Understanding Social Security Calculations

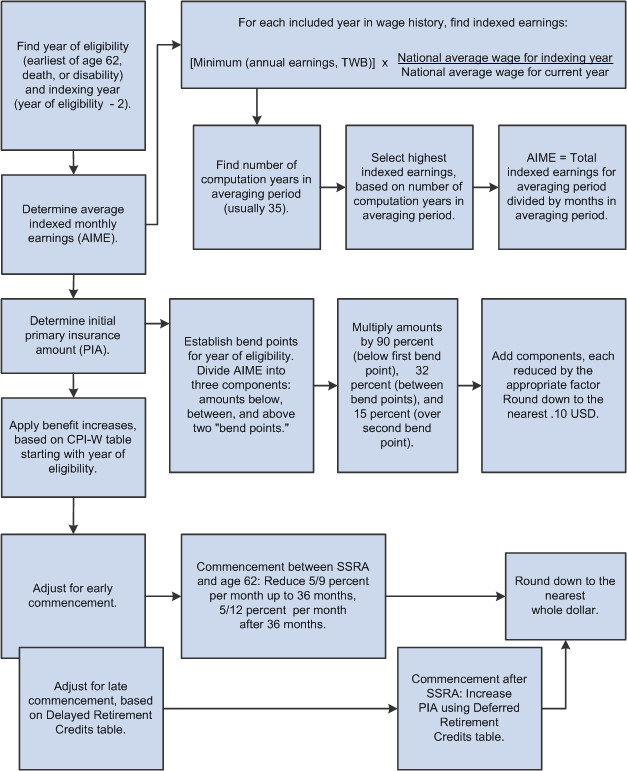

The following diagram shows how the social security calculation works. Notice that the calculation requires information from several tables published by the Internal Revenue Service: the national average wage (NAW), general benefit increases, and deferred retirement credits. Pension Administration stores this information in tables we deliver.

Social security calculations don't project the National Average Wage table beyond the year of eligibility. For an old age calculation, this is the year the employee attains age 62. If earnings years beyond age 62 are included in a projection, the system uses the value from the year the employee turned 62, as shown in the following illustration:

This diagram illustrates the social security calculation process. The main steps in this process are:

Find the year social security eligibility (based on age, death, or disability) and the indexing year (two years before the year of eligibility).

Calculate the average indexed monthly earnings (AIME)

Calculate the primary initial insurance amount (PIA).

Apply benefit increases based on the CPI-W table starting with the year of eligibility.

Adjust for early or late commencement., and round down to the nearest whole dollar.