Viewing the Calculation Results Pages

This topic discusses how to view a summary of calculation results.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_CALCULATION_SUM |

|

|

|

PA_CLC_415_SUM |

View results produced by 415 processing. The Internal Revenue Code Section 415 limits are applied to a participant's combined pension benefits from all plans. |

|

|

PA_CLC_EMP_SUM |

View participant information that might affect a calculation. |

Use the Review Main Results page (PA_CALCULATION_SUM) to:

View information about a calculation and personal data about a participant.

Access the detailed calculation results pages.

Navigation:

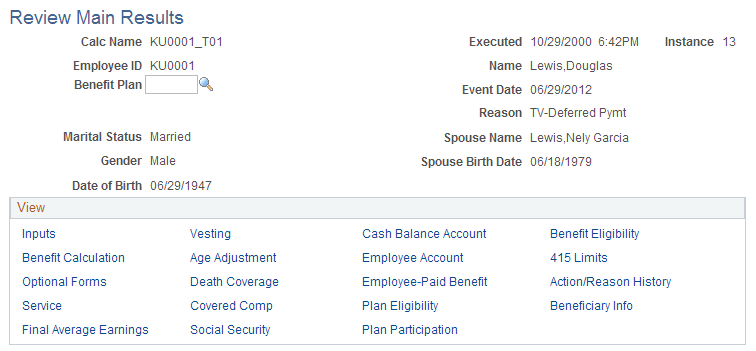

This example illustrates the fields and controls on the Review Main Results page.

Field or Control |

Description |

|---|---|

Executed |

Displays the date and time of the calculation. |

Instance |

Displays the instance assigned by the Process Scheduler when the calculation ran. Note: Use the instance to access calculation error messages on the Review Processing Messages page. |

Employee ID |

Identifies the participant whose results you are viewing. Although a calculation can process more than one participant, you can view results for only one participant at a time. |

Benefit Plan |

Select the plan to view. |

Event Date and Reason |

Display the termination information entered for the calculation. |

Marital Status, Spouse Name, Gender, Spouse Birth Date, and Date of Birth |

If you entered overrides for a participant or spouse birth date, those overrides appear on this page with the notation override value. |

View |

The links in this group box take you to the detailed results pages for the plan you select. For most links, clicking the link opens the target page in a new browser window. Note: You can also access the detailed results pages in the Individual Results component. |

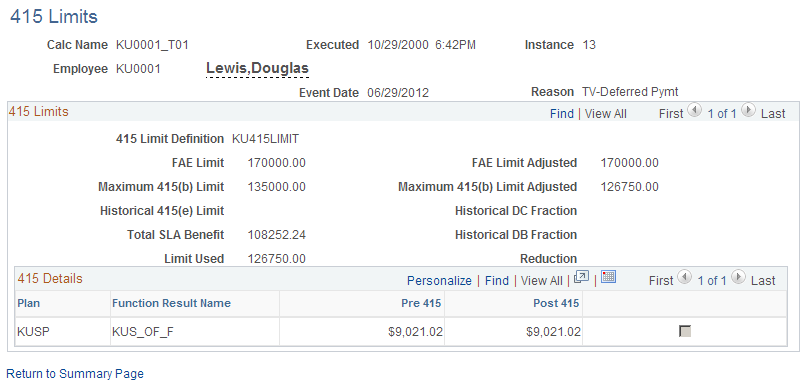

Use the 415 Limits page (PA_CLC_415_SUM) to view results produced by 415 processing.

The Internal Revenue Code Section 415 limits are applied to a participant's combined pension benefits from all plans.

Navigation:

Click the 415 Limits link on the Review Main Results page

This example illustrates the fields and controls on the 415 Limits page.

