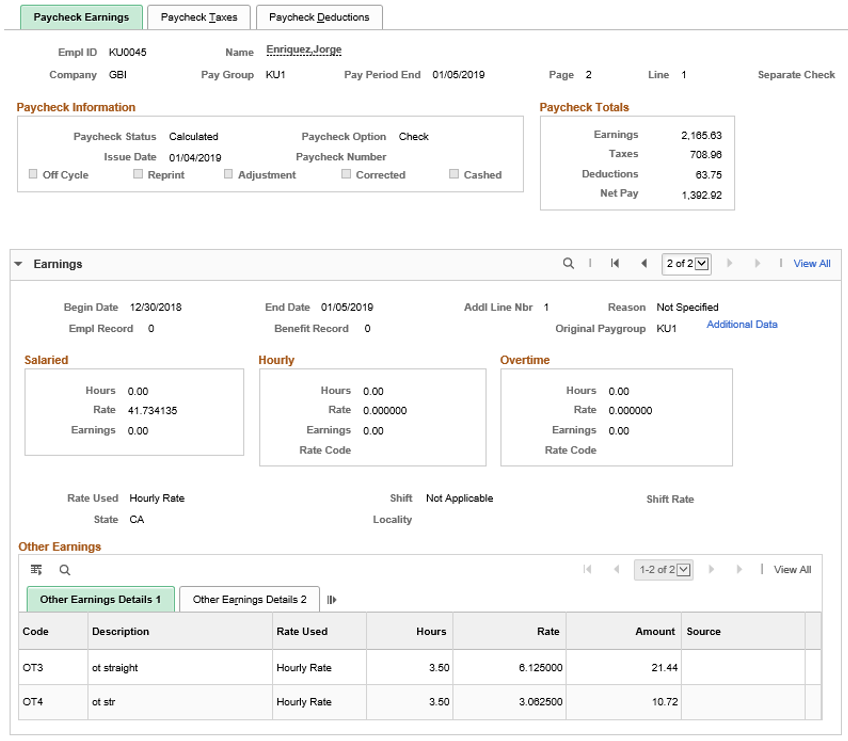

The paycheck displays the calculated hourly rate (hourly rate or regular bonus rate, with the multiplication factor applied) and amount for each of the Overtime earnings codes (OTP and OTQ) and Overtime on Flat Sum Bonus earnings codes (OT3 and OT4) in the Other Earnings section of the paycheck:

Straight time (1.0) Overtime Pay (OTP):

$41.734135 x 1.0 x 3.5 = $146.07

Half time (0.5) Overtime Pay (OTQ):

$41.734135 x 0.5 x 3.5= $73.03

Straight time (1.0) Overtime Pay on Flat Sum Bonus (OT3):

$6.125 x 1.0 x 3.5= $21.44

Half time (0.5) Pay on Flat Sum Bonus (OT4):

