Mapping Expense Groups to ChartField Combinations

To map expense groups, use the ChartField Expense Mapping component (PYGL_CF_MAPPING or PYGL_CF_MAPPING_CAN).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PYGL_CO_CF_MAPERN |

Specify mapping level and map earnings expense groups to ChartField combinations. |

|

|

PYGL_CO_CF_MAPDED |

Specify mapping level and map deduction expense groups to ChartField combinations. |

|

|

PYGL_CO_CF_MAPTAX |

(USA) Specify mapping level and map U.S. tax expense groups to ChartField combinations. |

|

|

PYGL_CO_CF_MAPCTX |

(CAN) Specify mapping level and map Canadian tax expense groups to ChartField combinations. |

|

|

Company ChartField Mapping Report Page |

RUN_PAY752 |

Generate the PAY752 report that lists all of the HR chart keys and their equivalent general ledger accounts and department IDs. |

|

Company Report - General Ledger Page |

PRCSRUNCNTRL |

Generate the PAY702 report that lists general ledger data from the Company table. This report is a companion to PER707 (the Company Table - General Data report), which lists the payroll-related general ledger information in the Company table. |

This topic discusses:

Mapping levels.

Example of employee-level mapping.

Component Search page.

ChartField configuration.

Mapping Levels

When mapping expense groups to ChartField combinations, you can assign ChartField combinations based on these levels:

Company

Department

Position

Job code

Employee

When resolving the mapping for a payroll record, the GL Interface PSJob process (PAYGL01) starts at the lowest level--employee--and determines whether there is a definition for the employee and activity group being processed. If it is not found, the search goes one level up, to the job code being processed, and continues up until a mapping for the current payroll record is found. The search stops when an entry is found.

This way, you need only define mapping entries at lower levels where desired. For example, earnings could be assigned at the employee level while the employer expenses for taxes remain at the company level.

Example of Employee-Level Mapping

You might want to map earnings expense at the employee level if an employee is on loan to another department and the originating department wants to charge the temporary department for the time. To do this, you would map the earnings at the employee level on a temporary basis. This also reduces any overhead due to initiating transfers, and so forth.

Note: To assign expenses at the employee level, use the Combination Code field on the employee's Job Data – Payroll page.

Component Search Page

On the search page for the component, you must select a company and business unit. If you select a mapping level more specific than Company, you must further select the particular value, such as the department, position, or employee ID.

ChartField Configuration

The fields displayed on the mapping pages are determined by the ChartField configuration.

Field or Control |

Description |

|---|---|

GL Group Name |

Select the general ledger group. |

Edit ChartFields |

Select to search for ChartField combinations by speed type, combination code, or ChartField transaction. |

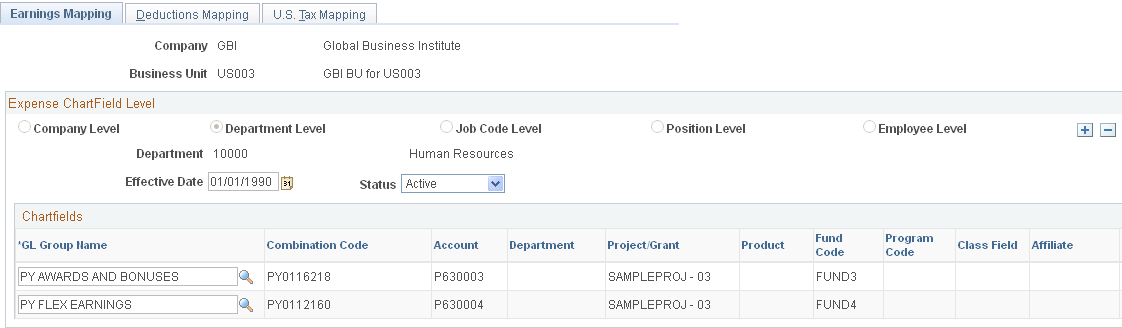

Use the Earnings Mapping page (PYGL_CO_CF_MAPERN) to specify mapping level and map earnings expense groups to ChartField combinations.

Navigation:

This example illustrates the fields and controls on the Earnings Mapping page.

Note: The whole page is not shown here. The fields displayed on the page are determined by the ChartField configuration.

