Setting Up Vesting Definitions

To set up a vesting schedule, use the Vesting (VESTING) component.

This topic provides an overview of vesting definitions and discusses how to set them up.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_VEST_SCHEDULE |

Set up vesting schedules based on age, service, or any other requirement. |

|

|

PA_VEST_CONDITIONS |

Specify events or other conditions that override a vesting schedule and trigger either full vesting or forfeiture. |

When you set up a vesting schedule, you specify the type, cliff or step. Then you specify additional parameters, such as age. The parameters vary, depending on the type. The Vesting Schedule page shows only the parameters that apply to the type you select.

When you set up a vesting schedule, you can set up conditions for vesting. Conditions are events that trigger either full vesting or forfeiture. They can include such events as death, disability, eligibility for early retirement or another type of benefit, and withdrawal of an employee's contributions.

Note: If you select Immediate Vesting in the Schedule Type field on the Vesting Schedule page, do not enter any information on the Vesting Conditions page.

Use the Vesting Schedule page (PA_VEST_SCHEDULE) to set up vesting schedules based on age, service, or any other requirement.

Navigation:

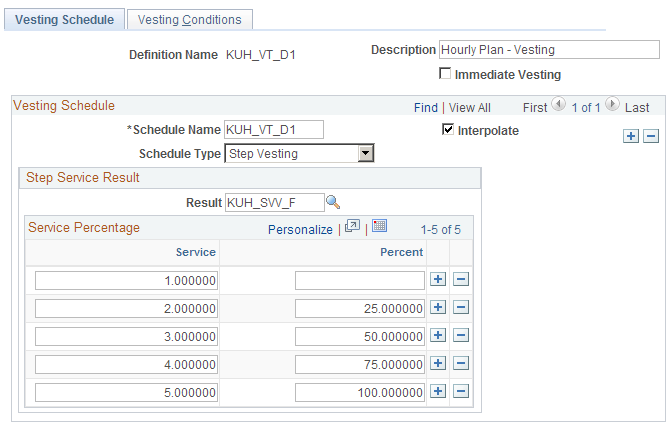

This example illustrates the fields and controls on the Vesting Schedule page.

Field or Control |

Description |

|---|---|

Immediate Vesting |

Select this option when employees are always fully vested in their accrued benefit. Do not enter any additional information on the Vesting Schedule and Vesting Conditions pages. |

Vesting Schedule

Field or Control |

Description |

|---|---|

Schedule Name |

Specify the name of the schedule. Except for immediate vesting, employees vest according to a schedule. Although there is usually one schedule per definition, a vesting definition can contain multiple schedules. When such a definition is applied, employees automatically use the schedule that yields the highest vesting percentage. For example, if vesting usually uses a five-year cliff service schedule, but employees automatically vest at age 65, you could set up two schedules: one for cliff service and one for step service that is age-based, with a single row showing 100 percent vesting at age 65. Employees 65 and over would automatically get 100 percent vesting, regardless of their service. The most common reason for using multiple schedules is a change to the plan rules. Giving employees the better of the two schedules allows you to grandfather the old rules. Typically, only employees participating as of the date of a rule change use the hybrid definition. You create this restriction by grouping employees within the vesting function result. |

Interpolate |

Vesting schedules show the percentages used for specific service amounts, ages, or other vesting criteria. You can use interpolation to specify how to deal with employees who fall between the explicitly shown steps on a schedule. When Interpolate is:

The system does not interpolate below the lowest step on a schedule. |

Schedule Type |

Select one of the following five options:

|

Age Result

Fill in this information when you select Age in the Schedule Type field.

Field or Control |

Description |

|---|---|

Result |

Enter an alias for the employee's age. This is a duration alias for the employee's age at the event date. |

Age |

Enter an age for each row in your vesting schedule. |

Percent |

Enter the percentage associated with the number you enter in Age. |

Cliff Service Result

Fill in this information when you select Cliff in the Schedule Type field.

Field or Control |

Description |

|---|---|

Result |

Enter the name of the cliff service result. Note: You may have different service function results for vesting service, participation service, and credited service. |

Field or Control |

Description |

|---|---|

100% Vested After |

Enter the number of years required for vesting in the Years field. Be sure your service function result is set to measure service in years. |

Step Service Result

Fill in this information when you select Step in the Schedule Type field.