$6.125 x 0.5 x 3.5 = $10.72

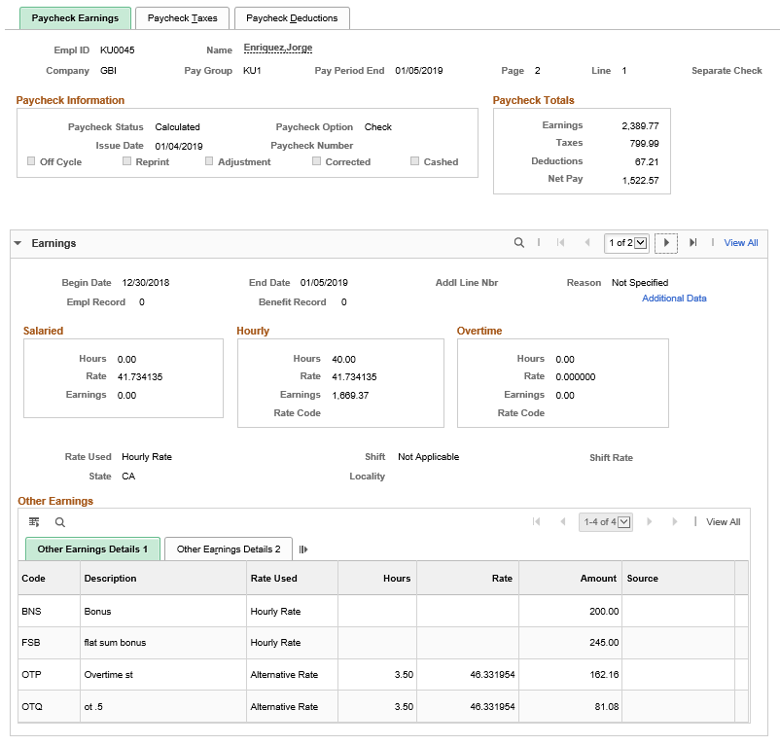

This example illustrates the fields and controls on the Paycheck Earnings page where the calculated hourly rates (multiplication factor applied) and amounts for overtime are displayed.

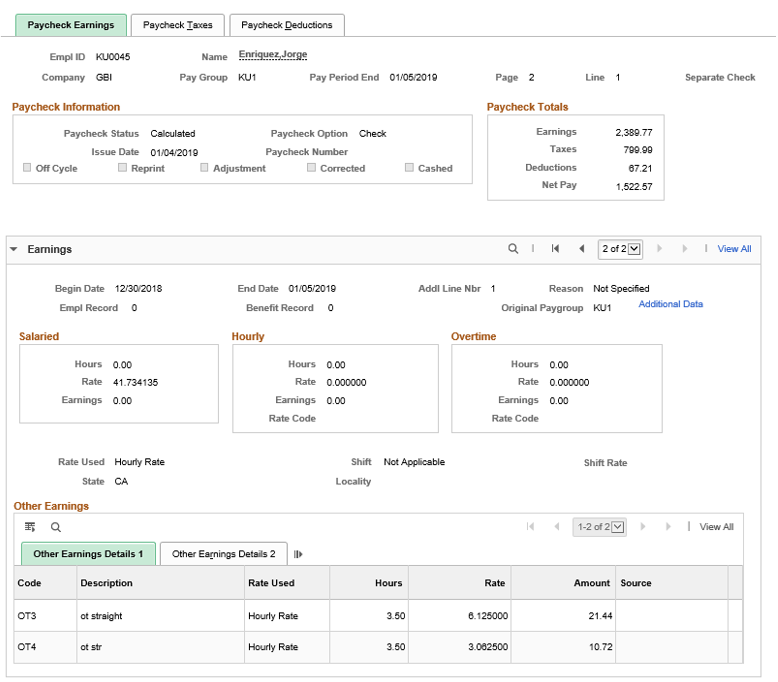

This example illustrates the fields and controls on the Paycheck Earnings page where the calculated hourly rates (multiplication factor applied) and amounts for overtime on flat sum bonus are displayed.

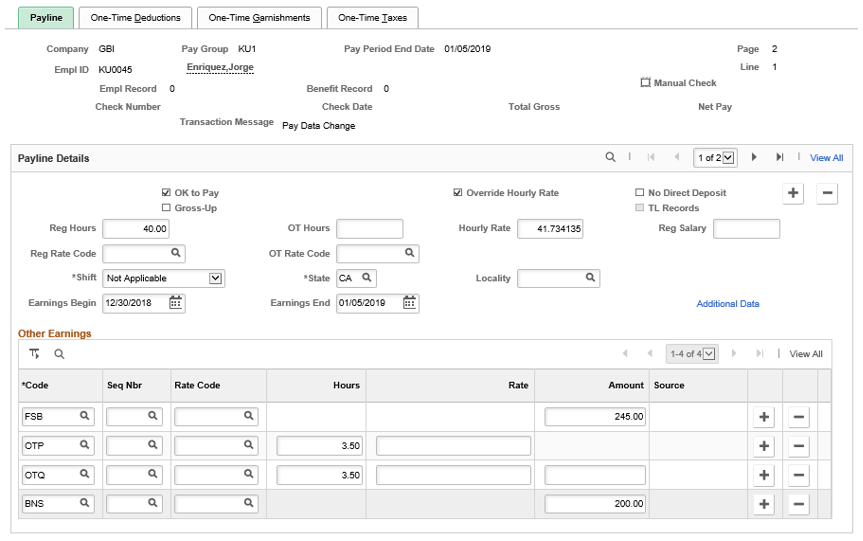

Suppose that in a slightly different scenario, a $200 FLSA-eligible bonus BNS is also added to the payline:

This example illustrates the fields and controls on the Payline page where FLSA-eligible bonus, flat sum bonus, and overtime information is inserted.