415 Limits

Field or Control |

Description |

|---|---|

415 Limit Definition |

Displays the name of the 415 processing rules. The actual 415 limit is the smallest of three separately calculated amounts in the following fields: FAE Limit Adjusted, Maximum 415(b) Limit Adjusted, or Historical 415(e) Limit. |

FAE Limit and FAE Limit Adjusted |

Displays the FAE limit, which is 100 percent of a participant's high three consecutive years' average earnings. This can be adjusted for short service. The page displays both the unadjusted and adjusted amounts. |

Maximum 415(b) Limit and Maximum 415(b) Limit Adjusted |

Displays the maximum 415(b) limit, a dollar amount published annually by the Internal Revenue Service (IRS). This can be adjusted for commencement date and for short service. The page displays both the unadjusted and adjusted amounts. |

Historical 415(e) Limit, Historical DC Fraction, (historical defined contribution fraction), and Historical DB Fraction (historical defined benefit fraction) |

Displays the 415(e) limit, an amount based on the relative values of the participant's defined contribution (DC) fraction and defined benefit (DB) fraction. These are values calculated according to IRS rules. This information is present only if defined contribution information was available for the participant. |

Total SLA Benefit (total single life annuity benefit) |

Displays a participant's total annual pension benefit from all plans expressed as a single life annuity (SLA). If this is less than the amount in the Limit Used field, the benefit was not reduced. |

Limit Used |

Displays the lowest of the three possible limits. This is the limit that actually applies. |

Reduction |

If the total SLA benefit is higher, then this field displays the difference between the two. |

415 Details

This group box lists all the benefits that are subject to 415 limits.

Field or Control |

Description |

|---|---|

Reduced by User or Proration Percent |

One of these columns appears if the benefit has been reduced. The column label indicates the method used to reduce the benefit, if necessary. If the column label is Reduced by User, then the column displays the order in which plans were reduced. That is, the entire reduction was taken from the first benefit, and if that benefit was reduced to zero, any remaining reduction was taken from the next benefit, and so on. If the column label is Proration Percent, then the column displays the percent reduction for each plan. |

Function Result Name |

Displays the name that your organization assigned to the specific benefit in the plan. |

Pre 415 |

Displays the SLA amount of the benefit before limits were applied. |

Post 415 |

Displays the reduced benefit after limits are applied. The Pre 415 and Post 415 values are the same when the combined benefit does not exceed the limit. |

<check box> |

If this check box in a row is selected, then the plan does not actually offer a single life annuity and you should not quote the displayed SLA amount to participants except to explain the 415 limits reduction. |

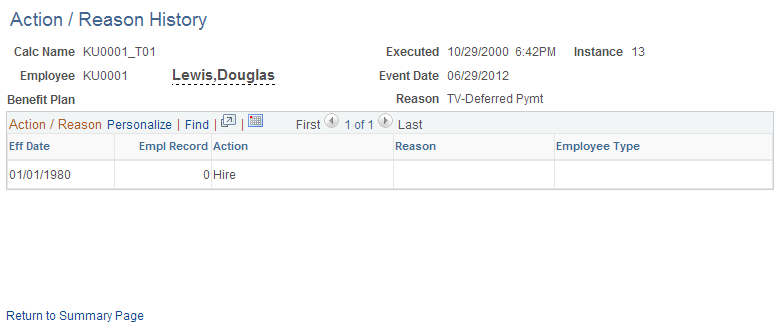

Use the Action/Reason History page (PA_CLC_EMP_SUM) to view participant information that might affect a calculation.

Navigation:

Click the Action/Reason History link on the Review Main Results page

This example illustrates the fields and controls on the Action / Reason History page.

Action / Reason

A calculation builds a pension-specific history of each action and the associated reason in a participant's job history. Not all events in the participant's career appear on the Action/Reason History page, only those specified as relevant to your pension rules.

Typically, service is the only calculation function impacted by action and reason codes. Although the consolidations functions also use these codes, consolidations do not run as part of the calculation, only as part of periodic processing.

Field or Control |

Description |

|---|---|

Employee Type |

Displays the history of a worker's changing types: Hourly, Salaried, Exception Hourly. |