Field or Control |

Description |

|---|---|

Result |

Enter the name of the step service result. |

Service |

Enter the minimum years of service for a particular vesting percentage. |

Percent |

Enter the vesting percentage associated with the number of years you enter in Service. Note: Do not enter a row for zero service; the system assumes that zero service always results in zero vesting. |

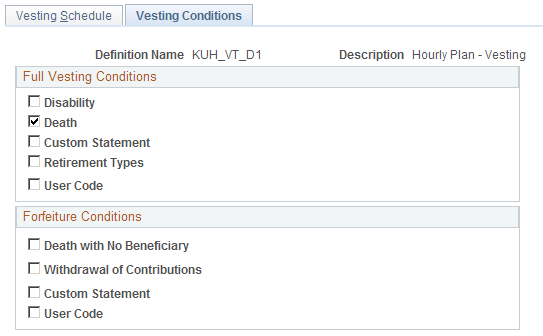

Use the Vesting Conditions page (PA_VEST_CONDITIONS) to specify events or other conditions that override a vesting schedule and trigger either full vesting or forfeiture.

Navigation:

This example illustrates the fields and controls on the Vesting Conditions page.

Note: Full vesting triggers have precedence over forfeiture triggers. For example, if death is a full vesting condition, calculations based on a death reason always grant full vesting, even if an employee meets a forfeiture condition such as death with no beneficiary.

Full Vesting Conditions

Select one or more of the following five options.

Field or Control |

Description |

|---|---|

Disability |

Select this option when disability triggers full vesting. The vesting calculation checks the reason code for the calculation to verify whether either condition is met. |

Death |

Select this option when death triggers full vesting. The vesting calculation checks the reason code for the calculation to verify whether either condition is met. |

Custom Statement |

Select this option to use your own custom statement. Enter the custom statement name in the text box. The custom statement

should consist of a Boolean statement that specifies the conditions

for full vesting. For example, if a special early retirement window

offers full vesting, you might use a statement like this: |

Retirement Types |

Select this option to grant full vesting to employees, based on eligibility for specific retirement benefits, such as early retirement. If you set up death and disability retirement types, you can use those instead of the Death and Disability options on this page. This enables you to check employee data for death and disability conditions, rather than relying on the pension administrator to set a particular calculation reason. Information about an employee's retirement type is provided by the benefit eligibility function. To indicate that a particular retirement type triggers full vesting, add the benefit eligibility function result for that retirement type to the Retirement Type list. If you include retirement types as triggers for full vesting, you need to be sure to process those benefit eligibility function results before you process the vesting function. This means you have to place them before vesting in the calculation job stream. |

User Code |

Select this option to use your own custom code to evaluate full vesting conditions. |

Forfeiture Conditions

Select one or more of the following five options. These indicate events that override all vesting schedules and cause employees to forfeit their rights to accrued pension benefits.

Field or Control |

Description |

|---|---|

Death with No Beneficiary |

Select this option if an employee who dies without a beneficiary forfeits all right to a pension benefit. If the event type on the calculation page is death, the vesting function first checks the plan beneficiary table where you record beneficiaries who are not spouses. If no beneficiary is specified, the system selects the Death with No Beneficiary check box. |

Withdrawal of Contributions and Max Vesting Percent (maximum vesting percent) |

Select the Withdrawal of Contributions option if the plan can demand that an employee forfeit the right to all accrued benefit if, when terminated, the employee withdraws his or her contributions to the plan. The system checks the plan's employee contribution account specified on the Plan Aliases page to see if contributions were withdrawn. If you select the Withdrawal of Contributions check box, you can also enter a maximum vesting percent that the system uses as the break point for forfeiture. For example, a terminated employee who is 80 percent vested might retain that 80 percent even after withdrawing contributions, while an employee who is only 40 percent vested might have to forfeit this vesting after withdrawing contributions. If you do not enter a maximum percentage, withdrawal of contributions always triggers forfeiture. |

Custom Statement |

Select this option to set up other forfeiture conditions by creating a custom statement. Enter the custom statement name in the text field. The custom statement should consist of a Boolean statement that specifies the conditions for forfeiture. If the custom statement is true, employees meet the forfeiture conditions. |

User Code |

Select this option to use your own custom code to evaluate forfeiture conditions. |

See Understanding Benefit Eligibility, Understanding Plan Implementation and Plan Aliases.