With an FLSA-eligible bonus in the pay period, the system calculates the FLSA rate to be used in overtime pay as follows:

(Regular period pay + Overtime pay at contractual + Total other FLSA eligible earnings) / Total FLSA eligible hours

($41.734135 x 40 + $146.07 + $200) / (40 + 3.5) = $46.331954

The OTQ overtime pay is excluded from the calculation because the earnings code is set to have no effect on FLSA.

The paycheck displays the calculated hourly rate (with the multiplication factor applied) and amount for each of the Overtime earnings codes (OTP and OTQ) and Overtime on Flat Sum Bonus earnings codes (OT3 and OT4) in the Other Earnings section of the paycheck:

Straight time (1.0) Overtime Pay (OTP):

$46.331954 x 1.0 x 3.5 = $162.16

Half time (0.5) Overtime Pay (OTQ):

$46.331954 x 0.5 x 3.5= $81.08

Straight time (1.0) Overtime Pay on Flat Sum Bonus (OT3):

$6.125 x 1.0 x 3.5= $21.44

Half time (0.5) Pay on Flat Sum Bonus (OT4):

$6.125 x 0.5 x 3.5 = $10.72

This example illustrates the fields and controls on the Paycheck Earnings page where the calculated hourly rates (multiplication factor applied) and amounts for overtime are displayed.

This example illustrates the fields and controls on the Paycheck Earnings page where the calculated hourly rates (multiplication factor applied) and amounts for overtime on flat sum bonus are displayed.

The FLSA-eligible bonus has no impact on the calculation of overtime pay for employees who get flat sum bonus payments.

In this example, an adjustment (flat sum bonus) has been made to the same FLSA period as the previous example. This action results in a recalculation of the regular bonus rate and overtime payments for that FLSA week. In this scenario, the old bonus rate will be backed out, and a new one calculated.

The user enters $200 of flat sum bonus to the payline for the previous FLSA period:

Term

Definition

Current Pay Period

09/17/2018 - 09/23/2018

FLSA Period

09/10/2018 - 09/16/2018

Flat Sum Bonus

$200 (new payment entered for the FLSA period)

($100 from prior period confirmed check)

Reg Hours

(16 hours from prior period confirmed check)

OT Hours (OTP)

(10 hours from prior period confirmed check)

Double Time Hour (DBT)

(10 hours from prior period confirmed check)

The system calculates the regular bonus rate in Pay Calculation, and inserts a new payline that contains the OT3 and OT4 earnings codes in the Other Earnings section with the corresponding number of hours, and the updated regular bonus rate before the multiplication factor is applied, which is $18.75 ($300 / 16). The $300 amount is the sum of the newly entered $200 and the $100 from the confirmed check of the prior period.

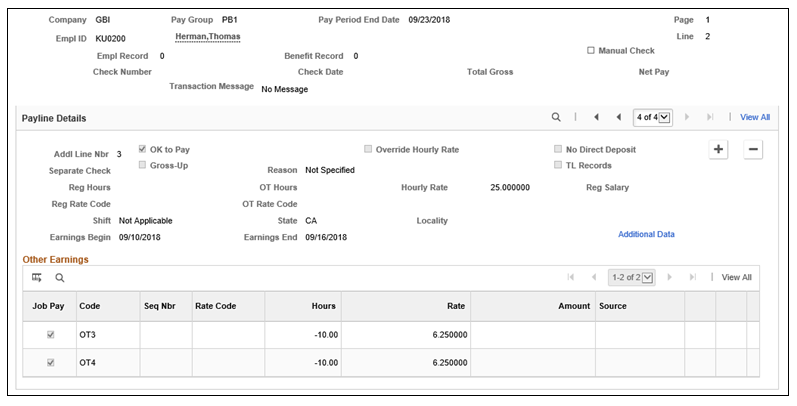

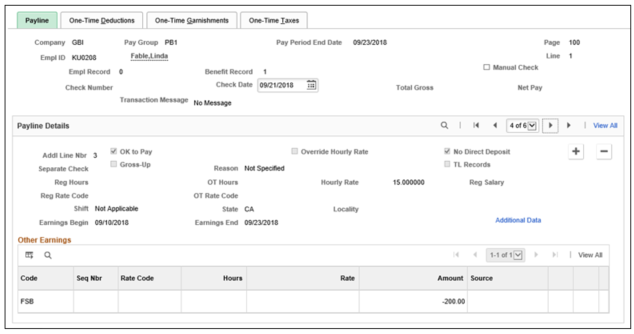

This example illustrates the fields and controls on the Payline page where mapped overtime codes, hours and updated bonus rate are displayed.