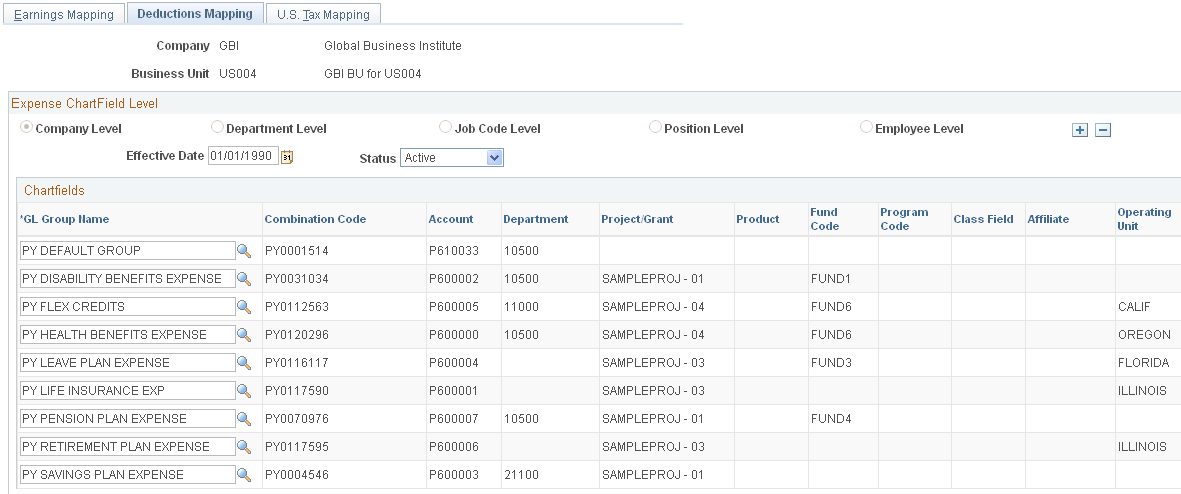

Use the Deductions Mapping page (PYGL_CO_CF_MAPDED) to specify mapping level and map deduction expense groups to ChartField combinations.

Navigation:

This example illustrates the fields and controls on the Deductions Mapping page.

Note: The whole page is not shown here. The fields displayed on the page are determined by the ChartField configuration.

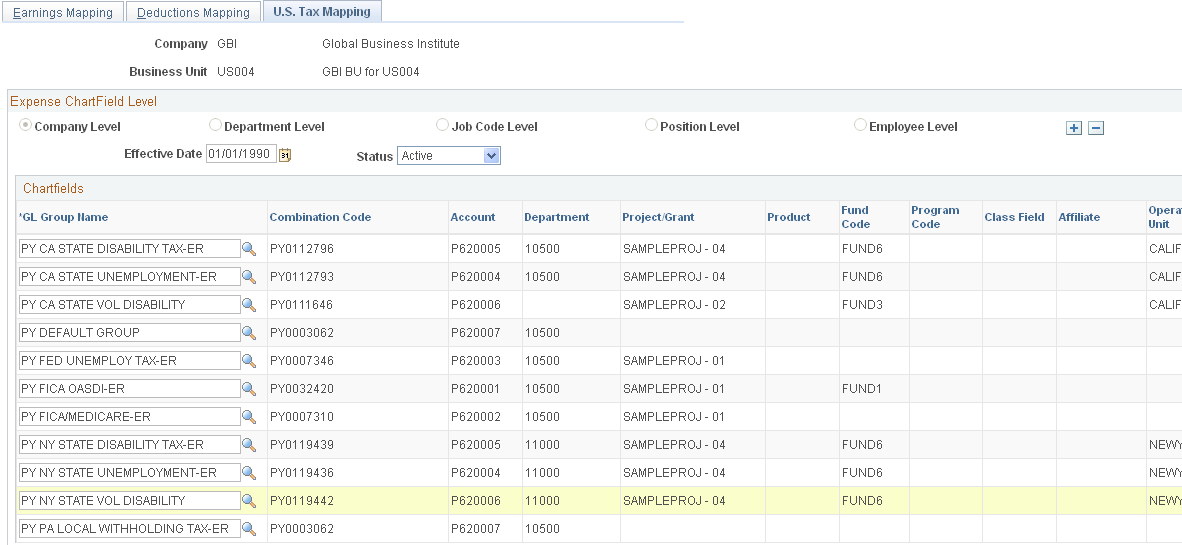

(USA) Use the U.S. Tax Mapping page (PYGL_CO_CF_MAPTAX) to specify mapping level and map U.S. tax expense groups to ChartField combinations.

Navigation:

This example illustrates the fields and controls on the U.S. Tax Mapping page.

Note: The whole page is not shown here. The fields displayed on the page are determined by the ChartField configuration.

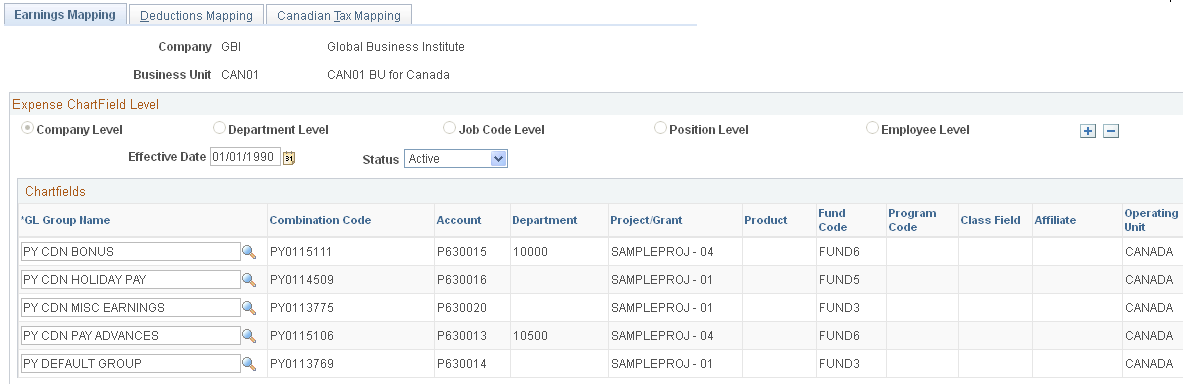

(CAN) Use the Canadian Tax Mapping page (PYGL_CO_CF_MAPCTX) to specify mapping level and map Canadian tax expense groups to ChartField combinations.

Navigation:

This example illustrates the fields and controls on the Canadian Tax Mapping page.

Note: The whole page is not shown here. The fields displayed on the page are determined by the ChartField configuration.