The old regular bonus rate of $6.25 is backed out:

This example illustrates the fields and controls on the Payline page where the old bonus rate is backed out.

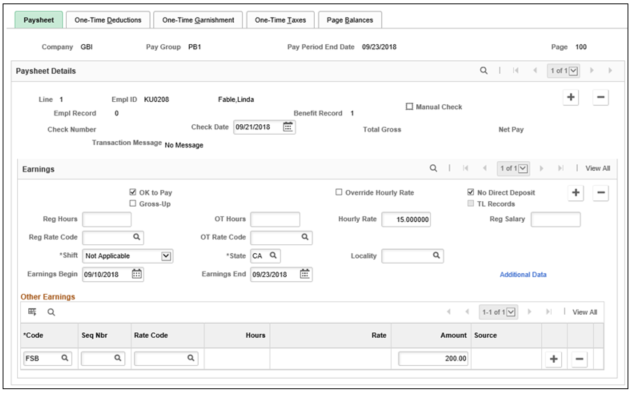

The paycheck displays the updated hourly rate with the multiplication factor applied and amount for each of the Overtime on Flat Sum Bonus earnings codes OT3 and OT4:

Time-and-one-half (1.5) Overtime Pay on Flat Sum Bonus (OT3):

$18.75 x 1.5 x 10 = $281.25

Double-time (2.0) Pay on Flat Sum Bonus (OT4):

$18.75 x 2 x 10 = $375.00

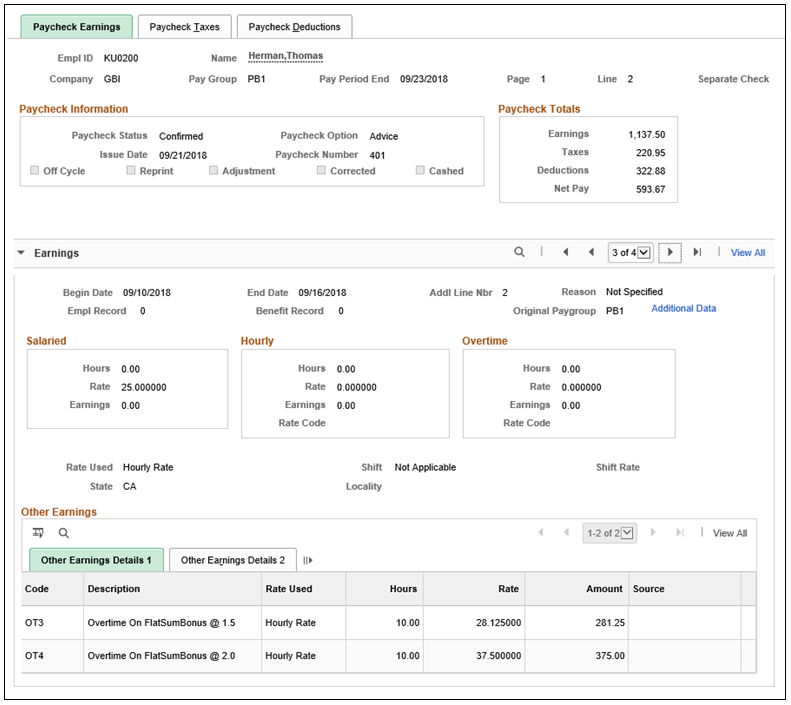

This example illustrates the fields and controls on the Paycheck Earnings page where the updated hourly rates (multiplication factor applied) and amounts for overtime on flat sum bonus are displayed.

The old overtime pay amounts ($93.75 and $125.00) that were calculated using the old regular bonus rate ($6.25) are backed out:

This example illustrates the fields and controls on the Paycheck Earnings page where the old bonus rates are backed out.

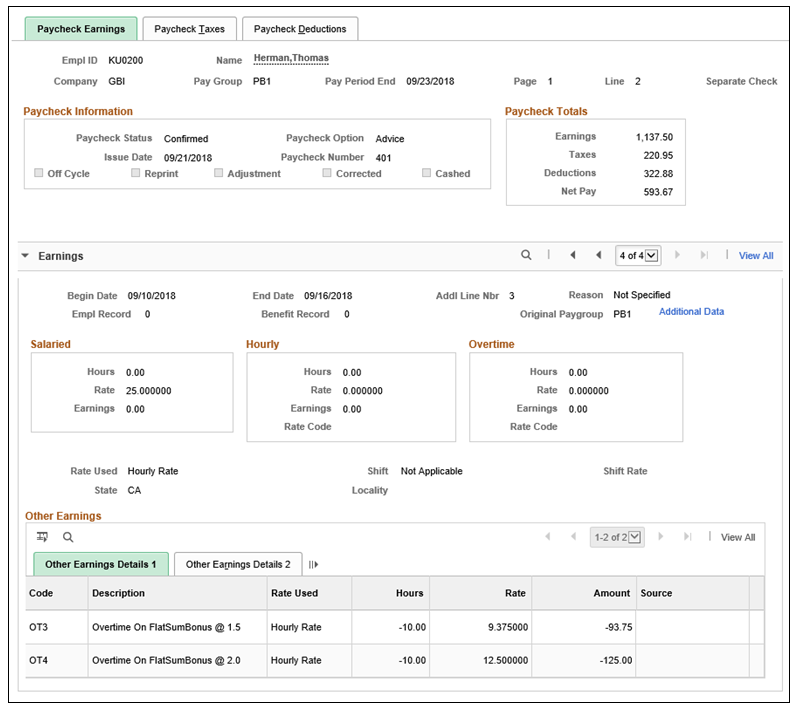

Detail lines for the updated Overtime on Flat Sum Bonus calculations are displayed in the PDF version of the paycheck as follows:

This example illustrates the PDF version of the paycheck where updated overtime pay on flat sum bonus is displayed.

If a flat sum bonus spans multiple FLSA periods, the system splits the flat sum bonus earning automatically into the appropriate FLSA periods, following the same method currently used to prorate a production bonus across multiple FLSA periods.

In this example, a $200 flat sum bonus is entered on an off-cycle payroll for the period between September 10 and September 23, which includes two FLSA periods:

First: 09/10/2018 - 09/16/2018

Second: 09/17/2018 - 09/23/2018

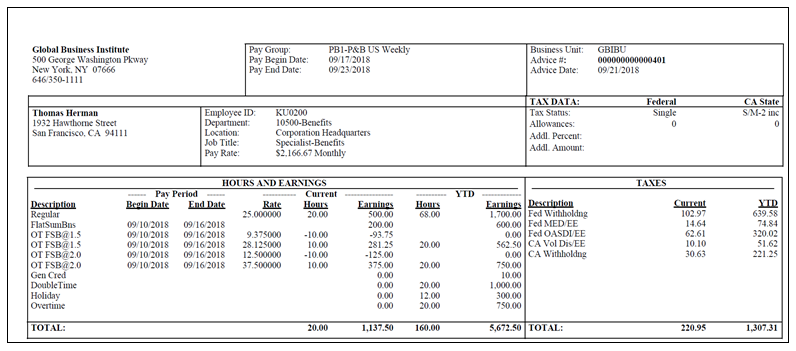

This example illustrates the fields and controls on the Paysheet page where a flat sum bonus is applied to two FLSA periods.

During pay calculation, the flat sum bonus amount of $200 is split into these two FLSA periods automatically, $100 for each period:

This example illustrates the fields and controls on the Payline page where a split flat sum bonus is added to the first of the two FLSA periods.

This example illustrates the fields and controls on the Payline page where a split flat sum bonus is added to the last of the two FLSA periods.

The original $200 bonus for the period of September 10 and September 23 is backed out:

This example illustrates the fields and controls on the Payline page where the old flat sum bonus is backed out.

Then, the calculation of overtime due on the flat sum bonus is performed for each FLSA period, as described in Example of Overtime Pay Calculation on Flat Sum Bonus Payment (Option 1 - Overtime Paid With One Earnings Code), or Example of Overtime Pay Calculation on Adjusted Flat Sum Bonus Payment (if the transaction includes a prior period adjustment).